When Diego Corzo got DACA condition half a dozen in years past, among the first some thing he regarded was to acquire good household.

“It had been important for myself,” told you Corzo, twenty-seven, who has got never leftover the united states given that to arrive from Peru on years nine.

“Purchasing my personal household proved in my opinion one to despite each of the chances stacked against Dreamers anything like me, I became however desire that it biggest Western Fantasy,” the guy said.

One of is own greatest fears now could be losing their house if the the latest Deferred Action having Childhood Arrivals program comes to an end forever. If it happens, Corzo you will definitely eradicate not only the initial household the guy bought once the an effective Dreamer, however, an additional house the guy owns he phone calls his “fantasy domestic,” and half dozen other rental qualities he and is the owner of and you can protects.

DACA keeps anticipate almost 689,000 Dreamers, have been delivered to the us just like the pupils, to publicly attend college or university and also work permits and you will driver’s permits. The application anticipate of numerous Dreamers to loans Glenwood Springs CO recover from the fresh new shadow cost savings and implement for mortgages and get home — the pinnacle of American Dream.

“With no employment, I will not be able to spend my mortgage and my personal household would go into foreclosures,” told you Corzo, whoever DACA position expires inside 2019.

President Trump announced during the Sep that he create avoid DACA however, leftover it in order to Congress to take and pass option regulations before Obama-point in time program expires towards February 5. But lawmakers as well as the Trump government had been struggling to flow give.

When the DACA expires, this means that each date for the next 2 years 915 DACA holders, an average of, loses their capability to the office in addition to their protection from deportation.

It is not just obvious exactly how many DACA owners individual home. A survey in excess of 3,000 DACA individuals into the 46 claims indicated that fifteen%, many years 25 and you will elderly, individual a home. You to definitely browse was presented together past August of the School regarding Ca, North park, and partner communities like the National Immigration Law Center together with Heart to have American Progress.

Corzo, which in addition to co-possesses a real house operation from inside the Austin, rates you to within his feel 95% off DACA homeowners has mortgages.

Whenever Corzo got DACA reputation, the guy applied for home financing out-of $160,000. “During the time, I happened to be being employed as a software developer which have Standard Automobiles into the Austin, and you can leasing. It took me annually to construct borrowing from the bank first,” he said.

Removed into loan, the guy ordered his first domestic — four rooms which have red-brick facade — when you look at the . 36 months afterwards, Corzo acquired a second domestic. He rents out his beginning home.

Corzo believes Dreamers who individual residential property was improving the new benefit. “I spend the money for financial, we afford the home inspector, i pay the builder and you will handyman,” the guy told you.

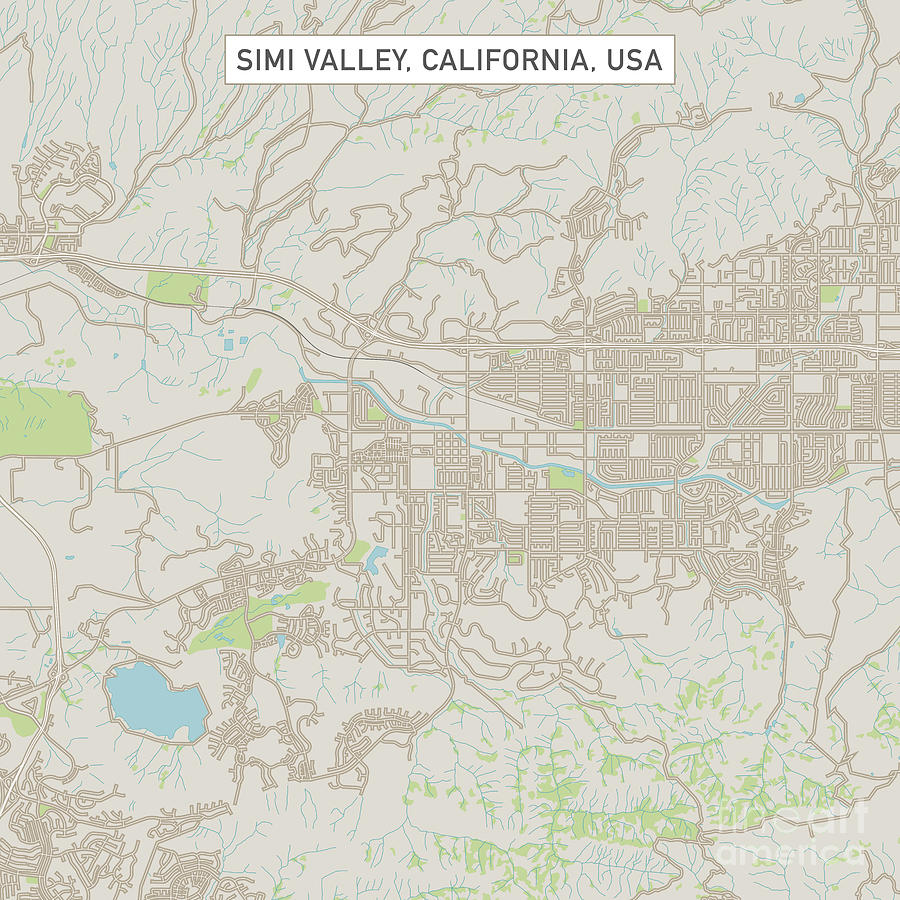

“If the authorities forced Dreamers outside of the housing market, the fresh new local rental field, and ultimately out of the nation, there may be a substantial reduction in the fresh casing costs where it alive particularly in large numbers,” he said.

So you can qualify for DACA, Dreamers need to at a minimum has actually a highschool degree however, of a lot including proceed to university, told you Randy Capps, movie director off look for U.S. apps in the Migration Policy Institute.

“He’s a team whom next make the most of its high education to get high earnings, professional perform, get belongings, cars and stimulate the brand new cost savings,” Capps said.

Juan Mendez, 28, also planned to getting a citizen however, feared taking out fully an excellent home loan on account of his DACA reputation.

“I imagined if the DACA is rescinded anytime, I might get into an extremely bad problem towards financing,” said Mendez, that is an overall health pro from the Walmart ( WMT ) . His DACA updates expires very early the coming year.

Rather, he made a decision to get land in Springdale, Arkansas, in which he existence and really works, of a pal exactly who lent him the bucks.

“My good friend know my personal standing but he in addition to spotted my personal push and you can gave me a chance to go my Western Fantasy,” he told you.

“We set-up a spending budget and the audience is each other fiscally traditional,” the guy said. “It hasn’t been cheap or simple.” To save money, Mendez with his spouse put the new flooring and you may installed shelves, windows and doors on their own. They have spent $twenty six,000 up until now.

To possess Dreamers, DACA’s end you may imply dropping their homes

When the the guy permanently will lose DACA defense sufficient reason for it the ability to get results, Mendez told you he’s going to be unable to pay-off the mortgage from his pal, in addition to he might not have enough to spend their assets taxes or utilities.

“The house is actually my personal way to obtain satisfaction. But it will become my personal biggest load,” the guy said. “I would guarantee President Trump, with his background inside the a property, knows. Dreamers could be a decrease in the bucket but we are creating our area as the property owners in order to trigger the newest economy.”