The interest rate on your own current home loan, then, will get a switch grounds if a money-out re-finance is actually a much better alternative than a property equity loan

What is the most useful benefit of home ownership? Of many manage point out the new guarantee you will get since you steadily pay down your own financial. By way of example, for folks who are obligated to pay $100,000 toward a house worthy of $150,000, you’ve got $50,000 property value guarantee.

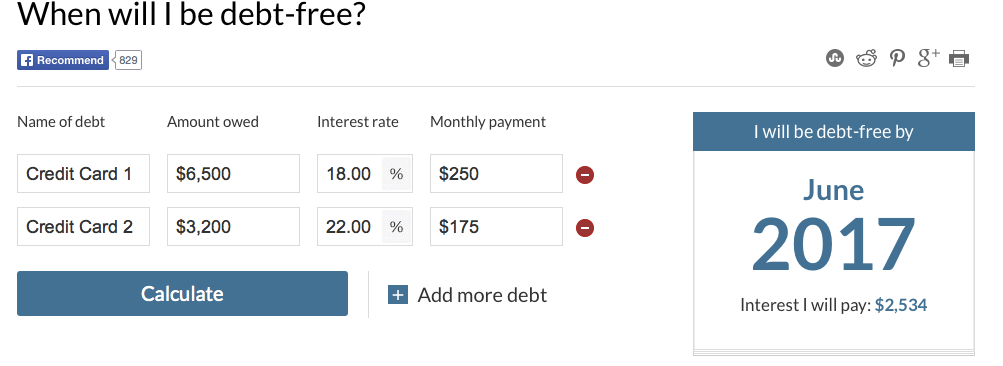

You could potentially tap into that collateral to help buy the youngsters’ college tuition, funds the price of a master bedroom inclusion otherwise pay down their large-interest-speed credit card debt.

And therefore of the two possibilities is the best for your? Bear in mind, this will depend on your private finances and your goals.

In the a profit-aside refinance, your re-finance your existing home loan toward you to definitely having a lower focus rates

A home guarantee loan are the second mortgage. State you have got $fifty,000 property value collateral of your property. Your lending company you are going to agree your getting property equity mortgage out-of $forty,000. After you sign up for it mortgage, you’ll receive a lump-sum seek the newest $forty,000, currency that one can purchase but not you’d like.

You will do, of course, have to pay that money straight back. Possible do that in the same manner you’ve been expenses the first mortgage: It is possible to build normal monthly installments. Your residence collateral financing will come which have a set interest rate and you can a set payment each month. Possible build this type of repayments until you pay back your residence equity financing entirely.

A cash-out re-finance is significantly distinct from property equity financing. When you are property collateral loan is an extra home loan, an earnings-away re-finance substitute your home loan.

However, you refinance your own financial for over what you currently are obligated to pay. Instance, state your debt $100,000 in your financial. For many who refinance to have a maximum of $150,000, you will get $50,000 within the dollars — that one may invest in anything you wanted. Then you definitely pay the new mortgage out of $150,000.

To your along with front, you’ll be able to always found a diminished interest after you sign up for an earnings-away refinance. That may end in straight down monthly premiums. Toward negative front, refinancing isnt free. In reality, the brand new Federal Put aside Board states that residents should expect to invest step three percent in order to 6 % of their an excellent mortgage equilibrium in closure and settlement costs whenever funding.

In case your latest rate of interest try high enough to ensure that refinancing so you’re able to less one to will lower your payment per month of the $100 or more a month, then an earnings-out re-finance most likely is practical. That is because it is possible to save adequate during the good quick sufficient period to fund your re-finance will set you back. Once your month-to-month coupons shelter those people can cost you, you could begin to benefit economically from the lower monthly mortgage fee.

If refinancing only save your self $31 otherwise $fifty 1 month, then it’s unlikely which you yourself can save adequate each month to get well the refinancing will cost you quickly enough so https://paydayloancolorado.net/pierce/ you can reap brand new financial positives. This kind of a situation, a house equity loan is likely your very best economic options.

A home security financing could make sense, too, when you’ve currently stored your property loan getting a large number of ages. By way of example, if you have been and make money on your own 30-year repaired-speed mortgage for twenty years, youre in the area in which a lot more of your own monthly home loan commission visits dominant much less to the focus. While such a situation, this may generate even more sense to look at a house equity loan than a cash-aside refinance.

The best option, no matter if, about the numerous an effective way to tap into your house collateral would be to talk with an experienced financial planner. Which professional can take a glance at your existing mortgage and your family members earnings to choose and therefore particular being able to access your property equity helps make the extremely monetary feel for you as well as your family relations.