Buying an alternate vehicles will be a highly psychological feel. Every sense – well, every but taste – try tantalised when you look at the process, and it’s easy to take a seat and let your thinking take brand new wheel ( the!).

Do not let that takes place. If you feel yourself become sometime foggy, action from the problem and take certain strong breaths to help you soil oneself once more. You dont want to decide as huge as to order an automobile otherwise choosing the right investment towards the a whim; take your time and then make a cool and calculated choice centered with the points, maybe not emotions.

Although this could possibly get slip a tiny away from auto loan’ area, it is vital to understand that the purchase price you have to pay for your the new auto usually indeed have an effect on the funding.

Negotiating can be extremely a tense/nervous feel for many people, with justification: chances are high the fresh new sales representative has exponentially alot more experience within it. İncele

What if you are taking away a loan off $1,000 having an annual interest rate away from 10%. When your interest rate is simple (will not material) after the season, you’ll are obligated to pay $100 ($step 1,000 x .10). Ergo, instead while making costs with the the principal, you’d owe $step 1,100 (the main + interest).

The fresh new computation is much more cutting-edge when writing about compounding interest. The attention try set in the primary at the typical intervals, putting some dominant expand larger once the appeal develops.

When comparing mortgages, rate of interest vs. Apr are two of the most important terms understand once the they change the real price of borrowing from the bank. İncele

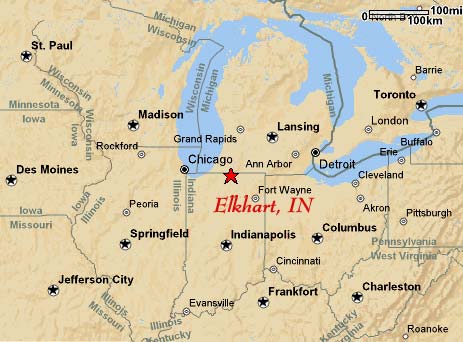

Who’s Eligible for a USDA Mortgage?

Lower income borrowers was an option class the fresh USDA system try aimed at. Retired people could be eligible, according to its income condition, however, working people should be inside money metrics out of the application form or they don’t qualify.

Do you know the Criteria?

The house are purchased might also want to be found when you look at the a great USDA appointed outlying urban area, and you may USDA loan officers can be confirm eligibility from a certain venue. Large residential property commonly greeting. The fresh life assets would be 1,800 sq ft otherwise reduced that have market value below your local mediocre. Further, the funds of your own debtor you should never exceed the low money limitation on the city, for each and every the newest USDA metrics (normally lower than 115 per cent of one’s median earnings to have the goal town).

What are the Costs? İncele

Consumers who aren’t capable set 20 percent off when to order a home is viewed because of the loan providers as increased credit risk.

More 37 mil borrowers aided

Individual MI keeps aided more than 37 million low down https://paydayloanalabama.com/trinity/ percentage domiciles buy property otherwise refinance a current financial because of the improving their ability to get home financing in the an easily affordable method . Personal MI is backed by private financial support, perhaps not taxpayers, for this reason cutting bodies contact with mortgage exposure.

There were many regulatory and you may business-added reforms during the last several years adjust and you will strengthen the part out of private MI on state’s housing money system. USMI’s statement, “Personal Home loan Insurance policies: More powerful and much more Long lasting,” analyzes the different regulatory enhancements and industry-contributed effort that individual home loan insurance agencies have taken and you can still take to verify sustainable financial borrowing compliment of all the sector schedules and you can to higher suffice low down percentage consumers from the traditional business, particularly throughout the times of economic distress.

- Individual Home loan Insurance carrier Eligibility Conditions (PMIERs) – Implemented for the 2015 and you may up-to-date from inside the 2018 and you may 2020, PMIERs nearly doubled the amount of resource for each home loan insurance provider is actually necessary to hold. USMI people with each other keep over $ten.cuatro mil over this type of conditions.

- New Grasp Rules – Set-up which have large input from the Federal Property Money Agency (FHFA), these up-to-date terms and conditions out of home loan insurers to have loan providers promote lenders that have higher understanding about coverage. İncele

Zillow Home loans is an excellent pick getting first-time buyers due to the fact program makes it easy to locate a great domestic and financing it

Exactly what writers such as for instance: According to a reviewer during the Virginia, Ideal Home loan try really responsive and you will short. A reviewer inside Washington loves you to definitely Better try very transparent into pricing, and its lending administrator gave multiple solutions and you may responded to letters timely.

The client services is great, we had no issues bringing a hold of all of our mortgage class

My spouse and i were looking for a less antique, less stuffy financial station, and higher Mortgage suit you perfectly for people, a customer from inside the Ny told you. And all sorts of brand new pricing was competitive. All the information and transparency is truth be told there.

A customer when you look at the The fresh Mexico told you, Most useful was really initial about what they expected regarding myself and you can I became able to bring you to definitely. They did not keep inquiring myself getting stuff-over as well as once more. We enjoyed the whole process. The rate and you will conditions I got have been what I desired. İncele

When buying or promoting a home, there are many details for everybody activities to adopt. Cost, settlement costs, and you will loan terms and conditions are generally the primary discussion factors. Of numerous customers and you can sellers are unaware that they can feel the solution to stop specific funding headaches of the considering a keen assumable loan.

Expertise Assumable Funds

Assumable funds allow homebuyers for taking along side previous user’s financial and you will end spending it well according to the brand spanking new conditions. Some traditional mortgages provides a term that enables them to become assumed, however, that is much less well-known. İncele

a) Brand new note and you can deed regarding trust task secure the the fresh financing. The content of pledge comes with mortgage money, due dates, growth of rates and you can costs, terms to have standard and you will property foreclosure, repair legal rights, while the form of lso are-communicating the new paper returning to the first note holder, now borrower (assignee) if the loan benefits is fulfilled. İncele