Refinancing your house financing are one-way out of taking control of your own debt making offers or develop wide range. But there are various what you need so you’re able to weigh up before you’re taking the fresh leap.

Doing so can assist you to possibly make discounts or power their wide range progress. However, like other some thing in the currency industry, refinancing is pain you if you are not careful, so are there a few things you should consider prior to refinancing your property financing. İncele

Understanding the loan fees options is essential when taking away a beneficial mortgage. A few popular options are dominant and you may desire (P&I) and focus-simply (IO).

Selecting the most appropriate home loan payment alternative feels daunting, particularly when comparing dominant and you may interest (P&I) that have attention-just payments. Each other choices possess the pros and cons, therefore it is important for residents and you may buyers understand the fresh new specifics.

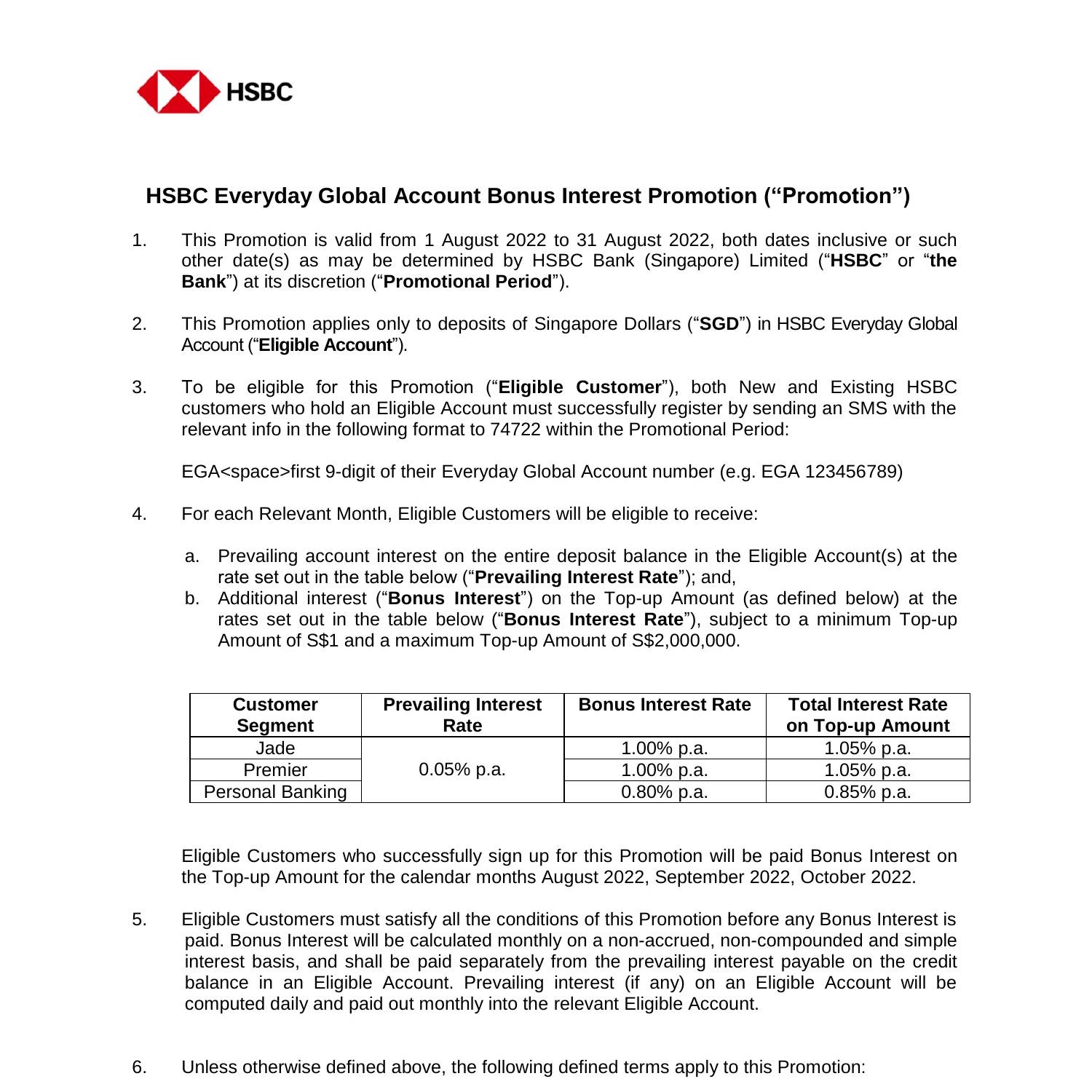

Inside a primary and you may focus loan, you may be chipping away in the both amount you’ve lent (the main) and focus that is stacking right up. Its some time eg a steady ascend, gradually reducing your balance and obtaining you closer to at some point possessing your residence outright. On the other hand, with an intention-simply financing, your initial costs are only covering the attract the principal does not policeman a reduction. Although this might seem particularly a breather to suit your bag from the earliest, you aren’t indeed taking people nearer to getting your property throughout which notice-just period, as the you are not strengthening people security of your home.

What’s dominant and attention?

Principal and you will interest repayments (P&I) will be the most typical brand of financial installment. For each and every percentage you make goes for the decreasing the dominant (extent lent) and desire charged by the bank. Very first, a bigger portion of the cost covers the attention, but through the years, since the prominent decreases, the interest component decrease, and more of one’s percentage happens into paying down the principal. İncele

Objective: Which have rates rising, Tanya keeps seen their unique rates move from step one.94% so you can 6.80% in about per year. She expectations to ensure this woman is towards the lowest rate you’ll be able to without paying more she has to.

Problem: Tanya phone calls their present bank California title loans and you may needs these to bring their unique a much better interest on her financial. She desires new pricing which can be claimed on their site. It regret to inform her that they don’t help since cost on their website are restricted to the financial users & she is currently towards top they could render.

Solution: Shortly after sharing his problem with a work colleague, Tanya is known their own colleague’s large financial company, Mortgage Professionals, which specialize in home financing getting medical professionals. They carefully analyse their own condition & the business to find their particular a knowledgeable package. İncele

According to their webpages, For the 2022, Federal national mortgage association let the credit around dos.6 million family purchases, refinancings, and you can leasing tools.

Obviously, they holds a serious reputation regarding financial sector. And it’s really that business all domestic client will likely be familiar with. But what exactly lies at the rear of which economic giant?

Keep reading even as we delve into the variety of financing circumstances Fannie mae also provides. We will help you have decided if the this type of choice line up along with your means assuming you meet with the qualifications requirements.

What is actually Federal national mortgage association?

Fannie and its own absolutely nothing brother, Freddie Mac computer, try bodies-paid businesses (GSEs). İncele

Day Published:

Tiny property are common the brand new frustration nowadays. With an increase of some one seeking downsize its lifetime, such absolutely nothing houses was preferred one of residents and you may clients exactly the same. But not, one of the biggest obstacles many anybody face of trying to buy a little home is how they will have a way to invest in they. On this page, we shall discuss some various methods you are able to making your perfect become a reality!

Why don’t financial institutions such mortgage loans to loans Branford FL the lightweight property?

Banking institutions lend money on mortgages in line with the property value the new underlying safeguards. In other words, they know a property to your a paragraph deserves, say, $800,000 today. They’re going to thus give 80%, possibly ninety%, on these properties. The problem with lightweight properties is they are incredibly effortless to eliminate. The financial institution doesn’t have make certain the small domestic they fund today would-be truth be told there tomorrow. One higher truck is also eliminate an excellent $50k-$200k resource regarding assets.

Aren’t garages effortlessly removable? Banking institutions often money all of them.

This is an excellent point. Garages was an easy construction that will, in theory, be easily got rid of. The main distinctions try one small land usually are towards rims ie; he is made to be easily moved while garages include fixed so you’re able to a tangible pad. İncele

Of course, usually the one clear caveat on the economic considered direction is the fact users which put too much into their household could become home-steeped and cash-terrible

Furthermore, more cashflow freedom once a beneficial recast homeloan payment can be probably increase future employment flexibility and improve the household’s full monetary stability. Including, down coming home loan repayments supply the debtor much more freedom to improve efforts otherwise professions (that may wanted one to earnings step back when planning on taking a few procedures forward), and also in a scene in which medical events that can cause quick-identity (or much time-term) disability try a leading cause of case of bankruptcy, which makes it easier to minimize month-to-month mortgage obligations has got the potential to reduce home loan standard chance first off.

On lender’s perspective, making it possible for automated recasting is also enticing, due to the fact recasting extra to own home loan prepayments (to attenuate coming mortgage payment debt) create lead to down mortgage stability, and you may better family guarantee towards borrower, and this reduces the exposure of the lender so you can a financial losings if there is a standard installment loan Eagle. İncele

Yarilet Perez is actually an experienced media creator and truth-checker having a master away from Technology in the Journalism. She has has worked within the multiple urban centers covering cracking development, politics, education, plus. Their systems is within private loans and you can spending, and you may a house.

The realm of take a trip has evolved significantly in the past several years-accommodations today aren’t usually the best choice for the majority of website visitors, especially parents. Short-title vacation rentals like Airbnb, VRBO, and you may Vacasa is going to be a good way having personal customers to help you enter this new hospitality video game. But not, unless you’re trying to find leasing your top residence, to find property which is attractive to visitors ‘s the first rung on the ladder in the act.

For people who already own a home, you have a good product to have capital that assets: your residence equity. A house security financing is a viable style of obtaining a substantial down payment personal loan Carolina on the brand new investment property.

Secret Takeaways

- Home collateral finance borrow on this new equity of your property having a lump sum payment of money.

- Money from a house security mortgage are used for anything, including to invest in other real estate.

- With cash will help make international possessions commands easier.

- A home guarantee mortgage is much like a personal bank loan, but a property equity loan try backed by the newest collateral in the your residence, in the place of a personal bank loan that is unsecured.

What is actually a home Guarantee Loan?

A house collateral mortgage is dependent on brand new guarantee that you’ve manufactured in your residence. Guarantee depends on the present day worth of your residence minus the total amount you borrowed from in your financial. İncele

Short-title mortgage loans along with normally incorporate all the way down rates of interest as you can be pay the loan quicker. Normally, the new shorter a loan provider has to waiting to get their currency straight back, the reduced its risk, allowing them to promote down rates within these funds.

Thus, individuals save on need for a couple of suggests. To begin with, they will certainly pay faster in notice along side life of the mortgage since they’re going to simply have financing for ten years. Following, it help save much more that have lower rates than simply 30-season mortgage loans.

Not all individuals commonly be eligible for quick-title mortgages. Because they need highest monthly payments, loan providers need believe affairs such earnings, property, expenses, DTI, and you will credit history to choose when someone is approved for those style of funds.

Understand that even if you try not to qualify for a great short-name financing, you might still qualify for a long-title financial.

How come a preliminary-Name Home loan Works?

A short-label financial really works similarly to an extended-label mortgage. However, since the term is smaller, you’ll be that have big monthly payments. Without a doubt, how precisely the short-label financial functions commonly mainly depend on the type of financing you are taking away. As an example, Non-QM money features additional qualifications conditions than just conventional financing.

In any case, you’ll be accountable for monthly premiums to cover the principal, attract, taxation, and insurance coverage away from a mortgage.

Their overall payment per month are different according to variety of home loan. Yet not, new reduced brand new cost months, the higher the monthly payment could well be, so it’s value calculating whether or not you can afford a primary-label home loan. İncele