The Va Financing program is actually a very important work with offered to eligible active armed forces employees and veterans, offering beneficial small print getting acquiring home financing. But not, navigating this new Va loan procedure will likely be complex and you will loans Courtland unfamiliar to own many consumers.

It is very important manage a lender that has feel and that you can also be trust, especially in the current market. Army House Destination Financing makes it possible to browse new Virtual assistant Household Financing Process of app so you’re able to in the long run obtaining keys to your new home.

Inside comprehensive book, we shall walk you through the step-by-action means of protecting an excellent Virtual assistant mortgage, in the very first app towards fun time off closure with the your brand-new house. Understanding the Virtual assistant mortgage process will help you to create informed line the application process, and ensure a delicate and you may winning homebuying feel.

Seeking a beneficial Virtual assistant-Accepted Bank

Step one is to find good Virtual assistant-approved financial who will guide you through the mortgage processes. Its essential to focus on a knowledgeable and you can educated bank familiar which have Va finance to make sure a smooth and you can effective techniques. Within Armed forces Family Destination Lending, we are going to assist you in completing the loan software and you can collecting the mandatory documents.

Qualification and Prequalification

Just before dive on Va loan processes, its necessary to influence their qualifications on the program. Qualification criteria tend to be specific criteria linked to army service and you may launch standing. Active-duty staff, experts, Federal Shield or Set-aside people, and you will specific enduring spouses could be qualified to receive a Va loan.

After you confirm your qualifications, it is the right time to rating prequalified. Prequalification pertains to delivering requisite economic suggestions to help you an effective Va-acknowledged lender who will assess the creditworthiness, income, and you may obligations-to-earnings ratio to determine how much cash you can acquire.

Getting Loan Preapproval

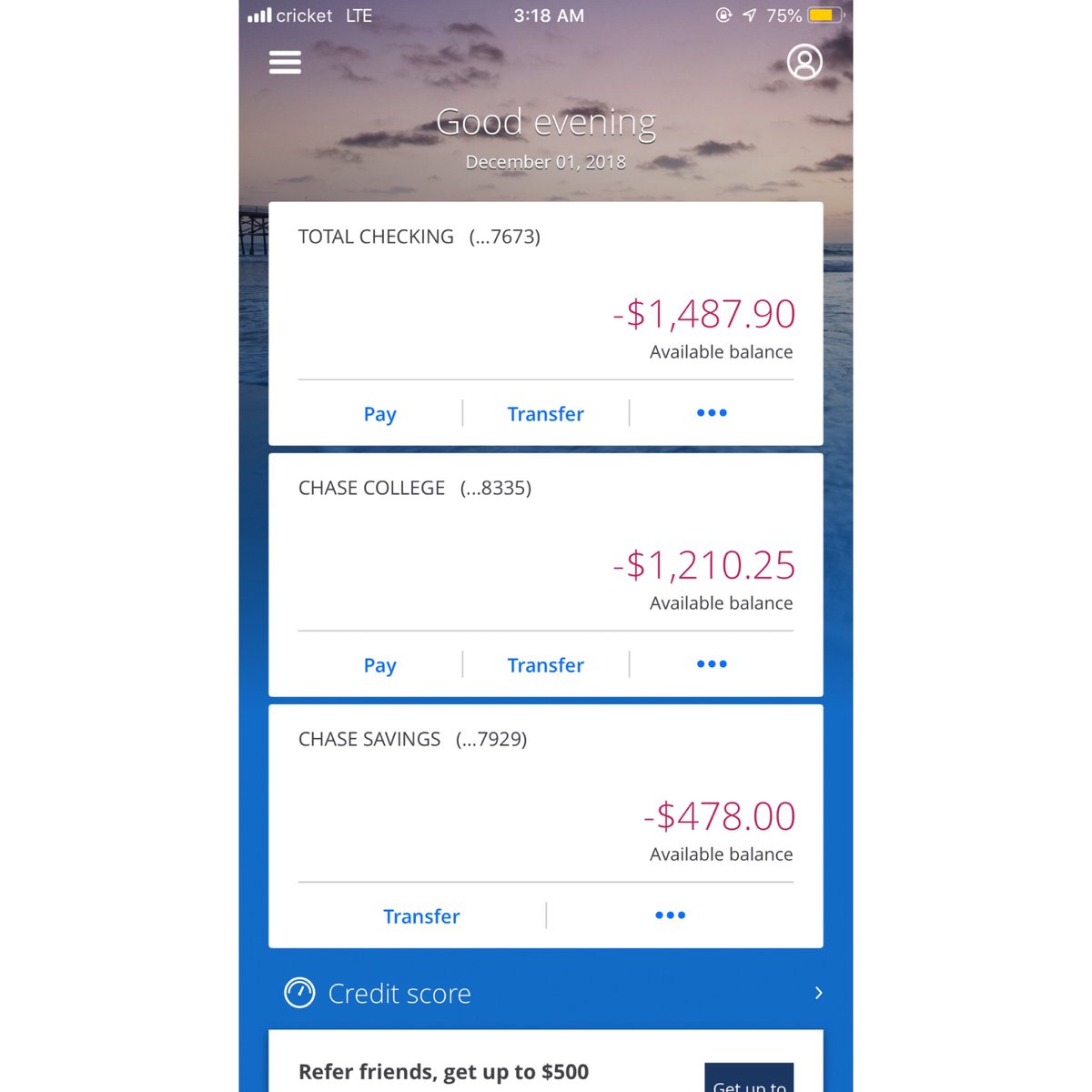

Preapproval ‘s the full procedure that involves reveal data off your debts from the financial. You will have to over a formal loan application and provide help papers, particularly money comments, tax returns, financial comments, work confirmation, or other records had a need to help your ability to repay the newest home loan.

The financial institution usually review your credit score, debt-to-earnings proportion, and other monetary issues. Considering this investigations, the financial institution commonly issue an effective preapproval page you to determine maximum loan amount youre capable to obtain. Preapproval sells more excess body fat than prequalification because it displays to providers you have been through a rigorous evaluation and are also browsing safer financial support.

Acquiring a certification out-of Qualifications

To maneuver submit along with your Va application for the loan, you will have to receive a certificate out-of Qualifications (COE) regarding Service from Pros Issues. The COE functions as evidence of your qualification for the Va financing system. You can sign up for the fresh COE on the internet from the VA’s eBenefits site, otherwise their financial might be able to assist you in obtaining they. The new COE often mean the level of entitlement you may have, and therefore decides maximum amount borrowed you could acquire instead an effective down payment.

Financing Handling and you will Underwriting

People trying to get a mortgage think that the latest software process happens when he is prequalified or preapproved, however, by definition, the mortgage software doesn’t happen until there is certainly possessions training. So it generally is when a house merchant possess acknowledged your own render to order their home. When this arrangement try hit, discover now property education together with specialized loan application, mortgage handling, and you will mortgage underwriting can start.

Va Appraisal and Assets Examination

Within the Virtual assistant loan techniques, a good Virtual assistant-accepted appraiser often measure the assets you wish to get so you can make certain they suits the new VA’s lowest property requirements. The brand new assessment will dictate the newest property’s well worth and you can assess their total status. The fresh new appraisal is essential as it handles both the borrower and you may the fresh Virtual assistant out-of to acquire qualities which can be exclusive or perhaps in terrible condition. It’s important to remember that the fresh new Virtual assistant assessment isnt a great substitute for a thorough home review. Its highly recommended which you in addition to hire a professional household inspector to evaluate the home for potential things.

Loan Acceptance and Closure

Once your application for the loan is eligible as well as the assets tickets this new Va appraisal techniques, you will get a conditional loan commitment page in the lender, called an excellent Conditional Mortgage Acceptance. That it page verifies which you have been approved for the mortgage and you may outlines one kept issues that should be found just before closure. Such conditions range between providing more records or handling any a fantastic points. During this time, it is crucial to maintain interaction with your bank and on time satisfy one requested standards.

The past help the newest Va mortgage process is the closure. Closing concerns signing the mandatory files to complete the purchase away from your brand new family. You are going to comment and signal the loan documents, like the home loan mention and action away from believe. Its necessary to meticulously opinion the fresh fine print prior to signing. Immediately following all of the data is actually closed, and you can people needed money was paid down, your officially be a resident!

Navigating the latest Va financing techniques normally 1st come daunting, but with a clear understanding of this new methods inside, you could with full confidence realize homeownership. From deciding your own qualification to locating a Virtual assistant-accepted lender, completing the program, undergoing an appraisal and you can inspection, ultimately closing on your own new home, each step of the process takes on a crucial role during the guaranteeing a profitable Virtual assistant loan feel.

Virtual assistant Finance are specially strong in the current very aggressive housing ily was in fact considering to suit your connection and give up designed for brand new country. Because of the arming your self that have studies and dealing directly that have an informed bank such as for example Army Home Put Financing, you can maximize advantages provided with the fresh new Virtual assistant financing program and you may achieve your homeownership goals.