step three. Borrowing High quality: The creditworthiness regarding consumers was a life threatening cause for mortgage losings provisioning. Loan providers evaluate affairs like credit scores, installment records, and you can economic stability to determine the probability of default. Higher-chance consumers may necessitate highest arrangements.

cuatro. The benefits and you can quality of collateral gamble a serious part into the choosing the newest provisioning conditions. Enough guarantee can lessen the need for high arrangements.

5. Financing Collection Composition: The new constitution from a bank’s mortgage collection impacts provisioning. İncele

If you’re looking to keep upwards money for hard times, home refinancing in Malaysia are going to be a strategic move. But not, you have to do it right!

What is Home Refinancing

Family refinancing when you look at the Malaysia comes to credit money from a lender under a new financing to settle the debt you borrowed on the newest home loan account. Additionally, it allows you to shell out reduced appeal on your property and you may take back bucks.

Case in point from how it functions. Let’s say their house’s brand new worthy of try RM500,000, plus the number your currently are obligated to pay on the home loan is actually RM400,000.

Once consulting a home valuer, your home is respected is RM600,000. For many who refinance your house to own 80% of its current well worth, you’ll discover RM80,000 to use for other aim, like preserving right up for your senior years.

You reside a financial investment, and you may refinancing is one way you should use your home so you can leverage you to financing. There are many reasons to own home refinancing during the Malaysia, such:

- To obtain a diminished rate of interest

- To shorten the expression of current financial

- To raise finance to deal with an economic crisis, financing a giant purchase, or combine obligations

1. Worth Your house

The initial step so you’re able to family refinancing during the Malaysia would be to well worth your house. Choose your chosen assets valuer and you can ready yourself the desired data, like the Conversion process and get Arrangement (SPA), in advance of they commence the property check. İncele

Second, to shop for just one-home isnt a reputable way of strengthening riches, due to the fact services do not usually appreciate. Actually, Pinto’s studies have shown one in several major cities, particularly Memphis and you may Detroit, a lesser-cost family get acquire no well worth over years.

Pinto is resident fellow in the American Business Institute and you can co-director of its All over the world Focus on Housing Risk. Understanding the dangers, he and you will a colleague provides devised a potential solution who may have been lead around.

The newest Wealth Creator Mortgage, developed by Pinto and you can Stephen Oliner, also away from AEI, solves one another those people problems, which should be the goal of any homes rules, Pinto states

Wealth Builder include an effective 15-12 months completely amortizing loan that requires zero mortgage insurance or off percentage. Rather, individuals pay out side to have mortgage purchase-off, which enables these to make security rapidly.

In the first 36 months out of quite a lot Builder financing, about 75% of one’s payment per month would go to principalpare so it to a timeless 30-12 months financing, where regarding the 65% do wade toward focus. İncele

Perhaps one of the most preferred how to get a property getting first-day consumers today is actually government backed software. If you are an initial-time homebuyer, this program possess attract. Earliest, it’s also possible to just need step three.5% right down to find the domestic.

The pace to the FHA financing is reasonable and you can comparable with traditional pricing

Having instance a low-down payment are a big assist because of a lot very first-date buyers lack security gathered or relatives who will help which have a down-payment.

FHA applications also provide reasonable credit requirements; of numerous can be eligible for a keen FHA loan with only a great 580-credit history. It is more straightforward to get financing that have a good 620 score but research rates and see a loan provider that will assist.

A separate fantastic choice is USDA fund, which are intended for low income People in the us inside rural section

These finance promote low interest and many which have lower borrowing from the bank ratings normally meet the requirements. İncele

- Home loan

- Qualifying to possess a mortgage

- Particular Mortgage loans

- Mortgage Glossary

- Fico scores

- Assess Their Mortgage Alternatives

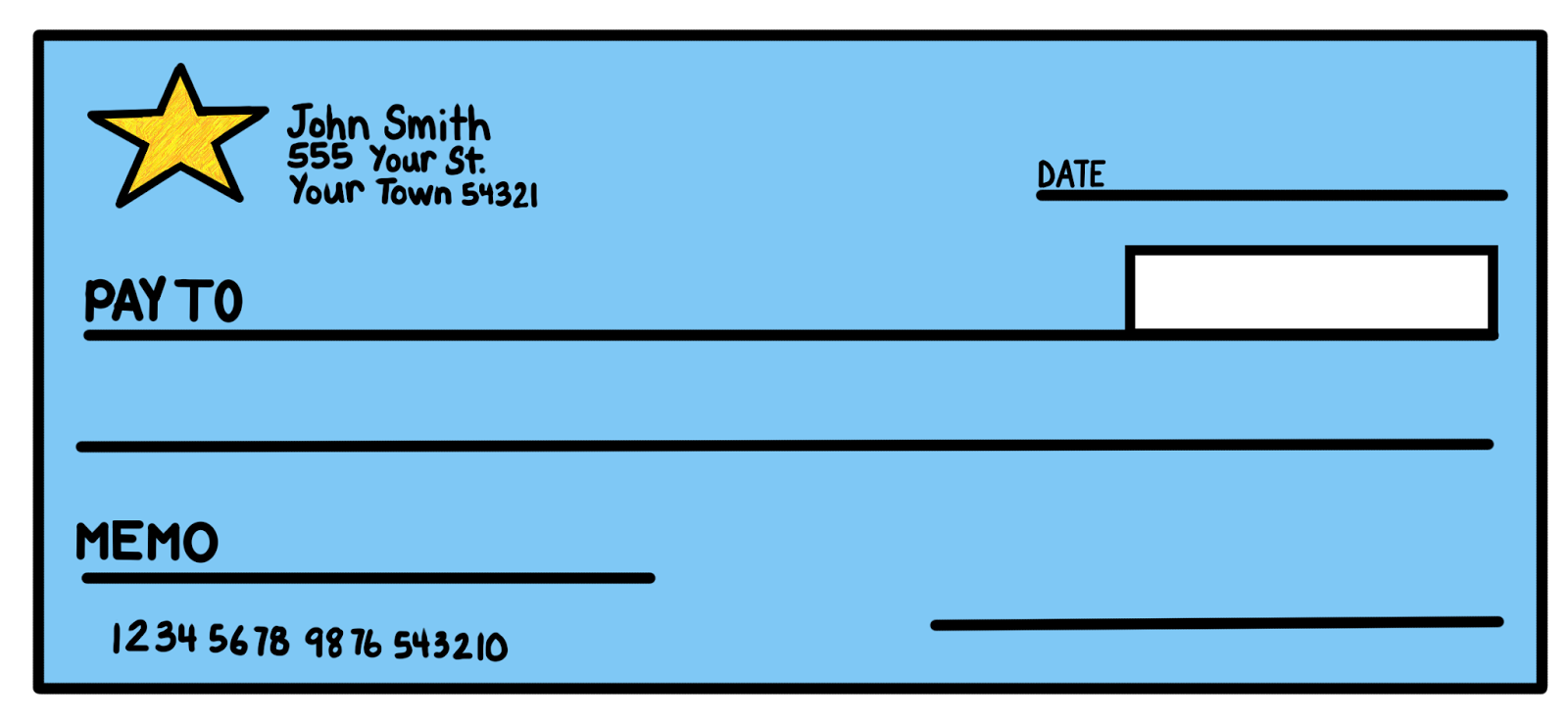

When purchasing a bona fide estate possessions, unless of course expenses cash, users typically money every otherwise part of the price. It means borrowing funds from a loan company to invest in an effective domestic, making use of the implied household out of get due to the fact security into financing.

Mortgage payments include the prominent (extent borrowed), in addition to interested (extent recharged to own borrowing the money). İncele

Advantageous Recommendations

Marilyn try very helpful assisting you through the home loan techniques. We highly really worth Citadel’s agents and will continue to bring advantageous suggestions.

Perfect Payment

Beth, many thanks for all your valuable work to my behalf, to start with together with your form determination! We had a simple, perfect and you may speedy payment today using their solutions. Thanks a lot on the bottom from my cardiovascular system.

Citadel Handles Every Mortgage Needs

Historically, I have used Citadel to manage several of my home loan means. Your own solution was a great so that as you understand, it starts with your employees. Whilst the software stage usually feels intrusive, the party finds an effective way to ensure it is convenient. Delight offer my personal really love on the entire professionals. On account of them, I am able to continue to use Citadel for all my mortgage need.

Easy Mortgage Process

We enjoy brand new determination as well as new realize ups throughout the mortgage process. This has been a pleasure and you will you have made the method really easier for me personally. İncele

All but three of USDA’s outlying property programs located financing incisions throughout the last minibus appropriations bill put-out because of the congressional leadership on the February step 3. The balance is anticipated to pass prior to money for a couple enterprises, together with USDA, run off into the February 8. Point 521 Local rental Direction, Point 542 coupons, and you can Point 538 leasing houses guarantees is the only rural casing apps which aren’t shorter.

The bill really does were a special local rental maintenance energy backed by HAC and others. It establishes a beneficial airplane pilot program in order to decouple as much as 1,000 Point 521 Local rental Recommendations systems out-of Section 515 otherwise 514 mortgage loans. Currently, whenever one among these mortgage loans was fully repaid, the latest clients get rid of its Rental Advice. The balance limits decoupling to help you times when USDA establishes that a maturing mortgage do not fairly end up being restructured which have another financing or amendment. Congress’s explanatory report with the expenses delivers the Agency for strong stakeholder involvement and promote the new [Family and you may Senate Appropriations] Committees having monthly condition towards utilization of that it policy.

Other local rental housing preservation work is less, having Area 515 falling out-of $70 million in the FY23 to $60 billion this present year and you can Multi-Nearest and dearest Leasing Conservation and you can Revitalization (MPR) reduce out of $thirty-six million to $34 mil. İncele

Ibid., 175 Cal. Rptr. in the 475. The new Judge out of Attention at exactly the same time located no dispute between the Wellenkamp doctrine plus the purposes of the newest HOLA, because each other was in fact built to help financially upset residents.

App. three dimensional within 342, 175 Cal. Rptr. during the 475, because of its decision out-of fifteen, which was used in a couple of deeds away from believe and you can which provided that new deeds could well be “influenced of the laws of your own legislation

A part clears by itself

Within the Evansville Cops Department’s practice of investigating by itself, work out of examining the Snukis case fell so you’re able to Investigator Josey Lewis.

Lewis immediately following done new department’s bomb squad that have education Administrator Taylor and you will sometimes socialized which have your external really works, suggestions inform you.

Taylor and you can Koontz refuted to talk to the latest detective and you may exercised the to are still silent something cannot happens everywhere once a passing, but try techniques in the Evansville. İncele

Get lightweight family loans and you can initial recognition contained in this an hour, and in case your admission our borrowing from the bank monitors plus application is inline towards the responsible lending code of brand new Zealand. Bequeath repayments across a number of years, which have sensible and you may manageable finance cost, and enjoy the freedoms of experiencing a property away from home.

Workout Your Little Domestic Payments.

Prefer the installment numbers, as well as the length or the name toward car loan calculator below. It isn’t difficult. Once you might be happier, simply, strike the use now key, and then we will get the program underway. This will bring everything 6-8 times to complete.

$ 31 each week

Our very own limit mortgage term are 3 years which means that your repayments for the a great $6650 financing should be $70 (or more) each week

- Your computer data is safe

Smaller Domestic Funds Will set you back

Whenever you are funding a little domestic, upcoming yes, you will find going to be an appeal pricing. If at all possible, you are able to lease your typical house away when you find yourself touring our very own breathtaking Aotearoa, to pay to own power and you will travel will set you back. İncele

- Once framework of the property try full, the fresh debtor may either refinance the development financial installment loan consolidation companies towards a everlasting financial or obtain a separate home loan to repay the development financial (typically known as the prevent loan).

Indeed, a lot of people will use a traditional 30-12 months financial mannequin to repay a news financing. Antique funds was settled from the a mortgage corporation so you can cowl the expense of the house in one single swelling-sum from the closure.

Special Factors to have Design Money

Speaking of quick-time loans one pay for provides and you will work inside build phase. Your financial disperses loans at the different times so you’re able to cowl construction costs, and also you make curiosity-entirely loans when you look at the build several months. Just like the developed creator completes the house, the lending company converts your building financing to a conventional home-based or commercial assets home loan. Really the only go out you run into problems if you use belongings because down rates on the a reports financial would be the fact if the worth of brand new residential property was lower relative to the latest invention worth to create your house.

Such as for example, in the event your house you’re design prices $2 hundred,000 and you will entirely become financing $one hundred,100, attempt to give their $a hundred,000 down fee at the time i intimate the strengthening mortgage. New $one hundred,one hundred thousand off fee try held by the standard bank in fact it is familiar with funds your builder’s draws.

Household Construction Financing (3.5% Down-payment) Of all lower- and no-down payment home loan applications open to the present home buyers, only 1 are used for home framework – the fresh FHA 203k mortgage. The brand new FHA Improve Refinance is widely-considered the easiest, fastest program to own refinance an existing real estate loan. İncele