Borrowing unions and you may banks is siblings, not twins. That is the best thing. They show an equivalent DNA, however, for every single possess novel and undeniable benefits that will you customize your own banking sense.

To take full advantage of the individuals rewards, you need to know the difference between the 2. Though i creditunion), we believe visitors must have the details they should be economically confident, no matter where they lender. Very without subsequent ado, some tips about what you need to know before you choose a financial institution.

Brand new #step 1 Difference between Borrowing Unions and you may Banking institutions

There are a few issues that lay borrowing unions and you may banking companies apart, but most of them stem from one to main distinction: Borrowing from the bank unions such as Idaho Central perform because the a not any longer-for-earnings, and finance companies work below a for-finances business design. İncele

There’s absolutely no judge restriction on level of co-borrowers into a home loan, however, loan providers hardly take software out of more than four or five borrowers due to limitations to your underwriting application. Trying to get a home loan that have several co-individuals makes it possible for you to receive a more impressive loan, however, things can get complicated whenever multiple individuals is listed on home financing.

In this article:

- What are the Benefits associated with Several Co-Consumers?

- How can you Sign up for that loan Having Several Co-Individuals?

- Exactly how Try a Co-Borrower Not the same as an excellent Cosigner?

There’s no courtroom restriction on quantity of individuals who can implement as one to have a home loan, but the simple limit on most U.S. financing try 4 or 5 consumers. If you’re using as one with individuals can help you qualify for a beneficial large mortgage, you will want to consider all of the ramifications out-of joint control and you may shared obligations prior to making brand new leap.

Do you know the Great things about Multiple Co-Individuals?

When you make an application for a home loan having one or more other individuals, the financial institution takes into account all your valuable income, expenses and you will borrowing from the bank pages in choice. This post is familiar with determine whether the lending company usually procedure the loan, the speed and you will charges to put involved, as well as the count you could potentially obtain.

It’s well-known to own people to use as you to own a home loan whenever to get a home they’re going to show. And it is not completely strange for household members such as longtime housemates to apply for a mortgage to one another. During these conditions, one or more applicant generally benefits from the credit records otherwise economic strength of one’s most other candidate(s):

This short article is exposed to an intensive truth-checking processes. Our very own top-notch fact-checkers ensure blog post pointers against number 1 sources, reputable editors, and you may experts in industry.

I discover payment in the products and services said contained in this tale, however the feedback will be the author’s ownpensation can get effect where has the benefit of come. You will find not incorporated all of the offered products otherwise offers. Find out about how exactly we return and you may all of our editorial procedures.

Choosing which bank to go with when selecting otherwise refinancing a house is Pickensville loans a huge choice you shouldn’t capture lightly. But how do you realize in the event the a loan provider is useful having your? As they are they all legit?

Within this Liberty Home loan remark, you will understand about the organization work, as well as what financing types this has and you can precisely what the consumer experience feels as though. This should help you decide if Freedom Home loan is a great choice for you.

- An introduction to Freedom Financial

- And that financing facts does Versatility Mortgage give?

- Exactly why are Independence Home loan more

- Just what Independence Home loan clients are claiming

- Faq’s about Versatility Mortgage

- Realization to your Freedom Mortgage

An overview of Liberty Financial

Versatility Mortgage Corporation is actually depending in 1990 of the Stanley C. Middleman, whom remains the organization’s chairman and you will Chief executive officer now. It is based within the Attach Laurel, Nj-new jersey, and authorized in most fifty You.S. says, as well as Puerto Rico and the U.S. Virgin Isles. Versatility Home loan is even a member of the borrowed funds Bankers Association as well as the Federal Connection out of Lenders.

Freedom’s objective centers on enabling Us americans achieve homeownership and you will monetary betterment. İncele

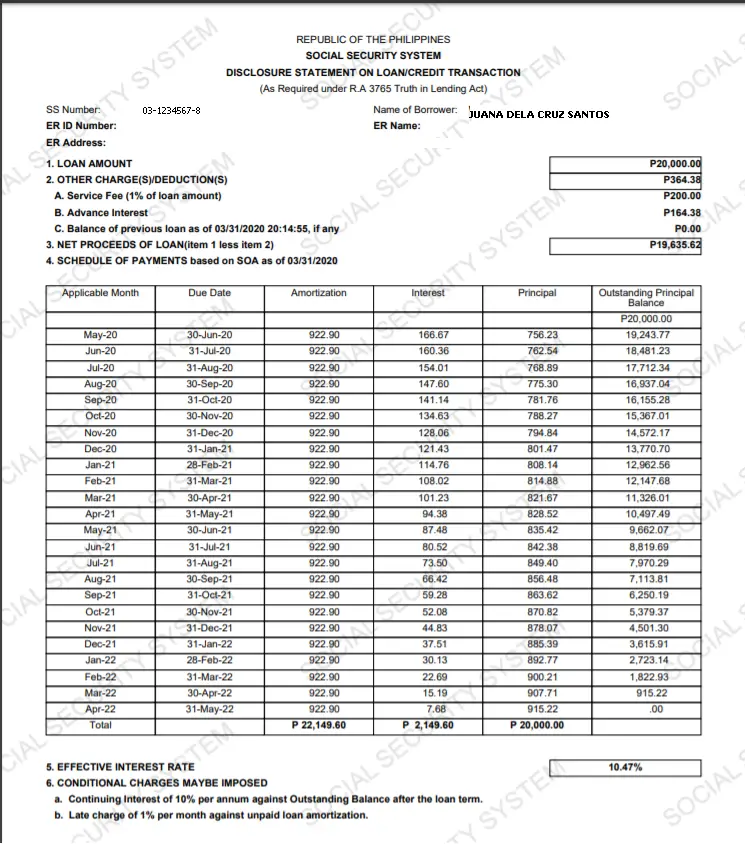

A beneficial refinanced restoration mortgage is when you take aside a loan to suit your repair with most readily useful cost, fees and you may charge so you’re able to pay back a different sort of financing (or funds).

You could combine several fund towards you to put. You could choose to get it done together with your latest provider otherwise type in another arrangement with a brand new you to definitely. It is mostly your choice, a unique begin.

As to the reasons refinance?

A loan with a lower life expectancy rate of interest than youre currently towards the, is practical. Possible decrease your repayment wide variety and could replace your fees terms and conditions. When you yourself have multiple expenses you can pay them out of and you can just use the one refinanced mortgage for easy, single, monthly payments.

Convenience is vital. But value try queen. Don’t re-finance that loan getting repair will cost you unless you’re going to be investing quicker for the full loan. Thus make certain you are round the what your latest full financing payments try, plus contact with charges and better attract. Then you’ll definitely get in the right position to decide in the event the refinancing now is the correct decision for you.

How to re-finance

Making the first strategies towards refinancing their ree once the starting to apply for a personal loan all over again. There are trick questions you really need to address:

Amount borrowed

While it is tempting to inquire of for more than you actually need, it’s a good idea to maximum you to ultimately the necessities – and also the amount borrowed you are refinancing.

Repayments

It’s the perfect time to have an upgrade – can you afford a whole lot more, otherwise lower than your current monthly fees? İncele

Whenever you are looking to a home loan, some issues may seem rather straightforward but it’s usually an effective first off the fundamentals right after which get into the main points. Here are some issues must look into while you are in search of property mortgage lender.

step 1. Are you willing to believe the financial?

From the understanding the union between your amount borrowed while the house collateral loan appraisal, you could make advised ount of money we would like to obtain plus the terms of the loan.

Interest

The speed towards the property guarantee financing is among the most the very first factors to consider when taking aside financing. Increased rate of interest will mean large monthly installments and you will an excellent better total cost out-of credit. The pace to the a house equity financing was determined by a lot of products, like the property value your property.

Fundamentally, belongings having higher appraised viewpoints have a tendency to be eligible for down rates of interest. The reason being loan providers consider home which have high opinions because less risky opportunities. As a result, they are ready to provide currency within all the way down interest rates so you’re able to borrowers which have property that have large appraised values. Particularly, what if you really have a house which is well worth $2 hundred,000. İncele

Certain real-world samples of experienced consumers one to fixed their home financing speed at correct time spoke so you can about their skills, as well as how far repairing spared them.

Dr Diaswati Mardiasmo

Given she holds an excellent doctorate in public areas policy, Dr Diaswati Mardiasmo is most beneficial placed than just very to anticipate the fresh actions of your RBA. İncele