Expert Representative

- #step one

We accustomed purchase chairs for the cash. I’d save money each month so you’re able to purchase one brand of chairs goods, since it is naturally expensive in the long run to pay they regarding more couple of years.

I don’t have an auto but really. So there was a good chance you to definitely banks doesn’t approve my financial one-day must i decide to buy a beneficial home. Thus today We visited city to get my parents a great the fresh kitchen stove worthy of R4000. It can pricing me R260 1 month having 24 months to the credit. But that number excludes VAT, insurance policies and you can a long promise, that would rates R432 thirty day period in the event that things are provided. The sales lady told me which i need insurance. Now R432 a month for couple of years would rates over R10 K. Is that a rip off or exactly what? I did not get you to stove as yet, however, would have to because of my lack of a cards number.

Government Representative

- #2

I believe you might be best off only providing credit cards and you may utilizing it [spending it well each month] Or delivering a short-term loan of a financial [and you will paying one to from]. İncele

Rating Bodies Provides which help guidelines software having lower income eager parents and people

Could you be a first-day household client within the Oregon? Well-done on jumping homeownership! Purchasing your earliest house is a vibrant and you may monumental milestone. But not, navigating the field of home shall be challenging, particularly when you are considering financial support your ideal domestic. And here Oregon Basic-Big date Home Client Applications come into play.

Such programs render assistance and support to help individuals particularly yourself reach the aim of home ownership. In this full publication, we will explore different First-Day Domestic Consumer Programs in Oregon, together with advance payment direction programs, has, and you will money. İncele

Improving Condominium Safeguards and you can Abilities

Getting into this new condo owner’s sneakers, I often stress the latest character away from solid gates and you can secure hair for the increasing condominium protection to help you FHA conditions. A condo’s entryway situations need sorts of attract as they are the latest frontline when you look at the assuring a safe and you may practical abode, making certain customers feel safe in their refuge and ticket inspection standards easily.

For the comfort away from a possible condominium, I turn to the brand new reliability away from emergency exits and best functioning of screen, besides because of their jobs for the ventilation and you can daylight however, including as vital escape pathways in the eventuality of a crisis. It is more about more than just visual appeals; it’s making sure a condo is actually a sanctuary out-of threats, a component that FHA inspectors often meticulously examine.

My personal guidance to condo people constantly comes with a mindful article on major products and you may possibilities to have energy savings. Updating to help you far better habits decrease electricity will set you back and you will make the newest condo far more closely that have FHA requirement, aside from improve total capabilities and you will attractiveness of the fresh property in the an aggressive housing marketplace.

Navigating FHA Assessment and Check Differences

Entering the trail to condo control try a pursuit laced with numerous steps and functions, for every single crucial with its very own proper.

Inside detail by detail moving, acknowledging the brand new distinct jobs regarding an appraisal and a check is actually crucial, especially when considering securing an enthusiastic FHA financing. İncele

Home loans have become the most beneficial means for people who want to fulfil their dream of buying their own place where they can live with their loved ones, create memories, and have financial security for future generations. In the past few years, with the efforts of NBFCs and HFCs, even people coming from underserved and unserved regions are now realising their dream of having their own house. Catering to the needs of these segments is a major step toward rural and semi-urban development. Aavas Financiers is one of those housing finance companies that top the chart in providing housing loans to customers belonging to low and middle-income segments. At the time people apply for a home loan, the lenders do take a look at credit rating of the applicant as it is considered a mandatory step to be taken by all the financial institutions to know about the creditworthiness of the borrowers. Therefore, the applicants must be aware of the ideal credit score to get a home loan. However, before moving on, first, understand what a credit score means.

What is actually a credit rating?

A credit rating are a beneficial step 3-thumb count one depicts a borrower’s credit habits and you can creditworthiness depending through to situations for example prompt percentage out-of expenses, EMIs, and other monthly premiums. İncele

- Up-date the latest affiliate that you will be shopping for beginning a business membership.

- Complete the necessary registration applications.

- Give the required papers and you may character for the company and its customers or registered signers.

- Generate a primary deposit to your new clients account.

And you can, voila! So long as you meet with the qualifications criteria, the process of getting an associate is not any different than beginning any kind of team lender or borrowing connection account.

Company Borrowing products and Characteristics

Regarding business banking in order to borrowing from the bank, money, and you can past, some tips about what Gesa Credit Relationship offers when it comes to small business borrowing products.

step 1. Team Banking/Examining

- Free accessibility online banking

- Automatic an internet-based statement pay

- Aggressive costs

2. Business Playing cards

Gesa Credit Commitment offers a few business charge card solutions designed to meet with the varied requires regarding entrepreneurs. Both notes give business owners with the ability to manage expenses efficiently while you are enjoying additional benefits particularly improved security measures and you can breakup from team and private cash. İncele

Get Bodies Gives that assist assistance programs getting lower income hopeless family members and individuals

Will you be a first-date homebuyer in Louisiana? Congratulations into the getting so it fascinating step into the homeownership! Since you continue your travel, you’ve got questions about the newest financial help applications open to create your dream of owning a home possible. Well, search no further! Contained in this article, we will talk about various grants and you can loan applications specifically made getting earliest-date homeowners when you look at the Louisiana. Regardless if you are looking to calm down from inside the Shreveport or Lafayette, these types of software also have beneficial help and you can pointers about to acquire process. İncele

- Improve household safe and slines mans lifestyle and certainly will build your house more appealing and you will beneficial. Starting an intelligent thermostat, wise bulbs and you will wise door hair is are just some of the brand new technological condition you possibly can make to change your own residence’s well worth. Safety is yet another factor. Ensure that the house has actually performing smoking sensors and you may carbon monoxide detectors. Very says need alarms and detectors getting property as up-to-code.

4. Re-finance Your home Financing

When you bought your property, you have removed a thirty-seasons financial. If you’re wanting strengthening home guarantee quicker, it creates sense so you can re-finance your loan in order to a 15-year home loan.

- Time: You’ll pay back good 15-12 months financing in two the full time it will take to pay off a thirty-year financing. That means you are able to individual your residence outright far sooner or later.

- Interest:Always, 15-12 months mortgages features lower rates of interest than 31-seasons financing because the loan providers evaluate them as much safer. A diminished interest function you pay even more to the the loan dominating monthly, that can makes it possible to create guarantee more readily. İncele

Without a doubt, it is possible to consult with your financial for specific recognition standards, however, listed here is a high-height list of how-to economically get ready for homeownership:

- Credit score: Get credit report and see your credit rating. Very loan providers need the absolute minimum credit rating off 620 or more than to possess conventional mortgage loans.

- Debt-to-income ratio: Make sure your personal debt-to-money proportion (DTI) is in line that have lender criteria. DTI proportion procedures the latest portion of their revenues you have to pay out every month to meet up with debts. Most finance companies will set a DTI proportion higher restriction of 43% and might will provide so you’re able to individuals that have a great DTI proportion out of below 36%.

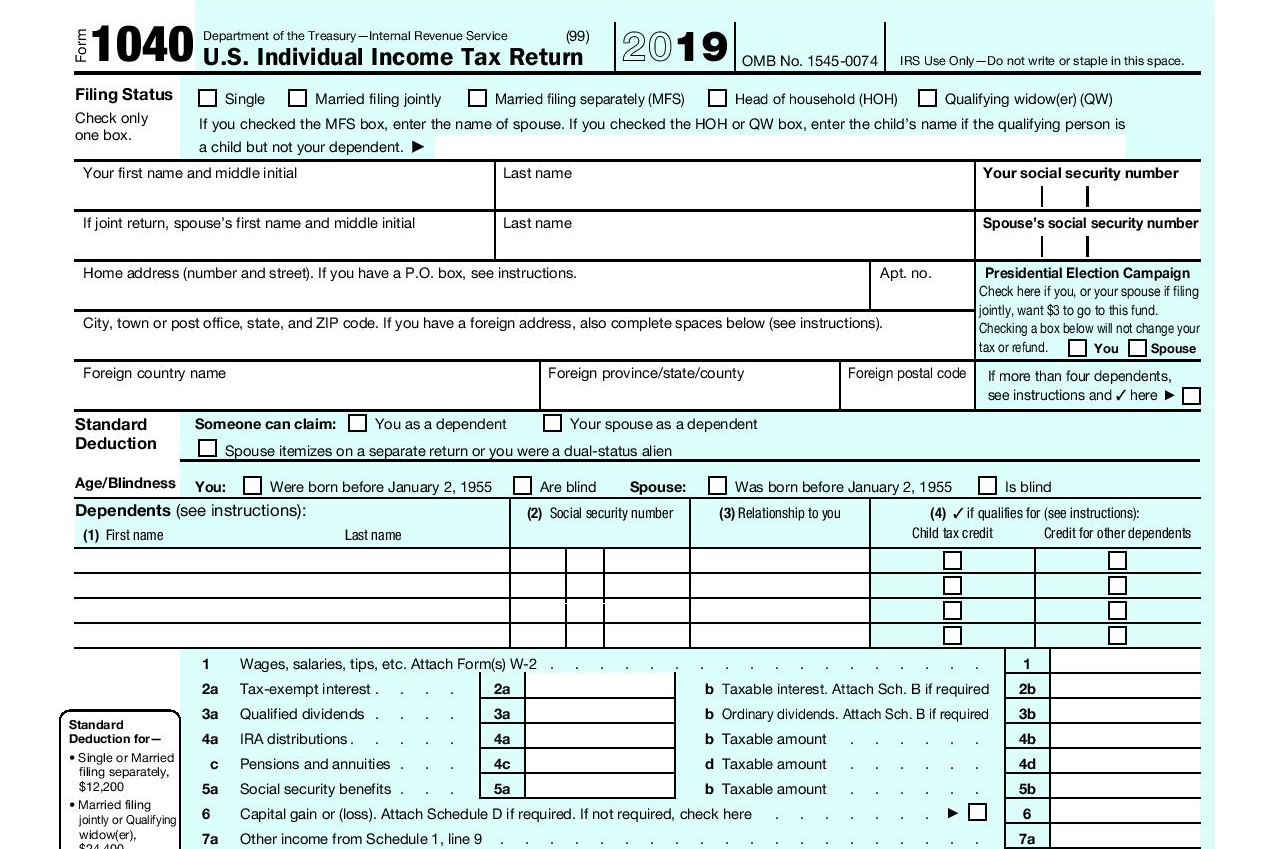

- Documentation: Gather pay stubs, tax statements, financial comments, and funding account statements.

dos. Set a very clear loans Amherst Deals Goal

The fresh code states that one or home would be to invest zero more 28% off terrible month-to-month earnings on overall property costs and never alot more than thirty six% on the upkeep obligations, which has their mortgage and additionally most other loans for example charge card payments.

Such as for example, for folks who secure a revenues away from $4,000 a month and you will proceed with the code, your restrict month-to-month homeloan payment should not be any more than $1,120 or twenty eight% of your own monthly income. The complete monthly personal debt payment should not go beyond $1,440 four weeks or thirty six% of your own month-to-month money, so that you are able as much as $320 various other loans. İncele

Our very own associates (i.age., companies pertaining to all of us by-common possession otherwise manage) for different aim let by-law, and additionally our affiliates’ advertising of their products for you;

Other individuals otherwise organizations, whenever we accept that disclosure is needed to choose, avoid otherwise declaration skeptical facts, avoid actual harm, monetary loss or violations in our preparations and you may regulations;

Aggregated/anonymized pointers

We would and additionally share aggregated otherwise anonymized information (hence cannot select your personally) for different providers motives because the allowed legally, for example:

Businesses to greatly help establish, markets and send services and products that are greatest designed so you can our users, site visitors and you will cellular application pages; and

If you are trying to find an affordable means to fix obtain a large, six-contour sum of money in recent times, you’ve got few ways to do so.

Due to the fact rising cost of living leaped, interest levels increased along with it, and make from rates to the unsecured loans to playing cards react properly. Now, unsecured loans feature mediocre cost alongside thirteen% when you find yourself playing cards is near accurate documentation 23%. Home security financing costs , however, continue to be apparently lower. And you may shortly after a good Provided price cut-in Sep, while some easy for November and you will December, this might become actually cheaper to have people in the rest of 2024bined on mediocre domestic collateral amount seated alongside $330,000 today, this is certainly more than likely how you can acquire a large number of cash immediately.

Family security funds and you may household guarantee credit lines (HELOCs) are two of the very common an effective way to do so. İncele