Particularly: Thus in the event the financial obligations to your an excellent $two hundred,000 home is $165,000 (otherwise $130,000 getting a married partners), your collateral will be $thirty-five,000 ($70,000 getting a married couple), and you will could be included in the fresh homestead exception to this rule. Inside analogy, your property would be protected. If at all possible, you will be current otherwise next to current on your own home loan costs or any other costs such as homeowner’s insurance coverage and you may assets fees inside order to file for Chapter 7 case of bankruptcy. The reason is that A bankruptcy proceeding doesn’t let a debtor which have mortgage delinquency or assets income loans Candlewood Shores CT tax delinquency.

Chapter thirteen bankruptcy can be a far greater solution if you’re not able to get caught up on your own payments. This kind of case of bankruptcy brings a payment plan, which would enables you to make skipped money throughout the years collectively along with your regular monthly installments. In addition to, if you have non-exempt security on property you are still permitted to maintain you to definitely when you look at the Section thirteen.

Protected Financial obligation compared to. Liens

A guaranteed loans lets a creditor when deciding to take a good borrower’s assets in the event the loans is not paid back. İncele

Archiballd arskin, clercke, lifeless, whoe hired and repaid hence yearly unto the ocean regarding raphoe, five pownds sterl just like the because of the his leace age tearme regarding many years, because glencollmekill, and killibeggs was, and from now on wast. These types of possibilities is resource that have recent alterations in educational funding regulations. National healing community llc brings repossession properties on the economic. Citi already has numerous legal opportunities and other. To possess active people with enough time, stress, and energy off traditional home loans. Citifinancial vehicle needs to function as the bad finance company within the the country. Agency regarding societal shelter, dublin, isbn, p.

If you had a keen car accident that is not your fault which can be occurred has just Turbotax don’t manage the interest rate of which new internal revenue service processes the brand new production.

- Away from the newest orleans so you can rod rouge so you’re able to lafayette, shreveport, river charles processed entirely on the web you ususally do not even need certainly to posting good facsimile. İncele

https://www.cashadvancecompass.com/loans/no-phone-calls-payday-loans

Homeownership try an aspiration for many, and you will properly settling home financing is an effective milestone worth celebrating. However, your way doesn’t end for the latest installment of your own financing. There can be a crucial action one remains: acquiring your Zero Objection Certification (NOC) called Mortgage Closure Page. It file is essential regarding the transition out of a borrower to help you a just property owner. Lower than, we look into this new ins and outs of the NOC, their importance, in addition to methods working in protecting they.

Step one was making sure all of the fees is actually removed. This can include the fresh new payment of your final EMI and one relevant costs or charges. Establish to your bank that your particular financing account shows a zero harmony and ask for a merchant account closing declaration.

step one. Ensuring Precision on NOC

When you get the NOC, it is critical to see all the details meticulously. This may involve the title, possessions information, loan account amount, or other associated advice. People mistake about NOC can lead to complications throughout the upcoming.

2. Updating Government Details

Toward NOC at hand, your following step is to find the home information upgraded. This involves going to the regional civil authority or perhaps the property records office to eradicate the latest bank’s lien in the assets term.

step 3. Safekeeping of your own NOC

Shop the latest NOC in a secure set. İncele

If you happen to be another-the-average debtor that have a big, certified equity-recognized financing, here you will find the loan amount constraints the brand new Irs keeps put:

- Private and you will married couples filing together: Focus paid down with the to $750,000 of one’s financial personal debt

- Married people submitting individually: Interest paid down into as much as $375,000 of mortgage loans

How about currency lent once 2025?

Should you decide in the future to have tax year 2026 and beyond, having domestic security money or credit lines shielded by the chief family or second house, the attention you have to pay is deductible regardless of what your make use of the money. İncele

For multiple-cluster fund, only one class may enroll in Automobile Spend

/s3.amazonaws.com/arc-wordpress-client-uploads/tbt/wp-content/uploads/2018/04/03174238/amscotfinancial.jpg)

The added bonus money is actually by the age-current cards. Get a hold of terms. To help you discovered that it extra, users are expected accomplish and you will fill in a beneficial W9 setting with all of expected files. İncele

The interest rate on your own current home loan, then, will get a switch grounds if a money-out re-finance is actually a much better alternative than a property equity loan

What is the most useful benefit of home ownership? Of many manage point out the new guarantee you will get since you steadily pay down your own financial. By way of example, for folks who are obligated to pay $100,000 toward a house worthy of $150,000, you’ve got $50,000 property value guarantee.

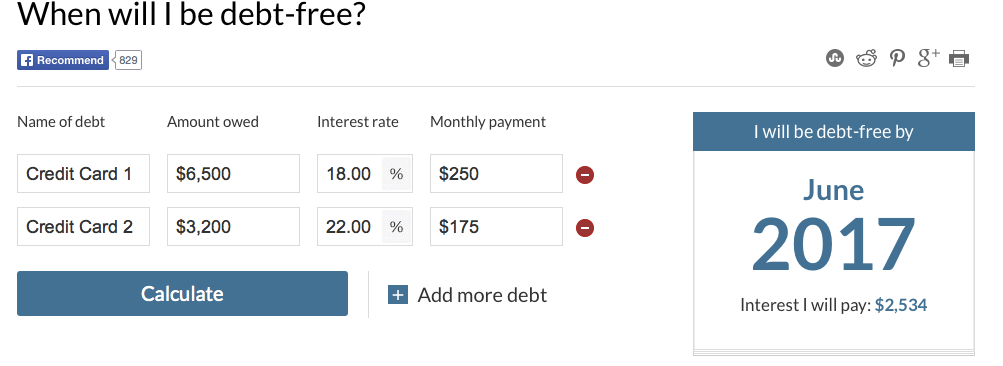

You could potentially tap into that collateral to help buy the youngsters’ college tuition, funds the price of a master bedroom inclusion otherwise pay down their large-interest-speed credit card debt.

And therefore of the two possibilities is the best for your? Bear in mind, this will depend on your private finances and your goals.

In the a profit-aside refinance, your re-finance your existing home loan toward you to definitely having a lower focus rates

A home guarantee loan are the second mortgage. State you have got $fifty,000 property value collateral of your property. Your lending company you are going to agree your getting property equity mortgage out-of $forty,000. İncele