By truthfully examining the value of these types of features, the lender managed to render aggressive home loan pricing and you will appeal consumers seeking to put money into the area

3. An alternative choice means becoming more popular are desktop appraisals. Within approach, appraisers fool around with tech to help you remotely determine a great property’s worthy of by the evaluating analysis and images. İncele

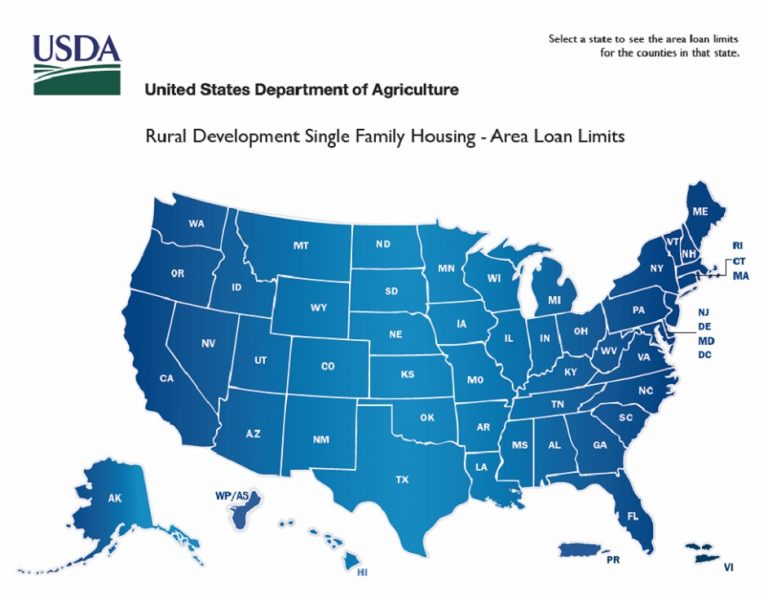

For many individuals and you may family inside The latest Hampshire, owning a home remains a serious milestone, the way to homeownership can often be scattered with monetary hurdles. These funds, backed by the usa Service from Agriculture (USDA), is actually a chance for the individuals looking to reasonable casing choices inside the rural and residential district regions of This new Hampshire.

Whether you’re an initial-time family buyer otherwise looking to go on to The fresh new Hampshire’s calm country, understanding how USDA finance work makes it possible to browse this new country’s housing market with confidence and clearness. Companion with Griffin Money to help you safer a beneficial USDA financing during the NH from the an easily affordable rates.

What’s a great USDA Financing?

USDA fund is backed by the usa Company from Agriculture (USDA) and you will be the specialized mortgage program geared towards assisting homeownership into the outlying and select suburban areas. The latest USDA loan program has its own root on Agricultural Loans Act regarding 1923, and therefore lined up to provide borrowing so you can producers having difficulties when you look at the Higher Depression. Typically, the applying evolved to deal with broader rural development demands, and the means to access houses.

It attracts anyone and you may group seeking to buy residential property in the this type of nations simply because of its unique professionals, along with low to help you no down payment criteria, aggressive interest rates, and flexible eligibility criteria. Such financing offer an alternative path to homeownership of these from inside the americash loans Leighton AL places that old-fashioned money is scarce otherwise unreachable. İncele

Getting these things under consideration, HUD concluded that the cost getting disbursements made lower than mortgage verify obligations approved into the FY 2025 is 0.82 per cent, and is used here at enough time out-of mortgage disbursements. Remember that future announcements may provide for a combination of upfront and you can unexpected charges having financing guarantee requirements approved in the future financial many years however,, therefore, HUD can give anyone the opportunity to remark when the compatible under 24 CFR (b)(2).

Simply because different circumstances, for instance the method of getting People Advancement Cut-off Offer (CDBG) finance as cover getting HUD’s ensure because the offered inside 24 CFR (b). S.C. 5308), borrowers will make costs to the Area 108 financing using CDBG grant loans. Borrowers can also build Area 108 mortgage costs off their envisioned provide however, continue to have CDBG funds readily available should they stumble on shortfalls regarding expected repayment supply. Despite the program’s reputation for zero defaults, Government credit cost management principles want the availability of CDBG fund to repay new protected finance can not be assumed from the development of your own borrowing subsidy prices imagine (get a hold of 80 FR 67629, ). In accordance with the price one to CDBG finance are utilized annually for fees of financing guarantees, HUD’s computation of borrowing from the bank subsidy rates need admit the possibility from coming defaults in the event that those people CDBG loans were not available. İncele

Looking a business personal line of credit for your organization? Usually, small enterprises seek out the major banking companies to find, including, a primary Republic Providers Credit line.

Ahead of jumping when you look at the, knowing what a financial actively seeks regarding acceptance techniques can also be help save a debtor long and you can concerns. Shortly after building eight businesses for the 25+ decades and working with many banks, We have discovered just how to enhance your chances of delivering acknowledged. İncele

This new Main Lender regarding Asia Home loan Calculator is an essential product having prospective consumers. They aids in determining brand new monthly money based on more financing quantity, rates of interest, and you will tenures. For those offered applying for a loan, the home Loan Qualifications Calculator also have next recommendations.

Making plans for your mortgage payments gets easier to your Central Financial out of India Financial EMI Calculator. Which product makes it possible to calculate their month-to-month EMI, permitting most useful monetary planning. To own a explanation thorough investigation, go to the Home loan EMI Calculator.

Extremely important Financial Aspects of Central Financial regarding Asia Mortgage brokers

Knowing the very important financial areas of home loans is extremely important for one debtor. İncele

Just what lifestyle would be like in Idaho’s financial community from inside the 2019 depends a lot on what the national and global economies do.

Idaho together with country enjoys enjoyed one of many longest bull segments ever, however, there had been signs your team is coming in order to a finish.

Inside 2019, I desired that Idaho’s cost savings and people continues to build also, said Brian Berrett, captain financial officer to have Idaho Main Borrowing from the bank Relationship. We allowed your rate grows we have been experiencing across the just last year otherwise two commonly impede. However, there could be a lag for the financing on account of one the develops in addition ones there is currently had.

December noticed the stock market edging on incur territory, the connection business flirting the fresh new upside down yield curve normally presaging a good market meltdown, plus the Government Set-aside Financial elevating interest levels, which decelerates financing

what do you need for a title loan in Montana

Due to increases inside the interest levels, there’ve been particular pullback on the financing, especially in the new refinance field, he told you. İncele

Just what a credit rating assortment method for your

When anyone reference “good” borrowing from the bank, “prime” borrowing from the bank, otherwise “bad” borrowing from the bank, he could be generally speaking writing on buckets from credit score range. Knowing where your credit score falls will assist you to know the way lenders you certainly will evaluate their borrowing from the bank app. İncele

Mortgage Lives and you may Impairment Insurance rates: Insurance bought by individuals to settle home financing in the eventuality of demise or make monthly installments throughout the matter-of disability. The amount of visibility reduces as the prominent balance declines. There are various regards to visibility determining quantities of money incase repayments initiate and you can end. İncele

Independent output. When you are hitched submitting by themselves and also you plus lover own multiple domestic, you can for each and every account for only one home just like the good certified household. not, for those who each other consent written down, the other partner takes both the chief family and you may good next house into account.

This part makes reference to certain products which is incorporated since the family financial attract while others that can’t. it relates to particular unique products that will affect their deduction.

Late percentage costs for the mortgage payment. You might subtract since the real estate loan attract a belated percentage fees if this wasn’t having a certain service did in commitment along with your mortgage loan.

Financial prepayment penalty. For individuals who pay off your house home loan very early, you may have to spend a penalty. You can deduct that punishment as home loan notice given brand new penalty is not suitable a certain provider did or cost sustained concerning the your own real estate loan. İncele

Discover crucial factual statements Fresno installment loans no bank account about book-to-very own sheds, out of funding without credit inspections to selecting the most appropriate build and size for your needs.

Chris Fluegge

A lease to own missing is a great choice for people looking to include extra space instead of damaging the bank. Whether you’re seeking to store tools, yard gadgets, or maybe just you want extra space to own a venture, renting for will likely be a handy and affordable answer to score what you need. İncele

Thus, one of several something Virtual assistant has been concentrating on is when we are able to create all of our loan program more competitive to possess Veterans having fun with the latest Va financing be certain that to purchase their property. We place even more emphasis on outreach to the Federal Connection from Realtors (NAR), so we have done outreach and you may telecommunications tricks to assist further teach Realtors and real estate agents regarding the Va mortgage procedure and you will how important its one to Seasoned consumers can be personal on the domestic they have selected to find for their members of the family.

When you look at the COVID-19 federal crisis, we had to handle Va assessment costs relative in order to traditional and you can FHA areas, additionally the volatility of these rising charge possess understated a bit. Turn-moments are significantly reduced too.

Va stepped up their fees inside the COVID-19 low interest environment. Given that the marketplace has started so you’re able to cooling off, those individuals costs ple, Este Paso Colorado are an extremely tough marketplace for new Virtual assistant. There are just unnecessary appraisers involved in new El Paso urban area. Traditional and you can FHA areas have been as well as spending a paid to possess appraisers. İncele

Yet not, you’re in a position to come up with a down-payment when you have some offers. Specific mortgage sizes (FHA, Virtual assistant, and many conventional loans) or downpayment advice software promote options to possess homeowners to get down 5% or reduced, therefore it is much more feasible which have less offers. A state or local construction department is a fantastic place to check for such unique apps.

No matter if student loan loans could affect your homeownership travels, it doesn’t preclude you from it. You can find things you can do to obtain available, even affordable, mortgages.

Very first, imagine refinancing or consolidating their figuratively speaking to reduce the month-to-month commission. Consider just how DTI are determined because of the breaking up the monthly gross income by your month-to-month personal debt payments? That is where you to will get extremely important. Refinancing your own student loans you may make you a reduced monthly payment, hence coming down DTI and you may leading you to eligible for a bigger financial. İncele