Cash-Away Refinance: A cash-out refinance pertains to refinancing their home loan to own a high count than just everything you already are obligated to pay and you can taking right out the real difference for the bucks.

Playing cards: Homeowners may explore handmade cards to invest in home improvement methods. Yet not, credit cards routinely have large rates of interest than other style of funds, therefore it is crucial that you consider this to be solution very carefully.

It is very important very carefully believe each type of do it yourself loan and choose one that is the best for your private economic condition. Consult with a monetary coach or bank to help you build an informed choice.

How will you Choose the best Do it yourself Financing?

![]()

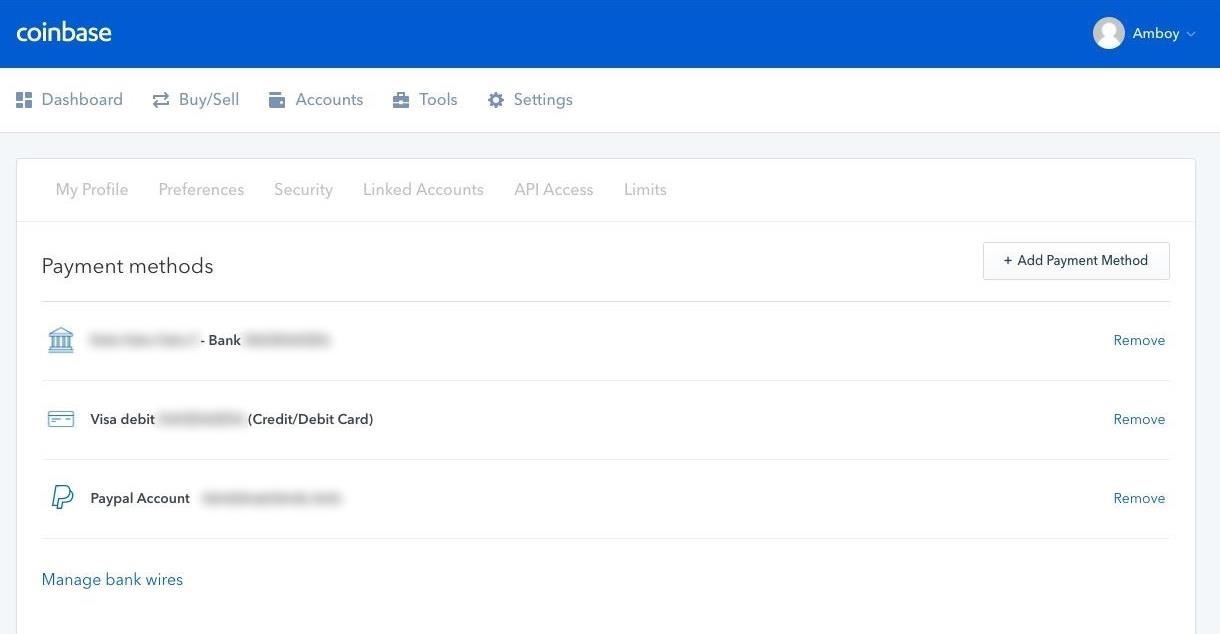

How can you choose a good do-it-yourself financing? Influence the price of home improvements, just what financing choice is appropriate, and you can compare financing solutions and discover the cheapest price you can. I want to borrow money of my personal household. Any kind of most other option selection? Do i need to score government funds? Let us start the application for the loan process.

Credit cards Ideal for reasonable, small-level tactics

Employ if you’d like to purchase a tiny currency on another type of auto otherwise paint investment you want to finance for a few days. Many playing cards are offering 12-few days free 0% Apr episodes which means that you simply will not pay focus on your own harmony more than one year. You have the accessibility to generating revenue when you will be making an upgrade get. İncele

We acknowledge the concern with privacy and you can defense online. That it Confidentiality & Protection Policy relates to the kinds of information attained about you away from your own visit to this site and you may kits the way we will use such recommendations. You may not utilize the Website if you don’t consent with this Privacy & Coverage Policy.

Thanks for visiting the site (“Site”) of San Bernardino State Auditor-Controller/Treasurer/Tax Collector (“i,” “united states,” or “our”)

Advice Susceptible to Public record information Statutes and other Judge Criteria Please become told that we try subject to anyone information legislation of the State away from California (“Ca Public information Work”) hence most of all the info you submit to us was public information under such statutes. İncele

Figure 1

The lower part of pupils whom acquire is certainly one reason Ca keeps a reputation to possess affordable school. Michael T. Nietzel, “And that Claims Feel the The very least And more than Expensive Social Universities?” Forbes, //which-states-have–the-least-and-the-most-expensive-public-colleges/. “> 8 But this doesn’t mean California is actually ahead regarding the other places, that report tend to mention. In lot of areas, the state measures up even worse than just extremely anybody else.

The fresh Bad news

If you are California are really-considered for its sensible public degree, the official is actually a far more precarious reputation than many other states together several trick aspects of the newest college student obligations drama: large mediocre obligations balance, the burden from financial obligation into nation’s Black colored family, the growth regarding risky scholar obligations, as well as the state’s dependence on moms and dad-kept obligations that’s so hard to have family to settle. Nowhere are these types of templates due to the fact pronounced because the as soon as we examine the brand new state’s to possess-money school market.

Profile dos

For the majority of borrowers, balances slide upwards just like the notice substances. However, another major push operating upwards California’s mediocre is large borrowing wide variety those types of taking out financing, with scholar obligations and mother or father personal debt are notable problems-products. İncele

Typically the most popular An effective way to Finance an effective Multifamily Property

Multifamily properties are a great choice for a house buyers. They have a tendency to-be lowest risk and have the potential to bring in a nice, predictable earnings. Yet not, whoever has never committed to one variety of functions just before might possibly be questioning just how they might qualify for investment. Anyway, speaking of higher qualities, and therefore can indicate that they are likely to be expensive. Try to has actually a better understanding of multifamily property resource.

People strengthening otherwise house who has got 2 or more equipment for the it could officially be an effective multifamily property. He’s on the same lot and property shares a familiar title. Properties that have between two and you can four systems will normally nonetheless meet the requirements home-based, while attributes which have four devices or even more are thought industrial.

Exactly why is it vital that you know that differences? As it could make a difference regarding financing the home. You will typically be choosing out-of conventional funds or authorities-backed funds. Conventional fund is shorter.

Whenever an investor is wanting on residential properties, he is almost certainly going to be wanting traditional mortgage loans that are like what might be used to have one-house. If you’re not likely to be living in the home and you will you are simply using they to possess a financial investment, old-fashioned loans become the only real solution around. İncele

FHA financing is insured by government, enabling loan providers to give more favorable terminology even although you reduce-than-finest borrowing otherwise minimal financing for a downpayment. Examining these federal options near to county and $1500 loan with poor credit in Houston you may local info deliver you an intensive knowledge of every avenues offered because the an effective first-time family client inside Oregon.

Using an enthusiastic FHA mortgage, you might safe financing for your brand new home having very little given that 3

Whenever you are a first-big date family visitors inside Portland, Oregon, there are several software and gives accessible to make your desire owning a home an actuality. İncele

If you think to purchase a home try many years out-of-reach once the a case of bankruptcy has jeopardized your opportunity out-of a home loan, reconsider. Based your variety of personal bankruptcy processing, your credit ratings, and your for the-day fee history adopting the bankruptcy proceeding, you can be eligible for property in as little as a few ages – even while you are in case of bankruptcy.

Occasionally, account which have been discharged because of the court may incorrectly tell you on your own credit history since “past-due” otherwise “inside the collection

When you’re a bankruptcy will continue to be on the credit file to have ten age after it’s released, it installment loans for bad credit online Utah can have likely reduced affect their possible credit needs after on few years. And you can, as the fewer People in america is actually filing for personal bankruptcy, banking institutions have less to consider for individuals dropping at the rear of in their home loan costs. In fact, once the a house downturn, bankruptcies has fallen gradually, out-of a highest of just one.5 mil in 2010, just to more than 770,000 for the 2016, with respect to the Western Bankruptcy Institute, a study group located in Alexandria, Virginia. İncele