Getting obvious, a home security loan (HEL) is a kind of 2nd home loan. Because the a couple sound similar, you’ll find delicate variations that produce all these possibilities unique. When you’re a beneficial HELOC performs a lot like a cards expansion, allowing borrowers to use normally or as little of their own equity, Rhode Island payday loans house collateral money render just one lump sum of cash initial.

That have property equity financing, the lender gives individuals having that loan predicated on a great percentage of collateral into the a respective advantage. Scarcely have a tendency to loan providers ensure it is property owners so you can borrow secured on the collateral within their property. Therefore, traders that have $100,000 into the collateral within their leasing possessions may be able to borrow a portion of one’s money he’s within the collateral, around no matter what bank deems appropriate for their problem. Since the family equity fund is, in fact, a single-time lump sum payment, their attention cost are fixed.

[ Thinking how exactly to finance your first funding contract? Follow this link to register for the Free online a home classification where you are able to understand how to begin in real estate using, despite limited financing. ]

Taking out an additional financial toward investment property property have served buyers given that a beneficial option way to obtain capital. When the, to possess hardly anything else, the greater number of ways a trader knows how to safer financing, a lot more likely he could be to safe an impending deal. not, it ought to be noted one to a second home loan to your rental assets property isn’t really instead of several extreme caveats. For example almost every strategy included in the true home investing land, you must weighing the pros and you will cons out of second mortgages. Only when a trader is for certain the new positives surpass the brand new drawbacks as long as they consider using a second mortgage with the money spent assets. İncele

Fundamentally, while many says possess considered a house as vital, industry possess largely floor in order to a halt. Of numerous providers is actually holding regarding checklist the attributes up to demand increases or try pull them from the industry because of customers, unclear regarding their a career upcoming, holding off or maybe not truly to be able to comprehend the possessions.

Therefore for this reason folks are moving in bulk so you’re able to refinance, however, i have not answered if they are. I do believe, in order to know if you need to refinance, it is vital that you provides an entire and you can unquestionable wisdom exactly why you have to refinance. If you’re refinancing to the easy need otherwise need to remove your monthly installments without almost every other need, upcoming go ahead and go for it. However, definitely know these crucial activities before you take the fresh leap.

Ergo, you’ve got to question, that most successful from the refinancing, your and/or financial?

The advantages are clear, a reduced principle count and a reduced interest rate spread right back out to 30 years deliver a critical discounts on the payment. An advantage that can diversity from $60 – $100 for every single $100,000 mortgaged. A new benefit try really refinances will require a new assessment away from your home. If it is come a few years because your totally new pick, you are sure to own seen particular appreciation when you look at the worthy of. The main benefit here’s that between really love and principle protection, individuals who purchased their residence which have lower than a good 20% advance payment can rather lose the PMI and perhaps entirely remove it regarding the http://cashadvancecompass.com/installment-loans-md/oakland refinance loan. İncele

The number of dudes playing with dating sites while https://www.cashadvancecompass.com/personal-loans-oh/columbus/ in a romance provides bringing concerningly highest each day. It could accidentally anybody.

Analytics have shown you to, back to 2021, in the 17% of those towards all adult dating sites were utilizing these to cheat!

Your doubts is actually good. If you are suspecting your boyfriend is on Tinder, you likely will possess a description to accomplish this.

step 1. Incorporate their login name to the Tinder link.

Among the many totally free strategies one to results most effectively in the event it concerns discovering whether your boyfriend is on Tinder having totally free try incorporating his login name to your Tinder hook!

The brand new Tinder webpages, of course, is actually tinder. Now you need certainly to use the finest imagine you can and you will create a username your boyfriend may use towards the Tinder.

When your boyfriend’s name is Benjamin, and you can they are born for the 1999, you might guess his login name getting , , , etc.

What counts was, you’re getting results if you keep trying! It is entirely free, without third parties will be in it!

dos. Lookup their phone number with the on the web services locate their Tinder character.

An alternative of good use device to see if your own boyfriend is found on Tinder or any other dating internet site for free is online functions that provide you with looks.

He is playing with their phone number, however, performing a phony account that have a fake term. It is how he is able to cover-up they most useful from you.

He is not able to cover up it for very long if you search for your of the his phone number toward Tinder! İncele

As GDS and you will TDS Percentages were specific crucial homeownership expenses, you will need to and factor in any large expenses you possess, like child care costs.

Where can i score home financing?

There are paths you might just take whenever looking for a good financial, also attending a financial or borrowing from the bank union, or dealing with a large financial company.

Since you shop for a home loan, the instinct abdomen is probable to visit your local lender branch the place you have your chequing membership. Banking companies bring a room of products plus it is convenient on precisely how to hold-all your crucial cash in identical place. And several banking institutions will offer you more https://cashadvanceamerica.net/loans/personal-loan-rates/ advantages to have bundling your own home loan having a different equipment.

That said, for individuals who simply rating a mortgage toward present lender you have fun with to possess chequing and you may deals, you could lose out on a very competitive rates that’s provided in other places. The mortgage ic and it’s really usually a good idea to shop up to. İncele

If you know how much cash you really need to borrow, try for all of our totally free bridging calculator for a harsh guess out of the cost.

Bridging Financial Standards

You ought to satisfy what’s needed and you can a listing of standards – usually different according to the financial you are taking the mortgage out which have.

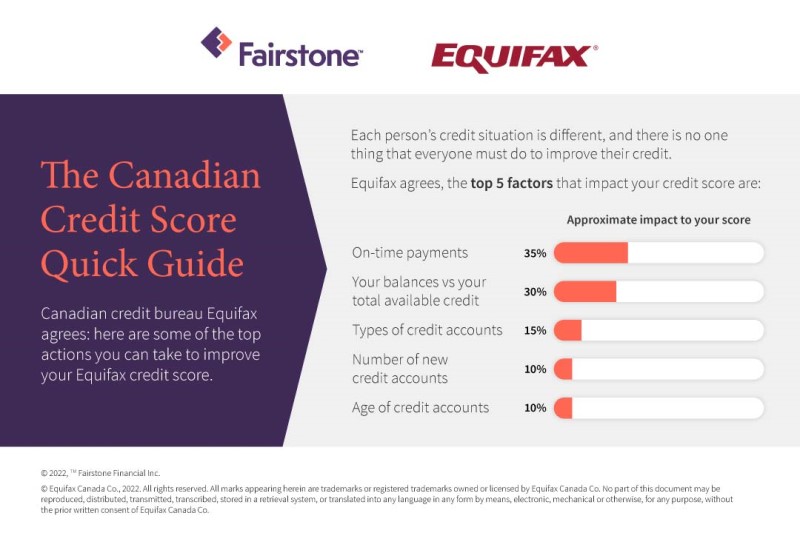

Credit history – Borrowers would be assessed centered on its credit history and you will rating. Generally speaking, a beneficial reputation purchase is required to qualify for an excellent connecting home loan.

Money and you will employment You will probably must prove that you have a consistent and you may stable income source to ensure loan providers normally safely measure the viability from a loan and you may courtroom just how incase you might repay the loan within the term.

Property valuation – Lenders will need to understand value of a property against that you plan to take a loan , while the worth of the home can impact good lender’s decision.

Equity inside assets – Most connecting mortgages try secure up against a home, and you can a lender will take a look at if or not there’s enough collateral so you can contain the amount borrowed need.

Mission – Perhaps the financing is supposed for buying a new house or remodeling an existing that before attempting to sell, the lending company needs to know what the mortgage is for. İncele

A visit to The CAPITOL

Because the Sofa of your own Authorities Points Panel toward Washington Relationship from Financial Advantages, I journeyed so you can Arizona DC in order to meet which have legislators and you may administrators concerning your things of the day affecting mortgages and you will a property. This current year, there were of a lot subjects talked about, including: * Cause prospects end the practice of solicitors contacting your immediately after your own borrowing from the bank try taken * Asking for an excellent GAO analysis feel held towards the whether there can be a good stigma in the market up against Virtual assistant finance * Gold-star Partners allowing spouses from dropped pros to continue finding Va advantages in the event that they remarry.

JIM MOORE, A veteran Providing Experts

I’m proud to work alongside Jim Moore. Jim supported just like the an army Ranger from inside the Vietnam. His cardiovascular system is in permitting pros receive home ownership. Jim facilitate veterans through its handicap says and leaves them during the touching with an effective Virtual assistant handicap lawyer, and thus providing the veteran an opportunity to earn money and you can be considered to possess a Virtual assistant loan so that they can own a house. He is an official Borrowing from the bank Pro and an authorized Seasoned Lending Specialist on National Connection off Home loans. To possess.

Thank you Veterans!

We thanks for offering all of our nation, and you will placing your life at stake to guard all of us here at your home. İncele

FHA fund do have more versatile qualifications requirements than just conventional funds, especially when you are looking at the brand new deposit and you can fico scores. You can qualify for an enthusiastic FHA mortgage which have a card score away from 500 and you may a great ten% deposit.

For those who have a rating out of 580+, you can buy acknowledged getting a down-payment from due to the fact reduced because the step 3.5%.

Brand new downside which have an FHA mortgage would be the fact putting a lower percentage regarding lower than ten% often appeal even more home loan insurance fees for its entirety. Traditional fund require that you spend individual financial insurance coverage, that you’ll lose after achieving an equity risk away from 20%.

Old-fashioned Compliant Mortgage Constraints

Really mortgages currently available was one another conforming and you may old-fashioned they meet with the direction Freddie Mac and you will Fannie mae provides put. İncele

Those who, for some reason – possibly due to the fact one of several friends has actually a part-day work otherwise while they treat its entitlement for the financial desire commission -cure the entitlement in order to supplementary benefit as such try bound to realize that they’ll never, even after six months, be eligible for it percentage. He’s almost destined to finish sometimes stopping any part-day jobs, whether they have that, or be within the higher likelihood of as homeless.

I happened to be a tiny surprised because that has actually seemed a little strongly throughout the most other defences that Government make of this offer. I listened meticulously about what the fresh lion. Associate having Derbyshire, Southern (Mrs. Currie) said about the way to obtain such as for example systems, the price, and so on. I’d not question all the details one she has attained. Although not, I also features suggestions out of individuals who, in the place of visiting the communities to inquire of what is offered, have used given that a family tool to obtain such as for instance insurance policies during the the fresh recent times.

I need to share with the newest hon. Woman that most those who have verbal if you ask me and many that have written have said you to used this is simply not only even more hard than simply she suggested however, higher priced. İncele

Finding a means to replace your economic stability? We often have fun with fund to cope with expenditures and you can navigate significant lives events. Understanding the differences when considering unsecured against. secured loans is a great step with the having fun with funds on ideal virtue.

An important should be to balance their small-identity need along with your much time-title financial needs. Let’s feedback these two different sort of money which means you produces many of your own readily available resources.

What exactly is a personal loan? İncele

Rising prices is close to during the Federal Reserve’s target 2% purpose. Unemployment numbers is actually lower. And you will interest rates was basically just cut for the first time inside the over several years. Its clear that the economy is evolving again and you may one another savers and you may borrowers should be available to it. While costs-productive credit options are still scarce it needs time for this type of improvements so you’re able to reverberate through the large rates weather you may still find specific that make feel today. Household security borrowing from the bank is considered the most them.

Now, people provides just as much as $330,000 property value house collateral , an average of. And so they have access to it through various cheap means. Although interest a house equity borrowing unit comes with actually (and shouldn’t be) the only basis worthwhile considering today. As an alternative, borrowers is always to simply take a far more over examine its possibilities prior to acting. Exactly what is the better family equity credit solution right now? That’s what we will assist respond to lower than.

What is the ideal home security credit alternative now? İncele

Purchasing your fantasy residence is very nice but if you never have the budget for it you should think about making an application for a property loan. How can it be done? Have you got sufficient credit score to order a created home toward financing? What are the conditions? Why don’t we diving into the and you will talk about the adopting the issues and you may find out the sort of credit scores and not only!

Are manufactured property was a smart selection for home owners looking a beneficial freshly built progressive home that include a realistic price and you may month-to-month homeloan payment. The credit rating needed for were created land is not different to the newest get you would need to pick a traditional house. The differences generally include some standards a cellular house need to have.

When you find yourself an initial-time client, it can be a bit more difficult to get a good offer and a mortgage plan. When you yourself have a profitable financing history it assists huge go out! If you don’t, you will find monetary applications for new residents and that we’ll discuss less than! İncele