How the funds from a home equity loan are utilized can indirectly impact the interest rate. Lenders might offer more favorable rates if the funds are used for home-related investments, such as renovations or repairs, as these investments can potentially increase the property’s value. Conversely, using the funds for non-appreciating assets otherwise high-chance ventures might result in higher interest rates.

Many individuals take too lightly the efficacy of settlement. Lenders usually compete to have consumers, and you may individuals cannot hesitate to discuss the fresh terms and conditions, for instance the interest rate, costs, and cost terms. Becoming better-informed throughout the prevalent market cost and having a strong credit rating can be bolster the borrower’s position throughout negotiations, probably ultimately causing a much better price.

A lender that is receptive and you can supportive in the mortgage processes helps make a positive change on your full experience

Economic markets try complex and you can previously-switching. It is crucial for borrowers to stay told on the sector fashion and you may continuously assess the loan options. Looking to guidance regarding financial experts or home loan pros offer beneficial information designed in order to personal issues.

Managing home equity loan rates demands a proactive approach and a deep understanding of the factors influencing interest-sensitive liabilities. By employing these strategies and staying vigilant in the active financial landscaping, borrowers can optimize their home equity loans, ensuring favorable rates and a secure financial future.

In terms of selecting the most appropriate financial for the assessment-100 % free home guarantee loan, it is vital to take time to assess your needs and you may check out the possibilities. İncele

Home security finance allows you to borrow money against the guarantee you have produced in your property. You can make use of domestic security to help you upgrade otherwise resolve your property, combine obligations, security scientific costs or purchase college. If you’d like most information, property collateral financing can give you access to required dollars. If you have bad credit, securing a house equity credit line which have positive words is be more tricky.

- Exactly what are Domestic Guarantee Fund?

- Would you Get property Security Mortgage with Poor credit?

- Ideas on how to Be eligible for a property Collateral Mortgage with Bad credit

- Select All of the 21 Factors

What exactly are Domestic Equity Finance?

A home collateral financing allows consumers to utilize the new equity during the their house while the security. The worth of the house establishes the loan matter getting a beneficial home collateral financing. A keen appraiser on the loan company should determine the newest property’s most recent market value. İncele

When you think about to find a home, you believe from a house about suburbs to call your grassy yard, picket fence, quaintly shingled roof having a cozy absolutely nothing chimney poking away. While you are which is yes a pleasant solution, it’s not the only person, and there is many different types of property you might individual. You to definitely option for homeownership, especially if you inhabit a massive area, are co-op casing.

Co-op houses, explained

Co-op homes, brief having collaborative houses, is different from some of the more traditional homeownership options. Co-op houses happens when clients or co-op players sign up getting a whole strengthening or possessions, revealing duty to have servicing. (Find out how individuals are cooperating?)

No matter if co-ops have a tendency to appear in multiple-product houses, this new co-op model is different from purchasing a flat or household since you may be maybe not to purchase a certain equipment you might be buying shares within the a low-funds agency one to has the building. And you can rather than hold a concept, because you create various other homebuying points, you own inventory as an alternative. It mutual possession and you can responsibility create running an effective co-op a different option. If you are co-ops commonly limited by certain specific areas, he’s significantly more common inside the large towns and cities such Brand new York Urban area or Chicago. İncele

By early 2008, credit came into existence scarce for everyone nevertheless top dangers, and you will slowing financial craft possess boosted the threat of enhanced unemployment and depressed profits

With many individuals to invest in their houses with little if any down fee and achieving little or no collateral within their land, this new lowering of rates provides remaining of a lot carrying possessions which might be well worth lower than what they are obligated to pay to them. Merrill Lynch prices that up to 9 mil houses can get provides “upside-down” mortgages where in fact the debt exceeds the worth of our home in addition to guarantee is negative.

That have next speed erosion almost certainly, this case only get worse. For that reason, of a lot individuals/customers try choosing the wiser movement should be to relinquish their house and you will debt burden and you will relocate to a less expensive rental. Since home values decline, this might spur more defaults, such among consumers whose mortgages are about in order to reset to help you increased fee. İncele

To help you demystify the idea, closing costs include various charges and you can expenditures incurred past the brand new property’s purchase price. These types of costs are a great culmination of numerous qualities and operations in it into the moving possession from the vendor into the visitors. Often, such charges are shared within client and you can seller, whilst the information is negotiated when you look at the a residential property deal. İncele

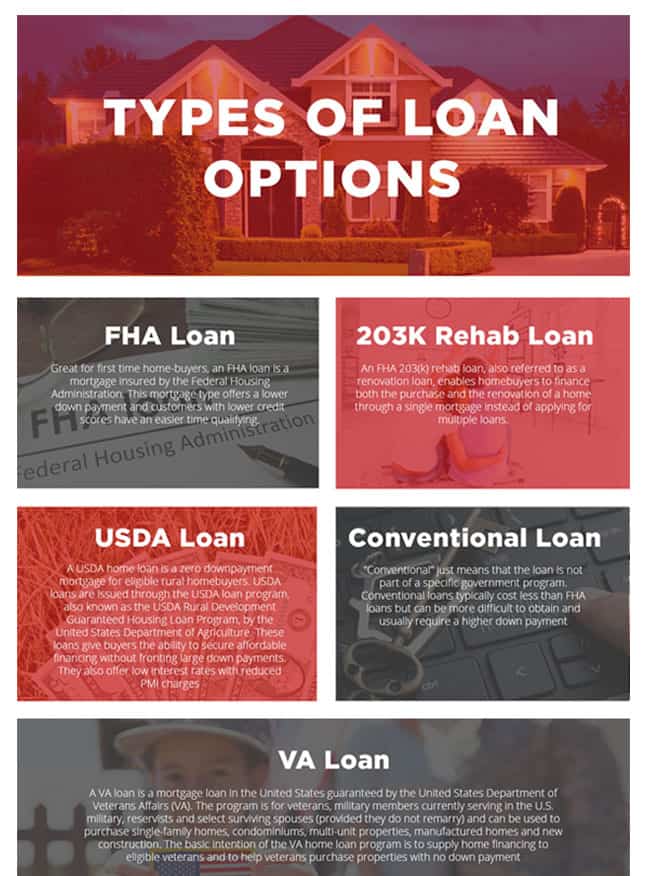

New Federal Housing Government also offers mortgage brokers that give buyers having reduce fee standards and more flexible financing standards than many conventional finance and other types of government loans. Because of this, FHA mortgages try a great option for of several home buyers and additionally home buyers shopping for to order fixer uppers.

But what while you are selecting to find a switched home you to definitely has already become fixed up by several other proprietor? Imagine if you might be wishing to use your FHA financing to invest in a home who has just been turned? İncele