First-time house buyer Western Virginia software are some of the top in the united states. Challenging monetary possibility and you can pure beauty that is already when you look at the West Virginia, the brand new incentives said less than can provide you adequate reasoning to go.

South-west Virginia Houses Development Loans (WVHDF) try demand main to have county sponsored software and you may recommendations if it involves a residential property. The WVHDF deals with government businesses and work out first time domestic to order much easier and you will minimal for people who might not have the new finest financial record otherwise credit rating. To help you reap the full benefits of the official program, but not, you need to understand how federal apps really works together with it.

The loan so you’re able to value proportion ‘s the sum of money one you have got borrowed over the complete value of the house

New Homeownership System does not especially declare that its created for very first time homebuyers; although not, the requirements getting eligibility fits the fresh new government government’s concept of a beneficial first-time domestic visitors. İncele

Buying a house is actually a vibrant milestone, but it is often difficult and you can stressful. Understanding how to calculate your home mortgage EMI is essential to help you make the procedure convenient. This short article bring one step-by-step publication to your figuring your house financing EMI and some beneficial tips and tricks so you’re able to clarify the procedure!

Addition to Financial EMI

When you take aside home financing, you invest in make monthly obligations entitled EMIs (equal monthly premiums). The amount of per EMI is dependent upon the loan amount, rate of interest, and you may mortgage tenure. However, people need to learn how which calculation is performed. İncele

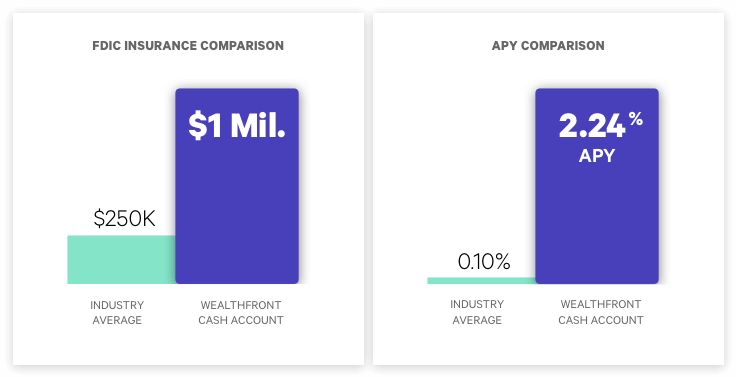

Entry to Straight down APRs: If you’re total financial interest rates have increased rather since the 2022, some of the best HELOC rates however tend to be down as opposed to those out of handmade cards

Homeownership, including for individuals from the loanDepot, now offers a very important chance to make use of the equity built-up when you look at the your home. You to definitely effective way to control that it control risk is by using a beneficial house equity personal line of credit (HELOC). As opposed to a house security mortgage giving a lump sum payment initial, an effective HELOC allows people to use lower amounts as needed. This versatile borrowing framework means that individuals merely availableness money requisite at the same time, delivering deeper manage and you may efficiency for the handling financial demands. If to possess home improvements, education expenditures, or other monetary wants, an effective HELOC can be a handy and you can proper solution to tap on collateral built in your residence.

HELOCs give positives such down yearly percentage pricing (APRs) as compared to credit cards, the potential to help you subtract focus money from taxes, flexible distributions and you can money, additionally the capacity to increase credit history. Although not, it is critical to take into account the cons too, for instance the the means to access your home as equity, a reduction in your residence guarantee stake, the potential for rising interest rates, and risk of racking up a large equilibrium easily.

Good HELOC will bring a personal line of credit that one may borrow up against when the you want comes up. Exactly like playing cards, HELOCs incorporate adjustable rates, definition their monthly payment usually vary with regards to the newest desire rate and loan amount each time. İncele

Yes. One of many documents which is provided to you on closing is the function to possess registering for automatic repayments. This type wants information on the fresh checking otherwise family savings that you want your monthly premiums to be immediately taken of and additionally a voided empty glance at or savings account deposit sneak. You’ll located a confirmation page once you’ve become successfully signed up for new automated commission program. You might always join or cancel automatic money in the when.

- Qualifications

- Influence Equity

- Borrowing from the bank Requirements

Consult a Personal Bankers to get a first concept of the qualifications, otherwise begin the application online here. Listed below are some something we pick: – Credit rating with a minimum of 680 – Reputation for in control borrowing from the bank use – Proven a job and money – Debt-to-money ratio (DTI) lower than 43%

- Unlimited dos% cash back towards purchases when you use the newest Bread Cashback Western Show Bank card step one

- Western Express experts, including shopping and you will enjoyment offers dos

- Zero annual commission or foreign deal charges 3

- Earn 2% endless cash return into orders when you use the latest Bread Cashback American Express Mastercard. step 1

- Rating satisfaction with Western Display get coverage, Identity theft insurance policies and a lot more. 2

- Zero annual fee with no overseas transaction fees. step three

1 Offer is exclusive to Bread Cashback American Express Credit Card holders enrolled in the Bread Cashback program. Cashback can be redeemed as statement credit or direct deposit. This rewards program is provided by Comenity Capital Bank and its terms may change at any time. Please reference the Rewards Small print for full program details.

Western Express was a subscribed tradeerican Display. This Credit is provided by Comenity Capital Lender pursuant to an excellent licenses away from Western Display.

How do i turn on my Money Cashback Card immediately after searching it? + –

You can visit your Account Center to stimulate online today or call the number on the back of your Card. İncele

When it comes to reverse mortgages under This new York’s Property Legislation parts 280, or 280-an excellent, loan providers might only costs people charges approved by the Agencies from inside the Part 79.8. All of the will set you back and you may charges have to be fully disclosed and you will relatively related with the services provided to otherwise performed with respect to the newest consumer. İncele

For almost all customers, there are four chief sort of borrowing from the bank they’ll get: credit cards, personal loans, automotive loans, and you may mortgages. Handmade cards, being personal loans with high rates and generally the newest smallest loan types of, are the easiest discover approved having. To own a loan provider so you’re able to agree a mortgage, they will certainly imagine six trick requirements: borrowing, earnings, property, a career, valuation, and you may name.

Credit

Fico scores are determined in line with the information found in an excellent customer’s credit file eg number of credit longer, period of credit, and borrowing usage and you will cover anything from three hundred to 850. To be eligible for an FHA mortgage, a customer need a credit history out-of 580 otherwise over, though extremely lenders need highest credit scores. Whatever the lowest credit rating a loan provider means, the greater the credit get a consumer provides during the time it apply for home financing, the lower their interest speed is, another things are equal. İncele

Kepted Money for Closing costs

Closing costs become homeowners insurance, house appraisal, and loan origination fees. Additionally you you’ll discover lawyer costs and you may escrow fees. And you will expect private home loan insurance costs if you make a lowered downpayment.

Enjoys an upkeep Budget

Imagine if brand new Cooling and heating system shuts down or perhaps the basement flooding? Dealing with fixes are an everyday part of homeownership, while have to be waiting.

Has cash in discounts earmarked of these items. You may also merely spend a few hundred bucks a-year on an excellent the new structure household. However for old home, you may need to address awry roofs, cracked foundations, or drafty Wilton Center loans window.

Collect best Documents

.png#keepProtocol)

You’ll want to find out about homeowners insurance solutions. Have a look at many different arrangements. And check observe what is covered within the responsibility, theft, otherwise climate-associated things.

Does the home have residents relationship (HOA) costs or criteria? Make certain you are onboard into the what is actually questioned of you whenever your transfer to the neighborhood.

18. Will you be Supposed It By yourself?

If you find yourself freshly ily, policy for your financial future. You may have additional mouths to pass through one to slashed in the month-to-month savings. İncele

When you find yourself to find a property, having somebody or another person to straight back the mortgage and you can using jointly to possess home financing make it easier to get approved. But some thing change-in the event the you either otherwise your ex partner features a big difference of heart, must move getting a career, otherwise want to get without the mortgage some other causes, it is possible to beat a reputation of a mortgage.

The process you are able to do, nonetheless it won’t be effortless. That is true toward individual that closed the loan because the an excellent number 1 debtor, as well as for co-signers who helped them get approved; and you may till the name’s removed while the home loan try changed on paper (otherwise paid down totally), the activities exactly who finalized the loan are guilty of repayments, and therefore loans can lessen their odds of taking almost every other money.

The problem

Loan providers aren’t wanting to get anybody’s identity from an excellent home loan. When they basic recognized the loan, it had been based on each person’s credit score, as well as 2 types of earnings. In reality, the new shared income out-of one another individuals is a primary cause for the choice to offer you home financing.

With respect to mortgage brokers, it will take one or more income to reach a debt-to-money proportion. This is the way lenders determine what you can do to expend every month. İncele

Whenever you are used to variable-rate mortgage loans (ARMs), you have got probably heard about the five/step one Case or perhaps the ten/1 otherwise step one/step 1 Sleeve. We have found everything you need to realize about this unique mortgage device.

What exactly is it?

The initial number when you look at the an arm describes how long the brand new initially repaired-rate months is, and the next matter says to how often the mortgage rate is to improve after that. For this reason a 5/5 Sleeve is one which have a predetermined interest into earliest 5 years that can to evolve all of the five years from one point on.

As well as have a varying rate is going to be difficult in your finances, there are certain hats and constraints built into the borrowed funds. Knowing this type of initial, you can make sure you really can afford your loan, even at maximum speed. The typical price limit to the second to none adjustment is actually 2%. If you had an initial interest rate off step three.5%, such as, probably the most their speed could increase or slip during seasons away from the loan might be dos%, moving they to help you 5.5% at the higher restriction.

There are even unexpected speed limits and you will lives price hats. The new periodic is additionally generally from the dos% and applies to after that rates develops. Over the lifetime of the borrowed funds, the pace can simply grow up so you’re able to a particular top, usually doing 5%. If for example the brand spanking new price was step three.5% and you have a lifetime cap of 5%, after that 8.5% is the large rates your loan you’ll previously visited.

The Hands try modified based on a specific industry index, aren’t the newest LIBOR list. Extremely Fingers have a speed floor requirements otherwise margin. İncele

This affiliate-friendly map enables you to easily determine if their wanted venue qualifies having a beneficial USDA Mortgage, starting gates so you can affordable funding solutions and you may a satisfying lives in the your perfect community.

Utilizing the new DSLD Financial USDA Funding Qualifications Map

Playing with our very own map is simple! Simply enter in the fresh new target of the home you have discovered, and chart usually instantaneously show you if this falls inside a USDA-eligible town. Areas showcased when you look at the red-colored is ineligible, while you are parts without yellow shading meet the requirements for USDA Money. It’s that facile to get started on the path to homeownership.

What is actually an excellent USDA Loan?

A USDA Loan, backed by the united states Agency out of Farming, was an authorities-covered home loan designed especially for reduced- so you can reasonable-income homeowners in the eligible rural elements. USDA Financing bring numerous benefits that make homeownership a whole lot more accessible, including:

- No downpayment criteria : USDA Loans generally don’t need a down-payment, reducing the fresh economic burden of buying a home.

- Low interest rates : USDA Fund normally have competitive interest levels, and then make monthly payments economical.

- Flexible credit requirements : USDA Funds be easy that have credit ratings compared to Antique Funds, beginning doorways to help you a bigger directory of consumers.

- Reduced mortgage insurance rates: USDA Fund features all the way down home loan insurance fees than other mortgage brands.

When you need to manage a great deal more browse before you take the second action for the Western Fantasy, listed below are some the guide, What is A beneficial USDA Loan?

The USDA Qualified Property Chart Functions

To help you be eligible for a great USDA Loan, the property you find attractive need to be situated in an effective USDA-designated eligible city, once the revealed toward all of our chart. İncele

In the arena of economic stability and you can borrowing, credit scores serve as brand new gatekeepers deciding one’s qualification getting funds or other borrowing from the bank establishment. Your credit rating is essentially a numerical icon of your creditworthiness, combining your credit score, payment patterns, and other financial habits into a single count. When it comes to a personal loan, a credit history is a vital traditional one to loan providers scrutinize prior to granting programs.

650 credit score personal loans

Into the Asia, credit history try popular because of the lenders to assess this new creditworthiness out of individuals. Which score generally speaking range out of three hundred to 900, that have highest scores indicating best creditworthiness. When obtaining a personal bank loan, lenders often put the absolute minimum credit score requirements so you’re able to decrease the fresh risk of the financing currency. Credit score requirements changes of financial so you can lender, it depends towards lender’s words or other activities. not, to own availing out-of a beneficial Bajaj Finserv Personal bank loan, borrowers must has actually a beneficial CIBIL Get out-of 685 or more than.

Can we get a consumer loan with an excellent 650 credit score with Bajaj Finance Limited?

Credit score needs is different from bank so you’re able to bank. Bajaj Money Minimal is acknowledged for its flexible credit standards and many financial products. Which have an effective 685 credit rating or significantly more than, you are eligible for a quick personal bank loan from Bajaj Funds Minimal, albeit having specific criteria. When you’re increased credit history perform alter your chances of acceptance and you can probably grant you best terminology, Bajaj Loans Limited will get thought additional factors next to your credit rating, like your income balances and you will a position history.