Georgia FHA Financing Criteria and you may Financing Constraints having 2022 Georgia FHA Loan providers

Georgia home buyers who need a small advance payment otherwise possess less than perfect credit results might possibly get a house which have an Georgia FHA loan. There are numerous FHA lenders from inside the Georgia who render FHA funds, not them participate in most of the FHA loan solutions.

We shall take you from Georgia FHA mortgage criteria, outline all it takes to help you qualify, up coming help you to get pre-accredited. For people who already fully know that an enthusiastic FHA financing is great getting you, following simply click to connect having an Georgia FHA lender whether you live-in Atanta, Columbus, Savannah, Exotic Springs, otherwise anywhere else.

The fresh down-payment conditions to own a keen FHA loan is similar in just about any state. The minimum significance of an FHA mortgage is step 3.5% of one’s cost. Yet not, if the credit score was below 580, then online payday loans your down-payment requirements might be 10%.

There are numerous deposit guidance programs in almost any condition. Below try a listing of but a few deposit direction programs that can easily be available to choose from when you look at the Georgia. Home buyers will need to contact, and you will policy for these apps on their own. Lenders encourage the cash from these programs for the down percentage but they will not plan for the fresh new deposit advice.

Georgia FHA Mortgage Criteria to possess 2022

They are the very first FHA loan requirements for it season. A few of these have to be found becoming acknowledged having an enthusiastic FHA financing. If you are not confident toward whether you satisfy these types of conditions or provides inquiries, a keen FHA bank might help.

- Down-payment regarding step three.5% or ten% if your credit history was lower than 580

- 2-seasons a job history with a few exclusions greet

- Fully document your revenue over the past couple of years

- Minimum FICO rating dependence on five hundred down payment vary

- Financial Top (MIP) is required each FHA mortgage

- Limit financial obligation to earnings ratio regarding 43% with exclusions as much as 56%

- Our home need to be your primary household

- No bankruptcies or foreclosure in earlier times 2 yrs

Georgia FHA Financing Professionals

- Down credit ratings permitted

Ideal Georgia FHA lenders

These firms are just a few options about how to believe. Please be aware that each bank varies and is also you’ll you to none ones choices are good for you depending upon your own circumstance.

Why don’t we enable you to get the best Georgia FHA lenders close by from the doing it FHA loan circumstances setting with some basic financing situation recommendations. No credit history was pulled and now we can be hook you for the best choice.

Georgia FHA Loan Limits

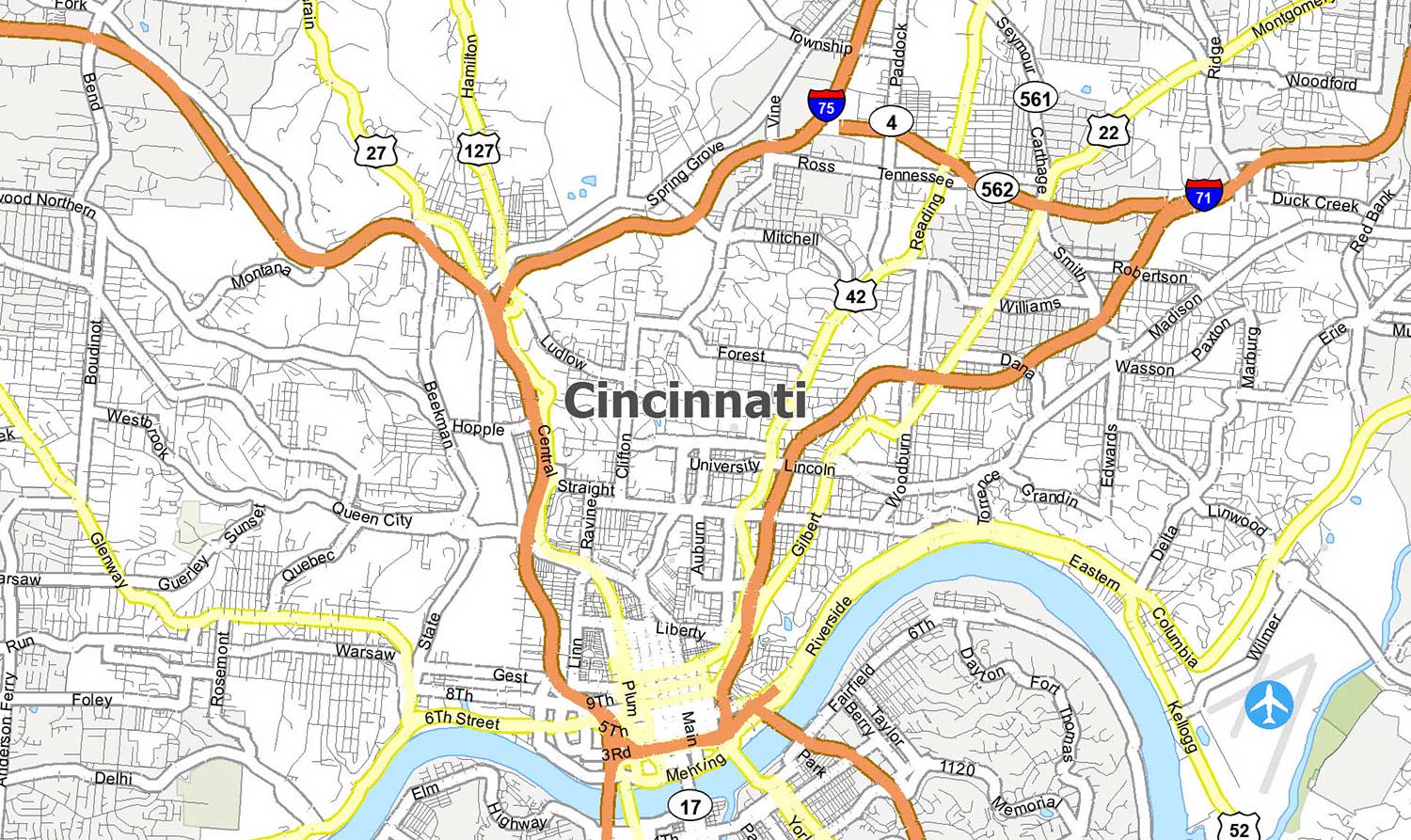

Most of the condition in the united states has actually certain restrict mortgage restrictions which can be in for single nearest and dearest house, and two-cuatro tool qualities. The fresh limitations are ready based upon an average household sales well worth for the reason that county. The bottom FHA mortgage limitation getting single loved ones residences in Georgia for almost all areas try $420,680. Utilize this FHA financing limit search device to see what the FHA mortgage constraints come into your condition.

FHA 203k Money from inside the Georgia

FHA 203k fund are a great system that allow you so you can use the bucks needed seriously to find the home in addition to a lot more finance must rehabilitate otherwise upgrade your house. This program is even found in a state and now we really works having lenders that can help with your FHA 203k mortgage.

If you like to fully understand how this choice works, i recommend training our very own article on FHA 203k financing .

FHA Streamline Refinance when you look at the Georgia

The FHA improve re-finance program is available so you’re able to existing homeowners which really wants to refinance for a reduced price when you’re removing particular of the refinance will cost you such as for example an appraisal. You can even get a cost savings to the mortgage cost which is another advantage.

Georgia FHA Mortgage Pre-Recognition Techniques

Communicate with a lender early in the process as they possibly can pick opportunities to assistance with the FHA approval. This needs to be done days upfront shopping for good domestic. Read more on the best way to score pre-acknowledged to have an FHA mortgage .

What things to Look for in a keen FHA Financial

I capture several things under consideration when examining and therefore loan providers i work on. These also is, otherwise are going to be essential for your as you remain searching to possess a keen FHA loan.