Rather than other mortgages, Va finance are transported of personal references. Why does good Virtual assistant loan presumption works? What are the pros and cons to own homebuyers, vendors, and lenders?

What’s An excellent Va Mortgage Assumption?

An excellent Virtual assistant loan expectation happens when another type of client spends the latest Va loan that is come situated with the a home. This new consumer should be qualified for the loan, and perhaps, it may not be you’ll to assume current Va loan. If you are considering taking on a preexisting Va mortgage, its important to recognize how it works.

The process of of course a current Va mortgage has nothing so you can would which have refinancing or bringing cash-out of your property eg in certain most other home loan circumstances. Once you suppose an existing Va financing, you are just taking over their payment financial obligation regarding the person that 1st got from home loan-and when you’ll find one charge on the closure thereon style of deal (such as for example assessment fees), men and women will cost you remain reduced from the anybody who sold their home to enable them to done their revenue.

You need to keep in mind that when someone assumes another person’s mortgage, they typically create all of the money up to their own home is ended up selling again; it differs from refinancing because refinancing comes to settling dated fund and taking right out brand new ones based on current rates and you may laws and regulations (and perhaps down prices total), of course a person’s financial involves replacement theirs completely as opposed to modifying people terms and conditions after all but perhaps increasing interest levels somewhat as an ingredient off regular sector motion over the years.

The procedure to own mobile a great Virtual assistant loan is relatively effortless: Owner consents on the thought loan you need to take more than from the consumer; following, the customer needs to render an advance payment (otherwise get a second loan) to pay for pit within domestic price and you may loan balance. The house vendor is then eliminated out-of delivering yet another Va financing until the presumed loan are paid-in full.

What are the Benefits and drawbacks To possess Homebuyers, Sellers, And you can Loan providers?

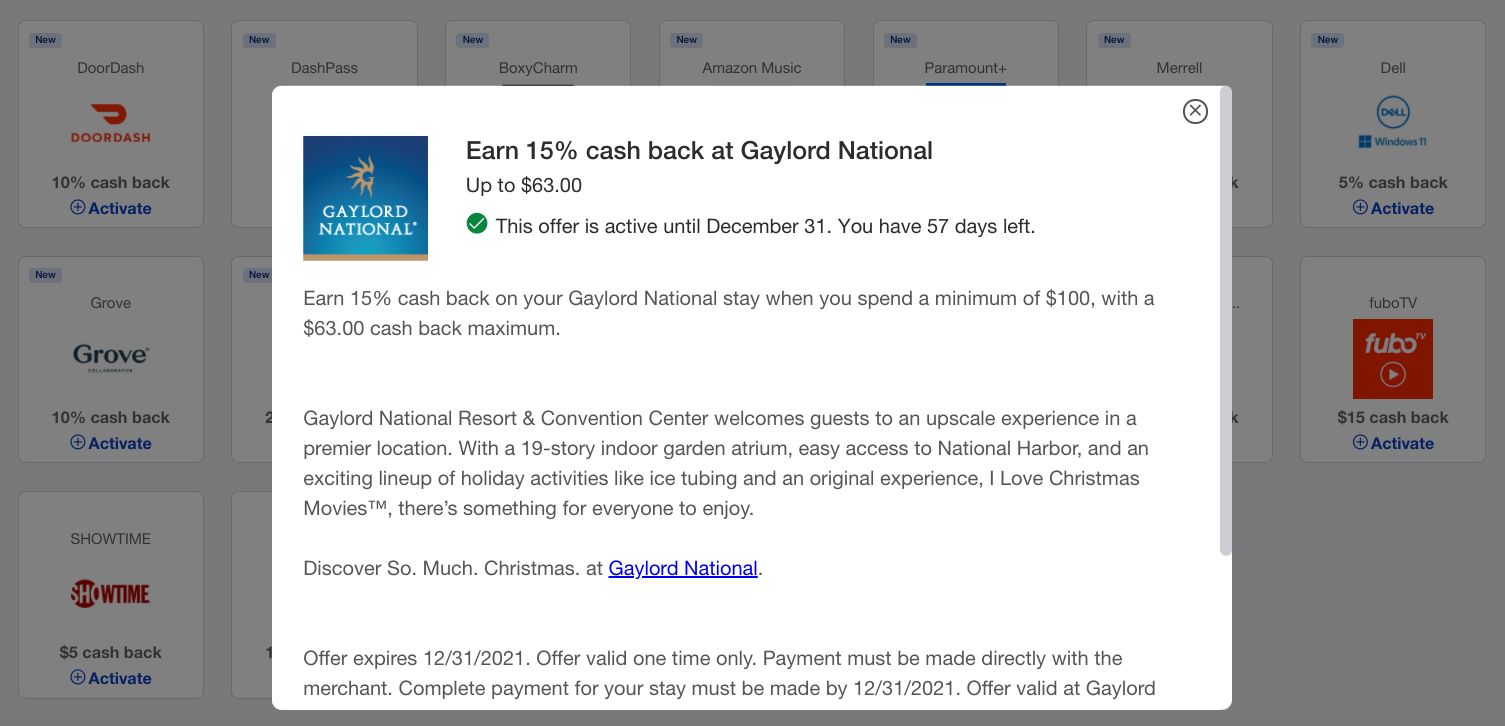

You can find advantageous assets to a Virtual assistant financing being assumable. Including, you don’t need to be an energetic-responsibility armed forces solution associate, veteran, otherwise enduring partner so you can be eligible for Va financing assumption. You really have a reduced Va funding payment and you can fewer closing will set you back than simply for people who submit an application for another type of loan.

An alternate larger brighten for buyers is because they may get a great down interest than initially given when taking aside their home loan having Pros Joined Lenders. This makes feel because the loan providers will often bring top costs whenever they know they don’t possess as frequently chance inside it in the event the some thing fails down the road-and having another person’s assumable Virtual assistant mortgage helps reduce exposure by the cutting uncertainty regarding how much exposure there was! Additionally, it form lenders is generally a whole lot more prepared to lend in the situations where almost every other lenders is almost certainly not ready, meaning that a great deal more possible potential designed for possible homeowners looking around today!

Brand new Downsides to own Buyers and you may Providers

Va loans was assumable, and that means you are selling property having a beneficial Virtual assistant financing to some other individual and permit them to imagine the mortgage. not, there are lots of things to consider ahead of this:

- Loan providers are not necessary to agree the assumption.

- You can still have to meet the lender’s borrowing and money criteria.

- It can be extended when your Va loan-office need to accept the belief online title loan Nevada.

- The latest veteran’s Virtual assistant entitlement remains to your financing in the event the a civil assumes it

Customers and you may sellers should be careful whenever moving forward which have a great Va financing expectation. Since the a purchaser, you ought to be sure that you will meet the latest qualifications. In addition to, wanting a seller prepared to execute good Virtual assistant assumable mortgage is be difficult.

End

You will find each other pros and cons to help you Va mortgage assumptions. The largest virtue would be the fact it isn’t difficult to own customers in order to get into a property it love as opposed to placing an abundance of money down or taking out a second mortgage. Although not, based on how much time the vendor have lived indeed there, the loan is difficult for these to repay before their passing or permanent impairment will leave all of them incapable of keep and make costs punctually every month.

Did you know Virtual assistant Money are mortgages available entirely to Veterans and you can military families? And you will are you aware advantages the latest Virtual assistant Financing offer boasts $0 down costs, no individual mortgage insurance policies, casual borrowing criteria, and competitive interest rates?