Your get drops into the selection of results, away from 670 to help you 739, being noticed Good. The average U.S. FICO Score, 714, drops into the A great variety. Loan providers check users with ratings on the a beneficial range because “acceptable” borrowers, and can even render them several credit items, even though not necessarily in the reduced-available rates.

Simple tips to replace your 690 Credit score

A FICO Rating regarding 690 provides entry to a general selection of loans and you may mastercard affairs, however, boosting your score can increase your odds of acceptance to possess an even greater matter, at inexpensive credit conditions.

Additionally, as the good 690 FICO Rating is found on the lower avoid of the A great assortment, you will likely want to control your get meticulously to prevent losing to your alot more limiting Reasonable credit history assortment (580 so you can 669).

The way to regulate how adjust your credit rating is to try to check your FICO Score. Along with your get, you’re going to get details about methods for you to enhance your score, considering particular guidance on your credit file. You will find some very nice general rating-improvement tips here.

See the great things about a good credit score

A credit history throughout the a diversity could possibly get reflect a somewhat short credit history designated because of the a good credit score administration. İncele

Complete, beginning another credit card membership and you can dealing with it smartly was good-so good-to suit your credit. However, taking yet another credit just before or within the home loan app techniques is not necessarily the most readily useful time. As to why? For starters, a short-term shed is normal once you discover an alternate account, and also you cannot truthfully predict how their score may differ. If this falls enough to circulate you against “good” to help you “fair” borrowing from the bank, such as for instance, you may no further be eligible for your loan. A lowered credit score may also lead to the financial so you’re able to bump enhance interest. Even a small boost in the interest rate you have to pay could cost tens and thousands of cash along the lifetime of a home loan.

Making a life threatening switch to the credit character together with contributes an element of instability towards the application. Home financing is a large loan with a lengthy lifespan. Loan providers seek evidence which you are able to spend your loan predictably, day immediately following week. Good credit and clean credit file assist show off your precision, also a strong work background, adequate advance payment and you will big offers. One changes from inside the app process-work change, a-sudden flow otherwise a unique card membership, such as for instance-is rule that your particular funds are located in flux. This type of transform may reduce the acceptance since your bank verifies recommendations.

New trusted strategy is to get rid of applying for the newest credit whenever you are you’re going from home loan recognition processes and in the weeks prior to the job. İncele

USMI professionals have focused its efforts for the enabling individuals remain in their homes by the support its bank consumers throughout these problematic minutes

Washington – You.S. Mortgage Insurance vendors (USMI), the latest relationship symbolizing the nation’s best individual home loan insurance policies (MI) people, today create a claim that features the countless regulatory and you can community-led reforms drawn because the 2008 financial crisis adjust and you will bolster the character from private MI on nation’s construction funds system. The newest declaration, Private Mortgage Insurance coverage: Stronger and a lot more Resilient, analyzes different tips the industry and you will bodies undertook and you may keep to take to ensure renewable financial borrowing by way of all field cycles and most useful suffice low-down payment borrowers about old-fashioned business, specifically through the vital minutes including the introduce.

In the event personal financial insurance vendors have been a crucial part of the houses money program for over 60 ages, this is naturally perhaps not their father’s’ MI globe. This type of improvements usually allow the world become a far more stabilization force due to different housing schedules – including the newest COVID-19 crisis – hence greatly pros this new GSEs and you can taxpayers and you will raises the old-fashioned financial loans program.

Improved financing and you can operational standards, plus enhanced effective handling of financial borrowing from the bank exposure, in addition to through the delivery out of credit exposure towards in the world reinsurance and you may capital markets, has place the globe within the a stronger reputation, told you Lindsey Johnson, President away from USMI

The newest report along with highlights the measures the industry has had just like the the start of new pandemic to help with the government foreclosure protection apps, such as the announcements from Fannie mae and you will Freddie Mac out-of forbearance applications or any other mortgage rescue open to help individuals inspired because of the COVID-19. İncele

- Engagement and you may assistance off Historically Black Universites and colleges (HBCUs) owing to organization service, employment out of people and you can alumni, and you may monetary availability.

TD Financial often provide, purchase otherwise give more $50 billion around the world, focusing on lower- to help you reasonable-money (LMI) borrowers, LMI teams, and you can groups off colour over a five-12 months months regarding 2023 owing to 2027. TD Lender plans to expand their visibility inside the low-income organizations, towards biggest commitment to the new twigs for the LMI organizations inside the one NCRC CBA yet.

As well, TD Bank will increase its amount of mortgage officers from inside the LMI and you may vast majority-minority groups

When the financing so you can a certain classification (Black, Western, Latinx, Native Western, Hawaiian/Pacific Islander), or perhaps in people investigations city advertised from inside the bank’s combined footprint currently lagging peer banks, isnt shifting during the rate which have target just after two years, TD Financial will meet which have area representatives to discuss an approach to improve credit on brand of class. To have the goals, TD Financial will continue to offer an alternate Objective Credit Program (SPCP) financial device in Black and Hispanic census tracts in the markets from inside the both TD Financial and you may Very first Opinions Bank footprint.

TD Lender will attempt to create a small business SPCP for smaller businesses that will be 51% or maybe more and you will registered given that WBE, MBE and you can Experienced businesses, that have an objective to include availableness within the directed places from the TD Bank impact, as well as Philadelphia, Nyc, Charlotte, North carolina, and you may Memphis, Tennessee, in order to become extended credit rules to make certain that fraction-had organizations and feminine-had companies are offered fair entry to borrowing. İncele

Expertise Financing Brands

Regarding borrowing from the bank money for real property, it is critical to comprehend the different types of fund available. Two preferred types of loans is actually compliant money and you will low-conforming loans. Why don’t we take a closer look at every of these financing items.

Conforming Finance Analysis

A conforming mortgage relates to a kind of antique home loan one aligns for the standards put by Government Construction Funds Company (FHFA). Really mortgage lenders give conforming financing, which makes them widely available to possess borrowers.

As considered conforming, a loan need certainly to fulfill certain conditions. These criteria is situations eg credit history, advance payment, and mortgage dimensions. Conforming money have to follow this type of conditions into the financing in order to be eligible for buy by government-backed entities particularly Fannie mae and you will Freddie Mac computer. İncele

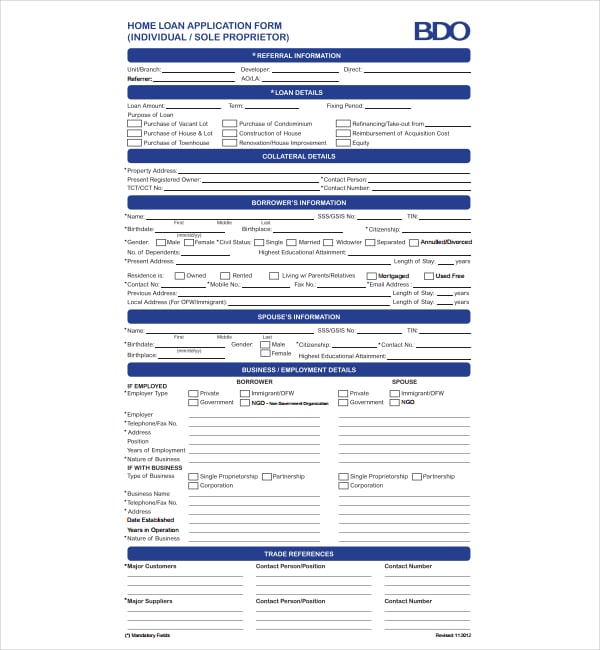

Once you make an application for an interest rate, your financial will look at your credit rating as part of the initial remark process. They could actually view it once again ahead of closing, to find out if anything has changed.

Most home loan software on the market today enjoys minimal credit score standards. Such minimal score can vary of 600 so you can 660, with regards to the style of mortgage getting used or other items.

5 Key Takeaways Out of this Publication

- Credit history criteria tend to come from additional teams, for example Freddie Mac computer additionally the Government Property Management (FHA). İncele

The deal is not offered in case the Dated Financing is created from, when you look at the collections or perhaps in infraction of your own arrangement during the time out-of discharge.

New Application for the loan can happen in advance of, at the same time, otherwise pursuing the customer will pay aside its Dated Loan and really should never be a primary re-finance otherwise reconstitute of the Dated Loan and other Virgin Currency Reward Myself Home loans

Simply for one to $dos,000 commission in order to an important borrower. A reward Me personally Home loan Partner Account is needed to feel unsealed next to a beneficial Virgin Money Prize Me personally Home loan. This new cashback could be paid toward Prize Me personally Mortgage Companion Account within 60 days out-of payment. Customers is to find their unique income tax guidance when considering the newest receipt away from a beneficial cashback for the settlement.

2024 Virgin Money (Australia) Pty Limited ABN 75 103 478 897 | Entered Target: Level step three, 100 Skyring Patio, Newstead, Queensland 4006.

^ Available for the brand new fixed rate mortgage applications submitted into the otherwise just after . Only available for brand new borrowings off $300,000 or higher. Not available on the refinance otherwise reconstitute regarding present BOQ Class mortgage brokers (which includes Virgin Money (Australia), BOQ, BOQ Specialist and Myself Bank).

Velocity membership and Points earn and redemption are subject to the Member Terms and Conditions, available at velocityfrequentflyer, as amended from time to time. Only the person listed as the Primary Borrower on the application will be eligible for Velocity Points, subject to meeting our eligibility criteria. İncele

To have eligible consumers having full entitlement, there aren’t any limitations on the loan amount they may be able obtain that have an effective 0% advance payment. This provides high flexibility to possess consumers exactly who qualify.

It’s important to keep in mind that such financing constraints is at the mercy of transform that will will vary considering status regarding the Government Property Loans Agencies (FHFA)

But not, borrowers with just minimal entitlement, also known as affected entitlement, possess mortgage constraints. The latest Virtual assistant mortgage restrict for impacted entitlement is dependent upon the fresh new state restrict, that is considering conforming financing limitations.

Miami-Dade Condition – The borrowed funds limit to own Miami-Dade State is $726,two hundred. This conforming mortgage maximum pertains to really portion regarding the state.

- Duval State – Duval Condition pursue the overall conforming mortgage limit out of $726,200. İncele