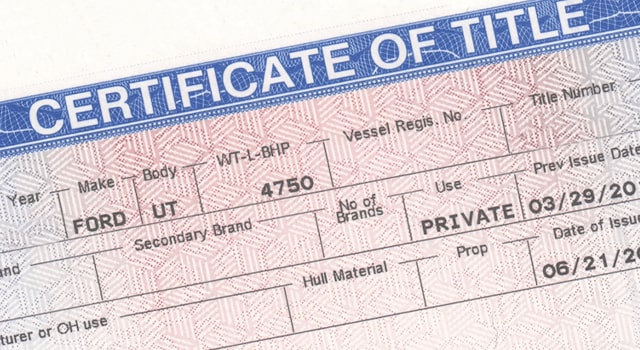

You will be asked to provide a minumum of one top photo setting from ID (e.grams. passport or driver’s license), and one low-photographic function (e.grams. birth certificate), plus second data files eg a Medicare credit, lender statements and you can bills.

Mortgage 100-section individual identity system

Most lenders tend to inquire about 90 days regarding bank comments to help you be sure your revenue facing the bills. If you are an initial-family buyer, might as well as make sure that the put could have been accumulated over day.

What loan providers want to see is a bona fide reputation of offers and you can responsible spending. Any late fees is a red flag. If you want to know the way the lender statements might look so you’re able to a loan provider, was the Totally free Bank Declaration Medical exam.

Be ready to have to determine any mismatch on your own money and costs. Be it a recently available vehicle buy or a money gift off relatives (in which particular case you will need a letter out of your benefactor), you will need to suggest so it for the lender for complete visibility.

Their lender also inquire about a listing of the money you owe and property in order to determine your debt-to-income ratio (the newest percentage of their month-to-month gross income supposed to your expenses) and determine what you can do to repay a home loan.

step one. Fill in new lender’s home loan application form

You’re going to be asked some basic questions regarding your bank account, put or security (whenever you are refinancing) and sort of possessions we want to pick. According to this informative article, their lender have a tendency to guess just how much you can acquire at just what speed.

This is usually quicker to apply for a mortgage on the web through the fresh lender’s web site, you could instead guide a consultation having property lending specialist if you like to dicuss so you can a man, are care about-functioning (additional qualification criteria apply), or are apt to have questions about the procedure. You might submit an application for a mortgage physically having a lender otherwise due to a large financial company.

Mansour’s suggestion: All bank have a somewhat additional financial application processes and you will credit underwriting conditions. Do not get overrun for the expected recommendations or take they step from the step. Remember, correspondence together with your bank is key on process.

The lending company offers a list of papers you need add online loans Mount Crested Butte CO, as well as payslips, financial statements, personality files, etc. A home loan professional usually be certain that your earnings facing the expenditures and you will liabilities so you’re able to far more correctly assess your borrowing from the bank capacity. They will certainly use an extra serviceability barrier of step three% (to make certain you can still manage your mortgage if rates of interest rise). It is best to assemble all the requisite files ahead to greatly help speed up the method.

Mansour’s suggestion: We constantly highly recommend your done all the files and you may post them across in one go as opposed to within the bits. The lending company cannot evaluate the application up to most of the files are considering.

The lending company get run a great soft’ credit check in order to flag any potential difficulties with the credit document early otherwise will get decide to over a hard’ credit score assessment (which has an effect on your credit score) from the get-go. That is whenever a home loan pro often look at the credit history for the an excellent expenses, skipped money otherwise non-payments. Keep in mind loan providers need certainly to pose a question to your consent ahead of performing a formal credit score assessment, in accordance with the National Credit Security Act 2009.

Mansour’s suggestion: Work at a credit report on the you to ultimately rating just before one after that facts and then try to eliminate all of them ahead of accommodations the financial application. You really have problematic in your credit history that would equal an automatic refuse, therefore speak to your large financial company to find out if this is exactly strongly related you.