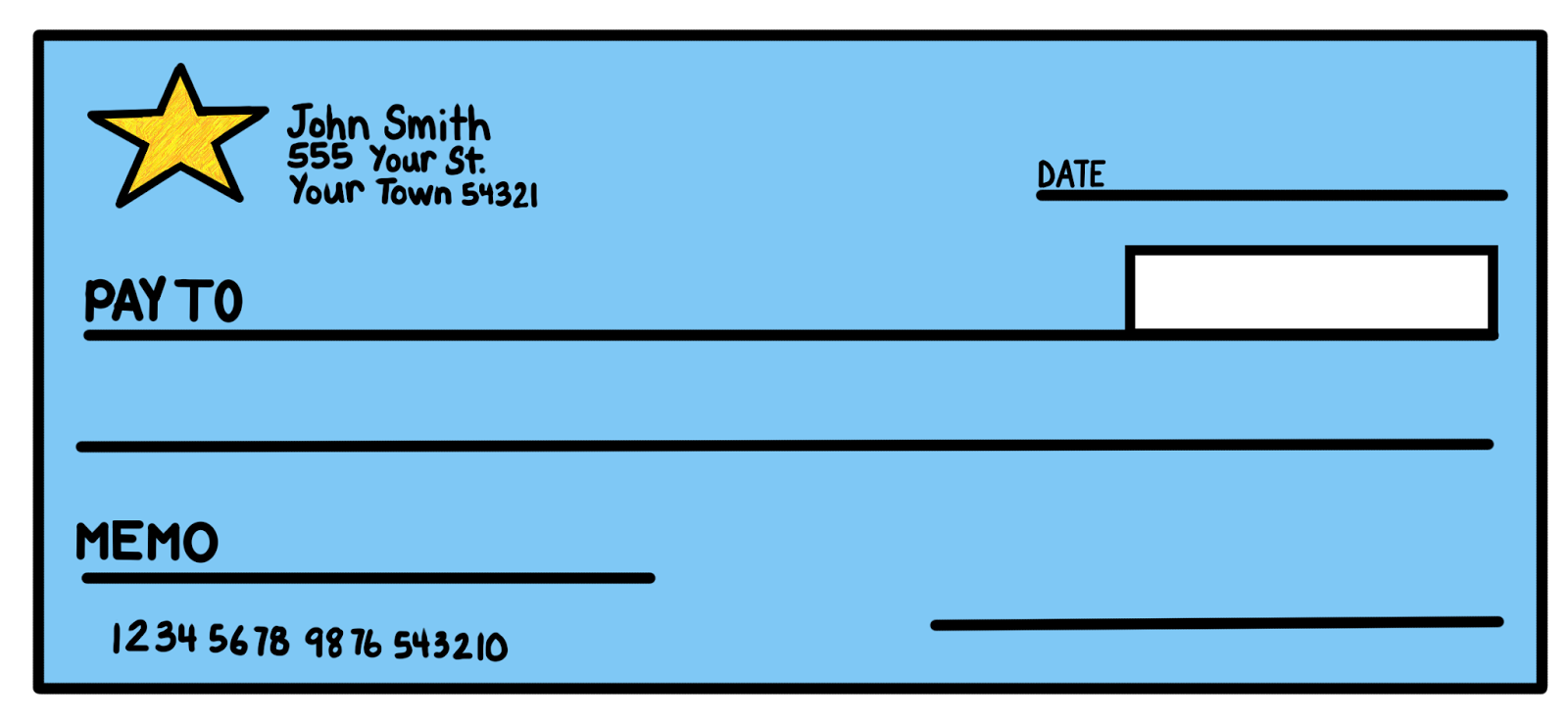

Get lightweight family loans and you can initial recognition contained in this an hour, and in case your admission our borrowing from the bank monitors plus application is inline towards the responsible lending code of brand new Zealand. Bequeath repayments across a number of years, which have sensible and you may manageable finance cost, and enjoy the freedoms of experiencing a property away from home.

Workout Your Little Domestic Payments.

Prefer the installment numbers, as well as the length or the name toward car loan calculator below. It isn’t difficult. Once you might be happier, simply, strike the use now key, and then we will get the program underway. This will bring everything 6-8 times to complete.

$ 31 each week

Our very own limit mortgage term are 3 years which means that your repayments for the a great $6650 financing should be $70 (or more) each week

- Your computer data is safe

Smaller Domestic Funds Will set you back

Whenever you are funding a little domestic, upcoming yes, you will find going to be an appeal pricing. If at all possible, you are able to lease your typical house away when you find yourself touring our very own breathtaking Aotearoa, to pay to own power and you will travel will set you back. If not, it could be an imaginative suggestion to take into account performing from another location having a notebook, and therefore you will need a strong Wi-Fi partnership or Elon Musk’s the brand new satellite.

You can bundle all of the additions, changes, and you can accessories to the solitary fund package. You will then need certainly to check around to your lowest interest levels of the financial institutions into the The fresh new Zealand, and also the best standards, and you can develop you are right back at the Crester, provided united states since your top little financial option.

All of our calculator goes toward all in all, $100,000 NZD, however, if you happen to be somewhat more than one to threshold, it’s no drama, and if you can afford they along with a suitable amount away from coverage to your loan. Remember, it is far from only the mortgage towards lightweight domestic you will want, it will be the jewelry, the brand new Wi-Fi features as well as the done set-upwards which you are able to have to loans. Constantly add a backup basis off ten% when buying, therefore you happen to be open to hidden expenses.

To get the fresh new & attempting to sell one minute-give smaller household.

The great thing about capital a unique smaller home is that they do not have a premier decline speed, such as a new iphone or an automobile might. These are generally way more similar to an effective caravan otherwise trailer, and in times of inflation, you’ll find they’re holding the beliefs better. The best thing to-do prior to a purchase is to try to lookup just how much their tiny family was well worth for the cuatro years’ go out. If you’re able to sell it to have a lot of brand new unique worth in the cuatro years’ time, then it is a good buy and you will upgrading, so you usually have a different sort of tiny home might be for the the newest notes, just in case you really can afford it.

Helpful information

Can i sell my personal tiny household till the financing contract are done? If you want to sell your lightweight home ahead of the loans agreement doing, next we are able to arrived at a binding agreement, however you have to e mail us very first. The small House is according to the loans companies’ possession, because it’s made use of due to the fact cover so you’re able to counterbalance the financing. It must be marketed in the ount has to be compensated immediately on deals.

What goes on easily get annually down the tune and you may can’t afford the new money. Existence alter both, however, be confident, we’re responsible lenders, and just lend to people who’ll pay the loans they have been trying to get. If you enter into a sticky condition, there are numerous choice, therefore it is far better contact us, however, one chance is that we can view refinancing, and this reduces your instalments more than a longer term.

Should i pay my personal tiny mortgage out-of smaller? Yes, we prompt that pay immediately to attenuate your overall price of interest. When you yourself have even more loans, it is needless to say a no brainer are directing these to your loan.

Interest rates to the smaller household investment Interest rates can vary, however, usually we offer financing out of % so you’re able to % which have a phrase over a period of up to forty-eight weeks. Having big sales, the eye cost are toward lower end of the level. Lightweight property are often noticed large sales.

If i provides a loan pre-approved, how long manage I must get? Once approved, you should have 90 days while making a buy, if not, we are legally bound on the best way to fill in the new documentation due to the fact proof of the earnings, along with your credit inspections, etcetera.

Just how much deposit can i you need? When getting into one finance agreement to have a tiny, Crester Credit actively seeks in initial deposit ranging from 10-20%, as well as taking defense.

Do i need to remain my personal insurance coverage state of the art? Sure, included in the money contract, you will want to remain insurance coverage up to date. It is very important or you’ll be for the infraction of one’s arrangement.

Carry out I need most protection having tiny a home loan? Yes, we request in initial deposit, and cover, where you can easily.

Pertain Now & You’ll be Approved by

Our very own on the internet application takes simply half a dozen-eight moments to accomplish. Start by filling up it inside the, assuming you would like to talk to a financing officials, please make a note of it on the software.