Dave is one of the most common economic apps. They generated a reputation to have by itself by eliminating overdraft charge to have its people. Notoriously acquiring a good investment out of Shark Tank’s Mark Cuban in its initial phases, Dave was better-also known as one of the best payment-100 % free payday loans software.

A cash loan, in other words, is a preliminary-term financing provided of the an establishment, constantly having a somewhat brief sum. Dave isn’t really by yourself in giving this service. So, consumers is to weighing the alternatives and select one that was perfect for them.

Just what Apps Resemble Dave?

Of numerous customers possess inquiries instance, Just what programs usually i want to borrow money instantly? and you will Exactly what app will offer myself bucks now? Including Dave, listed here are eight of the greatest pay day loan applications anyone normally used to get quick cash at this time.

step 1. Chime

Business owners and organizations usually see by themselves at the a good crossroads in which the best monetary backing renders a big difference. A corporate financing, inside context, is an effective resource that can assist propel a business on the desires. Let’s speak about seven of the very most powerful good reason why entrepreneurs might want to safer a corporate financing.

step 1. Kickstarting another Business

Probably one of the most prominent reasons to receive a business mortgage will be to release a new campaign. Setting up a business requires a critical financial. Away from protecting premise in order to procuring initially catalog and you may recruiting teams, the costs add up. A business mortgage ‘s the anchor help such very early-phase standards, making certain that entrepreneurs can also be work at building a feasible and profitable company.

dos. Fueling Team Expansion

Progress is actually a critical consider a good businesses visit achievements. Whether it is the necessity for a more impressive workplace, introducing new products, or increasing in order to the new geographical towns and cities, increases need financial support. A corporate financing lets business owners to gain access to the cash needed to execute extension preparations effectively. It enables them to make good financial investments in the place of deteriorating its working investment.

step three. Upgrading Gadgets and you will Stocking Collection

Abilities and preparedness are crucial for the ensuring simple businesses. As technology evolves and requires alter, updating gadgets and you can maintaining a robust catalog feel very important. Business loans dedicated to gadgets resource otherwise collection procurement guarantee that the business can also be maximize show, fulfill customer needs, and start to become aggressive.

4. Combining Expense

Juggling numerous bills, for every along with its individual interest rate and you can cost schedule are going to be troublesome and you can economically pushing. İncele

Soon after you found the loan pre-approval, expect to get a hold of records to own a conditionally acknowledged home loan. You to updates could well be on the best way to obtain something special letter. This happens an individual helps you help make your pick, normally by the chipping into your down payment pricing.

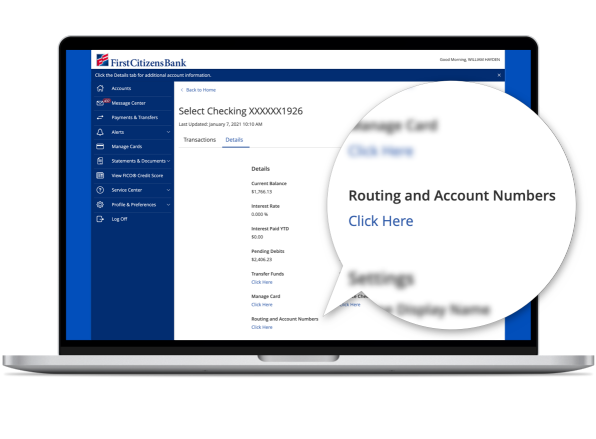

When someone is actually working for you, it’s best to ask for the new money well in advance. Deposit they. Allow it to 12 months in your take into account more two (essentially three) membership statements. By doing this, if your home loan professional asks observe the high quality a couple months from bank statements, the cash is little this new.

But if the provide import is found on their recent lender statements, their financial expert often request an explanation. Just how performed that money infusion will your finances? What’s the way to obtain the income?

Just what a gift Page Is to Incorporate

The new present page is a simple, one-webpage declaration installation of the key information on the money import. Your own home loan pro offers a layout to the letter. Rescue financial info: an image of this new look at as well as the transfer in the current donor’s bank account.

Your mortgage professional get consult all documents tracing the newest transfer, that can inquire about a lender statement from your donor. As to why? The lender really wants to see the reputation for the cash in the the account it came from. It seems the money might have been legitimately received.

- A name over the top, clearly to provide the fresh new document as Gift Page.

- This new donor’s label, done address and you may phone number, and relationship to the latest debtor. That is oftentimes qualified? Any person related because of the blood, relationships, use otherwise custody, involvement, otherwise residential commitment. No party mixed up in real estate purchase.

- The amount of new provide. İncele

You will find informed the newest chairman this can be perhaps one of the most important things they can do in order to assist our very own savings, Schumer told you on virtual convention. All of us require the new benefit to grow. Each of us want people to have a great lifestyle, where you could permit yourself as well as your household members.

An analysis by the nonpartisan Panel having a responsible Government Finances calculated if Biden motions ahead having an excellent $10,000 forgiveness package, it would apply to on you to-third of debt people and cost the government $245 million during the forgone loan and you will attract money.

Training Assistant Miguel Cardona, in the an interview that have MSNBC on may 16 told you section of the interior discussions encompassing debt settlement also include ideas on how to change this new commission system because the stop is actually lifted. İncele

(ECF No. step 3 20; Validation Observe ECF Zero. 14-4.) On , the recommendations for Plaintiff sent a page to help you Rosenberg in order to argument the personal debt. (ECF Zero. step three 21; Argument Letter, ECF Zero. 14-5.) Rosenberg don’t answer this new Dispute Page. (ECF Zero. step three 21.)

Rosenberg motions in order to write off Plaintiff’s Grievance pursuant to Provided

Rosenberg mailed Plaintiff a notification to all the Occupants regarding the foreclosures procedures against their particular house. Id. 23. Plaintiff alleges one, instead reason, SPS informed Plaintiff’s insurance company, All over the country Insurance, one SPS had started foreclosures legal proceeding up against Plaintiff’s domestic. Id. 22. To your , Rosenberg recorded a foreclosures step regarding Circuit Court for Howard County, Maryland (the fresh Foreclosures Step). İncele

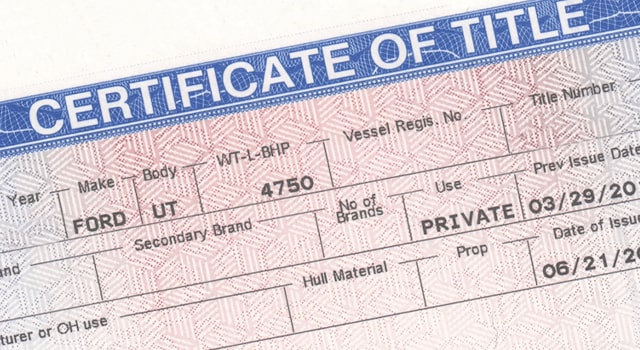

Lenders classification just what data files you want, but it revolves within the basics. You’ll have to offer their ID, Public Cover Amount, proof house, or other suggestions to receive a good HELOC.

Step 4: Opting for another Family

Accommodations possessions or trips domestic will provide you with more a home. You are able to money from rental money and you can enjoy. However, you have got to prefer an extra house that will build positive cash flow. Its fascinating to construct a bona fide estate profile, however, buyers need to take into account the problems when choosing an additional domestic. It’s best to examine numerous possibilities rather than accept getting a property that will not make along with your monetary goals. İncele

Password (repayment offers); 6509 California

It could be practical to point out, along with, that during the many years of the analysis associated with the question the newest reality was not overlooked when the fresh new Congress exposed the fresh new relationships so you can full income income tax, immediately following expenditures just, excluding the expense of money, named a dividend, following within a couple months we are able to rearrange all the contacts in order to make their price of money attract because the it is when you look at the banks towards offers account therefore it manage feel allowable in advance of income tax. Whenever we had shed all of our case, this should was indeed complete.

Because the Section 591 of one’s Funds Password implies, Mr. Russell’s view succeeded; an excellent cash advance, East Village, CT deduction with the “cost of money” is actually allowed; and also the globe don’t deal with the significance of restructuring alone. Prather together with recognizes that the fresh new ownership in accounts in the discounts connectivity whether when it comes to withdrawable offers or funding certificates, a whole lot more almost is similar to control regarding a benefit deposit than simply a share away from stock. İncele

Consider unlocking a gem chest undetectable in your home-this can be basically just what a house Collateral Credit line (HELOC) makes you would. Very, what is an excellent HELOC? A HELOC mortgage lets you make use of new based-right up equity in your home, providing an adaptable line of credit that you can use to own a myriad of motives. You can use it for a kitchen area facelift, combining higher-attract obligations, financing their baby’s knowledge or since a financial back-up so you can defense unforeseen will cost you. Quite simply, it converts your own residence’s equity toward accessible cash whenever expected.

How does a HELOC functions?

An effective HELOC operates similarly to credit usa furniture loan lost job cards however with your house given that collateral. It includes a beneficial revolving line of credit according to a portion off your own residence’s appraised worth, quicker their an excellent home loan harmony. İncele

A treatment loan allows home buyers to purchase property that need fixes otherwise renovations and you will package the expenses of them developments in their home loan.

Having first-day homeowners, a treatment or treatment mortgage can be a strategic solution to browse the costly and regularly aggressive Higher Boston housing market. Homes for the move-into the status sell for a premium. Land needing updating and you may fixes sometimes sell for below market value, making it possible for homebuyers access to an or costs-prohibitive people.

Although possible homeowners throughout the Boston area have the earnings to pay a home loan, preserving on advance payment and you will settlement costs was overwhelming. Add in requisite instant solutions – normal with Deeper Boston’s elderly casing inventory – and house-to get is unrealistic.

Multiple treatment loan options are readily available, however, a couple of most frequent may be the Government Construction Management (FHA) 203(k) Treatment Mortgage additionally the Fannie mae “HomeStyle” Renovation loan.

Federal national mortgage association HomeStyle Repair Financing

HomeStyle Repair Loan consumers can be upgrade people section of their home, and additionally restrooms and you can roofs, otherwise add connection hold systems such an out in-rules collection. Surroundings tactics, for example woods, patios, and you can sustaining wall space, meet the requirements. There is absolutely no minimum buck number, and you will homeowners can pick people company otherwise subcontractor, pending bank opinion.

Federal national mortgage association says HomeStyle Restoration Mortgage rates tends to be all the way down than just property equity line of credit, commonly referred to as an excellent HELOC, signature loans, or other higher priced resource solutions. İncele

You will be asked to provide a minumum of one top photo setting from ID (e.grams. passport or driver’s license), and one low-photographic function (e.grams. birth certificate), plus second data files eg a Medicare credit, lender statements and you can bills.

Mortgage 100-section individual identity system

Most lenders tend to inquire about 90 days regarding bank comments to help you be sure your revenue facing the bills. If you are an initial-family buyer, might as well as make sure that the put could have been accumulated over day.

What loan providers want to see is a bona fide reputation of offers and you can responsible spending. Any late fees is a red flag. If you want to know the way the lender statements might look so you’re able to a loan provider, was the Totally free Bank Declaration Medical exam.

Be ready to have to determine any mismatch on your own money and costs. Be it a recently available vehicle buy or a money gift off relatives (in which particular case you will need a letter out of your benefactor), you will need to suggest so it for the lender for complete visibility.

Their lender also inquire about a listing of the money you owe and property in order to determine your debt-to-income ratio (the newest percentage of their month-to-month gross income supposed to your expenses) and determine what you can do to repay a home loan. İncele