Many thanks for offered my personal application. We anticipate the possibility of leading to Wells Fargo and you may studying regarding the best in the.

Exhibiting Related Ideas

When you explore a project you’ve finished one to individually means their goal or even the character you will be trying to get, it not only shows your skills plus your understanding from the goals. In this situation, development a person-amicable monetary believe application teaches you have the necessary technology and you will logical knowledge, and the app’s triumph demonstrates what you can do to send abilities.

Industry-Specific Sense

Internships are an easy way attain hand-toward experience, and you may bringing up it on your own cover letter try a sensible circulate. İncele

Cash-out refinancing $255 payday loans online same day Hawai and you will home equity financing render one or two various ways to receive money from your home. When you find yourself similar in a number of suggests, for each and every channel has keeps that cause them to become more suitable to certain categories of consumers. I take a closer look within benefits and drawbacks from a funds-out refinance compared to. property guarantee mortgage

House Guarantee Financing compared to. Cash-out Re-finance

You reside your solitary greatest advantage, of course, if you have owned your own personal for over per year or two you truly features a good level of security in your possessions. Security is the percentage of your own home loan harmony you really have currently paid back.

Your collateral is also an evergrowing source of a lot of time-title safety since your house’s worthy of develops, however, often you really need to change that money for the actual cash you need to pay for a lot more urgent fundamentals like a great much-expected house posting or expenses-or perhaps locate a control in your higher-appeal debt. İncele

Keep in touch with Timmy and sell whatever you do not require – this includes weeds – for additional bucks. Today, the actual works initiate.

Connect, connect, hook

Direct southern area on the shore. Along the way, use your this new bug internet to catch one butterflies, beetles, and other bugs which you discover. Catching merely 10 bugs have a tendency to earn you miles, and you will getting ten book varieties often enable you to get a lot more. The same thing goes to possess fish.

If you means certain shells along the seashore, might switch up and inform you themselves getting hermit crabs. Such count because bugs, therefore catch these with your web. If it is raining, snails can look into the stones. Trembling woods may cause bots to-fall aside, which you’ll connect.

But be on the lookout – every time you shake a forest, there clearly was a haphazard chance of good wasp’s colony receding. If the a colony falls out and you can wasps start to swarm, you can attempt so you’re able to rapidly sign up for their internet and you can catch one to. Or even, manage as fast as you can in order to both the Citizen Features tent or your own tent and you will stay away from into the. In the event you get stung, although not, don’t get worried. You should buy treatments from Timmy to possess eight hundred bells.

After you achieve the shore, start to walk back-and-forth, picking up most of the shell and stopping in order to seafood whenever you find a shade in the water. For those who work with, the new fish gets scared and you may move out, so spend time walking. You could also see bottle, that will leave you the newest Do-it-yourself authorship solutions whenever opened.

Finding ten fish consecutively instead frightening any of them away from will enable you to get added bonus kilometers, so cast carefully. İncele

The fresh Protected Construction Financing is now switching so you can a family Homes Loan. The main alter are higher price constraints toward properties financed from the mortgage, additionally the probability of capitalizing on your family payment when you have property collateral contribution. The reason for the mortgage may also changes.

The family Housing Loan address the needs of the users exactly who are interested the very first apartment otherwise, in the example of parents having at the very least several children, that browsing get yet another flat. The application lets people who do not have the security expected getting a simple home loan to obtain financing. Now this package is additionally available to borrowers who’ve an security contribution of 20% if not 31%. As a result, more individuals will be able to benefit from the assistance and be people who own their house.

So far, users who had over 10% of their own collateral sum could not benefit from the program. İncele

Dining table regarding Material

- Qualifications

- The fresh Automatic Stay-in Chapter 13

- Throwaway Monthly Money

- The latest Section thirteen Bundle

- Home mortgages within the Section 13

- Next Mortgages and you will HELOCs into the Section thirteen

- Cram-downs off Low-Residential Houses

- Taxes in the Section thirteen

- Playing cards, Personal loans and you can Scientific Expenses inside Chapter thirteen

Analysis

Section 13 personal bankruptcy was a process built to make you a good new initiate where you could work with from the curing past-owed mortgage financial obligation, fees and you can/or car loans when you are however discharging as much of credit card debt, scientific personal debt, and personal financing debt that one may, along with times when you have got way too much income in order to be eligible for chapter 7.

Including chapter 7 or any other areas of the brand new Case of bankruptcy Code, we collect a great petition seeking relief and you can dates and therefore completely reveal your assets and you will debts, with other monetary advice. İncele

Didn’t find that which you were hoping to find?

footnote Borrow sensibly I prompt college students and you will family to start with deals, has, scholarships and grants, and you can federal figuratively speaking to fund school. Evaluate all the expected month-to-month mortgage payments, and exactly how far this new student needs to make afterwards, before provided a personal student loan.

Deal with your loan

footnote Dental care College Fund is to own graduate college students in good D.D.S. otherwise D.M.D. program at the acting degree-granting universities and therefore are susceptible to borrowing recognition, name verification, finalized loan files, and you will university degree. Scholar Certification/Continuous Knowledge coursework isn’t eligible. İncele

Of the investigating such different varieties of vacation a mortgage, you might buy the solution you to best suits your debts and you may objectives. Remember to consult a mortgage top-notch or economic advisor so you can see the certain criteria and you may ramifications of every money alternative.

Income tax Ramifications and you can Local rental Earnings

With regards to a secondary household buy, it is very important understand the income tax ramifications and exactly how local rental earnings could affect funding possibilities. Why don’t we explore this type of issues in detail.

Taxation Factors to own Travel Property owners

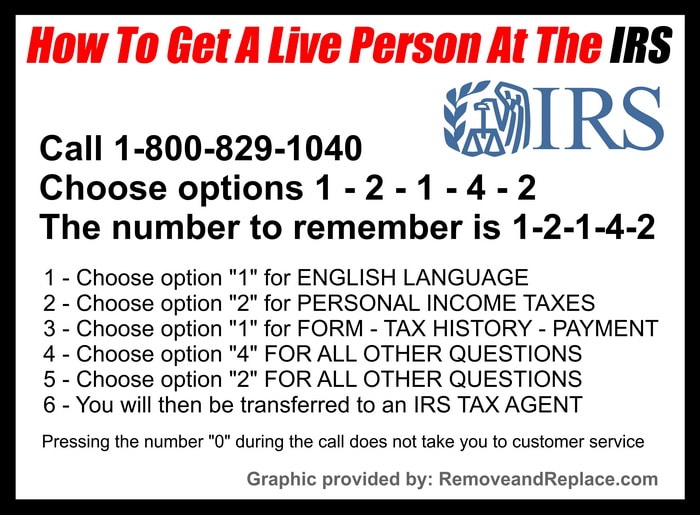

If you book your vacation house to get more than just 2 weeks from inside the a-year, the internal Revenue Solution (IRS) often assemble taxation in your rental earnings. This sells income tax implications that need to be noticed whenever money a vacation domestic. It is essential to consult with an income tax top-notch to learn the brand new certain taxation rules and regulations that connect with your situation.

Buying a holiday rental assets may bring taxation experts. The new Internal revenue service lets write-offs for different costs pertaining to rental features, also insurance rates, mortgage desire, fix will cost you, and you will depreciation . Such write-offs will help offset a few of the expenses associated with purchasing and you can maintaining a vacation home.

Leasing Earnings Influence on Resource

Whenever applying for a home loan for a holiday household, loan providers have a tendency to think about the prospective leasing income as the a factor in the credit decision. İncele

The new Virtual assistant financial work with is one of the most valuable of all the gurus granted to the service professionals. The application is depending a being qualified veteran’s initial entitlement, currently $thirty six,000. The latest Va pledges all of the Virtual assistant funds around 4 times the fresh current entitlement, or $144,000. Having mortgage quantity above $144,000, the latest Va guarantee is the one-fourth of the financing numbers doing $726,200 having 2023, high in the areas deemed “high prices.”

When an experienced is applicable for a great Va home loan, one of the primary methods is to find the Certificate out-of Qualifications otherwise COE about Department out-of Veteran’s Situations. İncele

( dos ) Each Government Set aside Lender should need one information they thinks suitable or desirable to make certain possessions tendered since the security to own enhances and dismiss are acceptable which the brand new borrower uses the borrowing from the bank offered in such a way in keeping with which part.

( i ) Keep by itself told of your own general profile and you can quantity of this new finance and you can expenditures off a depository institution once the provided in area 4(8) of Federal Reserve Operate (12 U.S.C. 301); and you will

( d ) Indirect borrowing from the bank for other people. 4(a), zero depository place will try to be the medium otherwise agent regarding a different sort of depository business in the researching Federal Set aside borrowing from the bank but to your consent of your own Government Put aside Bank stretching borrowing from the bank. İncele