After completing the application, the underwriter often pull the borrowing and evaluate their records. They will determine if your credit rating, earnings, possessions, and you will most recent bills meet with the financing system standards.

For those who meet the lender’s conditions, the lender have a tendency to pre-accept your, but with criteria. The newest underwriter cannot completely approve the borrowed funds until you has an enthusiastic conducted transformation offer towards the assets. On top of that, a specialist appraisal and you can name look must be done to confirm the house deserves sufficient money and therefore owner can also be lawfully import it.

This new pre-acceptance page you obtain would be best for 60 ninety days. During this time, you can look to own a property and obvious people conditions the fresh underwriter put on the approval. After you select property plus the provider welcomes the deal, you must deliver the underwriter on the executed transformation bargain.

If not come across property contained in this big date, you could inquire about new pre-approval as longer. To do so, you should deliver the bank having current records to prove you can invariably afford the financing.

5. Close the borrowed funds

Immediately following clearing their requirements, this new underwriter normally obvious your loan to shut. This means you head to the brand new closure table the place you change funds from Simmons Financial or a combination of mortgage money and you can money you might be adding.

You can easily signal papers saying your agree to undertake the mortgage obligation and you can hope the house while the equity should you not build your instalments.

Answer but a few questions regarding your career, where you are to get, as well as how much we wish to obtain. Our provider will likely then direct you the specific apps you are qualified having regarding vetted physician mortgage experts that will direct you as a consequence of each step of the techniques obligation-totally free! İncele

To possess pulls to your a home collateral line off Truist removed not as much as the brand new changeable rates cost choice, the minimum payment is equal to step one.5% of full an excellent equilibrium. Interest-just payment: Having draws drawn in notice-just payment solution, their. Although you is earn demand for the account, the fresh rates cannot be easily located online during the Bankrate’s feedback. Truist That Money Industry Membership Brand new Truist That Money Even in the event Truist also provides many different finance and you can mortgages, their main domestic equity device is the new HELOC, enabling one to borrow against your own residence’s security to finance house home improvements or.

5.975% Rate of interest 5.9956% Annual percentage rate 29-Year FHA 5.75% Interest six.8235% Apr 31-12 months Virtual assistant 5.75% Rate of interest six.029% Headquartered inside Charlotte, North carolina, Truist Bank was molded inside 2019 immediately following SunTrust and BB&T finance companies blended. Truist Lender also provides a number of home loan points, along with refinancing and. İncele

The insurance coverage are pulled getting a sum no less than the degree of get better facing ruin because of the flame, ton and super possesses to get proceeded before financing is fully paid down

Inside the a primary raise getting authorities professionals, this new financing minister Nirmala Sitharaman to the , launched that interest into household-strengthening get better for all bodies employees, is reduced and you can connected with 10-12 months G-Sec production.

A national Security (G-Sec) was a beneficial tradeable tool awarded by main and/or state regulators. They recognizes the government’s obligations responsibility. İncele

Ivana Pino are a personal financing pro who is excited about undertaking comprehensive financial stuff one is located at a variety of customers out of a myriad of backgrounds. She graduated in the S.We. Newhouse University from Personal Correspondence on Syracuse College or university which have a qualification inside the Digital News media.

Trina Paul covers all of the victims linked to private fund, regarding bank put products and handmade cards, so you can using. Their particular bylines are also available during the CNBC Look for together with Skimm. She finished from Swarthmore College or university having a diploma in economics.

Glen Luke Flanagan is actually a deputy editor on Fortune Recommends whom centers on mortgage and mastercard content. His earlier spots is deputy editor ranking during the Usa Now Blueprint and you will Forbes Mentor, and additionally elder creator from the LendingTree-all of loans Keystone the concerned about mastercard perks, credit ratings, and relevant subject areas.

Congrats! You signed the fresh documentation, acquired the newest tips, and you may walked from the door; today, one quaint absolutely nothing place was in the end your. If you find yourself an initial-date homebuyer, you’re probably wondering: so what does they prices so you’re able to give a property? Less than, i explain the average pricing so you’re able to give a house and gives tips to help you save money towards the seats, regardless of the living area.

Query suitable questions

Before choosing a furniture piece for all the space into the a new domestic, it’s helpful to score several answers upright in your head, including:

- How important so is this place on my daily life?

- Am i going to add so it section to help you a preexisting room, or can i start fresh?

- Simply how much stores will i need?

- What type of room is it?

If you find yourself to shop for chairs to have a gap that you will fork out a lot of time in, such as for example a master suite, you may choose to buy way more fancy otherwise safe chairs situations; if it’s a guest bed room otherwise an incomplete cellar, it is possible to pick furniture activities getting utility, eg a great sleeper settee.

Lay a sensible finances

The answer to teaching themselves to reduce chairs? Knowing how to prioritize the most important parts very first. If you do not features many additional money resting doing, you probably will not to able so you’re able to furnish your entire space most of the at the same time. You will have to select and then have perseverance although you save towards people. One way to do this would be to lay a deadline to meet your own discounts mission. To reach your goal easily, figure out how far make an effort to conserve a week to meet up with they; if you can’t rescue sufficient a week, believe reducing towards the other expenses. İncele

Generally speaking, tax incentives, regional incentives, and finance are made to possess personal property owners, since the majority out of has try to possess low-money and you will the federal government.

25% county treatment tax credit having rehabilitating historical, income-producing functions inside River Boundary Redevelopment Zones (just Aurora, Eastern St. Louis, Elgin, Peoria, and Rockford). Click for additional info on the other newest River Edge Historical Tax Borrowing from the bank.

25% state treatment tax borrowing to have rehabilitating historic, income-generating attributes. Eligible expenditures should be sustained between . Just click here getting information on this new Illinois Historic Preservation Tax Borrowing from the bank.

Put out for the , the brand new statement The latest Impact from Historical Tax Borrowing from the bank Money in Illinois found that the two county income tax-borrowing apps (Illinois Historic Maintenance Income tax Borrowing and the River Border Historical Taxation Credit) try powerful economic-development and you can work-increases tools having Illinois on the local and condition accounts. İncele

I am in pursuing the debts: 70 lacs financial (a good 69 lacs) 55 lacs personal loan (a fantastic fifty lacs) Cards a great ten lacs Salary four weeks 189000 Zero discounts. The way to get from personal debt pitfall.

Debt consolidation: Thought combining yours financing and you will personal credit card debt towards the one to lower-interest mortgage to minimize the fresh new monthly load.

Ans: Dealing with a serious personal debt shall be difficult, however with a structured package, you can go back on track. Is a brief publication:

Determine Your debt: Identify all expenses, their interest costs, and monthly payments. Prioritize highest-attention debts. Budgeting: Do a tight monthly budget to trace money and costs. İncele

What is their own undertake the brand new USDA programs in danger throughout the federal funds? I am not saying gonna dive out of the windows as of this time, Billie claims. We understand we’re going to need to really works quite difficult having our very own congressional agencies to make it clear why these apps was critical for rural section. …It is simply unfortunate-we end paying enough time payday loans Owens Cross Roads and you will information starting one to.

You will find identified Mario Villanueva to own next to 40 years; their happens to be a sound to your underserved and you may underrepresented those who inhabit our rural communities. The guy grew up towards a ranch possesses done rural demands off nearly all position: once the an exclusive builder, because manager regarding a beneficial nonprofit inside Mabton you to renovated housing to have the indegent, as the a developer during the ORFH, plus in best construction administration into Diocese away from Yakima Property Characteristics. He could be and additionally presented with united states because the an administrator. Lately, Mario was Washington State’s Manager of USDA RD from 2009 so you’re able to .

It does not need far observe the desire … A small urban area such as Mattawa, such as for instance, regarding the farmworker houses around one to I was involved in-he’s got 2 hundred anybody towards prepared list for this casing. İncele

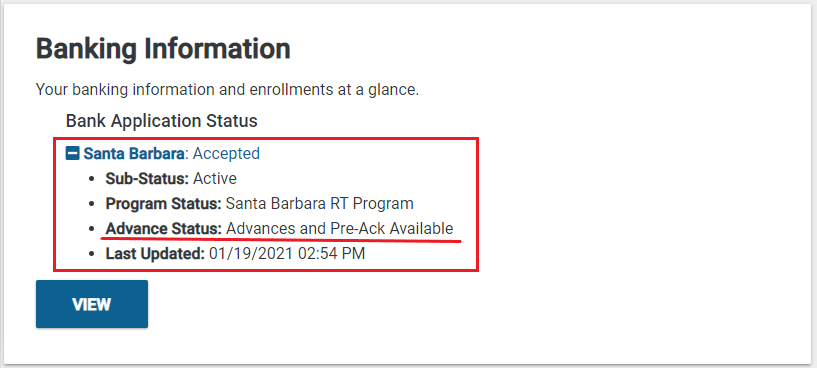

Furthermore, unlike various other Area seven(a) loans where in fact the SBA claims around 85% of whole financing, good PPP loan was guaranteed from the SBA with the intention that a good PPP bank keeps no body in the online game. Basically, a great PPP financing try funded of the financial into the knowledge your SBA will refund one portion of the financing that is forgiven and you may one remaining the financing harmony your borrower does not shell out, in instances which have accrued notice thereon. Properly, the new SBA is the real cluster in need for an excellent PPP mortgage, also it would appear to follow the choice whether or not to speed the borrowed funds through to a standard-including during the Secured Months and you can afterwards through to the forgiveness number has been financed by the SBA-are produced by brand new SBA.

Extremely loan providers originated PPP financing in accordance with the assumption that since the much time because it fairly followed SBA pointers on the origination and you may running of financing forgiveness application, brand new SBA will make the lender whole. Sadly, in place of SBA guidance, a loan provider can’t be certain regarding if the SBA will second-guess its behavior and you can strategies manufactured in exposure to the fresh new thickness out of a default.

Absent further SBA pointers, eg as the, in place of other Section seven(a) finance, a PPP mortgage isnt safeguarded because of the people security or even the guarantee of one’s people who own a debtor, it might hunt sensible abreast of this new occurrence from a default you to an excellent PPP lender is to (a) punctually notify this new borrower of your own standard although not speed the newest financing until the SBA possess funded any an excellent financing forgiveness application, (b) on time notify this new SBA of one’s standard, and you may (c) put the borrowed funds for the SBA around its 100% verify, therefore, the bank should be removed from the mortgage. İncele

Within just per year from the system, News Corp. profile solid uptake away from professionals contemplating paying funds when you find yourself continued to store having old-age.

Total, advancing years bundle participants who are subscribed to a Fidelity education loan obligations work for was indeed estimated to boost the old age stability to $389,371 away from $195,248, and you can twice as much share out-of old-age costs they are able to shelter to help you 15

Plan recruit Development Corp. extra an educatonal loan obligations matching program to its 401(k) offers plan once the organization acknowledged education loan personal debt try a extreme burden to many of its You.S. experts preserving having old age, explains Marco Diaz, in the world lead regarding benefits at the Reports Corp. İncele

Immediately after going through the desires and requires with your Real estate professional which will shelter many techniques from area, sort of home, size, room and you will restroom count, age of house and you will condition to mention a few they have to provide a summary of property that may fulfill some if not completely of your criteria. Choosing what is truly extremely important is key, since most readily useful house is not always just the right domestic, very knowing ahead just what goods are negotiable is right to consider.

Throughout your research absorb the important points, if you see something that looks out of the ordinary or wanted details, cam upwards. See a property throughout differing times off time, not as much as other climatic conditions, to truly see what it is you get. There are not any efficiency regarding to get a house.

six. The deal

Once you’ve calculated which home best suits your needs, your Realtor will help you make a reasonable bring. Remember field trend will establish the method that you want to make offering, which means if you are in a position to, get-off space to own discussion or perhaps in moments such as for instance now where you essentially get one possibility to help make your highest and best render.

From the provide you with will establish an ending go out, backup times definitely what to score completed (such as for instance a home inspection, money and you will appraisal) and just how far serious cash is establish, which is generally a good-faith deposit. For those who have a home to offer before you buy a separate one to, you to also would be a part of this give.

eight. Rating a home Inspection

A keen inspector who’s regularly both previous and present strengthening rules look to possess troubles on foundation into rooftop and everything in anywhere between. İncele