Secure a home loan in the place of traditional earnings confirmation procedures. With The brand new Mexico resource-depending finance, consumers need not worry about the amount of money said on their taxation statements. Rather, we shall dictate the qualifications for a financial loan additionally the mortgage matter that with the possessions as earnings. Asset-created money are perfect for notice-functioning somebody, retired people, and you may buyers who subtract costs off their taxation statements, decreasing the net gain. With these loans, you should use everything from their bank accounts into the old age and you may financial support membership so you’re able to be eligible for home financing.

What exactly is a valuable asset-Mainly based Loan?

Asset-based fund installment loans for bad credit direct lenders in Indiana are non-QM lenders that can help far more potential borrowers end up being residents. In the place of playing with a tight recognition process that means shell out stubs, taxation documents, and you can job records verification, asset-founded lending within the This new Mexico allows lenders in order to approve borrowers built to their possessions. A borrower are able to use various types of investment to track down recognized for a loan rather than playing with money confirmation about mode away from an income regarding a manager.

Like other sorts of money, asset-centered financing continue to have a minimum credit rating and you will advance payment requisite, however these money is advisable for those who want to make use of its possessions instead of cash in order to safer an excellent home loan.

Asset-founded financing during the The brand new Mexico is much more flexible than many other sorts of home loan choice. Truly the only requirements is that individuals confirm they are able to make their mortgage repayments with their assets’ thinking. These types of money are perfect for those who will most likely not qualify for old-fashioned loans, particularly if the earnings is seasonal, volatile, or their cash arises from assets and financial investments.

If you have difficulties protecting a traditional financial because of work condition otherwise income inconsistencies, their assets could help get a mortgage with smaller stringent requirements.

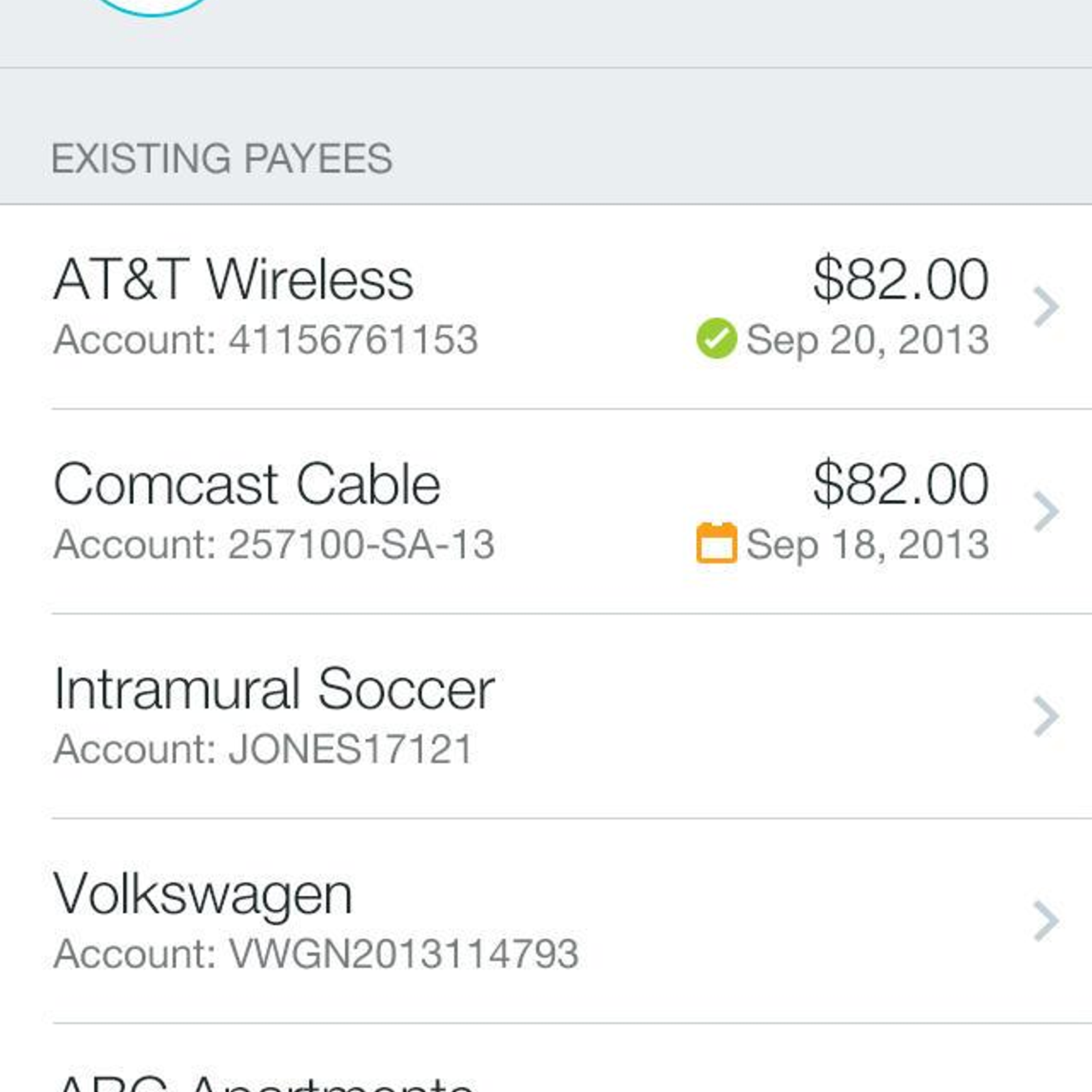

Which have The fresh Mexico advantage-established financing, your property commonly act as earnings. Lenders succeed individuals to utilize up to 70% from financial support accounts and you can 100% off quick assets to choose exactly how much might qualify for.

At the same time, consumers can pick which property they wish to use to meet the requirements towards the mortgage. Instance, you could potentially opt for inventory membership and your savings account otherwise all your property, based on its philosophy. As house-founded fund none of them one to make use of your property as guarantee, he is protected. Ergo, if you default for the that loan, your own assets will never be captured.

Sooner or later, the greater amount of beneficial the property try, more you could acquire. While doing so, a down payment regarding 20% is typically you’ll need for these types of low-QM financing, and they may have higher rates while they carry more chance on financial.

Advantages of Advantage-Centered Fund in the The latest Mexico

One of the reasons as to why many people like investment-oriented loans from inside the The fresh Mexico as opposed to old-fashioned mortgage loans try because of rigorous degree standards. Old-fashioned fund generally need a certain amount of earnings, with regards to the deposit, credit history, and you will total price of the home.

Sadly, many people fail to meet up with the income standards because they bring deductions to their tax returns, ultimately lowering their websites incomes you to definitely loan providers use to determine qualifications and loan number. Having resource-based loans, individuals need not worry about its income. As an alternative, loan providers will at the their capability to repay because of the looking at the property.

- No income conditions

- Zero jobs record standards

- Buy the assets you utilize so you can qualify

- Qualified to receive second property

- Loan wide variety around $step three billion

- Interest-sole option available

- Cash-aside anticipate

- Debt-to-Money (DTI) ratio not computed

- Credit ratings as little as 620

Just how to Be eligible for a secured item-Centered Financing in the The new Mexico

If you find yourself advantage-centered fund can handle those who will most likely not qualify for a vintage home loan, you can now be eligible for a secured asset-established financing inside The fresh Mexico should they provides assets that will be beneficial sufficient to safety the expense of the borrowed funds percentage. As investment-centered financing convey more flexible criteria than just old-fashioned mortgage brokers, they offer a streamlined software and you can recognition procedure.