The fresh new development for financial rate cuts is on its way so you’re able to an end and you may one another brokers and you may clients is to prepare for hikes this year, based on industry experts.

Meanwhile, lending beasts as well as HSBC, Across the country Strengthening Society and you can Yorkshire Building Neighborhood have taken the new axe so you can prices and launched finest-buy contenders into the latest weeks, mainly driven by strong battle. 78 percent with an excellent ?995 commission, to have borrowers with at the least a great 40 % deposit otherwise security.

Ft price Toward base-rates side, even though last trip there can be talk away from subsequent slices to your historic-low rate of 0.twenty five percent payday loans Central City area, actually thoughts features given that swung others ways, that have sentiment today indicating another alter might possibly be upwards. Based on who you faith, not, this might takes place when ranging from now and 2019. İncele

The new signal recommended to increase the web based well worth requirements for both Name We and you can Title II mortgage correspondents. Particularly, HUD advised so you can amend 202.8 to boost minimal web well worth requirement for Identity II financing correspondent mortgagees and Term I financing correspondent loan providers out-of $50,000 to $75,000. İncele

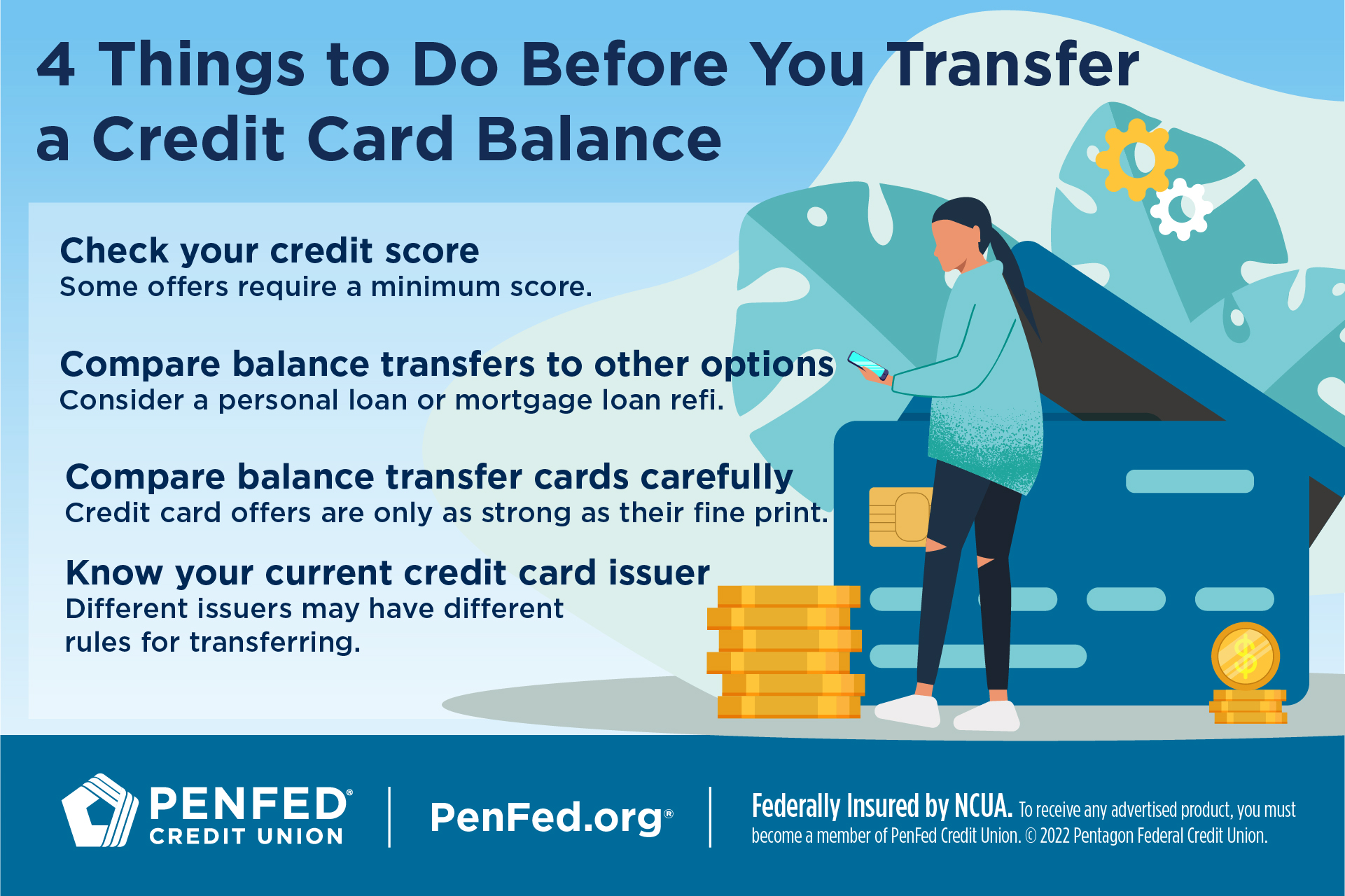

Refinancing a mortgage is a giant choice for the majority of residents. Your role and needs change-over big date so just why ought not to your mortgage? Now may be the correct time on how best to re-finance on the a reduced rates financial. You will want to make sure to take into account the after the concerns in order to see if refinancing is sensible for you.

- Are you currently fed up with the varying-rates you to never appears to avoid modifying?

- Was Private Mortgage Insurance rates (PMI) delivering your down if this doesn’t need to?

- Has the big date arrive at cut more money per month?

- Is actually home loan pricing currently less than what your price are?

- Usually almost every other economic options promote themselves because you refinance?

Refinancing is a simple treatment for https://elitecashadvance.com/personal-loans-nc/jacksonville/ resolve many of your own financial fears. From the Continental Mortgage Inc. we’re ready to find the right refinancing services to you. The employees off re-finance positives will allow you to check the financial need and you can draft a great refinancing plan that can save some costs.

Make sure you here are some the home loan re-finance center locate all the info you desire to create a sound ily.

These things aren’t away from HUD or FHA and you can were not passed by HUD otherwise a national institution and in some cases a refinance loan might result in large funds charge along the lifetime of the borrowed funds.

Common Refinance Issues

Deciding if property refinance mortgage excellent will likely be complicated. That’s why we now have put together a listing of popular concerns one to residents features when considering refinancing.

So what does refinancing prices? Generally speaking, new closure cost of good refinance was anywhere between 1% & 2% of the amount borrowed, financial charge included. İncele

It is additionally vital to remember that while taxation loans like those available in Louisiana are advantageous, potential buyers ought not to entirely have confidence in like incentives. Since showcased by community benefits, understanding the complete spectrum of homeownership can cost you, such as for example possessions taxes, and you may keeping monetary punishment by avoiding the fresh new fund otherwise lines of credit within the household buying procedure, remains very important. Entertaining which have a region user to have strategies for possessions taxation tests and you will pricing can be a proactive part of planning brand new monetary duties home owners deal with.

Once we celebrate this new role regarding real estate agents together with versatility away from houses in the usa, its obvious one homeownership is more than just a good investment. They lays the fresh foundation private victory and you may causes the cloth in our organizations. That have correct search, due diligence, additionally the proper service expertise positioned, first-date home buyers normally browse the path in order to homeownership with depend on and less economic filter systems.

Area and you may Parish-Certain Offers

Navigating the current housing market just like the a primary-big date domestic visitors from inside the Louisiana can be quite difficult. İncele

Traditional Mortgages

Though some anybody utilize the terms and conditions traditional mortgages and you will compliant mortgages interchangeably, they are certainly not a comparable, whilst eligibility standards is actually mostly equivalent.

Just what sets a conforming financial besides one that is not try that former should comply with conditions and terms one qualify set by the Federal national mortgage association/Freddie Mac, generally when it comes to the most financing amounts. İncele

Purchasing property is a big economic milestone for individuals and you will household within the Asia. Most people trust Home loans so you can complete so it fantasy. Although not, delivering a mortgage pertains to settling both the dominating amount borrowed as well as the notice billed because of the lender. Making this process transparent and organized, lenders give individuals having a file known as the Mortgage Amortisation Plan.’ Let’s speak about what a home loan Amortisation Plan was, how it functions and just why it is important to have individuals.

EMI number

For each and every line of the schedule screens the latest EMI amount you must pay money for that one week online personal loans OH. The fresh new EMI is sold with the prominent and you will appeal section. İncele

Locating the best South carolina lending company for the brand new home loan shall be a tense task. At the BrickWood Home loan we would all of our far better take the be concerned from your own home to find feel giving personalized provider tailored on the private a home loan requires. The next step is finding the best home loan prices , otherwise refinancing costs to you personally.

Whether you are a-south Carolina very first time domestic consumer, refinancing your home, a seasoned selecting a great Va mortgage , if not an investment household client, we will find the best you’ll be able to price for your home financial. We have a long history of success as they are you to definitely of the greatest mortgage brokers near Myrtle Beach, Sector Commons, Carolina Forest, DeBordieu, Charleston, Mount Pleasant and you will past, we serve every one of Sc.

– Let us make the be concerned from your own home financial feel. –

The audience is new largest mortgage broker from inside the South carolina, our team regarding home loan experts will be ready to safer property pick loan that uses the current higher financial rates of interest and also make your perfect household reasonable. Phone call today and you will secure higher terms and conditions with newest interest rates inside South carolina, and take benefit of the totally free simple and fast mortgage products to determine everything you be eligible for.