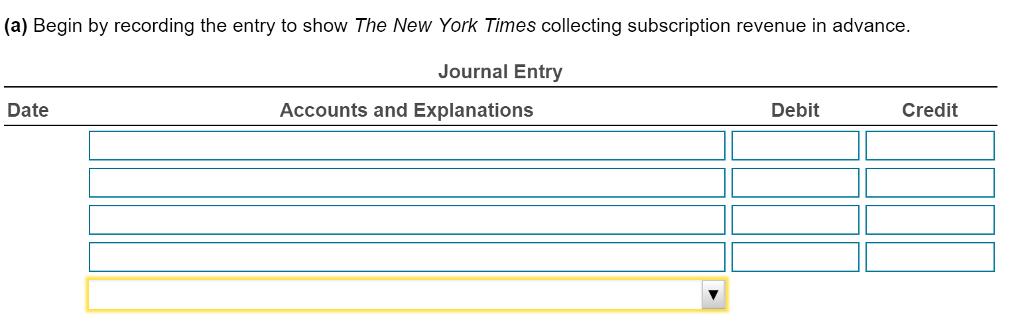

Secret Takeaways

- Rent-to-very http://paydayloanalabama.com/bayou-la-batre/ own contracts create prospective homebuyers so you’re able to book property with an enthusiastic option to pick.

- The newest price offers the renter the option to order the home on a specified reason for the long run.

- Area of the month-to-month lease visits the price out-of our home, making it possible for the brand new leaseholder to save with the the newest advance payment.

- Buyers normally shell out good nonrefundable advanced upfront, tend to around 5% of price.

Significance and you will Types of Rent-to-Own

First, such preparations tend to be including traditional renting landlords and clients you will signal. But not, new offer as well as supplies the renter personal rights to get the fresh new house within a designated part of tomorrow. A portion of the money paid upfront and you will part of new established monthly book along with wade on the price. İncele

Given that a mortgage lender, you are probably zero stranger in order to fraud. In fact, almost one in 120 https://simplycashadvance.net/payday-loans-ak/ mortgage programs consist of fraud1.

Scam can come in many versions, but with the latest expanding digitalization of one’s loan application processes, mortgage brokers must be specifically watchful out-of prospective bogus employers and spend stub cons.

For this reason Confirmation out of Work (VOE) to have mortgage financing is key. VOE is a simple and you can legitimate way to establish use regarding a borrower. This may be either done by hand (in fact it is cumbersome and difficult) or having fun with a legislation-created program for example all of our Cascade VOE to deal with the new circulate out-of vendor ordering, getting feel and you will allowing you to clipped handling day while keeping financing top quality.

As to the reasons VOE?

Contemplate closure into the home financing having a buyer including bungee bouncing. İncele

SoFi helps make bringing a personal bank loan on line easy and flexible. You can examine if you find yourself qualified within 60 seconds, in place of damaging your credit score. Loans are priced between $5,000 so you’re able to $100,000, ideal for debt consolidating, renovations, or larger lifetime occurrences.

SoFi’s procedure is quick and you can successful, will providing you with financing an equivalent date you will be acknowledged. Because the creating, SoFi has aided pay off over $twenty-six million indebted. This indicates how important SoFi is actually providing that have private finance.

SoFi finance have reduced, fixed pricing, providing you satisfaction regarding the upcoming rates. The loan processes is easy, enabling you to apply on the internet without difficulty and with depend on.

Benefits associated with an effective SoFi Unsecured loan

Taking a personal bank loan can seem to be tough, but SoFi makes it much simpler and decreased. They supply many benefits that will you choose suitable mortgage for the money requires.

Lower Fixed Rates

SoFi signature loans include reasonable fixed cost. This means you earn a constant interest for the whole mortgage name. It will help you budget best, knowing your repayments won’t transform.

Zero Fees Needed

SoFi is unique whilst does not costs any fees. You will not pay for origination, prepayment, or late fees. This will make it better to repay the borrowed funds, targeting area of the amount and notice.

Same-Date Resource Availableness

If you want currency punctual, SoFi have quick options. They’re able to offer the currency an equivalent date your incorporate on the internet. This really is great for issues once you cannot hold off. İncele

PIPA board manager and previous couch Peter Koulizos, whom presented the research, said the outcome turned out you to definitely possessions are a safe and you will steady singer along side enough time-title, having area alternatives key.

Everything i discover most interesting try the fact that along side earlier 20 years, it has generally come reduced resource places or more affordable regions which have brought the greatest performance, he said.

New research indicates the major property artisans over the past 2 decades, with a few alarming countries developing ahead

Tasmania grabbed away a couple of most useful three places nationally getting long-title investment increases, having local Tasmanian home values tape 233 % the greatest in the united states.

Adelaide came in next location with 209 per cent growth, accompanied by the administrative centre of your Apple Island, Hobart, during the 3rd room that have 193 %.

6 Atwell Ct, Lindisfarne, into the Hobart, was Tassie extremely viewed property from inside the late Sep, however, offered immediately following an earnings give away from $1.026m as well as over 5000 feedback inside weekly. Picture: Provided

These sorts of results also reveal that assets areas are not linear rather, rates development happen within different situations over time, Mr Koulizos told you.

Thought one to Hobart has received a great softening out of pricing over the past number of years, but the mainly based median home rate enjoys increased of the 193 each penny once the .

Simultaneously, that have Adelaide and you will Brisbane, whoever markets are extremely strong at this time, however, where one another got very long periods out-of flat-lining rates things through the years.

Someplace else, 20-12 months rate growth in Perth is 186 %, Quarterly report (181%), local NSW (172%), local Queensland (166%), regional South Australian continent (165.4%), Melbourne (164.7%), Local West Australia (162%), Canberra (160%), Darwin (136%) and you may regional Northern Area (100%). İncele

Highlights:

- Debt consolidation reduction is actually a debt administration strategy that combines your the personal debt into yet another mortgage which have just one payment.

- There are a few a method to combine debt. What works good for you depends on your unique monetary activities.

- Weigh the pros and downsides of debt consolidating and exactly how it you’ll apply at your credit ratings to determine whether it is the best road to you personally.

When you’re struggling to pay off several expense on the other hand, you can thought debt consolidating. Combination would be an extremely helpful installment means – provided you know the newest in, the fresh outs and just how the method could impression your credit scores.

What’s debt consolidation reduction?

Debt consolidating are an obligations government approach that mixes the outstanding financial obligation into another type of loan in just one to payment per month. You could consolidate several credit cards or a combination of borrowing from the bank notes or any other loans instance a student loan or an effective mortgage. Consolidation will not instantly delete your debt, but it does promote certain consumers towards units they want to blow right back what they owe better.

The reason for consolidation are doubled. Earliest, integration condenses numerous monthly payments, tend to owed to various loan providers, towards an individual fee. Second, it can make installment less costly. From the combining several balances on the another loan which have a reduced rate of interest, you might get rid of collective desire, the sum of the interest money made-over the brand new longevity of that loan.

Debt consolidating loans have a tendency to feature all the way down minimum money, helping you save regarding monetary consequences out-of skipped money along the line. İncele

When you take aside home financing, you can pay a predetermined amount per month (for those who have a predetermined rates financial: keep reading to learn more). This is exactly a bit problematic to figure out: the audience is larger admirers of utilizing a mortgage calculator while making a keen imagine. For people who would like to determine your payments, try this one by the moneysavingexpert: we believe it is higher level. If you want to understand how to assess mortgage repayments yourself, read on!

Why is it very difficult?

It could be very easy to ascertain home financing fee in the event that the fresh new wide variety did not change-over big date. Sadly for us, they actually do-quite a bit. Banking institutions want to make money off the currency they give, so that they costs attract towards that loan. Mortgage desire is actually the price tag the lending company costs you to definitely borrow funds. İncele

In today’s speed ecosystem where it appears as though cost are constantly heading up ( the newest Federal Set-aside keeps elevated all of them 10 times as the history ericans end up trying to find reasonable-desire choices. For almost all residents, this could grab the version of a property security mortgage or a home collateral line of credit (HELOC) . This unique types of credit will help purchase a variety off expenses – and it also does not include expensive rates otherwise conditions. İncele