Household Collateral Loans

Are you contemplating dealing with a major recovery? The latest equity in your St. Charles home may be the key to resource. Your home are a very important monetary asset. You should use your home collateral mortgage to repay highest-notice expense, money your baby’s training or safeguards a crisis debts.

It’s also entitled an equity mortgage , or a home guarantee fees loan . House guarantee fund is a means to have people in order to borrow against new security within land. The brand new homeowner’s most recent home loan balance, and house’s well worth, determines the level of the loan . Household equity financing are usually fixed-rates . not, a home security line of credit or HELOC is far more common and has now an adjustable interest rate .

A beneficial St. Charles house guarantee financing has many costs that you need to thought online tribal payday loans. They’ve been the latest settlement costs , rates of interest , assessment costs, and terms. This short article bring a thorough review of house collateral funds and their advantages while the will set you back. Before applying to own a house collateral financing , make sure you discover all fine print. Then you can decide if a loan to your house collateral ‘s the proper option for your.

Interest rate

The borrowed funds calculator will allow you to determine the rate on the a property guarantee financing . This product brings study of a few of America’s extremely esteemed banking institutions and you can thrifts. A $31,000 mortgage could easily be computed using an enthusiastic 80 percent mortgage to help you worthy of ratio. The borrowed funds-to-well worth ratio (otherwise LTV) measures up the degree of their home loan for the house’s value. Loan providers require you to possess collateral of your house, and therefore money was factored to your acceptance procedure.

The initial interest getting St. Charles household security funds are affected by many issues, including your money and you will credit history . İncele

St. Louis Conventional Financing

What is a St. Louis traditional mortgage? A conventional mortgage is a kind of financial that isn’t among the many government-backed financing. Consequently the lending company takes on the risk of lending the brand new money towards borrower, while the loan possess stricter standards having credit history than simply a federal government-supported mortgage.

A reduced downpayment conventional mortgage is present that have extremely aggressive rates and an easy approval procedure. The typical loan benefits on Midwest BankCentre will clearly identify your own selection and help you decide on suitable mortgage kind of for your unique financial predicament.

Conforming against Non-Conforming Traditional Funds

Traditional money are often divided in to a couple of kinds: conforming financing and you will low-compliant finance. Some tips about what you should know in the every type:

Compliant Financing: Old-fashioned mortgage brokers one to meet with the loan constraints lay from the Government Construction Fund Company (FHFA). The fresh new FHFA kits this type of limitations per year according to median home values in the a particular city. İncele

Some one relocate all day long. They could flow to own another jobs, because of an army transfer, or even inhabit an even more beneficial environment.

An universal problem many moving companies face ‘s the need to get another type of household while you are getting another. They both takes sometime to have land to offer, and you may waiting to buy an alternative household may not be convenient or you are able to-you might like to be turning over spending!

Whenever you are curious how exactly to buy a house if you find yourself possessing a different one, the following are a number of options to look at.

Use a connection Loan

Link funds are commonly regularly get the fresh house whenever man’s most recent property have not offered. İncele

Whenever restructuring a homes loan to the long lasting capital, I do not believe that you’re re-utilising the credit history

If this try brand new monies and making use of an equivalent credit file, after that yes, I do agree that the fresh revelation was again necessary regardless of if it will be the exact same credit history/report https://paydayloancolorado.net/edwards/ used.

A zero-cash-out refinance is actually an alternate loan purchase started because of the good individual for a customer goal, as well as the observe will become necessary in the event an earlier obtained score is employed. The main disclosure happens when the rating are gotten.

However, zero this new currency becoming advanced if any the fresh credit history being taken in the fresh purchase will not exempt this new revelation away from getting provided.

You’re simply lso are-composing established borrowing from the bank

Individuals whom can make otherwise organizes funds and just who uses an effective consumer credit rating, as the outlined during the subsection (f) on the area, concerning the a software started otherwise looked for by the a buyers for a closed-end mortgage and/or organization from an unbarred prevent loan to possess a customers objective that’s protected by 1 so you can 4 products out-of home-based property (hereafter in this subsection described as the brand new “lender”) will supply the following the to your consumer as soon as fairly practicable:

One of India’s best public markets banks, Financial off Baroda (BoB), keeps revealed the fresh new discharge of BOB Ke Performed Tyohaar Ki Umang strategy ahead of the festive season – significantly less than and this financing applicants can get home financing, car loans and personal fund from the glamorous interest levels. The financial institution told that the unique financing also offers will run till . The bank along with revealed brand new discharge of four brand new offers levels which will give account-people a host of pros and you can attractive interest also provides on home, automobile, private and you may training loans. The lending company together with reported that ahead of the of the festive season it’s got tied that have greatest electronics, travel and you may dinner brands to add festive offers and discounts to own their debit and you will borrowing cardholders. Here are the current financing interest levels being offered of the Bank of Baroda –

Financial off Baroda Lenders

In the festive months render, Financial out-of Baroda can give home loans starting from 8.forty percent yearly. The bank also waive of operating charges with the family financing.

Lender from Baroda Car and truck loans

In the BOB Ke Carried out Tyohaar Ki Umang promotion, monthly installment loans for bad credit direct lenders Texas the lending company will offer car and truck loans starting from 8.70 percent per year which have no control commission. İncele

Credit Advice and Credit history Conditions

USDA funds has pretty flexible borrowing from the bank direction, and qualify having a credit score given that lower once the 620. However, it is vital to keep in mind that the rate of interest could be high in the event your credit score was less than 680.

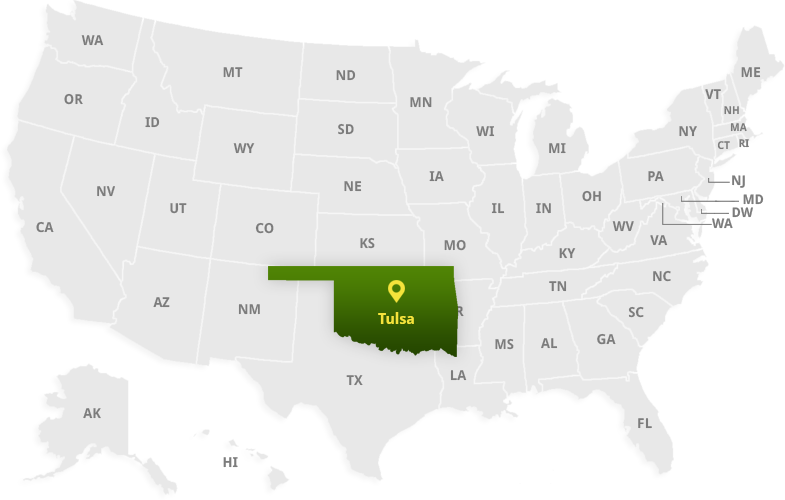

Where try USDA lenders readily available?

USDA mortgage brokers come in 97% of the United states, along with Corpus Christi. The house should be located in a selected outlying area for the order to meet the requirements. İncele

Desire about United states Area Court to the North Area of Colorado In advance of STEWART, Master Court, and you can King and you will DENNIS, Circuit Evaluator. Queen, Circuit Court:

The lending company submitted it lawsuit seeking a judgment and can foreclose, while the borrower asserted affirmative defenses and you can good counterclaim alleging multiple abuses loans Leeds AL of one’s Tx Constitution’s domestic collateral mortgage conditions. Discovering that using a several-season statute of restrictions was a student in mistake, i VACATE and you can REMAND. İncele

A long home loan name will make the monthly premiums shorter once the the main was spread-over longer but you’ll shell out alot more for the focus over the lifestyle of the mortgage.

Let’s say you may be credit 360,000 to acquire good 400,000 brand new build and you also safe a predetermined environmentally friendly speed off step three.45pc toward basic several years. If it mortgage is spread over twenty five years, their month-to-month installment manage amount to 1,792 and you may might spend overall interest off 177,781, incase the speed existed a similar on the deal, based on calculations by Joey Sheahan, head away from credit at the online agents .

For people who took away a thirty-year financial for the same matter, the monthly costs carry out lose so you’re able to step one,606 nevertheless do shell out 218,350 in total attention: that is 40,569 more than if you’d stuck towards the twenty five-year bargain.

If you had a beneficial 35-year mortgage, their home loan repayments create end up being significantly more comfy, in the 1,477 thirty day period, Sheahan’s figures tell you. However would be paying total attract from 260,523 along side life of the loan, for individuals who did not grab any scale to reduce the term. İncele

You desire a challenging currency financing when you look at the San Bernardino? Once upon a time, you requisite proof good money and you will a good credit score and you will record. Because of the boost in hard money funds as a consequence of reputable San Bernardino individual difficult currency loan providers particularly California Hard Money Lead, a residential property improve is a selection for you even though you has actually a hit or one or two facing your.

Why Our SAN BERNARDINO Loan providers?

Boosting and you will offering functions inside San Bernardino is quite financially rewarding this type of weeks, and is therefore no surprise that battle try intense certainly one of the companies attacking for everyone that cash. Invariably, you’ll find unscrupulous functions which engage in sketchy strategies, and it’s really your choice since a borrower to perform the due diligence to make sure you are not snared into their web. Ca Hard Money direct are a friends who has a verified reputation of successful financing. The back ground is beyond reproach, and in addition we is actually gurus during the everything we carry out. Usually, you will located approval for the hard currency loan within seconds from the conditions you can afford. İncele