We always procedure the pain sensation and you can guarantee of one’s country’s uprising to have racial justice in the course of an international health drama. You will see our current comments into uprising right here, all of our COVID-19 page right here, and you may our very own Race & Housing money cardiovascular system here. Expanding homeownership is actually a key component off racial collateral and you can health, therefore all of our mission is not more critical-and we’ll continue steadily to display the newest reports of Habitat’s really works.

If you are thinking about buying your first family, there is a lot to consider. Perhaps not the very least of those may be the economic concerns, which go method beyond the car or truck. Homeowner Development Director Pa Lor teaches you those dreaded in the our newest videos reacting common questions relating to homeownership.

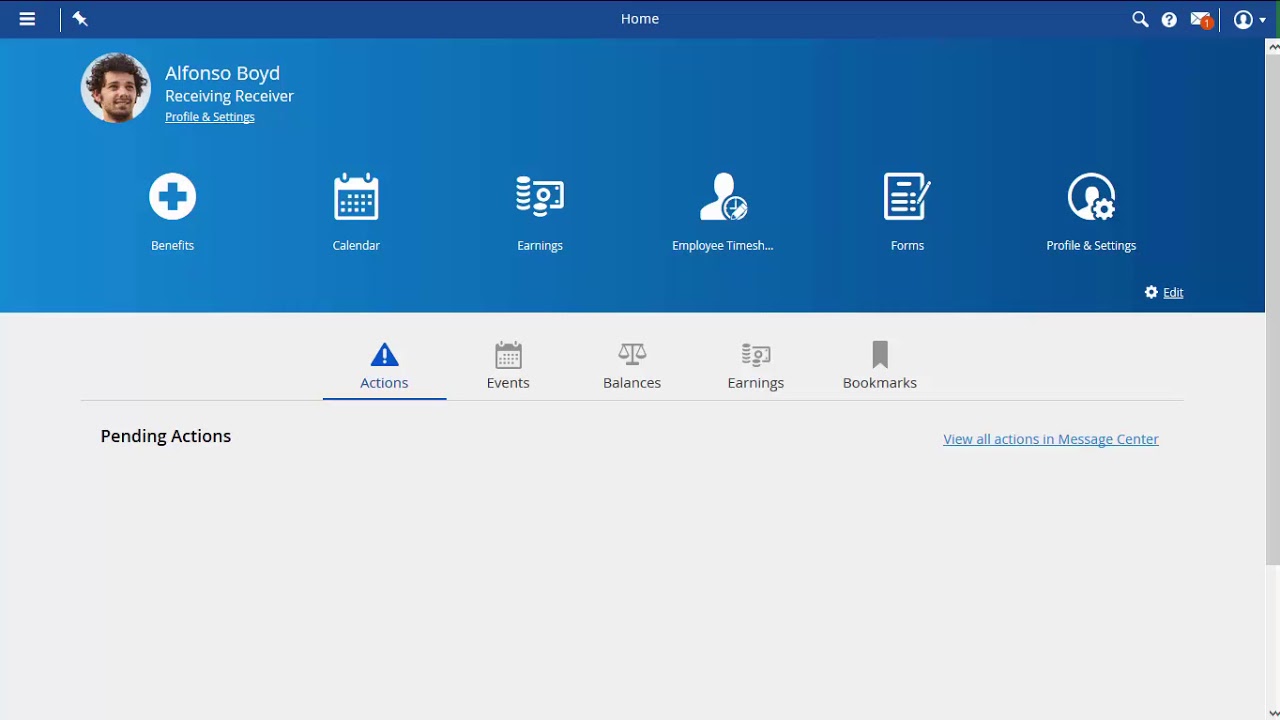

- Exactly how loan providers use your earnings to test the financial readiness [0:50]

- The importance of that have offers before you apply to own a home loan [1:15]

- Just how do the credit impression what you can do to get a mortgage? [1:53]

- What’s the debt proportion, and just how huge whether it’s? [2:26]

- Exactly what role really does your credit history enjoy in your home loan readiness? [3:46]

- Will you be mentally and you can mentally willing to buy property? [5:04]

“While you are buying a home, I believe the biggest thing should be to make sure that you might be contrasting and you can getting ready financially,” claims Pa. İncele

The mortgage proceeds was basically placed https://paydayloancolorado.net/moffat/ today on the my personal current borrowing union’s family savings, and that exchange was already downloaded truthfully.

Nevertheless the genuine loan are downloaded since the a great debit to my family savings, when in fact, my personal lender listing it as financing on their site and you will Perhaps not good debit back at my family savings.

Whenever i make an effort to Add Membership, discover my personal credit relationship, and search to your this new financing account, new search is ineffective. İncele

Forgivable: This mortgage provides a thirty-season name with an intention rate from 0% (0% APR). It financing doesn’t need a monthly payment into second mortgage. Forgiveness varies according to the fresh new DPA count:

- 5%: Forgivable shortly after thirty-six successive, on-date payments to the FHA first mortgage. Which forgiveness months resets in the event the borrower tends to make a late commission, nevertheless the borrower provides the complete 31-year name to meet up with this new forgiveness criteria. Which loan can certainly be forgiven at the end of the latest no checking account payday loans Cardiff AL 30-12 months term in case the past forgiveness condition hasn’t been fulfilled.

- 5%: Forgivable following the initial 120 successive, on-day repayments to your FHA first mortgage. İncele

- Infosheet – Residential Mortgage Underwriting Strategies and functions Rule (B-20)

- Execution note for the home loan insurance rates

We. Purpose and you can range of one’s rule

It Rule sets out OSFI’s expectations for prudent home-based mortgage underwriting, and is appropriate to federally-controlled financial institutions This consists of loan providers included, proceeded or controlled within the Financial Act, Faith and you may Collectors Work, Insurance vendors Act and the Cooperative Borrowing from the bank Relationships Operate. (FRFIs) which can be involved with domestic financial underwriting and/or perhaps the acquisition of home-based real estate loan property within the Canada. They complements associated provisions of your Alaska banks personal loans own Financial Act , Faith and you can Loan companies Act , the insurance Organizations Operate as well as the Collaborative Credit Connectivity Act , plus the Bodies regarding Canada’s financial insurance rates guarantee build, and this set the rules getting authorities-recognized insured mortgages. For the intended purpose of that it Tip, an insured home loan refers to an interest rate which is insured facing losings brought about by default on the part of a borrower, lower than a loan protected because of the real estate (i.age., one- so you’re able to five-product dwellings) or chattel, or for a home which is to your-reserve. Including each other personal exchange and you will portfolio insurance policies. It does not become separate insurance coverage products that often compliment home loan finance, for example: lifestyle, disability, issues, death of employment, identity, or assets valuation insurance policies. İncele

- Safety: The house is protect medical and you will shelter of the occupants.

- Security: Our home would be to cover the security of the home.

- Soundness: The house or property should not provides real deficiencies otherwise criteria affecting its structural stability.

So that as noted, an enthusiastic FHA financing try contingent up on the new assessment deciding the house match FHA Minimal Assets Requirements along with those people from minimum length conditions ranging from well and you can septic. Their unique backup condition are the following:

So it left their particular and no choice but to document fit against the lender and appraiser

- APPROVAL OF FINANCING: Approval for the financing described above will be deemed to have been obtained when Buyer Approval and you can Property Acceptance are obtained.

- PROPERTY APPROVAL: If Buyer’s lender determines that the Property does not satisfy lender’s underwriting requirements for the loan (including but not limited to appraisal, insurability, and financial called for solutions) Buyer, not later than 3 days before the Closing Date, may terminate this contract by giving Seller: (i) notice of termination; and (ii) a copy of a written statement from the lender setting forth the reason(s) for lender’s determination. If Buyer terminates under this paragraph, the earnest money will be refunded to Buyer. If Buyer does not terminate under this paragraph, Property Approval is deemed to have been obtained.

She called this new AMC exactly who shared with her the duty try this new appraiser and you will underwriter at bank

This new assessment came back conference value and family closed-in very early 2021. Three months afterwards, she first started experience plumbing system points and you will is informed besides performed the system need to be replaced, it needed to be brought to newest code. İncele

Those who open a merchant account can get access to significantly more than-markets rates and may even be eligible for specific Ohio state tax write-offs.

- Earn 7.25%APY* with the around $100,000 that have an ohio Homebuyer Together with Checking account.

- Doing $eight hundred matches**

- $800 credit to your closing costs***

- have to be a kansas citizen about 18 years of age

- should have a primary residence when you look at the Ohio

- just use the fresh account proceeds to your new advance payment, eligible expenditures, or closing costs of one’s purchase of an initial household in the Kansas

*Membership connected with the Ohio Homebuyer Along with must be used contained in this five years, look after at least harmony with a minimum of $100, and cannot meet or exceed an optimum equilibrium from $100,000. İncele

Together with other forms of investment, the financial institution commonly gauge the builder, opinion the funds and you will oversee the draw plan

A property-just mortgage has got the financing needed to finish the building from our home, although debtor is responsible for sometimes paying the financing inside the complete from the readiness (normally one year or quicker) or getting home financing to help you safe long lasting money.

The income because of these build loans is paid established the latest portion of your panels completed, and also the debtor is just accountable for notice costs towards money pulled.

Construction-simply money can also be eventually become costlier for a moment need an effective permanent mortgage since you complete two independent loan transactions and you can shell out two groups of charges. Closing costs often equal several thousand dollars, which helps you to avoid a different sort of put.

If you get rid of your job otherwise face additional hardship, you may not have the ability to qualify for a home loan after into the – and can even be unable to transfer to your brand new home.

In the event that a homeowner is wanting to blow lower than $20,000, they may envision getting a consumer loan or having fun with a credit cards to finance the newest reinski claims. Getting renovations doing from the $twenty five,000 or more, a property collateral mortgage or line of credit is appropriate, should your citizen has generated right up equity in their home. İncele