FHA-supported mortgage loans try popular options for very first-go out homeowners and you may borrowers with a high loans otherwise the lowest borrowing from the bank get. Sometimes, FHA funds render a route to homeownership having people who or even is almost certainly not capable see a home loan.

But not, the new Government Property Administration’s mortgage system has its own limits, especially FHA loan restrictions. This information covers how much currency you might acquire from a keen FHA financial because of the extracting the current FHA financing constraints in 2024.

Trick Takeaways

FHA financing limits are different by state and vary from $498,257 to help you $step one,149,825 having an individual-home into the continental All of us.

Maximum loan quantity differ by sort of property. FHA multifamily mortgage restrictions are greater than the individuals getting single-family property.

Irrespective of local limitations, you nevertheless still need the money to help with the mortgage you might be implementing getting and may plus satisfy basic FHA conditions.

The absolute most to possess a keen FHA mortgage may vary in accordance with the kind of household you might be to shop for and its particular venue. İncele

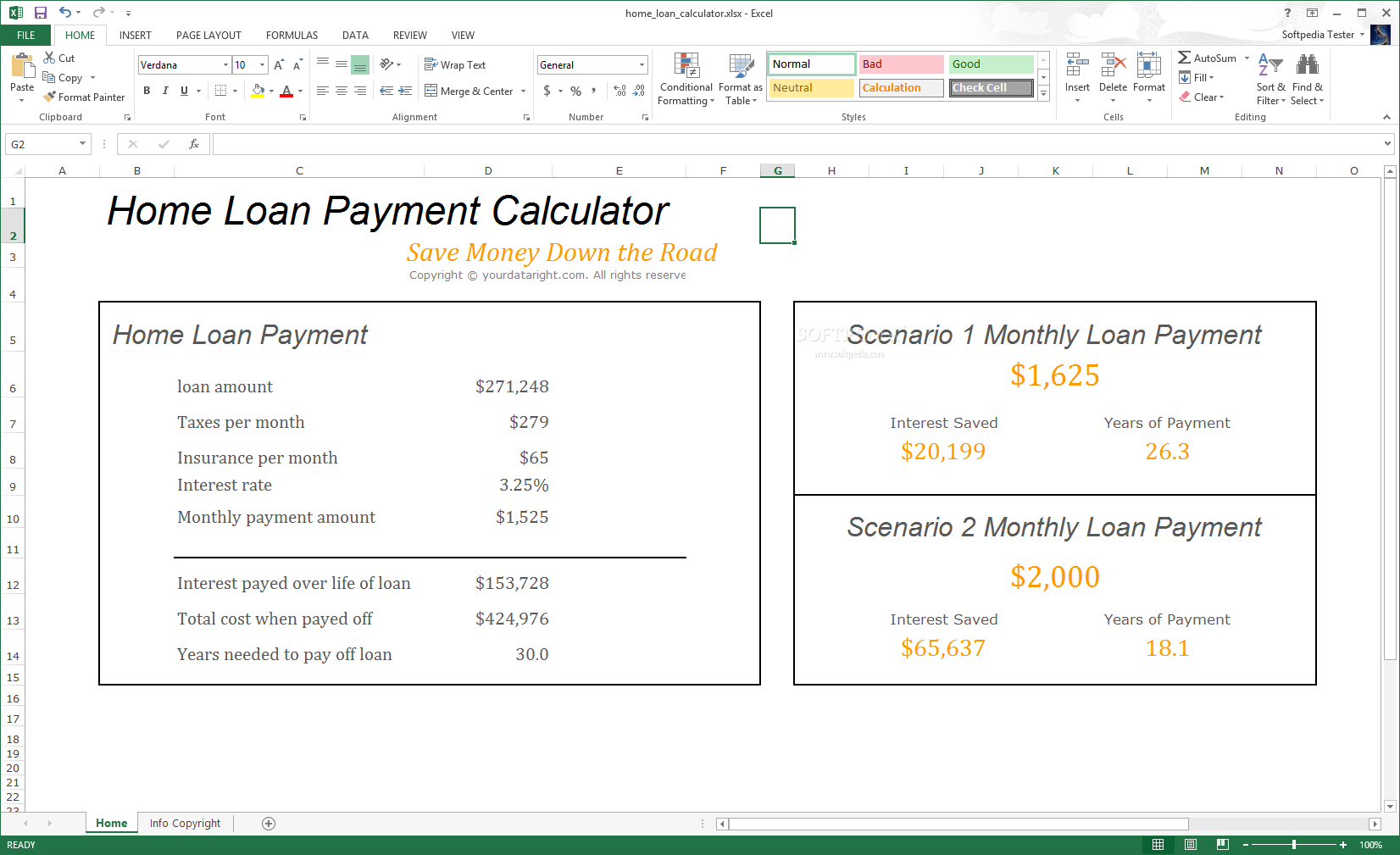

Regarding borrowing currency, home owners is at a plus today. Prices towards signature loans, mortgage loans and other lending products are greater than these people were several years back – but the strange economic climate one to led to those people highest cost even offers led the common homeowner to have hefty quantities of guarantee in their home.

With home owners that have an average of nearly $200,000 during the tappable home security on their hands, they can borrow secured on they for mission . For example, your property collateral is going to be lent up against to help you combine debt, build family renovations, pay money for school or training costs otherwise shelter almost every other huge expenditures. And, also, household collateral fund usually incorporate reduced rates of interest than what’s considering to the handmade cards or any other lending options.

Having said that, there are a few obstacles to dive owing to when borrowing from the bank from the house’s security, like the appraisal process . Much like to invest in a property, getting a property guarantee loan usually pertains to a thorough assessment off the fresh new property’s really worth. It is it it is possible to in order to safer a home equity loan as opposed to in the process of the new appraisal procedure? And you will exactly what are the choice?

Should i rating a home security mortgage instead an appraisal?

Conventional house equity financing encompass credit a lump sum payment contrary to the security of your home. To search for the loan amount, lenders generally speaking require a specialist assessment to assess the modern market worth of your home. That it appraisal helps to ensure your loan amount aligns to the property’s value while the lender’s risk threshold.

However, when you are traditional loan providers generally wanted an assessment having house equity funds, particular creditors may offer solutions that do not cover the full appraisal process. İncele

So it declaration discusses the issue out-of subprime mortgages, which are financing lengthened to borrowers with poor credit users

Subprime mortgage loans entail higher risk off delinquency and you may default. Latest increases when you look at the subprime borrower property foreclosure and you will financial bankruptcies has prompted inquiries you to particular lenders’ underwriting assistance are way too shed and therefore certain consumers may not have comprehended the risks of one’s mortgage points they chosen. Regulatory businesses are revisiting new suggestions they provide lenders and therefore are reevaluating called for disclosures so you’re able to people. Likewise, Congress is holding hearings on the subject and could believe consumer protection laws and regulations.

Purchase Code RL33930 Subprime Mortgage loans: Primer on Newest Credit and you can Foreclosure Facts Edward Vincent Murphy Expert inside the Financial institutions Government and you can Loans Division Subprime Mortgages: Primer to your Newest Credit and you cash advance Colorado Red Feather Lakes can Foreclosure Affairs Realization Subprime mortgages is actually fund expanded so you can consumers that have weakened borrowing users. İncele