Effective mortgage collection administration: financing upkeep and you will management groups enjoy a vital role into the handling the fresh lender’s mortgage collection

For example, imagine a borrower who needs a loan urgently to fund a business expansion. The loan servicing team efficiently collects and reviews all the necessary documents, expediting the financing approval procedure. As a result, the borrower receives the funds on time, allowing them to seize the growth opportunity.

Within this part, we shall delve into the primary duties out-of financing maintenance and you will government organizations, losing white into the certain opportunities it deal with to help with this new credit techniques

2. İncele

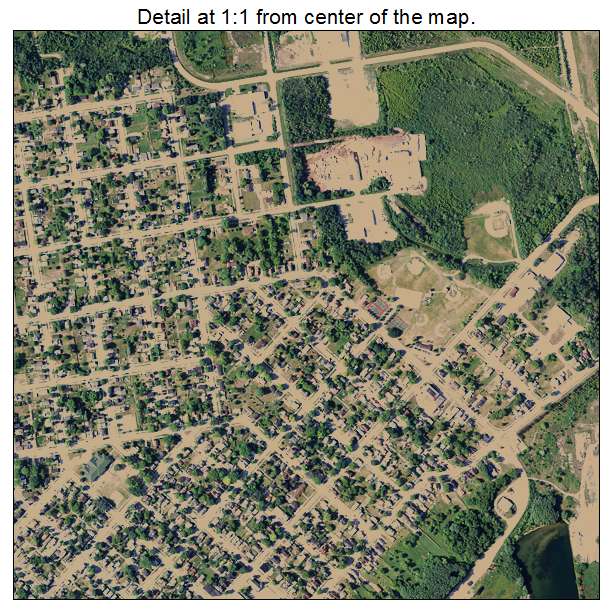

Va funds in Hillcrest are a popular mortgage money solution to possess home buyers. Indeed, Hillcrest Condition usually has a higher Va financing frequency than some other state on the You.S.

Having its of numerous Navy and you can Aquatic Corps angles and you may establishment, the North park area possess a big military population. That implies there are many home buyers in your community who you will make the most of making use of the Virtual assistant mortgage system.

Exactly what is a great Va mortgage precisely? How does this choice works? And you can exactly what otherwise do you need to know while using the a great Virtual assistant financing to invest in property in San diego? Why don’t we explore.

This new Va home loan program is treated by U.S. Department regarding Experts Facts. From year to year, the brand new service provides a research indicating Virtual assistant financing usage data having all county in the us.

San diego State usually ranking towards the top of which number, with increased Virtual assistant financing hobby than other county for the the fresh U.S.

Over the past 10 years or more, the following counties had the large quantity of Va fund generated on the part of homebuyers:

- San diego County, California

- Maricopa State, Washington

- El Paso County, Colorado

- Clark Condition, Las vegas, nevada

- Riverside State, Ca

Such areas as well as their associated towns has a few things in accordance. For one thing, they all servers an abundance of army basics otherwise installations.

The latest Hillcrest area, particularly, hosts the second: Naval Base Hillcrest, ar, Naval Sky Station North Isle, Go camping Pendleton, Naval Ft Part Loma, Naval Amphibious Legs Coronado, while the Marine Corps Hire Depot. İncele

See Collection Servicing, Inc. (SPS) try a mortgage servicer you to operates inside the country. The company specializes in upkeep unmarried-family members home-based mortgages. Created inside the 1989, SPS possess headquarters into the Salt Lake Area, Utah, although they possess a good Jacksonville-situated office here in Florida. Mainly a home loan servicer, SPS protects the afternoon-to-go out management out of financial profile, like the distinct regular month-to-month mortgage repayments.

Come across Collection Upkeep isnt qualified by Better business bureau (BBB) plus fact, he’s got had tens of thousands of issues lodged up against them. All of these surround the newest zombie next financial property foreclosure lawsuits filed because of the SPS up against consumers. If you are notified that the next home loan is actually standard, otherwise your company enjoys started property foreclosure procedures, you desire legal services. Our very own zombie next home loan foreclosures shelter solicitors offer it.

Try Discover Collection Maintenance Calling You Regarding another Mortgage?

Most people was indeed amazed when they are called by the Find Profile Repair. Because they might have identified they’d an extra mortgage, they may have-not heard of SPS before, given that company is not often the amazing mortgage-holder. In other occasions, borrowers are surprised to find out that in addition they have good next financial, as they have not heard about they for a long time.

People such as for example SPS purchased bundles out-of mortgages throughout and you may quickly adopting the collapse of your homes . Completely new loan providers, for instance the huge banking institutions, offered such mortgage loans so you’re able to 3rd-people people to have cents with the money, knowing it is very costly and you may date-sipping to foreclose into thousands of land. İncele

These supply the same low interest rate once the subsidized funds, however, without having any authorities-financed attention money. That means that notice accumulates if you’re at school, that will be upcoming put into the quantity you have to pay back (known as the prominent balance) once you scholar. While this may sound like a minor improvement, it will total up to multiple otherwise thousands of dollars regarding loans past everything borrowed. A beneficial education loan cost calculator considers the real difference anywhere between sponsored and unsubsidized finance.

In addition to the specific threshold from $23,000 to have backed Stafford loans, there was a limit to the cumulative total regarding unsubsidized and you will subsidized combined one any one college student may take aside. Student pupils who will be influenced by their mothers for financial support can take out all in all, $30,000 during the Stafford financing and you may pupils who’re economically independent can take-out as much as $57,five-hundred in Stafford finance. Therefore, to own students who may have currently maxed away their own number of sponsored financing, she might take away an additional $8,000 in order to $34,500 in unsubsidized loans, according to even in the event she’s an established.

Graduate and professional college students can no longer get backed money. İncele

In one way or some other, we are all chasing after the newest American Fantasy. Perhaps not the newest light picket fence by itself, nevertheless feeling of defense that is included with they. You are sure that, the recovery from expenses your bills punctually. New pleasure that include level your own kids’ tuition. The satisfaction away from owning a home you like.

Fortunately you may have much more purchasing power than just do you believe. Having a property Collateral Personal line of credit (HELOC), you can borrow on their residence’s security to view a lot more financing, commonly thousands of cash. İncele

One of the recommended next opportunity financial program yearly is actually new FHA loan. Household people still flock to FHA to possess 2nd opportunity loans and you may home financing. We genuinely believe that if they have seemingly less than perfect credit, they can’t get an FHA financial support, however, that isn’t fundamentally possible.

Shop 2nd Chance Funds for people with Credit Difficulties

Even if you have obtained a recent property foreclosure if not bankruptcy proceeding, you continue to may be able to get a moment chance mortgage online personal loans IA in a few facts.

An option factor for loan providers on the mortgage recognition procedure was assessing the level of borrowing from the bank exposure for the debtor.

Conversely, next options money is extending opportunities for those which have imperfect borrowing records to get into funding, empowering these to pursue their financial expectations.

Having mortgage rates and you can inflation rising, our company is enjoying more about lenders features extended their applications to provide far more second opportunity finance thus consumers can get back on their legs economically.

Repaired rates next chance finance is actually paid courtesy typical monthly installments, with different amortization schedules spanning of but a few weeks in order to probably extending more years. Here subprime lenders promote sensible second chance fund, providing qualified borrowers to get into up to $100,000.

Such economic offerings was customized to individuals that have less than excellent credit records. Certain financing organizations and private money lenders render second chance repayment loans which could give monetary relief so you’re able to individuals who’re usually deemed too much-chance by other creditors.

The RefiGuide will bring plenty of worthwhile money content for users to know about FHA recommendations and you can 2nd possibility home loan criteria. İncele

Straight down mortgage pricing and better solution.

Larisa intends to purchase an apartment inside the Ukrainian Village. Seven days later she produced an offer, the seller acknowledged it, and so they agreed to close in 1 month. Larisa has no much time to discover the financing she should purchase the condo, so she dropped by the financial institution so you’re able to commercially submit an application for the latest mortgage.

Once she accomplished their loan application, the mortgage manager gave Larisa the initial disclosures, plus financing Estimate. Then your loan officer wanted an excellent $450 examine to purchase price of the house assessment statement the financial institution often acquisition just before it approve Larisa to the loan.

Consider it since your dedication to a loan provider. This means your removed a loan, maybe with a few bank. Your opposed Loan Quotes and you can chose you to definitely house financing and something financial.

Cannot shell out any loan costs before choosing that loan and you will a lender. Its illegal to possess a loan provider to gather a fee until you pick the Loan Estimate and alert them that you are swinging ahead making use of their loan offer. İncele

It will be possible to repay a bridging loan because of the transitioning they in order to a conventional financial or comparable much time-name payment business.

Market Planning

On the days and days before an auction, full information on the brand new properties set-to go in hammer would be create. This can become an effective book rates for every single domestic, that most era might possibly be notably lower than the cost they costs.

When there is a home you are searching for purchasing, you will need to plan a call at-individual watching and you can a specialist questionnaire. İncele

The only real repayments you should be worried about was any property fees plus home insurance. You need to keep up to date with these repayments and keep your home into the great condition. Providing you accomplish that and remain of your house, your reverse home loan cannot been due. Also the monthly premiums, you should make repayments toward loan.

However, contrary mortgages commonly rather than their threats. While it’s extremely hard to owe more income versus well worth in your home, that is not to express contrary mortgage loans don’t have any risks.

It’s not necessary to make monthly installments which have reverse mortgage loans. For the reason that it interest try compounding quicker. At some point there may become a time when you need to pay back their contrary mortgage, constantly in the proceeds of profit of your house. You’ve got little to no equity left if you are pushed to sell and you can go on to a lengthy-name care business. So it is valid if the home values slip simply if you’re searching to do that.

Life is always changing. As a result agreements can alter. For folks who experience to settle their contrary financial sooner or later than just five years you can also face a penalty. You’ll want to inquire a loan provider for additional details on one before you sign upwards for a face-to-face home loan.

Why don’t we glance at the advantages and disadvantages out-of opposite mortgages in the second part to help you decide whether or not a reverse financial is right for you.

Benefits off Opposite Mortgage loans

- You don’t have to make normal money in your contrary home loan. This is going to make her or him perfect for up to $255 Colorado online payday loans seniors to your fixed income whose cash circulate is tight.

- You’ve got the independence to use the reverse mortgage funds once the you will find fit. You can use them with the home home improvements, bills, healthcare expenses and you will repaying almost every other loans. İncele

The fresh new LTV decides just how much you could borrow, as well as your loans-to-income proportion kits the newest payment per month the place you be considered.

Interest levels. The latest faster appeal you only pay, the more mortgage you can afford. İncele