The speed can change based on the benefit, definition it does increase on account of inflation and other affairs that apply at rates of interest.

I suggest HELOCs and household collateral funds so you’re able to young members just who must availability a bigger sum to have home improvements on their homes and who have the capacity to solution the additional loan payment every month.

How come a reverse home loan works?

A reverse financial allows you to borrow on their home’s collateral if you’re at least 62 years old. It minimum decades demands is obtainable given that reverse mortgage loans are made to help elderly people complement the old-age earnings.

In place of a vintage financial, opposite mortgages none of them monthly premiums. As an alternative, the loan is reduced when specific situations exists, such venturing out, promoting our home, otherwise dying. Attention and you may costs accrue on the a fantastic balance, and that develops over the years.

You’re not expected to create monthly obligations, however, you may be however accountable for keeping up with your residence taxation and you will fix to guarantee the domestic resides in good shape. İncele

This can probably require that you disperse financial investments from 1 caretaker to a different, but not, brand new deals and you can self-reliance the newest SBLOC providing brings might be really worth the flow.

Just remember that , the speed is only one of everything your can be given. Other things to adopt try improve rations, the latest lender’s rules as much as maintenance calls, their track record when you look at the switching credit requirements, and how usually they have had to suspend a line of borrowing from the bank.

Speaking of commonly according to a perfect credit rating, reduced debt-to-earnings ratios, and other affairs. It is extremely important to see all of the charge associated with the fresh new credit line. These can easily add up and in some cases, a lender could offer a lowered rate of interest but have high charges.

Finding the right speed may also imply that you might have to switch a few things particularly reducing your overall personal debt, boosting your credit score by a number of situations, otherwise waiting for you to definitely strategy you have been pregnant at work. İncele

New Fl FHA Good neighbor Next-door System is a federal effort designed to let certain area services gurus and acquire homes during the good deals.

So it FAQ point often target preferred questions about the program’s eligibility criteria, experts, and also the application processes, seeking to give clear and actionable suggestions.

Table from Information

- What is the Florida FHA Good-neighbor Nearby system?

- System eligibility criteria

- How come the applying really works?

- What are the advantages of participating in the application form?

- Who’s eligible for the brand new Fl FHA Good-neighbor Next door program?

- Just how to submit an application for this new Fl FHA Good neighbor Nearby system

- What types of services qualify on the program?

- Do you know the capital alternatives for functions beneath the system?

- Can be players offer the property through to the needed occupancy months ends?

- Summary

What is the Fl FHA Good neighbor Across the street system?

The fresh new Florida FHA Good neighbor Next door program provides a clear purpose – to bolster organizations by the permitting very important personal experts eg coaches and law enforcement officers own home.

The application offers large deals some dough regarding residential property so you can encourage these professionals to reside places where the average earnings is lowest to help you moderate. This helps improve people stronger and you can advances relationships from the neighborhood.

System qualification standards

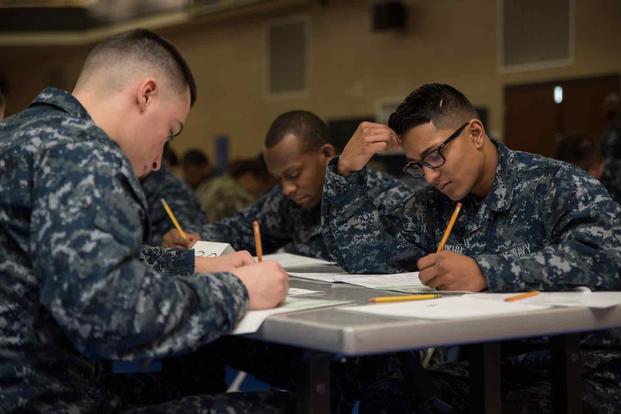

The fresh new Florida FHA Good-neighbor Nearby program supports community-boosting advantages, as well as educators, EMTs, firefighters, and police officers, in the homeownership.

In order to qualify for installment loans online West Virginia the Fl FHA Good-neighbor Nearby system, you ought to have a certain job. İncele

A guide to homeowners’ insurance coverage if your home is broken or if you rating sued to own another person’s wounds. Be sure to have enough to cover the most likely or costly disasters.

Ahead of signing a property pick, the vast majority of buyers plan for homeowners’ insurance policies on their the property. For example visibility is important for a few factors: First, as if the brand new homeowners are taking out fully an interest rate, the lenders will require these to buy about a reduced quantity of “possibilities insurance coverage.” Second, it caters to to safeguard the latest homebuyers’ private hobbies; not merely for destroy toward house, however, once the fundamental coverage also incorporates individual accountability insurance rates and you may a lot more possibilities exposure (more than the lending company demands). İncele

An alternate forecast to own mortgage cost predicted one to costs you can expect to , that’ll activate the actual property business while increasing family conversion process.

At the moment, the newest U.S. casing pered of the a mix of restricted catalog and you may cost pressures to possess homebuyers. A decrease inside financial pricing you will improve both of those individuals products however in different methods.

In this article, we are going to give house consumer techniques for 2024 and you may 2025 to aid you make an even more informed choice according to what is happened into the the business and you can what’s expected to happen in the upcoming weeks.

Forecast: All the way down Home loan Costs As a result of 2024, Towards the 2025

To the July 19, experts away from Freddie Mac composed an upgraded home loan rate anticipate having 2024 and 2025 on You.S. savings and you can housing market.

Freddie Mac computer is just one of the one or two authorities-paid companies (GSEs) one to get money off mortgage lenders to shoot exchangeability towards the business. Fannie mae is the most other GSE. Freddie Mac also has several economists and you may analysts one to article on housing .

“I invited a rate slash towards the end of the year if the employment market cools off enough to keep rising cost of living from inside the glance at. This speed slash, if it happens, could lead to a little reducing of mortgage pricing from inside the 2024, giving a glimmer out of hope for possible customers.”

Looking beyond you to definitely, Freddie Mac’s experts said that it expect financial rates so you can , dropping lower than six.5% normally. They believe this will then turn on the actual house industry of the while making homeownership more affordable for lots more Us citizens. İncele

forty-two Get a hold of 50 You.S.C. 3955. Creditors ought to be familiar with SCRA specifications out-of tax obligations, including fifty You.S.C. 3991, 4001(d), and 4021. forty five 50 You.S.C. 3957

51 Find in the challenge out-of U.S. Financial Federal Organization, Consent Order, 2013? CFPB?0003 () plus in the challenge of Dealers’ Financial Properties, LLC, Agree Buy, 2013?CFPB?0004 () (CFPB so-called one You.S. Lender and you will Investors Monetary hitched to need servicemembers to settle subprime car financing by allotment and you will, on top of other things, didn’t disclose costs, didn’t properly reveal commission dates, and you may misrepresented charges for incorporate-towards the products); Individual Monetary Defense Bureau mais aussi al. v. Freedom Locations, Inc. mais aussi al., Civ. Step No. 2:14-cv-643-AWA-TEM (Age.D. Virtual assistant.), Complaint () (CFPB, for the attorney standard regarding North carolina and you will Virginia, so-called you to definitely a store and you may related financial institutions unlawfully double-dipped by using repayments thru each other good servicemember’s allowance and you may lender and other required back-up membership in the same few days, and you may if not engaged in unfair or abusive business collection agencies means, such including nonnegotiable conditions inside the mortgage agreements mandating you to definitely conflicts end up being solved in the a faraway place awkward having servicemembers); plus the matter out-of Fort Knox National Organization and you will Military Guidelines Co., LLC, Consent Purchase, 2015-CFPB-0008 () (CFPB so-called one armed forces allowance processors did not reveal fee quantity having residual balance during the allotment accounts additionally the proven fact that charges was in fact billed).

Within this Question

- Keeping Fintech Reasonable: Contemplating Reasonable Credit and you will UDAP Risks

- Servicemember Financial Safety: An overview of Trick Federal Statutes

- Regulatory Calendar

- Development away from Arizona: Regulatory Reputation

- To your Docket: Current Federal Judge Feedback

- Calendar of Events 2017

Contact us

Copyright laws Federal Put aside System. İncele

Press release

The Honourable Chrystia Freeland, Deputy Primary Minister and you will Minister away from Funds, today revealed a suite of reforms so you can financial laws and regulations making mortgages economical for Canadians and place homeownership at your fingertips:

Canadians bust your tail to be able to pay for a property. But not, the high cost of mortgage payments are a boundary so you can homeownership, specifically for Millennials and you can Gen Z. To simply help so much more Canadians, eg young generations, get a primary household, new financial statutes came into affect ortizations having earliest-go out homeowners to order the brand new makes.

The Honourable Chrystia Freeland, Deputy Finest Minister and you will Minister off Fund, now established a room of reforms so you can mortgage laws and regulations and make mortgage loans less expensive for Canadians and put homeownership within reach:

- Raising the $one million price cover to have covered mortgage loans so you can $step 1.5 mil, effective , in order to mirror current housing marketplace basic facts and help a whole lot more Canadians meet the requirements for a mortgage with a down-payment below 20 percent. İncele

Yet not, you may also have to report some otherwise the mortgage continues because income, that enhance your income tax responsibility

step three. The fresh judge standing of your homes. This new court standing of homes is the ownership and you will label of the homes, along with any liens, encumbrances, easements, otherwise limits that will affect the land. You should make sure you have a clear and you may valid identity with the home, and thus you are the rightful manager which here are no other claims or issues over your own homes. You should also ensure that your property is free of charge of people liens, being expense otherwise personal debt which might be connected with their land, for example mortgage loans, fees, judgments, otherwise mechanics’ liens. İncele