Antique financing

Traditional funds, also referred to as conforming fund, was mortgages you to adhere to the standards and you may assistance set by the bodies-paid companies for example Federal national mortgage association and Freddie Mac. He’s limited to an optimum loan amount away from $726,200 (or all the way to $1,089,three hundred in some large-prices towns and cities). Guild Mortgage even offers fifteen-year and you can 31-year repaired-rates antique finance with deposit choice regarding 5% to 20%.

Additionally, it offers antique variable-rates mortgage loans with repaired periods of 5, seven or 10 years. Guild’s antique mortgage products include HomeReady mortgages – which happen to be accessible to people and you will group having lower-to-moderate revenue – and up to 97% resource to have very first-big date homebuyers.

Jumbo financing

Jumbo loans is actually mortgage loans one to go beyond the loan restriction lay from the Federal national mortgage association and you may Freddie Mac computer. Guild Mortgage has the benefit of jumbo fund that will go up so you can $3 mil, according to condition limitations. This type of fund will be repaired-speed or varying-speed, and want a credit history out-of 700 and you will good credit records. Rates and you can yearly proportions will vary based on mortgage terminology and type of loan.

FHA finance

FHA fund is backed by the new Government Casing Management consequently they are designed to help home buyers with minimal revenue minimizing credit results. Guild Financial offers FHA money getting home orders and you can refinancing having down-payment possibilities as little as step 3.5% for these having qualifying credit scores (fico scores lower than 580 require 10% down). İncele

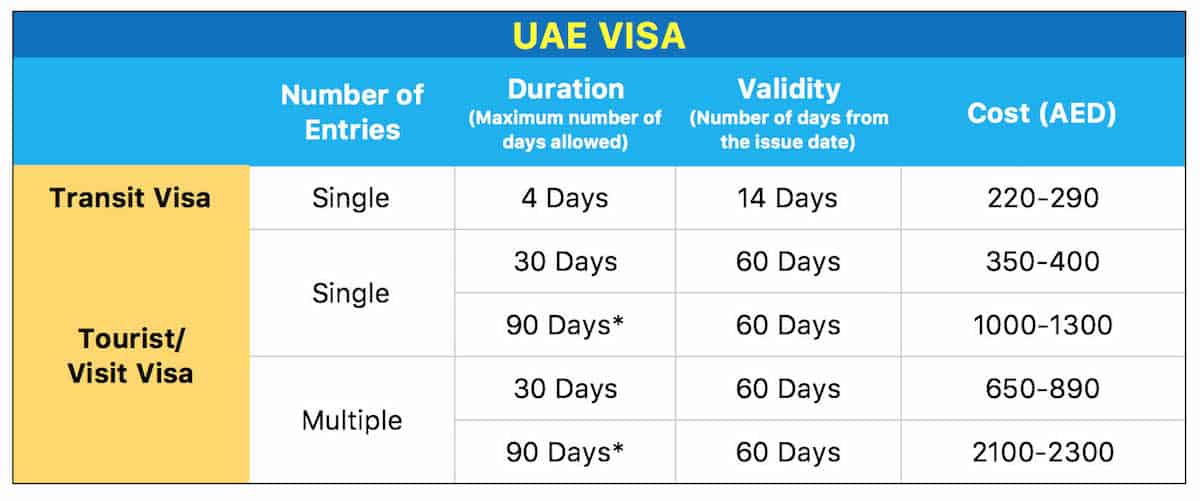

Looking sensible holiday accommodation is another essential aspect from cutting analysis overseas costs. Residing house halls towards campus, renting an exclusive apartment from university otherwise engaging in a great homestay try choices to explore.

Meticulously learning and you can interested in appropriate rentals for you will help you maintain reasonable construction can cost you and make certain a smooth remain abroad.

Exploring really works-data and you may internship ventures overseas

Work-study and you will internship opportunities abroad bring a unique path to help fund their training if you are wearing worthwhile experience and and come up with a change. This type of ventures not simply render financing, and increase industry candidates and personal development. It is very important see in case your visa or immigration reputation commonly enables you to performs lawfully while you’re on the chose nation. İncele

Credit unions tend to deal with alot more lawsuits from the bankers that simply don’t wanted race. It will eventually get real unsightly. I really look forward to it. We look ahead to the fight as we hold the large floor off helping representative/people who own limited mode because if they were millionaires.

I have been an extended-big date suggest of getting eliminate sphere of membership and you will serving folks of restricted means, not simply serving brand new affluent around the world. İncele

Mortgage prepayment function paying down your property financing partially otherwise completely till the end of the loan tenure. Home loan prepayment can help you save into notice can cost you and you may feel debt-totally free sooner. Have a tendency to, a lumpsum amount in the form of bonus, heredity, or provide can be used to pre-afford the debt obligations. However, prepaying mortgage brokers could well be useful just under particular affairs. If for example the mortgage rates of interest was highest, prepaying your house mortgage as fast as possible can be most useful to end higher-attention repayments. İncele

Managed connecting financing (to have properties) are usually 1 year, although not, specific non-managed bridging funds to have pick to help you lets and industrial attributes can be be up to three years.

Specific lenders be a little more flexible with the identity periods as opposed to others, and it may feel an instance-by-situation basis about if or not you’ll get recognition for a longer financing title.

Which matter would be covered by a bridging mortgage, so long as you has ways to re also afford the most borrowing total their lender.

Is bridging money secure?

Yes, bridging financing are sensed safe offered they are used to own suitable property purchases. Speaking to a connecting financing agent is advised when you are not knowing concerning the risks and suitability off a bridging financing for the disease.

Generally, an element of the chance of a connecting mortgage is that if your you should never pay off the borrowed funds, your residence is going to be repossessed and offered to clear your debt.

Such as for instance, by firmly taking aside a connecting loan to buy another assets but your present possessions fails to offer therefore don’t recover money, this may feel a threat. İncele

Refinancing a real estate loan is going to be a huge choice for many people. Your role and requirements change over date so why must not the financial? Now might be the right time about how to re-finance with the a lowered rates home loan. You ought to take time to consider the following the questions to find out if refinancing makes sense for you.

Refinance Funds

- Could you be sick of the varying-price one to never appears to avoid modifying?

- Is actually Private Financial Insurance (PMI) taking you off when it does not need to?

- Comes with the time come to save yourself additional money every month?

- Is actually home loan rates currently lower than what your price is actually? İncele

Mortgage brokers and you may finance companies today would like to give mortgage money to those users probably and make its month-to-month mortgage repayments timely. Remember, banks and you can loan providers don’t want to go into the home-selling organization. They should sell the foreclosed house, hence takes enough time and cash.

Whenever a debtor defaults on their financing and you can seems to lose their property to help you property foreclosure, that’s exactly the disease you to loan providers face

It ought to be nothing surprise, following, to learn that loan providers today bring a lengthy look at the economic strengths and weaknesses from possible borrowers prior to approving them to own mortgage loans.

Whether your credit score was low — say, 640 otherwise lower towards the popular FICO credit-rating program — you do not qualify for an interest rate off conventional https://paydayloansconnecticut.com/collinsville/ lenders. Should you, surely you will have to pay higher rates of interest.

That is because consumers with reduced credit scores possess a past regarding missing car loan, mastercard or education loan money. They might supply a case of bankruptcy otherwise property foreclosure in their earlier. Rather, maybe he could be stuck with high credit debt. All of these missteps commonly all the way down a credit history. Loan providers are careful of lending money so you’re able to individuals which have histories regarding overlooked payments.

If the credit score is very good, and thus a score regarding 740 or more into FICO scale, it is possible to drastically improve your capacity to qualify for a knowledgeable financial together with low rate of interest. İncele