step 3. Could you be able to repay the total amount? What is going to become your installment schedule?

Mainly, all of the financial, not just a professional lending company, wish to know in the event the debtor can also be repay the cash. This might be their top priority grounds and so they would need things to provide them the latest confidence you’ll pay their funds.

The money lenders demand a warranty which you sometimes feel the offers or the will power to repay all of them back.

It is crucial that bank and you will debtor talk about the loan installment build in detail when trying to get the mortgage. That have a commercial home loan, brand new installment structures are different.

There have been two form of payment dates-Immediate and Long haul. Instantaneous fund need to be paid in couple of years or less, whenever you are long-term loans can also be stretch to a period of around 20 ages.

Installment construction would-be similar to bank loans (amortizing) where count are settled round the numerous instalments as well as an enthusiastic attention. On top of that, fees is in the form of a great balloon mortgage one payment to blow the loan dominating amount.

cuatro. What is the assets?

Loan providers basic you will need to comprehend the property, their have fun with and how the fresh new borrower use the property. Nevertheless they inquire about the installment loans in Minnesota worth of the house or property, in the event that borrower own it, what amount they paid, the current property value the property, therefore the present reputation.

Really lenders prefer the possessions to stay suburbs or across metropolises. They’ll do an evaluation with respected organizations to understand the real worth of.

Tip: Be sure to supply the best suggestions towards financial for a publicity-free processes. If you have established mortgages to your possessions, definitely allow the financial learn about they and offer info to support the newest claim. İncele

BECU Home loan Things

BECU try a card union based inside Bellevue, Washington. The credit partnership unwrapped to have team when you look at the January regarding 1953, which will be currently run under the People Solutions Credit Connection Operate of Arizona. BECU are seriously interested in promising an educated lending means because of its members, if you are providing imaginative services solutions installment loans in Ottawa to the financing connection too given that non-players. BECU now offers mortgages, household guarantee money and you may reverse mortgage loans.

BECU provides 330,100 players which can be served by twelve branches located during Washington. Membership requirements was very versatile, making it possible for people that alive, work, worship or volunteer for the King, Snohomish, Penetrate otherwise Kitsap Areas to be entitled to registration appreciate the wonderful great things about BECU subscription.

BECU and sponsors a cards relationship to your Bellevue School Region and also the Seattle Personal Schools, enabling those people coaches and you can administrators in those college or university areas to love some great benefits of all that BECU is offering. İncele

Benefits and drawbacks out-of FHA Funds

Choosing your home mortgage actually simple. There are various things to consider, as well as the outcomes of making not the right alternatives is costly and a lot of time-lasting. But when you choose the best home loan, you will put away currency and then have a less complicated date qualifying for the mortgage.

Even if you think indeed there commonly of many differences between style of financial, he could be built to qualify of various brand of consumers. Certain mortgage loans will be really right for your situation, although some, however, very won’t.

With respect to FHA finance, there are many benefits to opting for these types of home loan. There are also particular prospective disadvantages that you need to become aware of before you decide to have fun with an enthusiastic FHA mortgage so you can buy your home. We look at the things you need to learn about a keen FHA loan.

Should you an FHA Financial vs Antique Mortgage?

These financing are present while making to buy property easy for far more somebody. People would not be eligible for a conventional mortgage, which means this mortgage is made by the Government Casing Government. The newest Federal Houses Administration (FHA) was developed inside the 1934 in an effort to treat the favorable Despair. FHA is created because of the Federal Houses Operate.

New FHA loan program has the benefit of consumers another option with relaxed rules so you can be eligible for the borrowed funds they need to buy their domestic. Without having an educated borrowing or far currency conserved into advance payment, an FHA loan you may obvious your path so you can homeownership.

FHA fund will be good option whether you’re a first-big date home visitors or not which help whenever funds dont meet the minimum conditions to have a traditional mortgage. But such mortgage will not end up being proper for everyone. İncele

Want to refinance the mortgage but worried you are refused? Observe a loan provider usually determine your residence loan refinance app.

A knowledgeable step you could just take upfront will be to work with an accredited lending specialist who besides understands your aims, but that is educated in borrowing from the bank and you may honest in most discussions.

Sometimes you could hear things you dislike but don’t carry it actually! A financing specialist’s purpose is to find an informed result to possess your centered on your personal affairs.

Your credit score is too reasonable

When you connect with refinance your property financing, you happen to be fundamentally applying for a whole new home loan. It means a loan provider tend to evaluate the application utilizing the same standards they might some other mortgage brokers. And something of the biggest activities they’re going to envision is your credit rating.

Your credit rating generally scratches your exactly how in control youre which have money and you can takes into account one borrowing from the bank infringements, judgements or bankruptcies. What’s more, it talks about how frequently you have applied for borrowing and whether you are meeting the mastercard and personal financing repayments towards the date.

Your credit rating change through the years, therefore chances are a varies now so you’re able to after you grabbed your latest home loan.

If your credit score is holding you back, you could potentially take the appropriate steps to solve they oneself. Including trying to repay any cash you borrowed, making certain you see the monthly money for the future and you may avoiding making an application for borrowing from the bank other than the refinanced financial.

Your financial situations has actually changed

And in case a lender analyzes a software, they always think about your capacity to meet the loan costs. İncele

All pricing and you can APRs is getting illustrative aim merely. At the mercy of transform South Dakota personal loans without warning. Said as low as APRs are derived from presumptions. Not all candidates commonly be eligible for a low rates/Annual percentage rate. Other prices and you may terminology can be offered.

Mortgage: To possess current prices and fee examples, excite refer to our day to day Financial Prices page. Monthly premiums dont tend to be property taxation otherwise insurance policies, the fee is highest. ily, number one household when you look at the California, a credit score of at least 740, and a blended LTV of sixty% otherwise faster. To have consumers with below a beneficial 20% down payment, financial insurance is necessary. Restriction mortgage numbers may include $647,2 hundred in order to $step 3,000,000, depending on loan system.

5/5 Variable-Rate Financial (ARM): Variable rates mortgage, notice and you may costs get increase once consummation. Towards basic 5 years, rate is restricted. Next, speed have a tendency to to switch with regards to the current list along with a good margin of dos% all of the five years into life of the borrowed funds.

3/step one Varying-Price Mortgage (ARM): Changeable rates mortgage, interest and you may costs may boost immediately after consummation. On the earliest 3 years, speed is fixed. Next, rates usually per year to improve depending on the most recent directory and an effective margin of dos% into the longevity of the loan.

Repaired Rate dos nd TD ten Seasons/ fifteen Season: Repaired month-to-month dominant and you may interest money for life of financing.

Family Security Loans/Credit lines: APRs suppose a minimum credit rating of at least 720, and you may a combined LTV (CLTV) off lower than ninety% to own a house guarantee financing and you can a mixed LTV out of reduced than just 70% to have an effective HELOC. İncele

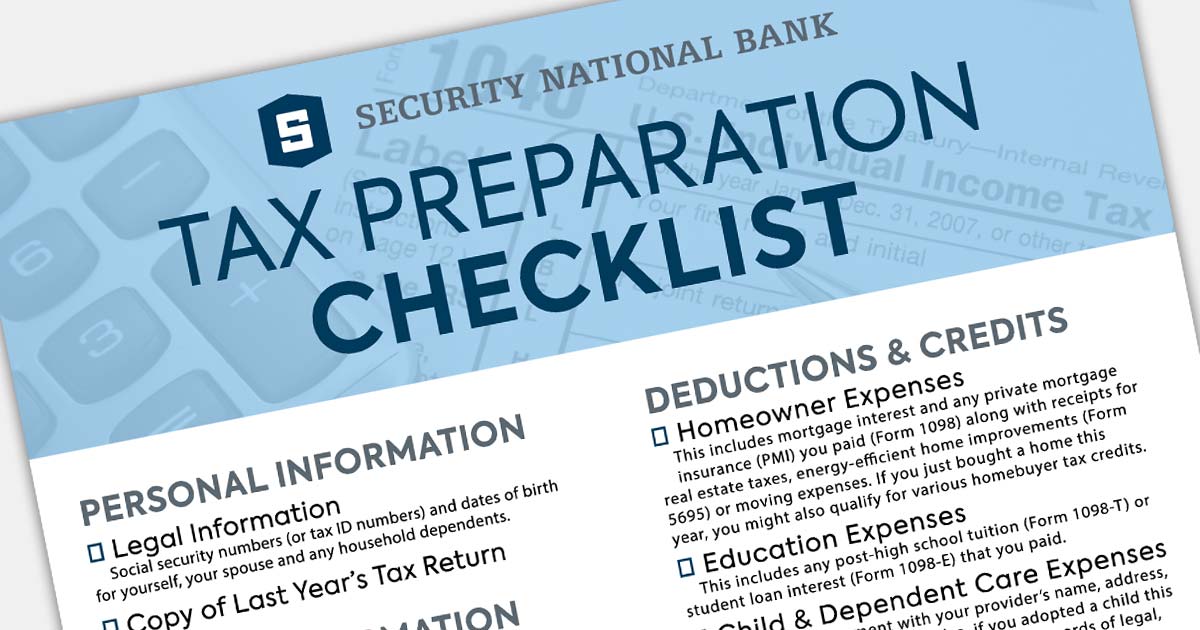

You’ll want to fill out proof any extra earnings you will get continuously too. best banks for personal loans in Idaho This might were alimony, child service payments, or Social Defense money, like. You need their Social Shelter award letter or their court agreement/court decree once the proof for these issues.

Employment confirmation

Lenders should not merely observe that you have got currency now – but feel pretty sure there will be the income and then make your own repayments for the long lasting, too. For that reason, they’ll want another.

Contact information for companies

You will have to provide the label, address, and contact number for the workplace and boss of some body more on mortgage. They will certainly contact these communities to verify you’re actually employed by all of them.

A career history

Additionally, you will need outline your own past a career, and schedules, providers labels, or any other info. This indicates the financial institution which you have already been continuously working – that have stable money – for some time and will likely continue to be that way for the overall.

Credit guidance

The bank can look to your credit rating to gauge just how well you manage loans. To accomplish this, they’re going to need:

Consent to have a credit assessment

The lending company often eliminate your credit history and you will get and you will see your installment record. They’re going to and see simply how much personal debt you may have and you may your existing stability. These borrowing checks generally have a small fee you’ll be able to spend during the closure.

If you will find people imperfections on the credit report, you can identify such into the a page and fill out it to your bank. Such, in the event your high credit card harmony isn’t really on account of crappy investing models but rather, good scam artist exactly who stole the mastercard amount, you may want to establish this toward financial that it won’t impression their home loan opportunity. İncele

Having a zero-closing-rates re-finance, there are 2 famous downsides. Beneficial as it may getting to hold on to your hard earned money, there clearly was speed to pay for the convenience:

Don’t assume all lender offers these alternatives, thus evaluating at the very least a few companies can ensure you get the loan you want at a consistent level you can afford

- This may cost you extra money in the end: Running the latest settlement costs with the mortgage means raising the dominant harmony. A loan provider credit develops their interest. Both options improve your refinance rates.

- Your I): In case your rolling-to summarize costs of your own the new mortgage push your loan-to-value (LTV) ratio over 80%, leaving you with lower than 20% guarantee of your property, the financial institution requires you to buy PMI. İncele

The knowledge & Analytics department out of Black colored Knight handles the nation’s top data source out of loan-height domestic financial investigation and gratification advice since the almost all the general markets, and additionally 10s from countless finance across the spectrum of credit products and more 160 million historical details. The fresh combined insight of one’s Black Knight HPI and you may Guarantee Analytics’ household rate and you may a house studies brings perhaps one of the most done, appropriate and you will timely tips regarding home prices available, covering 95% out-of You.S. residential properties right down to this new Zero-code top. Likewise, the company best personal loans Colorado preserves one of the most powerful personal possessions details database readily available, coating 99.9% of your own You.S. society and you may house off more 3,100 areas.

Black colored Knight’s research professionals meticulously get to know this info to make an excellent conclusion supplemented of the all those charts and you can graphs one to echo development and you will part-in-time findings towards monthly Financial Display Declaration. İncele

Just what are their doubts? And just how ‘s the performs progressing? Which will be as to the reasons We made new journey Used to do. It’s very simple to say, as the particular said, when this new President trip from the nation he is going that have a blare from trumpets, having crowds same day loans Old Hill CT of people to your pathways, with battery packs regarding journalists and you can photographers — speaking and you can posing with all the politicians of your property. But which have had particular experience in which war along with the new last battle, I can reveal extremely merely that sort of journey I took enabled us to concentrate on the performs I’d to accomplish as opposed to spending big date, appointment the requires out of coverage.

And you will — I’d incorporate — it was a certain fulfillment and then make a trip of your own country without the need to provide just one believed to government. We expect you’ll make other trips for the same intentions, and i also will make certain they are in the same manner. İncele

Our very own special credit applications are also create to minimize our borrowing from the bank exposure

A critical diminishing of the equilibrium sheet will be complete apparently rapidly, since a substantial part of https://paydayloanalabama.com/frisco-city/ the assets the Federal Put aside holds, including funds so you’re able to loan providers, brief central financial exchangeability swaps, and you will instructions regarding commercial paper, was small-term in nature and will simply be permitted to runs out because the some programs additionally the organization is actually closed or scaled straight back. İncele

- Result in the house as well as slines mans lifestyle and will create your house more appealing and you can rewarding. Setting-up a sensible thermoregulator, smart lighting and you can wise home locks are just some of the latest technological reputation you may make to evolve the house’s well worth. Cover is another factor to weigh. Ensure that the home features working cigarette alarm systems and you will carbon monoxide gas sensors. Extremely says want sensors and you can sensors to own a property are up-to-password.

4. Re-finance Your residence Loan

When you purchased your home, you have taken out a 30-seasons financial. If you find yourself wanting building family collateral more readily, it makes sense to help you refinance your loan so you’re able to good 15-seasons mortgage.

- Time: You are able to https://cashadvanceamerica.net/payday-loans-il/ pay back a beneficial fifteen-seasons financing in two the full time it will require to repay a 30-season financing. This means you’ll be able to individual your home downright far sooner or later.

- Interest:Usually, 15-seasons mortgages have lower rates than 29-seasons loans because lenders see all of them once the safer. İncele