could have the legal right to material conformity purchases, require unique audits, and need brand new holding team to boost its investment where facts warrant; and you will

Too, the balance create enable almost every other businesses as interposed between your lender as well as the holding providers, so long as the newest holding organization managed all the agencies more than the financial institution throughout the strings regarding ownership. İncele

Other popular information

- Look for Build a repayment

- Choose Register

- Search for Prices

- Try to find Get Rewards

Essential Announcements

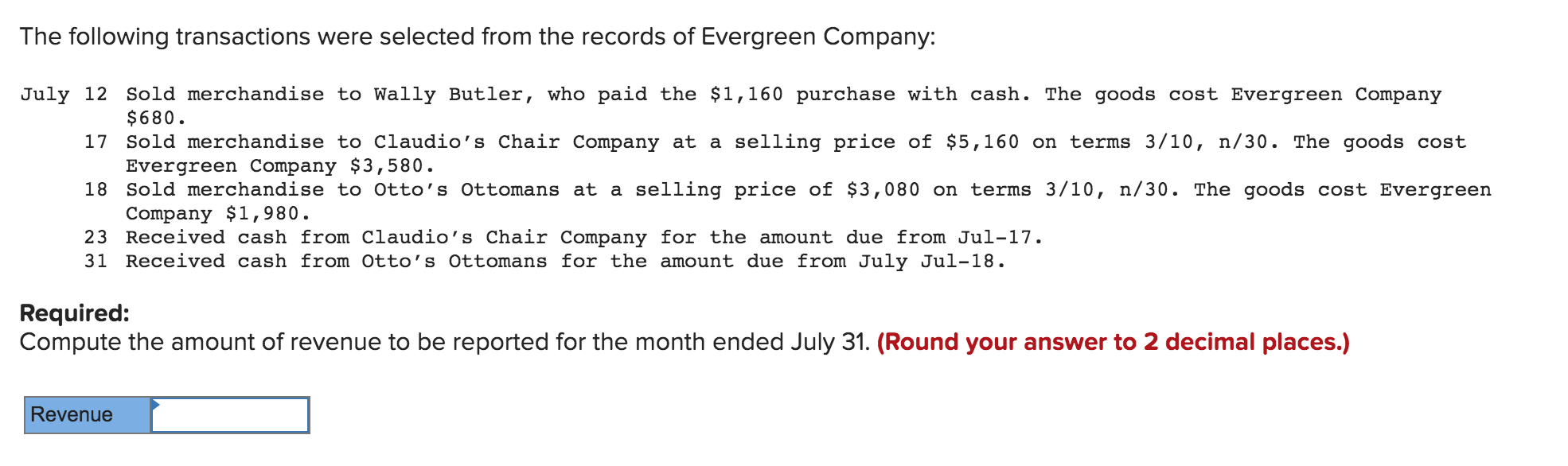

Which is clear. A property is a significant purchase and a large funding. Exactly how much you will be spending money on they over the years normally be impacted by some things, a few more visible than the others.

As the a washington state very first-go out homebuyer, you may ask yourself regarding the different types of mortgage brokers readily available and which you ought to favor. Luckily, there’s many guidance to adopt. If you get a home loan, you are investing in purchase a major get that you experienced, and you also wish to be sure you will be carrying it out proper. Financial costs, conditions and you will financial requirements ought to be studied into account.

Locating the best loan for your house get has no so you can become terrifying or stressful. You might move through the method more readily with some piece of studies. Here is what you need to know one of the popular prominent types from mortgage brokers.

Old-fashioned financial

A conventional home loan was home financing that is not offered or secure because of the an authorities institution. This is basically the “typical” home loan most people contemplate when they speak about to purchase a beneficial household, and is provided by very lenders. Conventional home loan costs is pretty similar around the economic organizations, however you should always examine has the benefit of regarding about about three loan providers for the best rate. İncele

With respect to to acquire its very first family, lots of people and you may family members inside Maine may face economic challenges and you will traps. And here basic-go out homebuyer advice software need to be considered. This type of programs make an effort to render support and you will information to simply help very first-date homebuyers browse new advanced means of to get a house, making it significantly more accessible and you may sensible. Inside point, we shall mention the significance of this type of assistance programs and offer an introduction to Maine’s housing marketplace.

The significance of First-Big date Homebuyer Assistance Apps

First-date homebuyer guidelines applications are designed to target the requirements of somebody and you may family who’re going into the homes s recognize this new economic hurdles that can end aspiring property owners away from realizing the goals. By offering various forms out-of assistance, such as for example down payment guidelines, low-rates, and informative tips, this type of applications make it possible to top the play ground to make homeownership way more achievable.

Direction apps not just provide financing and in addition offer recommendations and service throughout the homebuying techniques. İncele

Sign in into on line membership and click towards the Security passwords to see their dashboard. Just click Costs and click in the great outdoors Pending Money.

If you would like us to alert you as soon as we withdraw the commission from the savings account and you can post it towards financial account, create text message or email address announcements. İncele

All over the country recently established that it’s today giving first-day buyers a primary improve by the financing as much as half dozen moments earnings. The newest circulate the first from the a primary high-street bank assists target the brand new value complications you to nonetheless suppresses a lot of people regarding taking onto the assets ladder.

Britain’s most significant building people often increase the maximum Loan-to-Income (LTI) proportion available along with their Enabling Give the mortgage improve getting first-time consumers revealed when you look at the 2021. İncele

Financial underwriting process United kingdom

Before you can get the home loan recognition, there are many stages in the loan application techniques; tips and agreements was exchanged. The loan underwriting stage is one of this type of amounts. This will be an essential part of every home loan application, and it will devote some time.

It is essential to know how enough time it entails to help you buy property, just what processes can take expanded, and you may just what costs are. Because of this lenders just who promote tailored mortgage recommendations are very useful.

Our company is specialist mortgage brokers

Underwriting ‘s the part of the home loan software which enables you observe what economic risk the financial requires from the giving you a mortgage. İncele