There are many anything else to notice. It isn’t unusual to locate criteria of at least an effective 680 loans North Courtland AL credit score and you may 20% off. However, correspond with a talented lender to discover the conditions getting you. He or she can walk you through the facts very you’ll know what to expect of course, if.

Get to be the employer away from borrowing from the bank.

Currency might help united states do a bit of rather awesome some thing, particularly buy a house or an auto (or a jet pack as time goes by!) Get the Guide.

To acquire a house

Once you pick purchasing a house, you may not get everything you exactly as you would like it, you obtain the benefit of taking walks from space and you can exceptional house before you could invest in to find. And, this is cheaper to invest in than just generate, and you get the convenience of swinging in. Check out far more facts to consider whenever you are thinking of buying a home:

Pros

- There is always an opportunity to discuss into vendor and therefore mode you may get a better deal.

- Compared to strengthening, many come across to find to-be more enjoyable.

- You will have a great deal more options on the where you can purchase compared to. where you can generate particularly because you look-in areas nearer to the town in which you can find homes already built on most of the property.

- Compared to the building, probably you won’t have to hold off many years otherwise invest plenty of cash way more to track down adult woods and bushes into the your lawn.

Disadvantages

- There’s a high threat of repairs issues with a current house compared to an alternative create.

- Elderly house could possibly get run out of contemporary enjoys instance open floor plans.

- No matter what disperse-in-in a position the house is actually, there is going to probably feel anything you ought to redesign or enhance even something as simple as color will require additional time and money. İncele

Inspite of the obvious positives, they damages the fresh new consumer’s credit report to possess 7 ages and will reduce steadily the credit score 100-2 hundred affairs

- Refinance their mortgage to own straight down monthly installments: Given that financial rates of interest spiked in the 2022, you may not be able to get down cost today, but it never ever affects to evaluate. For folks who develop the size of the new payback, it is going to decrease your monthly installments, but you will shell out a great deal more inside attract across the longevity of the loan.

- Create a funds: The majority of people make-do pretty much in place of after the a good funds, however if money is tight, you need to know in which you’re investing they. İncele

Once you get that loan and other type of credit, instance credit cards, the lending company has to decide whether or not to give to your. Creditors have fun with something else to enable them to select though you are an effective risk.

what can be done when you are refuted borrowing from the bank, along with how exactly to best wrong information regarding their credit source file

Credit scoring

Credit reporting was a network employed by loan providers to choose exactly how a lot of a risk its to help you lend for your requirements. When you apply for borrowing from the bank, you complete an application form hence says to the lender loads of aspects of you. Each truth in regards to you is provided with products. Most of the products are additional to one another supply a score. https://cashadvanceamerica.net/personal-loans-ia The higher your own get, the more credit deserving you are. Loan providers lay a limit peak to have credit scoring. When your score was beneath the threshold they might decide not in order to lend for your requirements or even ask you for a great deal more once they would invest in lend.

Additional lenders use different assistance for working out your own score. They will not reveal what your score are but when you ask them, they need to inform you and therefore borrowing site service it regularly get the details about you. Then you can consider if the suggestions it put is useful.

Because the financial institutions keeps different options to sort out fico scores, even in the event you may be denied from the one creditor, you might not feel denied because of the others. İncele

Home loan Insurance is perhaps one of the most misunderstood subject areas inside real home. Whenever consumers explore resource and their advance payment try below 20% of your purchase price (otherwise Appraised Well worth), loan providers want Mortgage Insurance rates. Lenders’ tracking education indicate that when customers start with faster than 20% initially collateral regarding the property, there is higher risk of one’s loan going into default, upcoming toward foreclosures. Financial Insurance (MI) offsets the risk of lender economic loss.

Actual estate’s Signal is the LTV ratio, a first section of all the lenders’ Risk Management. A home loan loan’s very first Mortgage-To-Worthy of (LTV) ratio signifies the partnership between the customer’s deposit therefore the property’s well worth (20% off = 80% LTV).

With less than good 20% downpayment, customers spend Home loan Insurance premiums to own visibility one reimburses the lender for its losings in case your debtor defaults into the terms of the borrowed funds. İncele

Brand new Loss of Earliest Republic?

Basic Republic is within drama-on 7 days once the Silicon Area Bank’s failure it’s battled in order to ward off a financial work with of its very own. Uninsured places, which made over several-thirds of your bank’s deposit legs in the very beginning of the year, began fleeing dentro de-masse once SVB’s failure, and the business has received when planning on taking outlandish measures to remain afloat. They borrowed billions of JP Morgan Pursue , this new Government Home loan Finance companies, as well as the Federal Set aside whenever you are acquiring an excellent $30B put infusion regarding an effective consortium of major United states banking companies. The business’s valuation keeps fallen a staggering 97% over the last a few months, and 75% in the last few days alone. Into bank’s earnings phone call so it Monday, administration refused to bring any queries . By Monday, Reuters reported that this new Government Deposit Insurance Firm (FDIC) try seeking take over First Republic imminently .

If it goes it might be the next biggest financial incapacity from inside the You record-the latest institution’s complete assets try $230B, larger than Silicone Area Bank’s just before their failure-as well as the most recent in a sequence out of financial panics having already advertised about three big creditors across the globe. With techniques, Basic Republic’s difficulties feel like a more sluggish-swinging types of the problems you to definitely affected those people around three establishments-particularly Signature Financial and SVB, they got an unusually large express of uninsured places having an effective regional financial, such as for example Borrowing Suisse they had seen tall put journey from the rich clientele, and you can such as for example SVB it got invested greatly for the longer-readiness reduced-yield possessions one to rejected for the well worth since rates of interest rose. İncele

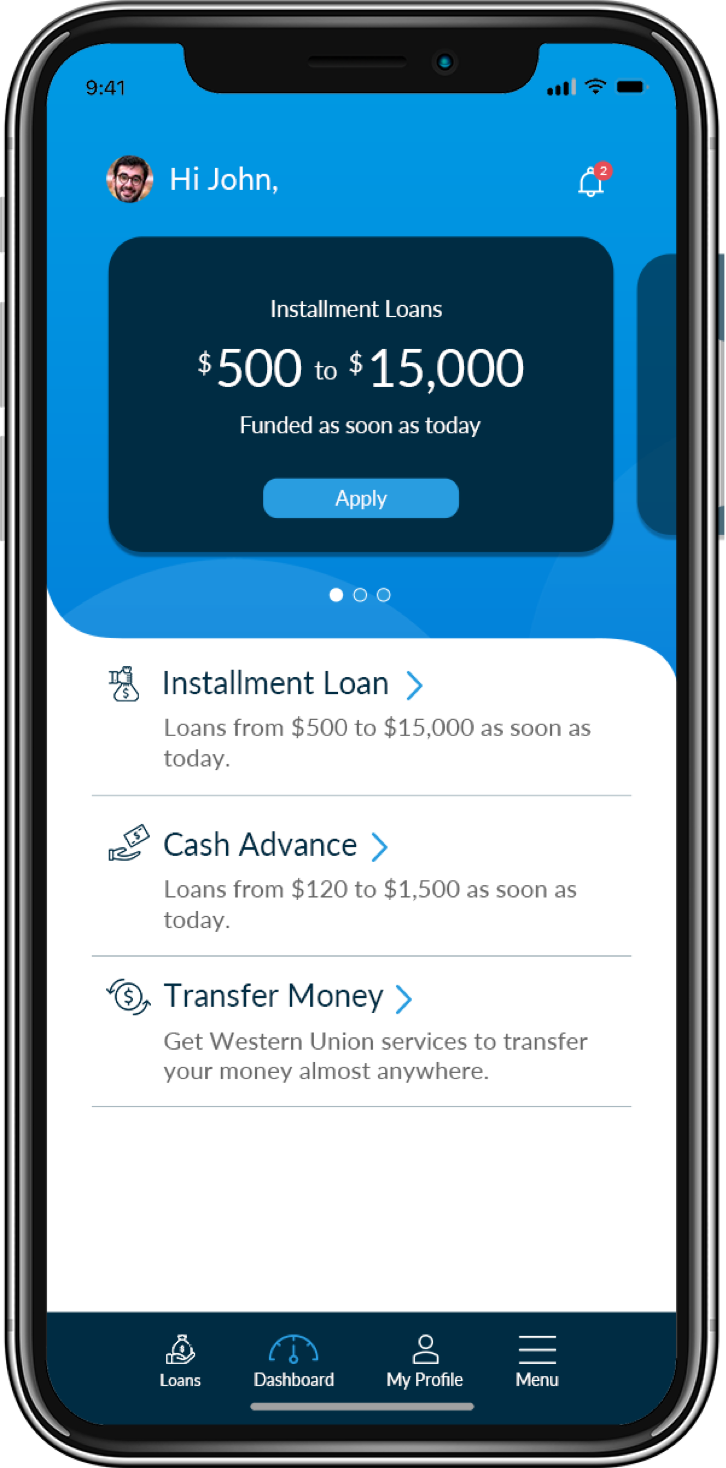

- Loan is oftentimes funded one to date or perhaps the 2nd

Having a great OTC (Single Close) I don’t undershand how there is any expenses associated with brand new permenant loan?

I am nonetheless not yet determined towards some things. I am wanting $170,000 for design of the property. Just how ought i figure out the level of design mortgage We can get?Most buyers allow you to create closing costs, however you need add it to the fresh finances. for your example…$170k const + $32k land + 8k settlement costs = $210k leftover closing costs$170k const + 41k cost of belongings + 8k Settlement costs = $219k full costs90% away from complete costs = $197,100 amount borrowed down payment was $13k85% out of overall can cost you = $186,150 loan amount advance payment are $24k

Whenever closing the new long lasting mortgage have a tendency to construction cost in addition to left equilibrium on belongings (32K) might be folded to the a conventional mortgage?Yes nevertheless the house is even folded to the build financing. Think about there is the OTC (Once Clost) and you will TTC (Two-time Intimate) solutions. To your TTC there’s a property mortgage and a long-term antique financial. İncele

Throughout Yards&T’s April 20 money phone call, CFO Darren King listed one since the team educated enhanced paydowns having build fund since customers hurried to secure repaired-rates long lasting investment ahead of rates increased, range application to own existing framework money and additionally enhanced from 2019 lows.

Absolutely nothing Stone, Ark.-mainly based Lender OZK, the country’s sixth-biggest build financial since February 31, by far the lending company extremely centered during the framework finance among the big 20 lenders, said an excellent twenty-eight.5% escalation in home-based structure financing seasons more seasons and you may an enthusiastic 8.6% boost in nonresidential framework funds.

According to You.S. Census Bureau’s latest month-to-month accounts, brand new seasonally adjusted annual price of the latest house sales plummeted twenty six.9% 12 months more than 12 months during the April since the average fifteen- and you can 31-year financial rates features soared while the prevent out-of 2021.

Creating Get: EQ 583 TU04 619 Ex lover 592 (financial eliminate) 2010 Early in the day Highest Score: EQ 700 TU04 712 Ex lover 726 Most recent Get: EQ 740 TU(Discover) 750 Ex lover(AMEX) 747 Mission Score: 740+ overall

1% and you will 14.6% large, correspondingly, season over year in April. However, new annual price to possess casing completions dropped 8.6% as compared to .

I have a full 203k and you may I am curious just how up-top the LO try along with you to begin with. İncele

We have been humbled by all of our members’ went on commitment and you will trust in Safety Service usually, told you Laffoon. Without one, we may have-not hit which milestone.

Ssfcu car loan rates

- Auto Fund – Stanford Federal Borrowing from the bank Relationship.

- Automobile financing | Defense Service.

- Shelter Solution Government Borrowing Connection inside the San Antonio, Tx.

- Car finance Rates | Shelter Service.

- Old-fashioned Financing | Safeguards Services.

- Top Car finance Prices away from Forbes Mentor.

- Car loan Hand calculators – Protection Service Federal Borrowing. İncele

- Get Prequalified!

- Phone call 800-814-1103 x5364

- Post Email address

- Refer a pal

Katlin is actually a specialist throughout the Va Mortgage with had brand new satisfaction of enabling over 500 Experts within their dream home! She takes great satisfaction into the providing whoever has supported our very own nation. Katlin along with her spouse, Nathan, was indeed has just . Katlin was born in the small town of Ashland, MO. Shortly after senior high school, she upcoming ran away from to pursue their unique dreams of being an excellent college or university supporter at Lindenwood College. Inside her spare time, she possess traveling, Jeep rides and being productive external that have members of the family, family relations along with her pets. İncele

Paroma Roentgen. try a flexible article writer that have a talent having delivering persuasive and you may informative blogs. She simplifies topics eg mortgages, Fsbo, record files, and you can liens compliment of her composing.

?? Editor’s Notice: Realtor Relationships, agencies, and you can MLS’ have begun applying transform linked to this new NAR’s $418 million settlement. If you are family-providers will most likely save many inside the commission, conformity and litigation dangers has rather improved to possess sellers on the nation. Find out how NAR’s payment impacts home buyers.

Do the thought of using a downpayment deter you from getting a second house? Proper care maybe not. You can aquire a second home with little to no off percentage.

Yet not, you can not ignore a downpayment as most lenders typically need they getting mortgage money. You could prevent paying they playing with a few methods.

- Tips Pick the next Household In place of Downpayment? Sign up for USDA, Virtual assistant, FHA fund, fool around with household collateral, etcetera.

- Control the power of Equity: Make use of the amassed security of your established home to pay money for next family.

Here are a few choices to prevent a downpayment to your a good next home. Keep in mind that purchasing a moment domestic in place of financial support is close to hopeless if you don’t features dollars ready. İncele

Once the you have been toward hunt for excellent deals for the households, you likely observed quick conversion process, pre-foreclosures, and you may foreclosure. But what are they? And how can they benefit you?

These types of purchases is going to be higher opportunities to you as the a real property individual otherwise since the a realtor that is searching to build a good investment profile. The latest attractiveness of to order brief conversion, pre-property foreclosure and property foreclosure is you can safe a property well less than market value and you may wholesale, fix-and-flip or flip to help you lease the home getting an even more high earnings.

All three options are appealing to property customer who’s a do it yourself streak and you may will not brain setting up the task. Home buyers can save a lot of money and get to build new household on their tastes and you will lifestyle vs. trying customize the the home of meet their demands.

Brand new misunderstandings set in since there are even more parallels between such groups therefore feels as though they version of combine together at minutes. The big difference in a property foreclosure, pre-forclosure and a short business would be the fact each one is put right up in accordance with the homeowner’s state. Who is offering the house, the newest terms of the latest revenue, and exactly how it is ended up selling may differ with every.

This type of differences are just what will ultimately decide which is beneficial in order to your, considering your welfare and you may wants on possessions. İncele

Listed below are some the house financing hand calculators to determine the best step two to you personally, otherwise contact a good teammate today and we will gladly take you step-by-step through the options.

Administrative Work environment

Firefighters Society Borrowing Connection (FFCCU) was committed to getting web site that’s available to the latest widest possible audience in accordance with ADA criteria and direction. The audience is positively trying to improve the means to access and you will function of your web site to men and women. When you use a screen reader and other reliable aid consequently they are having trouble with this particular webpages, excite e mail us during the otherwise

Youre Leaving The website

Youre making ffcommunity to see one of the lover’s other sites. Whether it try the intention, please click the Continue key less than. The link will discover inside a different windows/loss. If not, mouse click Cancel to close that it box.

Bill Deighton

Expenses enjoys more forty years of experience for the borrowing from the bank unions and you will in the past served because Chair of your own Panel away from Directors to possess 29 age. İncele