Glen Luke Flanagan is a good deputy publisher on Luck Advises just who focuses primarily on financial and you will bank card blogs. His earlier in the day jobs were deputy editor ranks within U . s . Today Formula and you can Forbes Mentor, plus senior publisher from the LendingTree-all the focused on credit card benefits, credit scores, and relevant subjects.

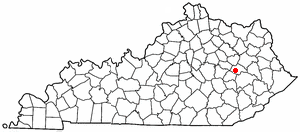

Benjamin Curry ‘s the director out of blogs at the Luck Suggests. $500 loan with poor credit in La Fayette With well over 20 years out of news media experience, Ben enjoys generally protected economic locations and private funds. In the past, he was an older editor at the Forbes. Prior to you to, the guy struggled to obtain Investopedia, Bankrate, and you will LendingTree.

The present day average rate of interest to have a predetermined-rates, 30-12 months compliant mortgage loan in the us are six.127%, depending on the most recent analysis made available from mortgage technology and you can data organization Maximum Blue. Read on observe mediocre cost for several type of mortgage loans and exactly how the present day costs compare with the final said day prior.

Historical home loan pricing chart

Note, there is a slowdown of just one working day within the data reporting, which means most current rates as of today is really what the newest graph suggests for Sep twenty-six.

30-season compliant

The typical interest, for every probably the most newest analysis available only at that creating, is actually six.127%. That’s right up out-of 6.077% the very last said go out prior.

30-seasons jumbo

What exactly is a beneficial jumbo home loan otherwise jumbo mortgage? This means that, it exceeds the maximum amount to have a frequent (conforming) home loan. Fannie mae, Freddie Mac, therefore the Federal Construction Financing Service place which limitation.

The common jumbo mortgage price, each the absolute most most recent investigation available during that writing, try six.429%. That is upwards of 6.417% the very last reported date previous.

30-year FHA

The Government Property Government brings home loan insurance to certain loan providers, and the loan providers in turn could offer the user a far greater offer into the points for example to be able to qualify for a good home loan, potentially to make a smaller sized down payment, and perhaps taking a reduced price.

The typical FHA home loan rate, for every single one particular most recent research offered during that writing, is 5.875%. Which is up off 5.818% the very last said day earlier.

30-seasons Virtual assistant

A great Va home loan exists by a private bank, nevertheless the Department from Experts Points guarantees element of it (cutting risk into the financial). He is available if you are an excellent You.S. military servicemember, a veteran, or an eligible enduring mate. Such as for example financing get either let the purchase of property which have no advance payment at all.

The typical Va home loan price, for every single many newest investigation available at this creating, is actually 5.579%. Which is up out of 5.510% the final claimed big date past.

30-seasons USDA

The U.S. Agencies of Farming operates applications to assist reasonable-earnings individuals achieve homeownership. Including finance can help U.S. owners and eligible noncitizens get a property and no deposit. Remember that discover stringent conditions in order to qualify getting a beneficial USDA home loan, like money restrictions and household being in an eligible rural city.

The typical USDA home loan speed, for every many current data available during that creating, is 5.982%. That is down from 5.987% the very last reported day past.

15-year home loan costs

A good fifteen-season home loan will normally indicate higher monthly payments but quicker interest paid back across the lifetime of the borrowed funds. The average rates for a good fifteen-12 months compliant financial, each many newest investigation offered at the composing, is actually 5.304%. That is right up from 5.224% the past said big date past.

So why do mortgage rates transform so frequently?

Your own personal credit rating greatly influences your home loan rate, however, discover exterior facts within enjoy also. Key factors were:

- Federal Reserve behavior: When the Government Set aside alters this new federal fund rate, lenders normally adjust their interest prices responding. This process assists the fresh new Provided carry out the cash also provide, impacting credit charges for customers and you will organizations.

- Rising prices styles: Regardless if linked, inflation and Fed’s measures is independent points. The Provided changes pricing to manage rising cost of living, while you are loan providers you will on their own boost prices to maintain winnings through the higher rising prices symptoms.

- Financial facts: Loan providers consider such things as economic gains and you will casing likewise have and you may demand when setting home loan prices. These are simply two many issues that determine rate transform.

And this financial is best for you?

There’s no universal answer to a knowledgeable type of home loan. Although many mortgage loans are old-fashioned, government-backed financing you’ll promote a cheaper way to homeownership to possess accredited anyone.

Jumbo mortgage loans was right for to get expensive homes you to definitely go beyond conforming mortgage restrictions, but they is costlier in the long term.

Adjustable-rates mortgage loans (ARMs) fundamentally start by reduced cost which can improve through the years. Consider this meticulously considering debt agreements.

When the rate hunting seems challenging, a large financial company will help (to own a fee) to locate the best financial bring according to your needs.

Just how high possess mortgage rates been in during the last?

When you’re financial costs may suffer air-higher these days than the sandwich-3% prices particular homeowners scored during the 2020 and 2021, exactly what we are viewing already is not that strange in comparison with historical studies towards the home loan speed averages. Listed here are two charts from the Federal Set-aside Monetary Studies (FRED to possess brief) on line databases to have perspective.

30-seasons repaired-rate home loan historical manner

If you think rates between six% and you may 8% today was scary, believe September using November off 1981, and this noticed an average speed hovering ranging from 18% and you can 19%, predicated on FRED.

15-12 months fixed-price mortgage historical trend

Pricing now into 15-year mortgages, just like the shown about Optimal Bluish study above, try more or less into the level if you don’t some lower than that which we look for during the many early in the day attacks. Such, view FRED studies into the stop from 1994 and you can beginning of 1995, whenever rates neared nine%.