Appeal repaid is generally associated with the affairs for example finance and you will credit cards

Notice received

Attention that’s achieved over a period of date is well known once the notice earned. Constantly made on the individual account, desire obtained is a reward for account residents to carry on to lay their money in the a certain account. The amount of attention you get depends on the kind of membership and interest.

Coupons profile

Offering you the capability to achieve your coupons specifications reduced, discounts account can come with introductory rates of interest into the first couple of months of your own membership becoming established or added bonus interest if the you satisfy particular conditions. Interest percentage is calculated according to research by the amount of loans from the membership. The more the sum of the funds regarding the membership, the greater attract you get. Look for our family savings choices to choose the right savings account for your existence.

Identity deposits

Name dumps was a far more attractive option if you are looking in order to increase their money along with your deals. Giving fixed, but higher, rates of interest, a phrase deposit has the benefit of big increases away from rates. İncele

Navigating the loan landscape are difficult, plus a small supervision can cause high economic consequences. Luckily for us, your judge knowledge hones your own logical and you can problem-solving feel, allowing you to pick potential downfalls and avoid costly mistakes. In the event it concerns assessing the new trustworthiness off home loans, knowing the implications out-of changeable-rates mortgage loans, otherwise pinpointing predatory financing methods, their judge acumen can protect debt passion and prevent too many expenditures.

Regarding obtaining home financing, lawyer and you will lawyers can take advantage of certified home loan software designed on their unique demands. These programs offer benefits such as for instance straight down interest rates, quicker charges, and much more positive terms. If you’re a lawyer trying maximize your mortgage deals, here are four lawyer financial software worth taking into consideration:

Attorneys Loan Programs:

Of a lot lenders bring personal loan apps specifically made to possess lawyer. These types of programs have a tendency to offer competitive interest rates, flexible underwriting conditions, and you will smaller down-payment requirements. Some lenders might even offer discount closing costs otherwise waive individual financial insurance rates (PMI) to own licensed attorney consumers. You may want to analyze and compare attorney mortgage apps of more loan providers to obtain the the one that is best suited for your financial specifications.

Bar Organization Home loan Applications:

State and regional bar relationships often collaborate which have loan providers supply financial apps simply for its participants. This type of apps will come with novel professionals, along with deal interest rates, shorter fees, and you will unique capital solutions. Get in touch with your neighborhood pub association to inquire of people available financial software they might features in partnership with lenders. İncele

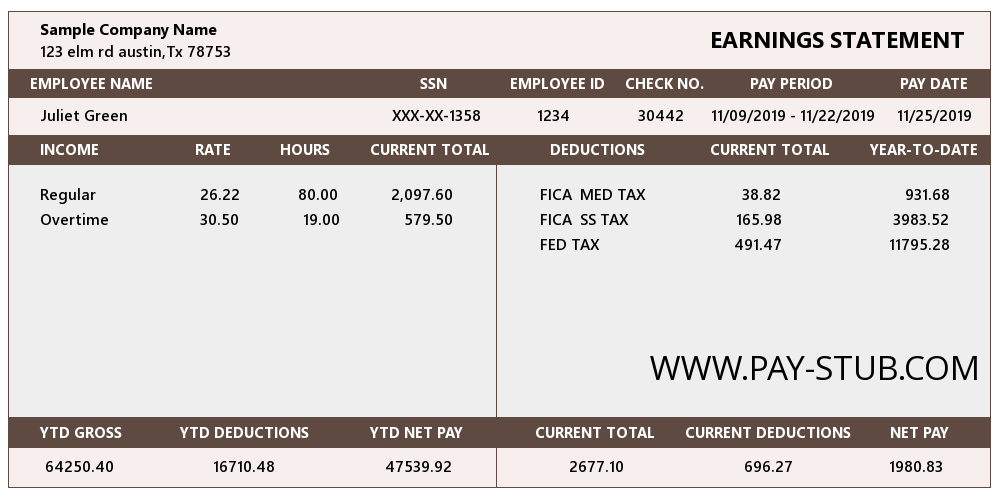

Before you go to try to get a mortgage, that have your entire documents managed is vital. Loan providers will want to find proof your revenue, taxation statements, and you can information regarding people costs you borrowed. They will also be looking the new facts one to contributed to your case of bankruptcy, therefore be ready to offer papers otherwise causes linked to you to.

Collecting your tax returns for the past 24 months is very essential. This type of files provide lenders a definite image of debt record and you may balance. They will certainly make use of this recommendations, together with your newest financial status, to assess whether you’re a great applicant getting home financing. Being organized and you can comprehensive along with your paperwork normally notably streamline the new app procedure.

The brand new Preapproval Procedure: What to expect

Providing preapproved to possess home financing is an important help the home-to order travel, especially post-case of bankruptcy. İncele

What is actually a nursing assistant mortgage?

No, part of the issue is you to nurses in the united kingdom generally performs into NHS and their incomes will likely be wacky. A nurse has lots of other allowances: shift allowances, big area allowances and lots of something else on your payslips.

Do you know the qualifications requirements to have a nursing assistant looking to get home financing?

The brand new standards having mortgages are identical for everyone. You need to have a good credit history, but not necessarily an excellent score, because we’ve got covered of an additional event. Loan providers you want the ID, and we will need to assess your income and you can whether or not you’ve got any life insurance, important disease policies otherwise Wills set up.

Which allows us to after that suggest for the borrowing from the bank we could receive. We had take a look at the forms of money including, every shift allowances therefore get inquire about extra documents to verify you to definitely. İncele

Although this no-put plan would not be suitable for very first-time people, it may be a convenient way of to shop for so much more possessions versus saving otherwise attempting to sell up!

So it route pertains to releases equity off another assets you own to use a deposit with the yet another set. To achieve this, you would have to remortgage your existing assets.

Signature loans

Another type of route with the owning a home that you will find believed are getting a personal loan. Although not, these types of fund are described as unsecured loans that can come with significantly highest rates of interest and requires as paid off straight back more than less time months.

From the sight out of lenders, individuals with this personal loans are thus will recognized as highest risk, which makes them an unsightly applicant. While it is true that signature loans have a big effect to your an applicant’s value, specific lenders will nonetheless believe providing mortgages to those ambitious people.

Handmade cards

Playing cards are similar to signature loans in this loan providers tend to take a dim look at applicants credit money to make use of as his or her deposit. not, playing cards aren’t have a tendency to always make up the complete deposit.

Rather, they are additionally familiar with increase dollars places to possess folks who are concerned with how big the deals Gaylordsville payday loans no credit check. Just like applicants which use unsecured loans to increase their put, yet not, fewer loan providers may be willing to provide you with a home loan.

If you currently book a beneficial council property, but are eager to be a homeowner, then you can should discover more about the brand new government’s Correct to invest in program. İncele

In the event the Donald Trump gains the brand new presidential election, Republicans promise he’ll fulfill a historical GOP goal of privatizing the borrowed funds beasts Fannie mae and you may Freddie Mac computer, that have been lower than bodies control due to the fact Higher Market meltdown.

However, Democrats and lots of economists alert one, particularly in this time of highest mortgage prices, doing this will make to get a property a lot more costly.

Republicans participate this new Federal Houses Loans Agency could have been supervising the newest a couple businesses way too enough time, stymying race regarding houses money sector when you are placing taxpayers from the chance is always to yet another bailout feel required, like in 2008. President Donald Trump looked for in order to free both businesses out-of authorities handle when he was at place of work, however, Joe Biden’s earn in 2020 averted the ones from happening.

Democrats concern stop the new conservatorship manage produce financial rates to help you jump just like the Fannie mae and you can Freddie Mac will have to raise fees while making upwards into the enhanced dangers they would deal with instead of bodies help. The 2 companies verify roughly 50 % of the $several trillion U.S. discount.

Enterprise 2025, a hands-on for the next Republican management, is sold with a switch call for the brand new conservatorship to end, in the event Trump enjoys tried so you can range themselves on the 920-page file, which had been drafted because of the long time partners and you may previous officials off his administration.

If the their (Donald Trump’s) Endeavor 2025 agenda is placed to your feeling, it can put around $step one,2 hundred a-year into the regular Western mortgage, Popular presidential nominee Kamala Harris told you during the an analysis from the economists Jim Parrott and Draw Zandi.

.. pressuring them to sometimes boost mortgage prices for those individuals or lend less on them. İncele

Bank and you can Bonus revelation

This is A publicity. You are not Expected to Make any Fee And take One Other Step In response To that Render.

Earnest: $step one,000 to own $100K or maybe more, $200 to own $50K so you’re able to $. To have Serious, for individuals who refinance $100,000 or higher by this webpages, $five-hundred of your $1,000 bucks incentive is provided physically from the Education loan Planner. Rates variety a lot more than has recommended 0.25% Vehicles Spend discount.

Conditions and terms pertain. To qualify for that it Serious Added bonus provide: 1) you should not currently become a serious visitors, otherwise have obtained the bonus previously, 2) you should complete a complete education loan refinancing application from the designated Education loan Planner link; 3) you ought to promote a valid current email address and you can a legitimate examining account count into the application techniques; and you can 4) the loan have to be completely paid.

Might located a $step one,000 extra for folks who refinance $100,000 or even more, or an excellent $200 incentive if you refinance a price out of $50,000 in order to $99,. İncele