Avant has the benefit of fixed-price do it yourself fund that can be used since the a remodeling financing, property fix loan or to let purchase a choice to your house. In the place of home collateral funds, these do it yourself loans is actually awarded centered on creditworthiness instead of home collateral. Funds, offered once the 2nd working day, was in person placed in the family savings, so you’re able to utilize the fund yet not best suits your position.

eight. Wells Fargo HELOC

Rate: Best speed together with capped rateTerms: 10-seasons draw period and something monthLimits: $twenty five,000+Fees: Minimal monthly payment regarding $one hundred, $75 yearly percentage, $five-hundred prepayment punishment percentage might incorporate whether your account is actually closed within three-years from account opening

You might apply for Wells Fargo HELOC or a fixed-rates house collateral mortgage when it comes down to kind of home improvement capital. Brand new mark period was 10 years and another times. As the loan’s Apr at stake off credit develops that have the prime rates, you will find speed caps into the loan, so the rates cannot boost over 2 % per year in line with the time you finalized your own personal line of credit agreement. İncele

Is the Utah FHA Mortgage an educated complement your?

New Federal Houses Government (FHA) is created in 1934, in order to assist in You.S. homeownership blog post the Higher Anxiety.

During the time, simply 4 for the ten house owned residential property and more than individuals were renting. Not a huge surprise, since you decided not to rating that loan as opposed to a fifty% down-payment!

Inside 1965, FHA became part of this new Agencies from Property and you may Urban Invention (HUD). FHA ‘s the only government agency one works totally out-of care about-produced money, and you may will cost you this new taxpayers little it is financed of the home loan insurance premiums paid of the FHA property owners.

Complete, FHA fund are ideal for often consumers with borrowing from the bank situations and you may/or you to bring even more obligations than simply acceptance because of the a conventional or USDA financing. İncele

A decreased earnings mode this new borrower will need so much more care and attention of their team will set you back and you will costs than their loans.

To know about their income and money move, financial institutions look at the business accounts’ bank comments together with team owner’s lender comments.

not, advertisers can enhance their cash flow from the goal setting techniques, undertaking an income data of their company and you may getting a great well-defined percentage stage in position.

step 3. Equity

Finance companies promote protected and you can personal loans in order to companies. In the event the lender features requested a promise having covered financing, they would like to limit the risks inside. Therefore, banking institutions wish to know in advance the sort of safety or security the company will offer in exchange for the borrowed funds. The security or collateral should be a commercial real estate property, devices otherwise pricey gizmos of team, vehicle, account receivable or other providers possessions. İncele

Planet Home Lending LLC, Meriden, Conn., registered towards a decisive arrangement to obtain specific assets of your own delegated correspondent station of Homepoint Monetary Corp., a mortgage founder and servicer and you will a part off House Area Money Inc.

The fresh go on to Globe Domestic Lending gives Homepoint lenders access so you can market affairs, including consistent prices and you may quick turn minutes, he told you. Handling a single much time-name, solid companion reduces risk and you will lets lenders attain performance and working efficiencies.

Homepoint made $20.seven million inside the delegated correspondent frequency inside the 2021, making it the latest 13th biggest correspondent financial, based on In to the Home loan Financing investigation. World Household Financing is actually rated twelfth with $twenty two.8 mil for the correspondent frequency.

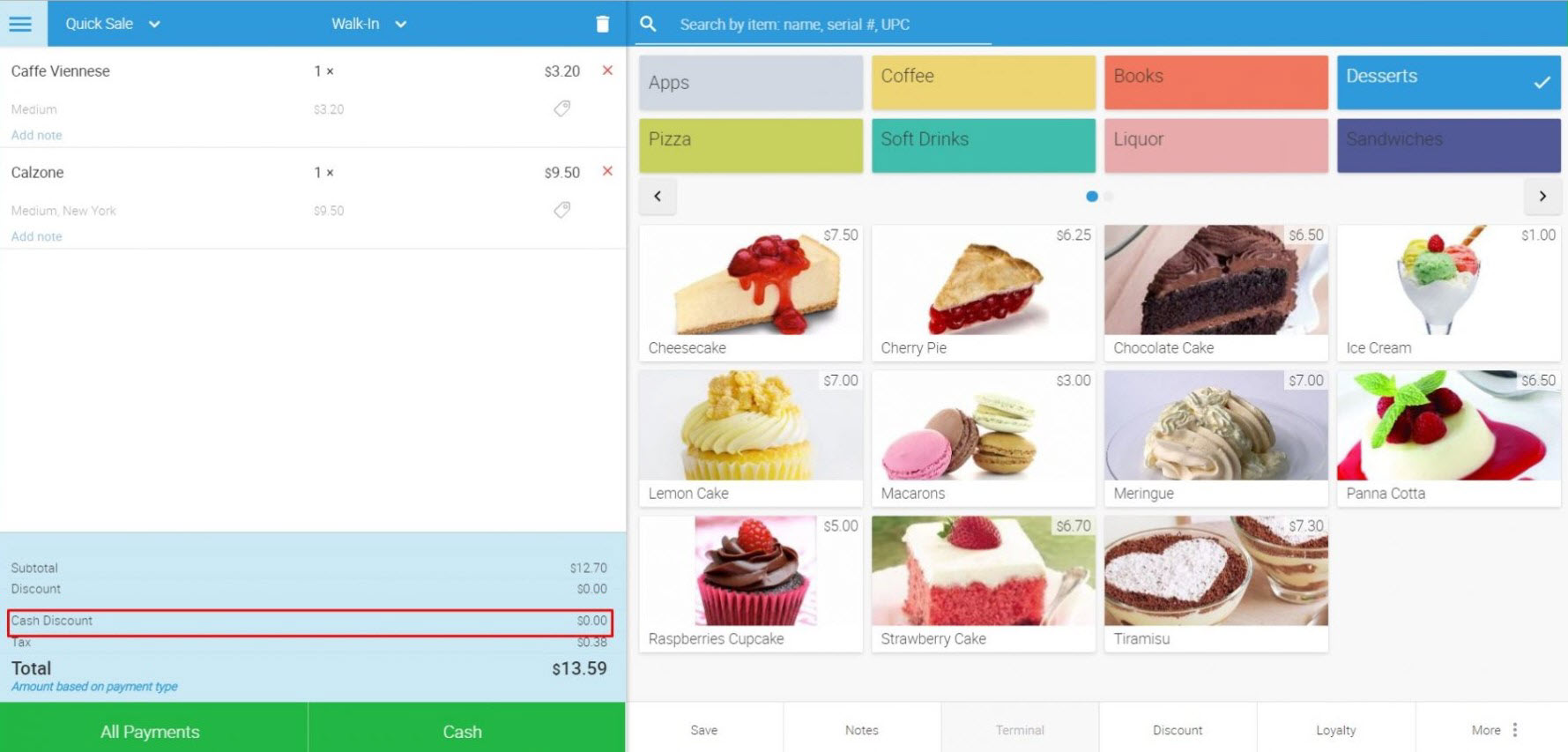

Easy use of your own tech and associate-friendly and you can aesthetically pleasing reporting highly relevant to all the quantities of an enthusiastic organization after that enhances returns and you can correspondence on loan origination processes

The deal is anticipated to close throughout the 2nd one-fourth, subject to conventional closing conditions. İncele

There are many advantages of choosing a beneficial Va Home loan guarantee, however, constantly discover misleading recommendations that discourage experts by using all of them. Lower than is a few earliest factual statements about houses benefits to have pros.

Have always been We Eligible?

- 3 months active obligations anywhere between 9/ and you can seven/ (WWII)

- 181 weeks ranging from seven/-6/ (Post-WWII)

- 90 days between six/ and 1/ (Korean Combat)

- 181 months anywhere between dos/1/1955 and you may 8/4/1964 (Post-Korean Battle)

- ninety days anywhere between 8/5/1964 and you may 5/7/1975 (Vietnam Battle)

- 181 weeks anywhere between 5/8/1975 and you may 9/7/1980 (Post-Vietnam Combat)

- 24 continuous days anywhere between 9/8/1980 and 8/1/1990 (and/or complete months the place you was in fact titled or purchased to help you active responsibility)

- 24 continued days off 8/2/1990 to today.

Next, you need to get their Certification off Qualifications by going to , you can also contact a loan provider to own recommendations. Lastly, you must have suitable credit and you will sufficient income. İncele

What can you want to go after?

The borrowed funds & Related Characteristics marketplace is wearing impetus toward decline in financial pricing determined from the optimism related the new Federal Reserve interest rate slices. The newest reduction in interest levels enhances the demand for financing origination and you may refinancing by simply making the price of borrowing comparatively less expensive.

With particularly positive developments, traders can imagine to find stocks particularly Speed Monetary Inc. ( VEL Short Estimate VEL – 100 % free Report) , Onity Class Inc. ( ONIT Small Offer ONIT – 100 % free Declaration) and you will PennyMac Financial Attributes, Inc. ( PFSI Small Price PFSI – Free Declaration) for long-identity development.

Positive Pattern on Home loan & Relevant Properties Business

This new optimism in regards to the far-awaited interest rate cut-in the latest Fed’s rules conference pulled the yields to your long-label ties all the way down, causing a drop when you look at the mortgage cost. From inside the Sept. 17-18 FOMC fulfilling, the brand new Provided decreased the rate by the fifty foundation activities immediately following more than couple of years. İncele

A family group springboard mortgage allows first-go out consumers to order property without having any put. At Tembo, i name it a savings since Defense mortgage. Exactly what was an effective springboard mortgage and exactly how create it works? Continue reading to ascertain

All of us you want a little help from relatives and buddies out of day to day that is not ever been truer to possess earliest-day people than simply now.

Every month or two home rates seem to visited a special listing high – but there’s help. Realising one homeownership try expensive for many, regardless of the re-advent of 95% mortgages, particular loan providers offer lenders that allow friends and family so you’re able to make it easier to on the assets hierarchy – springboard mortgage loans. İncele

Kamala Harris features advised a different sort of offer that could bring very first-big date homeowners to $twenty-five,000 to assist defense the costs of getting property.

In this article, we’ll break down the information for the advised offer, as well as which might be considered, tips use, incase the applying could become offered.

What is the Kamala Harris $twenty five,000 Very first-Date Homebuyer Offer?

New $twenty-five,000 Earliest-Date Homebuyer Grant was designed to let People in the us overcome among online personal loans MO the largest barriers to homeownership: the fresh new downpayment. The grant brings to $25,000 so you can qualified basic-big date homeowners, that can be used to pay for price of a straight down fee, closing costs, or any other expenses related to to get a house.

The applying is aimed at deciding to make the dream about homeownership a great truth getting countless Americans whom may not have brand new financial resources to store of these initial costs.

According to the Harris campaign, which offer could be designed for number of years, aligning to the next presidential label. The application form is actually projected so you’re able to cost around $100 million over this era, based on the assumption one approximately 4 million eligible homebuyers carry out gain benefit from the system. Yet not, the genuine pricing was high in the event your number of people is higher than it estimate.

Performed the brand new $twenty-five,000 Very first-Date Homebuyer Offer get passed?

The newest proposal is actually put included in Harris’s bigger strategy approach and has become a center point inside discussions on the growing homeownership, eg certainly underrepresented organizations.

Kamala Harris Homebuyer Offer standards

not, an important requisite would be the fact candidates should be first-go out homeowners, meaning they have not had a house in earlier times three years. İncele