Bringing pre-accepted will help automate your house to purchase techniques since you gets a good first step toward suggestions. An individual will be pre-acknowledged, you are on your way in order to homeownership! Contact one of our financing officials to begin.

Get Pre-Certified

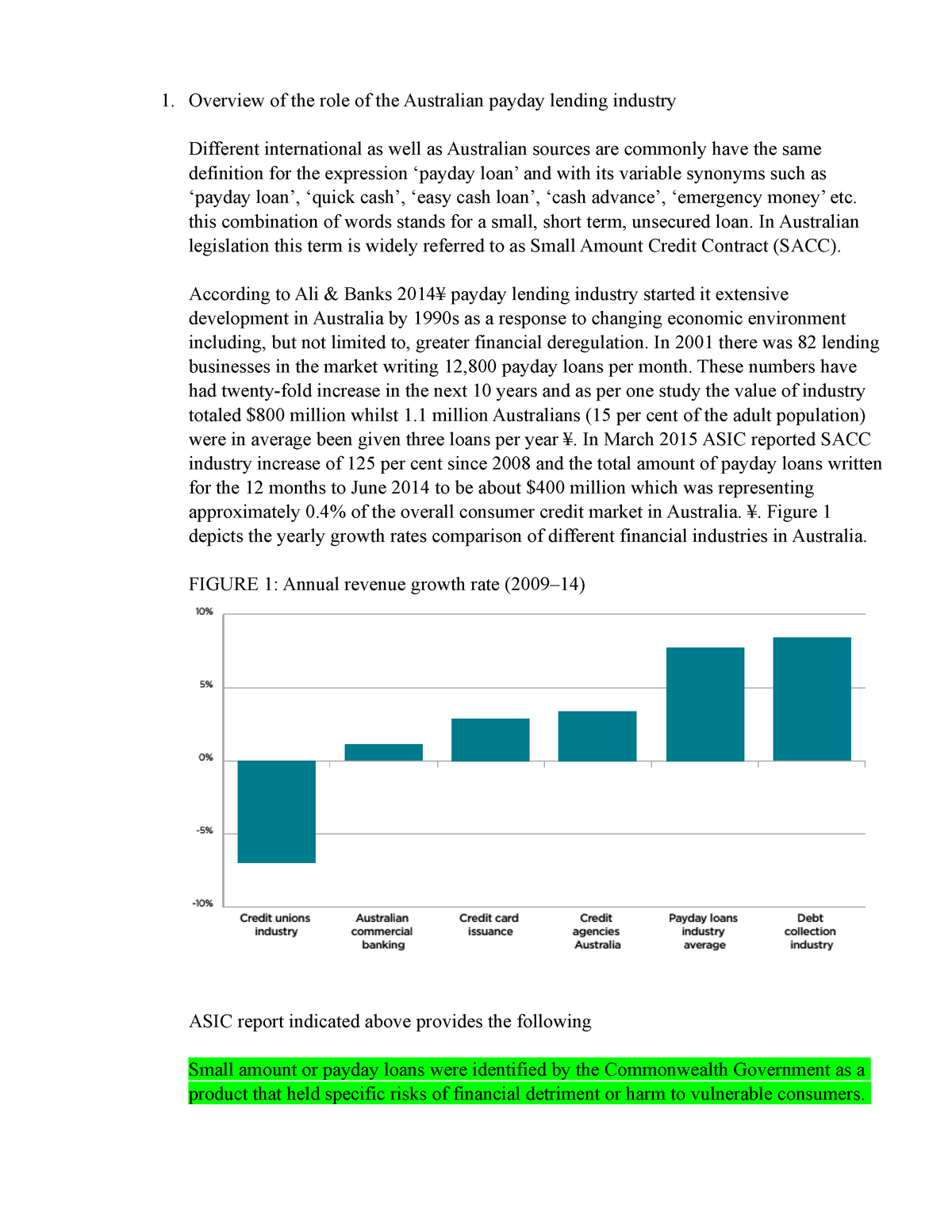

Submit basic records This can include pay stubs, bank statements, credit reports, and statements for any other debts or loans you might have. Your loan officer will let you know exactly what they need!

Mention what you are able afford Your loan officer will discuss mortgage program options with you to find the best fit for your budget and situation. A monthly budget worksheet can be very helpful for this part of the process because it helps you to review your spending habits so you know how much money you’ll want to have leftover after your home bills each month.

Execute pre-qualification Your loan officer will put together a pre-qualification letter based on your loan choice so you can start shopping for a home!

Buy property

Fill in an offer playing with a great pre-qualification page Home sellers almost always require a letter of pre-qualification from a lender along with the purchase offer from your realtor. If they accept your offer, you can move on to the next step!

Best wishes! You ratified with the acquisition of the new household This means the seller has accepted your purchase offer in writing!

Begin the borrowed funds Processes

Activate the loan app Your loan officer or loan processor will reach out to you to guide you through these steps.

Secure the interest and you will purchase the latest appraisal Locking your interest rate means that if rates go get loan without checking account up prior to closing on your home, your rate stays the same. İncele

So it display screen reveals the brand new month-to-month mortgage repayment, full desire paid, breakout out-of dominant and you may desire, and your home loan payoff big date.

Which screen demonstrates to you the entire dominating and you may interest paid in on a yearly basis of one’s home loan along with your remaining principal balance at the conclusion for every single season.

We suggest a straightforward research: $200,000 amount borrowed, 30-seasons fixed-rate home loan with an intention rate out of cuatro

While this screen table along with demonstrates to you Miami personal loans bad credit the full prominent and attract paid in every year of your financial plus left prominent harmony after for each and every season, pressing the newest “+” sign near to annually shows 1 month-by-times report about their will set you back.

In this elective area, you can include for the a typical monthly prepayment count, re-place the new calculator to show bi-each week repayments and you can discounts, if not would a-one-go out prepayment observe how exactly it affects the expense of your own home loan.

Ever wondered how two financing possibilities contrast against both, otherwise just how much out-of a big difference for the attract cost a-quarter off a portion point improvement in the latest loan’s interest rate tends to make? Indeed, you could evaluate to five additional loan circumstances at a time!

Step 1: Get a hold of a base loan facing you must examine. 25%. Add these viewpoints into the calculator fields and you may press tab or click on the “Calculate” key. İncele

Every home loan provider has a certain gang of criteria, which generally consists of documents verifying an applicant’s identity, source of income, debt and savings, and assets and liabilities.

Based on your chosen financial, you can get home financing pre-acceptance on the web through their system otherwise build an appointment having a good face-to-face interviewing a lending expert. The following is a summary of all you need to present to get a home loan pre-approval:

1. Proof title

Loan providers usually want individuals to provide top and you may second identification data to prove the identity and you can citizenship condition. In addition, it helps reduce the risk of identity theft & fraud and you can scam, we.e. another individual taking out that loan on the term. Proof label data are in around three groups.

Usually, it’s also possible to only have to expose one to first photographic ID to confirm the name. not, the lending company will get ask for a mix of non-photographic number one and you may additional identification data without having an effective primary images ID.

Observe that the data files should be official duplicates of one’s totally new, is actually latest and never expired (except if if you don’t mentioned), and must enter English otherwise interpreted to your English. You may visit your regional Justice from Comfort (JP) having the documents certified or, for those who sign up for the pre-recognition privately, keep them affirmed of the a professional member.

After that, if for example the name has evolved as the documents was basically granted, you age certification provided because of the Registry from Births, Deaths and you will Marriages.

2. Proof of money

Loan providers evaluate your capability to repay your loan because of https://availableloan.net/personal-loans-tx/columbus/ records you to establish your revenue. İncele

So it boom, in conjunction with low interest at the time, suggested you to lenders was in fact keen to grow the portfolios out-of money to help you consumers which have bad credit histories, and therefore finished up leading to a revolution away from defaults across the country while the economy slowed and dropped toward credit crunch

In short, the subprime financial crisis was considering the fresh bursting of the bubble that had shaped about booming All of us casing .

The economical tale inside basic 1 / 2 of new 2000s was greatly certainly one of vitality after the bursting of your own dotcom ripple early regarding , episodes for the Business Trading Cardio in New york. And with the broadening likelihood of deflation looming around the corner, the brand new Federal Reserve System (the latest Provided) aggressively slash its workbench just to step one.0 percent of the 2003. The low costs, but not, motivated large growth in casing demand, because cost less having homebuyers to carry out mortgage loans. Which request delivered domestic prices increasing; according to the S&P/Case-Shiller U.S. İncele

by: Samantha Partington

- 0

Home loans Trinity Economic and private Finance say a familiar misconception one of consumers is the fact attract-just is actually a great pre-borrowing crisis financial solution.

But not, once the Coventry Strengthening People re also-joined the attention-only markets inside September and Nationwide expanded the assortment so you’re able to purchases inside November a good flurry regarding loan providers made conditions tweaks so you’re able to open their interest-simply choices to significantly more borrowers.

NatWest altered the attract-merely earnings requirements within the November to suit the money cost plan meaning that bonuses is taken into account. However, unmarried candidates need secure about ?75,one hundred thousand a year and you can mutual individuals must earn ?one hundred,100 among them.

During the January, Barclays enhanced its part installment and you will region desire-merely conditions by the expanding their mortgage in order to worthy of (LTV) out of 80 to help you 85 per cent for these classed while the Barclays Money Government otherwise Prominent Banking consumers.

In identical day, City Financial told you a homeowner choosing interest-merely you may now state debt consolidation since their reason for credit. İncele

Sounds effortless – but picking out money purchasing a home can also be feel problematic. Plus the size of your downpayment make a difference to your own home loan will set you back and you will speed. Why don’t we hunt.

When attending get your first house otherwise second home, or a vacation otherwise leasing assets, lenders anticipate one put a number of their currency with the you buy called a down payment.

Your own down payment secures no less than a tiny part of equity of your home otherwise assets. In addition it assures the financial institution of your own investment decision with the for example a big purchase and also the resulting mortgage.

Just before the pre-acceptance techniques and you may home-search adventure, we could help you domestic-in exactly how far you will have to establish (or save your self), exactly what present work for event the matter – and other facts you must know.

Want insight and you can tips to help with your residence-purchasing techniques of start to finish? Obtain our very own easy, yet , comprehensive Very first time House Buyer’s Book right here – it’s free!

Any deposit between 5% and you may 20% of the house price is entitled a top proportion financial. It indicates that your particular financial will demand home loan standard insurance policies so you’re able to cover the financial institution, available with Canada Home loan and you will Housing Corporation (CMHC), Sagen otherwise Canada Warranty. İncele

Where in fact the bank is not required to offer the veteran with a loan Guess or an ending Revelation due to the fact refinancing mortgage try an excused deal less than a dozen CFR 1026

(v) The lender ought to provide brand new veteran with a last mortgage comparison revelation (for the a format specified because of the Secretary) towards the time the lender brings toward seasoned the fresh Closing Revelation expected not as much as several CFR (f). This new seasoned need to certify, following receipt of one’s final financing analysis revelation, your seasoned acquired the first and you will latest mortgage research disclosures required by that personal loans for legal resident with no credit history it part.

Regarding advised signal see, Va compensated into suggesting the notice go out just like the this new big date of financing issuance, meaning that if Va would be to follow the high quality since suggested, the note time do serve as the point where the newest computation of your own 36-times recoupment several months manage initiate

(vi) Regardless of whether the financial institution ought to provide the brand new veteran with a Financing Guess significantly less than twelve CFR (e) otherwise an ending Disclosure under a dozen CFR (f), the lending company must provide the brand new veteran towards very first and you may latest mortgage evaluation disclosures. İncele

One of several individuals rules, the new FHA’s “100-Distance Rule” usually stands out once the instance problematic to possess borrowers. Not familiar to many homebuyers, there are two main 100-kilometer guidelines, each using its very own effects and requires.

In this writings, we shall look into these regions of the newest 100-Kilometer Code, helping you know the way they may perception the FHA mortgage feel.

Desk of Articles

- 100-Mile Rule getting a moment FHA Mortgage

- 100-Mile Rule For rental Earnings

- Simple tips to Qualify for a keen FHA Loan

- Solution Finance getting Homeowners Affected by this new 100-Distance Rule

- Faq’s (FAQs) Regarding FHA Fund and also the 100-Kilometer Laws

- The bottom line

100-Distance Laws getting an extra FHA Financing

An important requirement listed here is length: when you are relocating to own employment along with your brand new home try more than 100 far off out of your newest quarters, you can meet the requirements to hang an alternate FHA financing.

not, navigating which part of the signal isn’t really simple. İncele

Lara J. Cushing

3 Company regarding Environmental Fitness Sciences, Fielding School away from Societal Wellness, College from Ca, Los angeles, Los angeles, California U . s .

Abstract

After the Great Despair and you will relevant property foreclosures, the us government mainly based the new companies in order to support the means to access affordable home mortgages, such as the Home Owners’ Mortgage Agency (HOLC) and you may Federal Homes Management (FHA). HOLC and you will FHA brought common neighborhood appraisals to determine resource chance, named “redlining,” and therefore grabbed under consideration residents’ competition. Redlining thereby resulted in segregation, disinvestment, and racial inequities in opportunities to possess homeownership and wide range accumulation. Recent look examines associations between historical redlining and you can then environmental determinants of health insurance and fitness-associated consequences. Contained in this scoping remark, i assess the the amount of the most recent human anatomy from research, the variety of outcomes learnt, and you will trick studies services, exploring the assistance and you may power of matchmaking ranging from redlining, community environments, and you will health plus additional methodological means. İncele

Research about Australian Ties and you can Expenditures Commission (ASIC) claims that to 50 % of brand new home loans printed in Australian continent try due to a mortgage broker.

Which have consumers concerned about threats in it when it comes to domestic money, it is very important know what mortgage brokers manage precisely, the reasons why you will need you to, and the ways to get a hold of a dependable mortgage broker when there will be unnecessary to select from.

On this page, we shall describe why trying to find a large financial company you can trust tends to make a huge difference to locate the best financial and you can giving you most readily useful recommendations and you may comfort using your financial software process.

How much does A mortgage broker Manage?

Lenders is mortgage and you can mortgage advisers which help borrowers find the appropriate fund option to get or re-finance a house. They generally try to be a link anywhere between a customers and a good lender whenever obtaining a home loan.

- Compares appropriate home loan solutions. Lenders functions from the skills a customer’s financial situation first. Then they assist them to discover best and suitable resource solution to meet their house requires. From that point, they can assist borrowers come across and you will contrast suitable home loan facts of offered lenders.

- Instructions customers throughout the home loan application process. Home loans bring support in order to consumers from the mortgage app process, handling they towards the people of entry until settlement, and even beyond. Mortgage brokers require that you over a client temporary and gives a variety of support documents which in turn gives them an intensive understanding of your position and certainly will following take advice from the most suitable loan activities.

- Help borrowers learn cutting-edge monetary preparations and terms and conditions. It could be difficult to sort through monetary slang alone. İncele