Tackling homelessness more info here inside European countries: an even more ‘radical’ approach

Inside bout of Real Economy, Euronews Journalist Paul Hackett finds out just how providing the homeless having casing since a kick off point unlike an-end mission, is changing existence and you will fast to-be a lengthy-term services.

Predicated on federal studies, homelessness for the The country of spain has grown because of the 25 percent along the last several years. For example statistics has actually pressed government and you can NGOs to generate an option opportinity for dealing with homelessness.

The answer suggested are surprisingly effortless: render everybody living in the pub a property. First created in the us, the newest step called Homes First, has been then followed even more during the Europe.

Instead of conventional steps, it doesn’t wanted people to fulfill certain conditions in advance of searching housing advice. The theory is that abandoned people have a higher chance of performing a brighter coming for themselves if they earliest possess an excellent roof more the heads.

- Time and energy to get a property? It might costs double the speed

- Uk auctions anticipate respite to own housing market

Carlos Martinez Carrasco lived rough for many years prior to a housing Basic effort provided your with a condo to your borders of Madrid. İncele

Freddie Mac computer/Government Mortgage Mortgage Company (FHLMC) An excellent credited company that sales conventional mortgages regarding insured depository associations and you may HUD-accepted mortgage bankers.

100 % free and you will Obvious This can be a term useful a home that will not have liens otherwise bills submitted towards name. Meaning the particular owner does not have a mortgage.

Provide Letter A file that is required by the a loan provider when the a debtor receives a down payment otherwise one part of a deposit away from an individual due to the fact a present.

Ginnie Mae Also known as Government Federal Mortgage Organization. It includes types of financing getting residential mortgages which might be covered or guaranteed from the FHA or Virtual assistant. İncele

From the 24 months because start of the pandemic, people are finding themselves regarding a career. More 114 billion members of the usa come lookin for another means to fix make ends meet.

People needed to see ways to continue the team afloat, commonly having alternative staffing. Which brought about a major extension from separate contracting positions; many people started her organization otherwise considered freelancing.

As well as changes throughout the housing market, the newest pandemic cost savings plus switched of several man’s preparations to have getting a beneficial resident. While an independent contractor as they are thinking of buying a beneficial domestic or be a landlord from inside the Houston, Texas, some tips about what you have to know. İncele

By the Sarah Jacobs, Esq.

If you have ever ordered property just before, you are sure that it can be a demanding processes. Has the benefit of, counteroffers, contingencies, appraisal, even more counteroffers-its a number of functions. And that’s if you find yourself dealing with somebody who wants to offer you their property.

Whenever soon-to-be exes are navigating a split up when you are seeking to determine whether you to definitely usually buy their family house regarding almost every other and on exactly what words, it can be difficult.

Often, the home is actually interwoven toward towel away from exactly how we come across ourselves or our family, especially if we are element of a close-knit area, provides accomplished custom models otherwise renovations, or increased people home. Its a difficult processes and really should feel addressed strategically which have a clear feeling of your aims and needs. İncele

There are many secret differences when considering Credit scores and you may VantageScores. A person is one Fico scores envision tax liens and public record information, when you find yourself VantageScores don’t. On the other hand, the newest scoring patterns play with some other weighting expertise towards individuals borrowing from the bank things. Instance, fee record is really worth 41% on VantageScore step 3.0, when you’re FICO try thirty-five%. The age of your own borrowing reputation try 21% which have VantageScore step three.0, when you are FICO was fifteen%. To see how some products make a difference to your own rating way more in one single model compared to a separate.

A unique huge difference is the fact there are several systems of every rating design. FICO® account that they have sixteen distinctive line of brands of your FICO® Get active, when you find yourself VantageScore keeps four (step one.0, 2.0, step three.0, and 4.0). İncele

Must i Hold the Family throughout the Breakup?

Choosing whether to stand, promote or get-off the fresh marital home to your spouse inside a good divorce or separation are an elaborate decision

Divorce case stones your own very basis – virtually and you will figuratively. While licking dated and you can fresh mental injuries, you may well be going to terminology to the facts the house you increased your family members inside, was available about divorce. Whether or not to secure the home is a sensitive choice and you will understandably very, of the many property so you’re able to good couple’s name, the new relationship household always retains the quintessential financial and you can emotional well worth. The good news is, of all problem during my divorce or separation, it was none of them. Which have recently transferred to an alternative area and you may new home, I got absolutely no ties, emotional otherwise to your house. In reality, your local and you may encompassing community got never slightly decided house for me, so when a single lady I understood I would not safe truth be told there. When my ex lover-partner managed to get clear the guy desired to ensure that it stays, We happily required.

For some someone around, particularly the stay-at-domestic father or mother who has invested the most time in brand new marital household, it doesn’t usually wade this way. In reality, determining how to proceed towards the relationship domestic throughout a divorce case is really so challenging a large number of real estate professionals get official due to the fact either separation and divorce experts or formal divorce a home masters . That is right, it can be brand new strong niche inside a home. Whenever i view it, discover three biggest regions of said when determining what things to perform along with your domestic while in the a breakup. İncele

When you find yourself a citizen around australia wanting a way to availableness dollars, a home collateral financing may be the service you would like. A property collateral mortgage allows you to borrow against the equity on your own assets, providing you with this new monetary liberty you really need to achieve your requires.

Having a house collateral financing, you could tend to borrow doing 80% of your own value of your house, that have flexible repayment terminology between step one to thirty years. The lenders will help safe a collateral loan having desire costs which might be highly competitive, it is therefore an inexpensive choice for homeowners who wish to open the value of their house.

Whether you’re looking to upgrade your home, consolidate personal debt, otherwise generate a large pick, a home security loan helps you reach your needs. And since its a secured mortgage, you ounts at a lower life expectancy interest than simply an unsecured individual financing.

All of our software process is fast and easy, and you can all of us away from experienced lenders was right here to aid you thanks to every step of your ways. So, if you find yourself a homeowner trying to find an adaptable, sensible means to fix availableness cash, get a home equity mortgage with our team today and take step one with the gaining debt wants.

How can i make collateral in my home?

There are some a way to enhance your residence’s collateral and therefore you can expect to improve value of an equity financial. Here are some ways to do so:

- Improve Costs For individuals who increase the volume from payments on your own mortgage every month, this can add more security additionally the pace in the which you gather security. Because you continue steadily to pay down the loan, your increase your security.

- Spend So much more In place of raising the volume of the repayments, you could potentially just pay so much more every time you generate an installment. İncele

From inside the a house, understanding the some capital possibilities is also somewhat impact the to get and selling techniques. One solution, commonly skipped however, very beneficial in particular activities, is the assumable financial. In this article, we will see what an assumable financial was, how it works, its gurus and you may limitations, and in the event it could be the right choice for you.

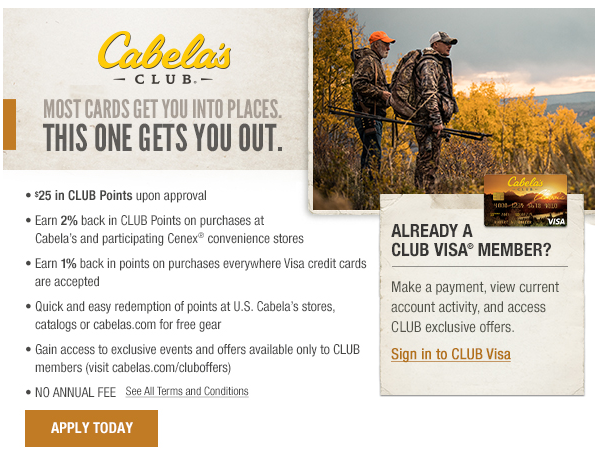

Have the Virtue with this loyalty system

An enthusiastic assumable financial is a kind of financial that enables the customer when planning on taking over the seller’s present mortgage, and additionally their rate of interest, installment several months, and you can words. That it transfer away from financial duty would be a strategic move around in a changing interest rate ecosystem. In lieu of old-fashioned mortgages, where in actuality the visitors need secure a different loan, assumable mortgages offer significant advantages, especially if interest levels have increased since totally new mortgage try applied for.

Why does a keen Assumable Home loan Performs?

- First Agreement. The consumer and supplier concur that the buyer have a tendency to imagine the brand new existing mortgage.

- Lender Approval. The loan lender need certainly to approve the mortgage assumption, making certain that the customer meets their credit and you will financial criteria. İncele

You could need take into account private home loan insurance coverage (PMI). Home owners would need to pay PMI when they never create during the minimum a beneficial 20% down payment on the house. With all of these types of possible costs, it is useful to explore our Ohio home loan calculator. The product will assist fall apart your own will set you back so you can see what your own monthly home loan repayments can look like in some other circumstances. İncele