Pre-acceptance is a vital, in control starting point when you’re ready to buy a property. If you are pre-accepted and you are clearly prepared to see land, you are on ideal tune. But it is simple to mistake home financing pre-recognition having a pledge. Whatsoever, it spent all of that go out painstakingly dealing with your credit score, money, bills, and you can property. Whether or not pre-acceptance is an extensive, crucial starting point during the to purchase, its not a done offer. A mortgage are denied after pre-recognition, in fact it is one of many grounds one property transformation fall courtesy. Will not want assertion shortly after pre-acceptance? Maintain your finances consistent, and you will understand what your own pre-recognition will be based upon. This is simply not the amount of time to buy an alternative auto, key professions, or loans a major pick. In case your funds transform, good pre-accepted mortgage was refuted before you go to close on the a property.

What is home loan pre-approval?

Home loan pre-approval set how much you can easily use you can acquire a house. After you favor a lender to possess pre-approval, they determine your debt-to-income ratio and you may consider your revenue, expense, property, and you can credit score to establish how much cash they’d believe loaning your predicated on this type of affirmed quantity. A great pre-acceptance says to suppliers your earnings come into acquisition which just be capable keep the currency you need to complete with your render. After you build a deal, submitting good pre-approval page along with your give gives the vendor cover and you will guarantees all of them that you’re a verified consumer. İncele

There will come a time in virtually any family-to acquire techniques whenever a purchaser has the possibility to bring a good look behind this new drapes actually and you will figuratively. After you fill in an offer into property and you may before you can complete the offer within closure, you might get a lengthy, hard look from the the way the household try make as well as how its holding up, and assess if you’d like to stick to the purchase otherwise negotiate your brand-new render.

While you are to acquire a house from Va house-loan program, discover at the outset that the Va has its own lay of standards to possess examining really worth and you can condition. Indeed, conventional home inspections commonly required getting a good Va home-financing get, but they are crucial for a customer’s security and serenity regarding notice. In addition, your bank will advise you to order an inspection.

When you’re stuck and never yes whether to pull the brand new lever into an evaluation, continue reading to understand the differences ranging from Va loan appraisal conditions and you will a timeless home examination.

Information Virtual assistant Financing Assessment against. Inspection

In essence, Virtual assistant mortgage appraisals and you may monitors was one another built to determine a great house’s well worth, should it be safe and suitable for occupancy and that it suits standard homes conditions. İncele

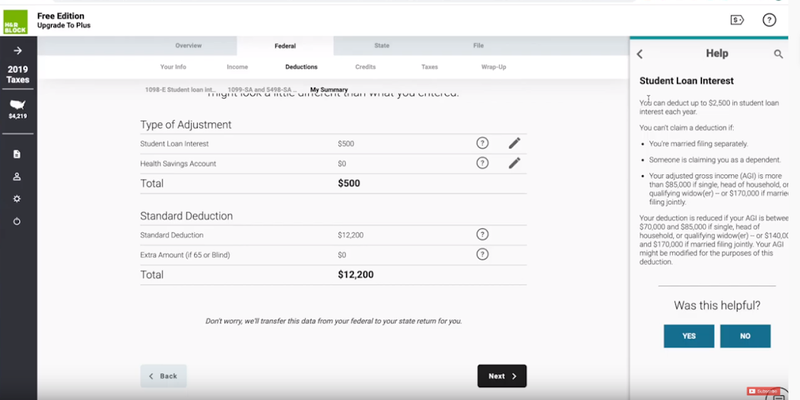

- Whilst you do not need to keeps a perfect credit score to locate an unsecured loan, loan providers essentially get a hold of those with credit scores from 600 or over because down risk.

- There are a number of points to possess in a position to have financial before you apply for a personal loan, also economic information, work status, along with your SIN.

- Different varieties of signature loans include secured loans and you can signature loans. Before getting a consumer loan, examine mortgage options to select what type is applicable better to your own book situation.

There is no need best fico scores to help you safe a consumer loan, and there is no secret number with respect to getting a specific count to receive ideal mortgage costs and you will words, however, lenders generally come across people who have fico scores regarding 660 and significantly more than since straight down chance. Individuals with credit scores out of 560 or listed here are apt to be having difficulties qualifying getting better loan terminology.

A consumer loan try a predetermined amount of money that you commit to pay off over a flat period of time. One can look into unsecured loans if they are given renovations, vehicles, combining debt one deal higher rates, or other events whenever there’s not adequate offered cash on hand. Although not, from the agreeing into mortgage, you need to pay back a full matter along with focus and you will one charges on the it. Unsecured loans are paid as a result of small otherwise much time-label financing arrangements, by and also make typical repayments titled installments. İncele

Desk off Contents

Capital a house creativity will be pricey and you can expensive. From clearing the latest home and leveling it, in order to setting up tracks and you can necessary system, there are various off expenditures inside it and this can be rates-expensive for someone and a home designers. İncele

: Trust me, easily gets a 3rd work (I curently have a couple), I might have inked thus once upon a time. Regrettably, I am into the an innovative profession, and the ones are not just choosing nowadays. I also just don’t have time for the second jobs.

I am in the process of trying initiate my own personal freelancing providers and that i already performs fourteen-18 circumstances a day, between my personal newest a couple real operate and also the really works I really do obtaining my freelancing up and running

i am nevertheless having Kelsey on this….not seeking gang right up otherwise things.. your opinions have become a good. Only when it comes to your own opinion create longer at work (so you keeps an entire month) or rating a second region-date occupations ..really, that to state that we aren’t currently working an entire day? Thats exactly what Kelsey is saying.. she gets paid down $1200/month doing work Over the full few days and that i get money $2000/month doing work a complete few days (40hrs). But even at that it’s still hard… and Sure, we are able to rating a part-day employment however, possibly our life don’t allow me to carry out you to definitely. Such as for example: I am providing nights french programmes and make myself significantly more valuable, We regularily go to the gymnasium after work and so my merely recovery time is on the fresh new week-end which may be invested creating renovations on my (very old) family. If i was to undertake a part-day business this weekend, it woudlnt last long at all just like the I’d be entirely burnt out. Everyone needs down-time. Thus..perhaps not attempting to make reasons or one thing.. only, it is admirable that you guys can pay of financial obligation thus really given that many of us don’t have the deluxe. Unfortuitously, for the majority of of us, we need to explore our very own handmade cards Now and then (aka, rarely) to purchase such things as groceries, ect. İncele

It decision tends to have a profound impact on the fresh Indian monetary program. Particularly in terms of repaired dumps, 5000 dollar personal loan loans, and therefore the home business. With this particular hike, its appropriate to state that the new affect new repo speed will definitely have an impact on the (NBFCs) non-financial financial enterprises and it surely will sooner or later trickle-down toward customers since banks are now gonna increase their interest prices toward repaired places and you can money. Very imperatively, the latest main lender would be to promote economic balance so you can credit companies. As well as, fintech businesses that give retail banking characteristics is presumably to go through because of decreasing need for the attributes. At exactly the same time, it also should be believed that it does extensively apply to businesses since this is new 6th hike on the repo price. The fresh new rising cost of living is likely to remain at 4% additionally the Governor are pregnant it so you’re able to average 5.6% because of the fourth one-fourth off 2023-twenty-four. The newest governor are sure towards GDP development, it is projected to be at the 6.4% in the monetary seasons 2024. Although not, Given that fintech businesses are heavily determined by lower-rates of interest, that it increase in repo rate might have overall influence on the team surgery and profitablity. He emphasized the Indian savings try resilient whilst international ecosystem are tricky.

Edelweiss Standard Insurance policies renamed due to the fact Zuno Standard I

Binitha Dalal, Creator & Managing Mate, Mt K Kapital said Our company is now 0.25% more than the pre pandemic repo rate off 2019 and in addition we pledge here is the prevent of one’s speed boost course. İncele

For most homeowners, an excellent fixer-top is their thought of an aspiration household. However, the procedure of to buy a beneficial fixer-upper is sold with a lot more obligations versus qualities inside the best condition otherwise the newest design home. Getting ready for the procedure relates to undertaking a remodeling bundle, being aware what to search for when looking for listings, and you may facts exactly what investment choices are offered.

Planning for an excellent Fixer-Higher

Fixer-uppers need a future-based therapy. Understanding the magnitude of one’s strategies both you and your household was willing to accept will help setting your budget and you can your standard down the road. With a few very first cost studies for your given project, you’ll have to choose be it worth every penny to find the brand new information yourself and you may do it Doing it yourself otherwise get an expert. Whenever review the latest waters getting elite renovations, score particular quotes to help you contrast costs anywhere between builders. Understand that plus the down-payment and closure charge, the expense in an excellent fixer-top buy have the potential to go over-budget without difficulty. Become familiar with permitting in your area to know ideas on how to browse one courtroom roadblocks about renovation process also to finest assess their timeline for your home upgrade tactics. İncele

As the related here, exclusion (F)(iii) provides you to [t]the guy title [personal debt enthusiast] doesn’t come with . . . any person gathering otherwise wanting to assemble one obligations due otherwise due otherwise asserted to-be owed otherwise due an alternative for the the total amount particularly passion . . . concerns a personal debt that has been maybe not in the standard at that time it actually was received by the instance people. fifteen You.S.C. 1692a(6)(F)(iii). To simplify, so it different implies that one collecting nondefaulted expense for the account from anyone else is not a financial obligation enthusiast. İncele

And thus, Perhaps the overriding point is, as much as possible think of just how much higher priced it would getting in the event that, after you got completed with strengthening one, your weren’t capable of getting personal debt

Reese Harper: And if you had to market collateral to accomplish this, I am talking about… consider the speed out-of go back to go from zero bucks so you can a million as well as in value right away, or if you learn, in certain small decades. After all, it is a great fifteen%-20+% yearly get back on the value of the business, however, getting it been and heading out-of zero compared to that area where it is full… there is lots out of return that occurs in those very first number of years. .. you’d to offer inventory to help you a partner, or you must sell guarantee to help you somebody, like any enterprises need to, while can that point where its at capacity, and you have distributed half your wages. Which means that your return instead of are a great 20% return- how come We asserted that matter is basically because a good amount of dentists, once they shell out themselves normally, they could have 15%-20% profit- what if you had provide half of that-away since you’d to improve as a result of guarantee or another typical in advance, you realize? You give out which 29-12 months stream of half of your profits. Very obligations is an activity, although, you to definitely seems costly, as you are purchasing 7% otherwise 8%… you are aware, 5%, 9%… but the collateral you individual in this behavior, for individuals who individual everything, What i’m saying is its purchasing you 20% a year simply to hold on to it.

Its those individuals first few age, following upcoming, it is a good return when you’re working here

Reese Harper: Yeah, and is most considerably. Such as for instance, even though you provides financed your practice the life, therefore never ended upwards repaying your debt, youre investing seven% to own a thing that was causing you to 15%-20% yearly, whenever you are prepared to merely are employed in they. İncele

An enthusiastic ARM’s interest is dependent on an index that refers to many signs, for instance the that-season constant-readiness Treasury (CMT) bonds, the price of Finance List (COFI), and the London Interbank Provided Price (LIBOR). If your list increases, very often your own interest rate, and you may monthly installments; in case your list decreases, therefore will your own interest, and you may monthly obligations.

Having a predetermined-rates mortgage, monthly premiums and rates of interest will continue to be consistent on entire mortgage. This one makes it easier having individuals to help you finances and you will perform their earnings.

Just what are changeable-rate home loan prices?

Adjustable-rate mortgage (ARM) costs range from lender in order to lender. Rates of interest was a significant factor to take on when obtaining a mortgage because they heavily influence what kind of cash a borrower pays. Utilizing an online calculator can present you with an estimate out of exactly what you may anticipate having mortgage payments and interest every month.

- Activities a lowered rate of interest and you may monthly premiums in initial period of the label. Borrowers was keen on so it mortgage because allows them to purchase larger homes having reduced monthly installments.

- Borrowers will enjoy all the way down rates in the place of refinancing. They won’t have to promote fund for another selection of closure will cost you otherwise costs. Just like the rates slide, Sleeve individuals commonly watch its monthly premiums fall as well online payday loan Utah.

- Arm consumers save yourself and purchase more cash than the fixed-speed mortgage loans. Consumers having straight down repayments can save money and earn significantly more from inside the a higher-yielding financial support. İncele