What exactly is an 80-10-ten Home loan?

The original home loan lien are taken that have a keen 80% loan-to-really worth (LTV) proportion, meaning that its 80% of your house’s rates; the second mortgage lien provides an effective ten% LTV ratio, in addition to debtor produces an excellent ten% down payment.

Trick Takeaways

- An 80-10-ten mortgage is arranged having a few mortgage loans: the first becoming a predetermined-rate mortgage during the 80% of one’s residence’s pricing; the following getting ten% because the a home guarantee loan; additionally the remaining ten% since the a cash advance payment.

- Such mortgage strategy reduces the advance payment out of a domestic without having to pay personal mortgage insurance rates (PMI), enabling borrowers obtain a property easier toward upwards-top costs.

- But not, individuals commonly deal with relatively larger month-to-month mortgage repayments and may even see high costs owed to the variable financing if the interest rates boost.

Understanding an 80-10-ten Mortgage

???????When a potential resident acquisitions a house that have below this new important 20% deposit, he is required to pay individual home loan insurance rates (PMI). PMI is actually insurance policies one to covers the bank credit the bucks up against the likelihood of this new debtor defaulting towards that loan. A keen 80-10-ten home loan is commonly utilized by borrowers to quit using PMI, which may make an excellent homeowner’s payment per month highest.

Generally, 80-10-10 mortgages include prominent on occasion whenever home prices was quickening. americash loans Kinsey Since belongings become quicker sensible, to make good 20% downpayment of cash is burdensome for one. Piggyback mortgage loans enable it to be customers in order to use more income than just its off commission you will highly recommend. İncele

Decreasing the price of university is certainly going quite a distance to help you making it cheaper. Couple that with preserving having university and you may you’ve went a long cure for reducing the load out of student loans. The target is to graduate that have no financial obligationor perhaps as little as you are able to.

Possibility Pricing

Whenever we count purely to the mathematics, it generates way more feel to expend, unlike spend more to your financial. $500 30 days more on your financial get help save you

If in case home financing balance from $200,000 during the 4%, having two decades remaining to the label. Paying the minimum percentage would mean possible spend $90, inside attention. Including $500 a month to your commission could save you $37, and certainly will shave away from about 7 years.

The exact opposite would be to invest one to $five-hundred thirty day period. If we dedicate $five hundred thirty days towards the a low-costs wider-mainly based list loans you to averages 8% for another 13 age (enough time it could take me to pay-off the mortgage with this more money) actually leaves all of us having $134,. A more old-fashioned come back away from 6% do exit us which have $117,.

You simply can’t Downplay Freedom & Versatility

Clearly, the fresh new math leans greatly on the purchasing more paying down their financial. Although not, there are many more facts on gamble. Exposure is the one. There clearly was no financing exposure when paying the borrowed funds. Youre guaranteed a 4% come back, contained in this analogy. You’re not secured one thing whenever investing the stock exchange, regardless of how well-diversified.

Peace of mind is an additional basis. The protection of getting a premium-out of residence is something that enables higher serenity. Since Dave states, 100% out of foreclosed belongings had a home loan. İncele

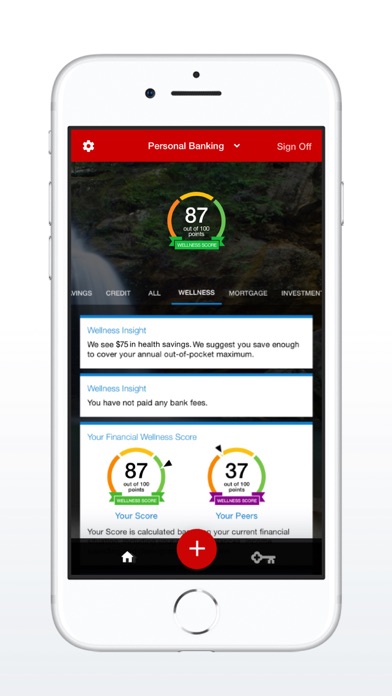

Comparing Borrowing Unions to help you Conventional Banking companies

Deciding on the best financial institution is important, while the at the conclusion of a single day, visitors desires a good financial lover to hold the difficult-gained currency. , people will determine between a lender and you will a cards union. Although they may seem equivalent on top, there are several a lot more nuanced differences one to we’ll experience lower than:

Particular potential cons on the HUD foreclosed home might be offered proper said. Earliest, it is critical to remember that new department provides taste so you can owner-occupants which plan to live in your house for around 1 year. According to the property style of, investors usually have to wait a specific period of time in advance of they may be able fill in its estimates, on offer owner-tenant people top priority. HUD-owned homes are offered as-is actually, and you may have a multitude of products, many years, criteria and features.

In order to estimate what forms of fixes otherwise improvements you need become produced, prospective buyers have the ability to order a home review before the quote is put. It is very vital that you note that the latest HUD will not allow assignment regarding agreements, therefore wholesalers need find the assets before attempting to sell they and really should spend earnest currency and show proof of finance.

Needless to say, a savvy trader should plan an examination to ensure that their investment are practical

An investor are required to pay earnest money towards the You.S. İncele

We do not bring money in-house. (Additional a couple of is actually Residential property and you may Legislation, if you’re curious). With respect to Small Home, money is without a doubt king. If you build it your self and can find a good amount of salvaged material, chances are a beneficial you’re getting of the. This calls for one to have much time even if, together with assistance and you will a good units. People end up being warmer choosing a specialist Small House-builder. A fraction of these people might have $30-70k inside the bucks they are able to install to own such as for instance property. Think about those of you who don’t? Worry maybe not, options are readily available. Always remember as well, in which there was a might, there can be a way. Why don’t we explore some you’ll be able to technique of funding a little Family.

step one. Friends/Family-You could know somebody with cash that could be willing to loan you the cash on www.paydayloanalabama.com/daphne a 3 to 5 year notice with an intention rate that may succeed worth its when you are, yet, maybe not lay huge excessive burden you, no financing expert, but here’s specific quick math. Imagine if we should pick a tiny Household to own $35k. We hope you can created $5k of dollars. Wherever you get that loan, the lender is about to would like you to take some skin on the online game. You to will leave a balance out of $30k. In the nine% over 36 months, the overall appeal might be doing $4300. That is a great return on the investment towards the bank, which can be a while higher for you, but it is maybe not ridiculous. İncele

If you’re considering the options and commonly yes regarding specific regions of the latest FHA refinance procedure, you might find specific methods to your questions lower than.

FHA re-finance funds generally speaking wanted credit monitors and appraisals. There clearly was that exclusion. There is absolutely no FHA need for either while you are using getting an enthusiastic FHA Improve Refinance mortgage.

If you would like refinance but love your ability to help you qualify for an FHA mortgage because of borrowing from the bank items and other difficulties? İncele

When obtaining good Virtual assistant mortgage, new statement out-of provider letter is amongst the very important files you need to has actually. It provides loan providers on called for information about your armed forces services standing as well as have enables your income confirmation.

If you do not have the Virtual assistant financing declaration of provider letter, you will not manage to get a Virtual assistant mortgage due to help you put-off receipts which come out of without that it page. İncele