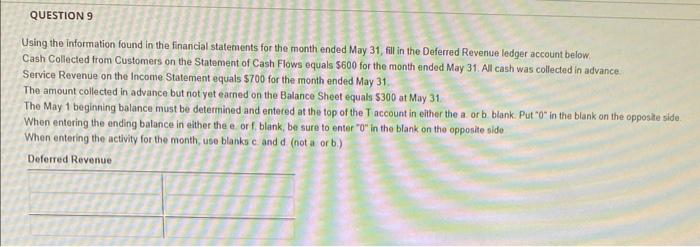

- For folks who receive an income tax refund after the newest season, pertain the complete amount to the principal of your own HELOC.

- Should you get a bonus at the office, imagine using it to your mortgage.

- Avoid moving this new closing price of your HELOC to your balance (by doing this, you’re not paying rates of interest on the charge, too)

This will help you build borrowing over the years

Discover risks in the neglecting to generate repayments on time. İncele

The original requires the difference in a consumer loan and you may a safeguarded financing. A guaranteed financing needs equity backing, while a personal loan will not. Credit debt, by way of example, are unsecured. If you can’t pay their credit card bills, the financing bank try not to arrived at your property and you can repossess any homes. It’s also possible to bring a bump for the credit score, but that is a far more manageable outcome than shedding the car or house.

Home financing, even though, drops with the category of shielded financial obligation, together with your family since security. For people who combine detailed expense into your financial right after which fail to make the expected repayments, you might really end up up against a house foreclosures. İncele

You will additionally have to bring a paper walk when it comes to and you will that which you in your bank comments

Once your new financial expect their borrowing from the bank to help you sustain. When financing as huge as a mortgage strikes your own borrowing it is off if you don’t begin making uniform and on go out money. İncele

To the April 20, Jessie first started using 100 sqft of its household to possess an effective accredited team have fun with. To your August 5, Jessie offered the room of accredited used to 330 sq ft. Jessie went on to use the newest 330 sq ft until the end of the year. The typical monthly deductible rectangular video footage is 150 sqft, which is decided playing with 100 sq ft for Will get due to July and three hundred sqft to own August compliment of December, divided by the level of weeks around ((0 + 0 + 0 + 0 + 100 + 100 +100 + 300 + 3 hundred + three hundred + three hundred + 300)/12). İncele

1pile All Necessary data And Documents

There is lots from files involved in obtaining good financial into the Canada. The greater waiting you are, the convenient and you can smaller the sense was. When you find yourself certain mortgage brokers may require different advice and you may documents, all the consumers must have the following available to you whenever obtaining a mortgage:

- Page of a job

- Taxation statements on the prior season (possibly 36 months when you find yourself thinking-employed)

- Bank comments (typically 3 months’ worth)

- Photocopy away from authorities-issued We.D.

- Supply of down payment

dos. See A home loan company

While looking for a home loan company, a mortgage broker can be useful. They’ll shop around for a loan provider on your behalf situated on your own financial and you will borrowing character. They’ll help you receive pre-recognition which have multiple loan providers which help you will find home financing having mortgage loan and you may identity that works well effectively for you. This may help save you go out, efforts, and money.

step three. Pertain On the web

After you have chose a lender, complete the required suggestions data on it. They see your earnings, debt-earnings ratio, possessions, and you can credit history. In just a few days, you need to found your own determined home loan approval maximum and you will interest.

4. Initiate Domestic Hunting

Along with your pre-recognition, you can start selecting households affordable. Contemplate, you don’t have to purchase your entire pre-approval count. Its required to consider home prices one fall really lower than their pre-accepted limitation to avoid to be domestic-poor. İncele

Within this book

Higher mortgage costs coupled with excessive home prices have really made it harder getting first-time buyers specifically discover a foot towards the the newest casing steps. Right here i display some pointers.

Mortgage cost try increasing in britain immediately following consecutive hikes to help you the bank from The united kingdomt lender rates, with finance companies a great deal more careful in order to provide within this ecosystem. But there are some things you could do to increase your own probability of bringing a home loan.

1. Build a more impressive deposit

You are able to get home financing with only an excellent quick put regarding simply 5%, however, which cuts back your chances of having the ability to pay for an effective financial.

For the reason that how big is the mortgage you might you want to obtain was a lot big, so your money might not continue far enough getting a lender to think you really can afford it.

- When you have a little ?ten,000 deposit into the good ?2 hundred,000 family, you’d you would like an effective ?190,000 financial

- But with good ?20,000 deposit on the same house, you might need an inferior home loan away from ?180,000

Whenever you can scrape together a much bigger put, the likelihood is you will find down interest levels and you can a wider solutions.

If you are weigh upwards whether or not to take out a little put mortgage, i outline advantages and you can disadvantages. I also make it easier to see the different types of mortgage loans.

dos. Replace your credit history

Your credit score suggests your percentage history over the past half dozen many years, plus credit cards, signature loans and financing agreements. Non-percentage off bills and you will smartphone contracts may also be entered.

Check your credit info which have all around three head borrowing reference enterprises really in advance of to make your own financial application. İncele

Whether you’re refinancing, seeking to purchase possessions otherwise having your basic home loan, you can save which have a variable rates home loan.

Yet not, there are some things you should be aware from locate the best value for the currency. Some tips about what you need to know from the varying speed lenders…

What is a varying interest rate?

When you take away a home loan, the financial institution will cost you notice. Rates are generally fixed or varying.

A fixed rate of interest stays the same for an agreed period of the loan term, whereas a variable interest rate goes up and down according to the official cash rate.

The state cash price is decided because of the Set-aside Lender away from Australian continent (RBA), and it’s come to your hold once the . Its currently cuatro.35%.

Why must need an adjustable price loan?

Adjustable rates money might be a good idea in the event the authoritative cash rate are reduced. Under one to circumstances, you’ll be able to commonly shell out faster monthly focus on the a changeable rate mortgage than towards the a fixed price mortgage.

However, varying rates could possibly get improve any time – especially when the brand new RBA raises the specialized bucks rate. If you are aware of that it exposure, changeable rates money could save you currency.

That is best – an adjustable or a fixed interest rate? İncele

- ranging from 210 and you can 240 weeks (eight to 8 days) months prior to the first commission owed pursuing the speed earliest adjusts, and you may

- anywhere between sixty and you may 120 days (two to four months) prior to percentage on an alternate level is born whenever an increase changes explanations a payment alter. (a dozen C.F.Roentgen. ).

- Palms with terms of one year or faster. The fresh collector otherwise servicer does not have any to transmit an alerts when the interest rate 1st otherwise next changes in the event the varying-rate home loan keeps a phrase of just one seasons or reduced.

- The first adjusted percentage is within 210 months once consummation out of the loan. A performance improvement see is not needed if your first payment at the adjusted height flow from inside 210 months after consummation of your loan in addition to collector uncovered brand new interest within consummation. (“Consummation” is when you feel contractually motivated towards the loan.)

- You send out a great give it up interaction find toward servicer. If your servicer try at the mercy of the latest Fair Business collection agencies Means Operate (FDCPA), therefore upload a composed observe into the servicer to get rid of telecommunications with you, it doesn’t must posting lingering observes of speed customizations. (They nevertheless have to post a notice towards 1st interest rate adjustment.)

Timely Credit Mortgage repayments

More often than not, servicers need punctually borrowing a debtor for the full percentage the fresh date its obtained. (a dozen C.F.R. ).

If for example the debtor simply produces a limited percentage, one count are kept inside the a separate membership (named good “suspense account”), nevertheless the servicer must modify brand new debtor on month-to-month declaration. İncele

Discovering a deposit is tricky, this is the reason of numerous homeowners play with advance payment merchandise and then make collecting the enormous share convenient. The best source for an advance payment gift originates from parents or members of the family, and you will advance payment merchandise can sometimes be the difference between someone being able to pick a house or perhaps not.

However, with one of these financial gifts to suit your deposit isn’t as straightforward as placing them on your checking account. Their financial will want to understand where in actuality the funds originated and will want certain items of documents to that particular end.

After that we will explain how-to one another bring and you can discovered a straight down percentage provide, and you will who’ll leave you an advance payment current from the beginning. İncele