Leave behind the changing times regarding having to offer your home before you buy a different one to. There clearly was an easier way, and you will our 100 % free publication stops working how it can work for your.

An assumable financial is a kind of mortgage enabling a purchaser when planning on taking along the seller’s present mortgage, while obligations because of its words and repayments. It plan can offer benefits to one another customers and you can providers, assisting much easier purchases and possibly good words.

Assumable financial listings high light qualities where this one is obtainable, drawing customers trying to like ventures. Knowing the ins and outs from a keen assumable financial is very important both for activities inside, ensuring transparency and you will informed choice-and also make for the a property deals. Therefore, understanding the ins and outs of which financial particular can also be enable customers and you may providers similar inside the navigating this new housing market. İncele

Bridge Financing compared to HELOC: After you might need one to

What happens if you wish to buy your 2nd domestic however, have not yet ended up selling your existing that? You will need financing, generally as an extra mortgage. Two types of the individuals try solid contenders. However, that is healthier? We’ll help you decide inside our bridge financing compared to HELOC post.

What is a connection loan?

Oxford Dictionaries represent a link financing just like the a sum of money lent because of the a financial [or other bank] to pay for a period between one or two transactions, usually the purchasing of one home and also the promoting of some other. İncele

We create selling your property an easy affair.Only submit the form below otherwise contact us at: (612) 260-5577 to truly get your totally free, no-responsibility cash offer!

When you are both mortgages and you will deeds from believe try foundational inside property capital, they aren’t synonymous. The primary differences is based on brand new parties involved together with foreclosure processes.

Home financing arrangement has two people: the latest debtor and bank. The fresh debtor guarantees the house for the lender since security for the loan. In the event the borrower non-payments, the lender must look at the official foreclosures processes, which often requires the court system and can getting day-consuming. İncele

Whilst you won’t comprehend it up to just after these include gone, but we-all need to day someone that i imagine so you can function as the one who had aside, if perhaps and also make our everyday life feel a great Gabriel Garcia Marquez book.

eight. The latest Personal

Oh, this new close! After you live-in a society in which romance is an effective heart emoji, after that searching for a genuine close is a significant contract. Everyone will probably be worth so far the brand new intimate; the person who shows up that have flowers, produces unbelievable love poems about you, and isn’t afraid to be affectionate in public areas. Men and women.

8. The new Connection-Phobe

The thing is, really the only good thing that accompany relationship an union-phobe is actually, if you are searching for someone to help you going afterwards, it is possible to notice the union-phobe of a distance throughout your daily life. This might be a great ability to possess.

9. The latest FWB

Whenever you are dating isn’t exactly a term you to goes hands-in-give which have messing around along with your pal with professionals, it’s still an online dating/sexual/almost-relationships sense we would like to get into one which just wed. İncele

- Railings: Stairways and elevated porches must have railings.

- Paint: Property situated ahead of 1978 would need to address top honors-created painting demands. Inside homes dependent just before 1978, around can’t be chipped otherwise flaking painting anywhere. Which have broken or peeling painting, to the otherwise exterior when a property was based ahead of 1978 are a primary red flag. The new no peeling color criteria and pertains to outbuildings also.

- Termites and other wood-destroying bacteria: You’ll want so it assessment. If the inspector pick past ruin, it may must be repaired. You simply cannot enjoys active termites or other destroying insects. When the discovered, the home and out buildings need to be addressed ahead of closure.

- Kitchen appliances: It requirements is a little unclear but information on how We experienced they explained to me. İncele

Buying your basic residence is a large decision. But learning much more about the procedure will assist you to end up being waiting while increasing the depend on shifting. Less than was a summary of first-date house buyers’ faqs. Continue reading to find out about brand new pre-acceptance techniques, while making an offer, and you may escrow payday loans Iowa.

Pre-Approval Processes

What’s pre-approval? Pre-approval is actually a means about how to expose your creditworthiness before to invest in a home. It is a significant first step to have earliest-go out homebuyers. It will help your find out how much you can borrow. Using this count, you are motivated to begin with house bing search by the once you understand your own price variety. To get pre-approval, you should talk to a loan provider to begin the method. This is good possible opportunity to mention financing options, and you can budgeting demands, and you will identify prospective credit things.

When ought i initiate the brand new pre-acceptance techniques? When you have a good credit score and generally are positive about your ability in order to be eligible for a loan, you need to consult with a loan provider if you’re able to start family hunting. İncele

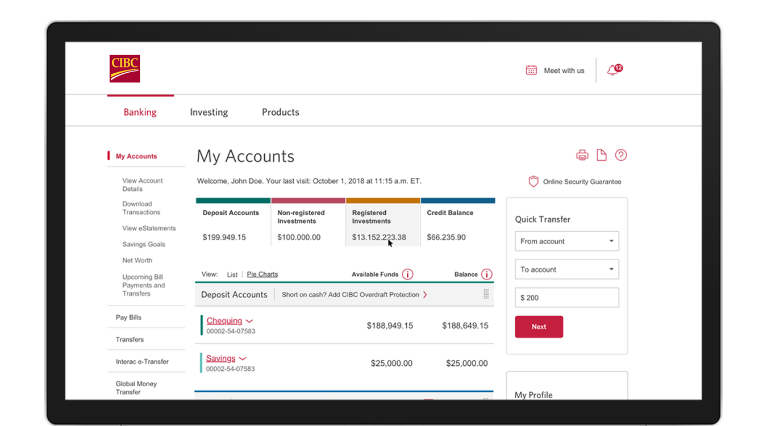

Functions ACH and check stop repayments

Universal Representative Relationships Expert I VyStar Borrowing Relationship 114 evaluations – Jacksonville, Florida Complete-day, Contract Inside the a multiple-activity, wide equipment environment, individually interview professionals to recognize chances to promote and you may expand brand new professionals relationship with VyStar Credit Union. Describes from the interview techniques products and/otherwise functions who work with the fresh user. Educates and efficiently even offers these materials and you will/or characteristics improving the associate experience. Correctly makes ideas in order to VyStar organization couples. Reveals assistance of one’s borrowing from the bank unions business strategy in addition to their branchs dating building and services expectations by the creating quality, full range products, demonstrating a professional, is going to do attitude and providing the high quantity of solution. İncele

Assumable mortgage loans will let you buy a house if you take over (assuming) the seller’s mortgage in lieu of getting another type of mortgage to acquire the house or property.

You retain brand new seller’s interest, dominant equilibrium, repayment years, or other mortgage terms once you imagine its mortgage and be responsible for purchasing it well.

The new seller’s financial should agree the job, and you may need certainly to comprehend the advantages and disadvantages off and when the borrowed funds to decide when it is a good choice for your requirements. Keep reading for additional information on assumable mortgage loans. İncele

Try a home loan anticipate when you look at the Islam?

Islamic students basically agree that this isn’t permissible having Muslims to acquire property using a classic real estate loan. That’s because in the middle from a vintage financial was riba, the technique of credit and borrowing money on attract.

Particular students say a classic home loan may be enabled significantly less than extenuating circumstances, where purchasing a house is recognized as a wants and no solution so you can a mortgage is present. Yet not, Islamic fund solutions to home financing now exists on West. In which reasonable selection exists, the different won’t pertain.

Shariah-certified possibilities to help you a home loan create can be found, and therefore are no longer merely easily obtainable in The united states but competitively priced as well.

What is actually a keen Islamic home loan?

An enthusiastic Islamic financial derive from an entirely other basis off a vintage real estate loan. A great halal home loan is not financing anyway, but an entirely some other particular team deal based on standards that are appropriate below Islamic legislation.

How do you ensure that your home financing try sharia agreeable?

- First, favor a house financier you to exclusively will bring Islamic home financing. It is best to prevent choosing a bank that provides thus-titled Islamic mortgages on the side if you find yourself stepping into many products that are not halal. Read more on as to why less than.

- Following, make sure that the brand new financier’s attributes is riba-totally free. The entire first step toward the credit might be organized for the sound Islamic tactics. İncele

During the 2013, in the ages of 26, I purchased my personal basic family. Long time members out-of my blogs, L Bee in addition to Money Forest, can ascertain this new achievements and you may downfalls with the monetary flow, but the thin is that I leveraged advance payment help score a lot. really the only drawback are it necessary a great amount of really works.

Renovating my personal first house are an emotional processes: I got a falling-out using my contractor; We chatted about my mistakes and home restoration money-related issues in this post and therefore one, but I haven’t discussed where all the money to fully ree out of. İncele

4. Proof Income

Just as in most funds, lenders must ensure you have enough earnings to settle a beneficial house equity financing or line of credit. Nonetheless they make use of money and other factors to determine their borrowing limit. Before applying, make sure you possess pay stubs, W-2s, tax returns or any other style of earnings verification available to you in order to prove you may have enough money.

5. Lower Financial obligation-To-Income Ratio

The debt-to-income proportion (DTI) is one of the most essential factors lenders feedback before making an approval ount of your monthly gross income you to goes to your own monthly debt burden. Overall, a lower DTI ways to help you lenders you might be expected to successfully would a different mortgage otherwise line of credit than just a debtor that have a leading DTI. Lenders typically choose an effective DTI off 43% otherwise quicker.

6. Evidence of Home insurance

Loan providers usually do not generally agree that loan secured by the home unless of course you may have homeowners insurance. The insurance coverage covers the brand new lender’s capital facing an economic losings in the event the your property endures a disastrous feel.

Family guarantee funds and you may HELOCs are worthwhile products to help you tap into your household collateral so you’re able to combine loans otherwise pay for large costs. Nonetheless, almost every other funding solutions will get fall into line better along with your specific condition. İncele

Immediately after the stock market crash within the October 1929, Hoover prolonged federal command over farming from the broadening the reach away from the latest Government Ranch Board (FFB), that was composed a couple months before

seven The idea behind the fresh new FFB would be to create government-financed fund so you can ranch cooperatives and create stabilization companies to store ranch pricing up-and deal with surpluses. You to definitely fall, Vacuum cleaner pressed this new FFB on the full action, financing in order to producers nationwide and you will if not subsidizing farming in an effort to keep prices upwards. İncele