Securing a home loan could appear to be navigating courtesy a good network, but with Financial from Baroda, your way into possessing your perfect house is made straightforward. The financial institution has the benefit of many financial alternatives, for each designed to meet up with the varied need of its people.

One of many key factors you to potential consumers look into was the interest rate, whilst myself influences the monthly fees and overall loan period. Financial away from Baroda, noted for their competitive costs, implies that users make use of words you to definitely work best with its economic affairs.

Inclusion so you’re able to Financial off Baroda Mortgage brokers

Bank of Baroda shines on packed field having its comprehensive variety of home loan points. Each product is designed so you can cater to more financial support demands, regarding to acquire to constructing otherwise extending your current household.

For these looking to key the established home loan for more positive conditions, Bank out-of Baroda’s financial balance transfer solution now offers an easy pathway. Which have glamorous rates and you will restricted records, it’s made to verify a softer changeover. İncele

Getting all over the world people because the a group, certain email address details are you to definitely to find a property is more credible than simply renting. You will find several reasons for having that it:

To begin with, there are various unreliable items from inside the leasing a flat. Including, the problem of going together involving the foreign scholar additionally the landlord. Chances are resulting in many unnecessary issues. Considering the difference between way of living models, and disappointing life is attending impact the studies once the really.

Subsequently, playing with a home to support knowledge has been perhaps one of the most essential suggests to own foreigners so you’re able to plan its assets. To acquire property isn’t only a means to live of the on your own, and also a method to book they with other people. Ascending rents can also increase the value of the house. Generally, whenever per tenant signs a rent, there is a yearly escalation in the new lease. Depending on the area, the rise is sometimes from the step 3-5%. Residential property which can be close to colleges usually are not problems in order to rent.

1. Planning this new Downpayment

When you’re question can foreigners get possessions in the usa having highest home prices and a hot market cashadvancecompass.com/personal-loans-va/cleveland. It is recommended that you’ve got about good 20% down-payment in hand along with your Choose condition. The target is to have the believe to pick up property. Many global children who possess merely come operating you need the parents’ make it possible to loans the new advance payment. İncele

Have you always identified what you desire in your fantasy home. Or, have you no clue! Anyway, it is preferable to write down their need to-haves and you may show all of them with your real-home representative. In a competitive field, you might not score that which you require, but about your own agent knows the most important thing in order to your as he or she delivers listings your path.

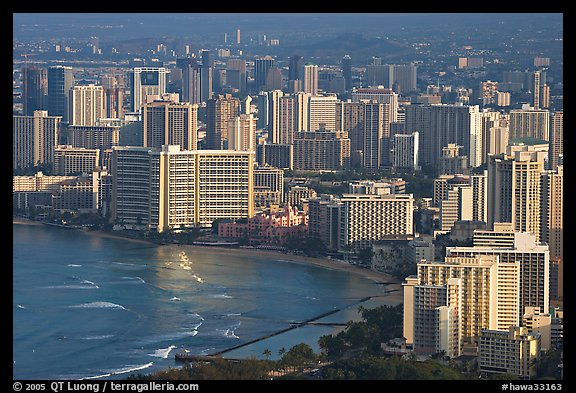

In addition, it may help to poke to on the internet observe just what homes arrive, with what locations, in accordance with what facilities this helps your be sure that record is actually realistic and in range with your price. Well-known home research portion for the Arizona become Glendale, Phoenix, and you will Scottsdale, and the other people you noticed with the all of our artwork a lot more than.

Above all, don’t neglect to end up being clear on what you don’t want within the the new domestic! If discover low-negotiables (i.elizabeth. your despise pool maintenance) you could share by using your own representative also. İncele

So you’re able to be eligible for funds from inside the subsequent numerous years of college, college students need to care for sufficient informative improvements as laid out of the its college.

Although this don’t grounds into the all of our rankings, your choice of school is a significant loans Boligee deciding factor for the if or not you could sign up for any mortgage. If you don’t stick to the antique university roadway, you could get financing that have SoFi.

What is the maximum amount borrowed?

SoFi’s lowest financing are $5,000. Discover officially no restriction restriction to possess a good SoFi Personal College student Financing in order to, the theory is that, use up to 100% of your own price of attendance.

Being qualified costs are university fees and you will charge, eating, place and panel, courses and you may offers, transportation, and private costs. Your own school’s school funding place of work have a listing of issues they include in the cost of attendance. İncele

The whole process of to find home and you will strengthening a property is going to be perplexing, particularly if you’ve never complete they in advance of. There are numerous an approach to financing the home additionally the structure of your property, and your regional lender will be able to make it easier to understand what might perform best for the style of condition.

Belongings funds are used to pick a bit of property or a building lot. You might apply for a land financing if you would like obtain a lot to have a new home or office however, you will be not ready to begin framework instantly. Concurrently, if you’ve got plans and a creator working, the new residential property mortgage is not the best option. Rather, you’ll request a property loan within this circumstance.

Discover three preferred version of home funds:

- Intense home financing-Brutal belongings was house who has no advancements with it at the all of the. There are no paths, no energy, without water. It’s undeveloped homes. To obtain an intense belongings financing, it’s likely your lender will want to discover details about exactly what you intend to manage for the belongings. Also, it is a smart idea to establish an enormous down payment of at least 20% of full purchase price towards the belongings. Intense house are cheaper to order than simply improved belongings, but an intense belongings financing will have a high interest and may even require a larger down payment than many other residential property loans.

- Unimproved house mortgage-Unimproved home is much like raw land but it’s maybe not completely undeveloped such as for instance raw land. Unimproved homes have tools in position but or even, it is simply residential property. İncele

Preservation Areas plus the Pure Info Preservation Provider (NRCS) provide pricing-display applications which can help you pay for fencing, integrated pest government, and other maintenance jobs.

Condition Preservation Districts works directly and their Government equivalents the Pure Tips and you can Conservation Service but administer programs in the county in that they are established. Pick your regional preservation workplace by going to the latest Pennsylvania Association regarding Conservation Areas Inc. or because of the calling all of them within 717-238-7223. There are also your neighborhood Pennsylvania Conservation Area on the internet.

To possess information about this new USDA Absolute Financial support Conservation Services (NRCS) go to their state Offices Index. NRCS also provide the essential right up-to-big date information regarding cost-display applications and you will maintenance potential obtainable in your own state. Look for neighborhood office into the PA online.

NRCS has some apps made to save your self floor and you will cover brush water. They supply tech advice and cost sharing for some preservation strategies. You are required to fund the fresh practice and then incorporate getting compensation because of their portion of the cost.

Due to the Preservation Advancement Gives, NRCS provides grant resource having tactics or tech that have a high chance of achievements. See facts concerning the financial help NRCS offers on line.

Like: The environmental Top quality Incentives Program (EQIP) brings financial and you can tech assist with farming manufacturers in order to address sheer capital issues and deliver ecological professionals particularly enhanced water and you will air quality, conserved surface and you will skin liquids, quicker floor erosion and sedimentation, otherwise increased otherwise written wildlife habitat. İncele

On good $100,000 financial, that might be around $6,000. The past rates tends to be high otherwise all the way down based on facts such just how much a borrower has to shell out in the pre-paid back taxation, being unique to every possessions. According to bank and you will loan types of, of a lot borrowers can afford choose for no-closing-costs finance. It sometimes roll new settlement costs within their financing otherwise pay a higher mortgage speed that is built to safeguards the expenses more than date. Both choices end up in a top fee however, keep initial out-of-pocket expenses off.

Property owners which spend less by the refinancing including often recover their closing can cost you in some ages or reduced due to their straight down homeloan payment. Such as for instance, for those who save yourself $300 thirty day period by refinancing and have $step 3,000 in conclusion will cost you, you are able to recoup you to expense for the deals over 10 months ($3 hundred x ten = $step 3,000). Therefore, what’s the finally means to fix how much does it costs to refinance your home? It can are different predicated on your financial need as well as how their financing is planned.

Common expenditures

The fresh new closing costs in your own re-finance are comparable into settlement costs your taken care of the brand spanking new home loan. Some traditional expenses were:

Assessment payment: Depending on your loan method of, loan providers may need an appraisal to check on your house’s standing and you will to determine their worthy of. İncele

One to concern take a trip nurses provides is what they’re going to manage having our home while you are gone into the travelling nursing assistant projects. As to why pay all that cash when you are perhaps not around?

- You to option is as you are able to break even if you don’t make currency that with your property because the a short-identity leasing if you are gone

- You might like to decide for a roommate (long-identity tenant) which manages our home and offers lingering passive income when you are not home

To some extent, organizations one lay legislation to have mortgage loans getting travel nurses is actually ok with the methods. Just remember you have to in reality move into your house and you may real time here when you find yourself not traveling.

Very home loan rules state you must move into a house in this 60 days of buying it. So make sure you perform you to, even although you possess some expanded deals planned.

If you are planning to prepare certain quick-label apartments, get aquainted that have Airbnb and you will consider hiring a home management providers. You more than likely won’t desire to be dealing with reservations and other info if you are doing work several-hour shifts a few says aside.

Many companies often manage your property getting 1020% of your local rental commission. There are many organizations to choose from, but shop around before choosing you to. Make certain that they supply the support you would like and you may are not too pricey. Here are some Airdna’s variety of necessary government enterprises.

You to definitely choice is to simply arranged a post for the a beneficial traveling breastfeeding forum otherwise Twitter category and only rent they so you’re able to fellow travelling nurses who are close by.

Due to a provided profession and online community, there was instant believe and you may accountability anywhere between you. İncele

Property are a significant resource, and as with any assets, it needs to be treated properly in order to make yes you have made the best possible go back. But it’s not all individuals who actually pick for you personally to pay more focus on it capital after joining their bond.

Increase your bond payment:

After you borrow cash to get a property you are in perception taking out fully a few fund. The first financing is to try to repay the capital count (referred to as prominent sum) additionally the next mortgage will be to repay the eye charged more than that point of the mortgage.

The majority of the money your repay in the first age of obtaining home financing happens towards the trying to repay so it attention, that can just marginally reduce the prominent sum.

When you look at the Southern area Africa, notice is usually computed daily in your home loan. As a result extent you borrowed from the lending company expands the time. Of the nature out-of substance focus, normal extra costs generated early in your loan term get an even greater influence on the cost of your own bond than simply for many who start paying extra money into your bond account five otherwise a decade down-the-line. İncele

Money could have been attained anywhere between PNC Lender, Letter.Good., and you may a great Michigan partners who so-called the financial failed to posting them called for loan comments into domestic-equity personal line of credit it reaffirmed in their personal bankruptcy.

Jeffrey and you may Barbara Polonowski received an excellent HELOC away from PNC into the 2017, centered on documents. They registered to have A bankruptcy proceeding bankruptcy in and you can reaffirmed the fresh up to $141,000 home-collateral loans two months afterwards.

Reaffirming a loans, that is a frequent area of the case of bankruptcy techniques, setting the new borrower agrees to keep and work out repayments to the obligations given that previously consented. Debtors usually reaffirm home otherwise car loans so they can care for possession of the property.

When a debtor announces bankruptcy proceeding, an automated stand falls towards the put. Undertaking, perfecting, or enforcing an excellent lien against assets of case of bankruptcy house is explicitly forbidden beneath the bankruptcy rules. The newest stay stops extremely range services, as well as communications with debtors. The brand new automatic stand is an important and you will strong safeguards to have debtors. Case of bankruptcy officials while the courts come down hard on creditors one do not honor the newest automatic sit.

Monthly payments have been made by the homeowners on HELOC prior to and you will after the reaffirmation, according to judge. The happy couple gotten its discharge out of case of bankruptcy inside the .

It so-called the bank has a habit of failing to upload occasional financing comments to users going through bankruptcy proceeding, despite instances where financial debt could have been reaffirmed – damaging people of the blocking them out-of receiving find of interest rates changes, lowest fee wide variety, kept harmony, and other crucial recommendations, depending on the plaintiffs. İncele

For people who owe somebody $14, when they be eligible for grab a great $100 statement from the handbag and maintain the alteration? Without a doubt maybe not. But really in the a dozen states therefore the nation’s resource, government entities accumulates delinquent a residential property taxation by doing this.

Grab, instance, 93-year-dated Geraldine Tyler. When she don’t pay just as much as $2,3 hundred during the assets taxation on the former Minneapolis condominium, Hennepin Condition foreclosed and you will sold the house or property to have $40,000. Rather than refund Ms. Tyler the brand new $twenty five,000 left right after paying every her delinquent fees, punishment, focus and you may associated can cost you, the government remaining all of the penny.

Exactly the same thing happened to Kevin Reasonable from inside the Nebraska once the guy dropped about into his assets taxes as he prevent his work to look after his dying partner, Terry. During the Mr. Fair’s case, Scotts Bluff Condition ended up selling their property tax loans in order to a personal providers, Continental Resources, which allowed the new individual to get Mr. Fair’s fees together with costs and 14 % notice. He later on got find from a good 90-go out deadline to blow your debt, which in fact had grown up in order to $5,268, and you can clear their assets. İncele

In hopes Home loans has provided a mortgage Glossary even as we discover you to adjusting to mortgage conditions is oftentimes confusing. Significance and you may terms and conditions may be interpreted https://simplycashadvance.net/loans/law-school-loans/ differently to people provided lower than.

AAPR: Also referred to as a comparison price, the common Annualised Payment Speed reflects the price of your own loan by firmly taking into consideration other can cost you other than new advertised rate of interest. This really is after that expressed given that a total rate of interest costs so you’re able to you over an average financing label. İncele