17 Jun Is a Virtual assistant Loan Limit Go beyond State Limitations

A beneficial Va mortgage doesn’t have a max lending matter. The question is much more regarding calculating what kind of cash your can also be use instead of getting down any money.

To have army homebuyers and those close by the borrowed funds industry, the idea of brand new VA’s loan limitations can be confusing. You likely will pick loads of misinformation and wrong information on the web.

What is home financing Restrict?

Virtual assistant financing limits would be the limit financing number the Service away from Experts Things can also be be certain that in place of requiring one build an effective downpayment. İncele

Editor’s notice: This is exactly Laura Lima’s earliest contribution for the Pantsuit Politics weblog. The woman is a physician off Physical Procedures just who specializes in ladies’ health when you look at the Orlando, Florida.

In 2009 I found myself acknowledged towards Duke University D. We know I would end up being incurring most figuratively speaking however, We considered comfortable inside my choice due to the fact I realized that this was a financial investment inside my coming. At all I experienced finished financial obligation totally free just after probably state school for the grant. We considered motivated to adopt much more considerable personal debt. İncele

As well as these types of pros, the Hometown Heroes Fl program even offers instructional tips and you will support to simply help qualified people browse the fresh new homebuying techniques. This can include homebuyer knowledge classes, monetary counseling, and you will entry to regional real estate professionals just who comprehend the novel need and you may challenges of your own Home town Heroes population.

The latest Home town Heroes effort is an important identification of one’s sacrifices made https://www.paydayloanalabama.com/lillian by military professionals, experts, earliest responders, and you can coaches. By providing special advantages and you may guidance, this method helps to make homeownership a great deal more obtainable and you will affordable to possess this type of worthwhile anybody.

Full, the newest Fl Housing Homeownership System to possess Heroes was a valuable money if you have loyal the lifetime to providing their communities as well as their country. İncele

Government Mortgage Home loan Company – FHLMC (Freddie Mac)A stockholder-had firm developed by Congress that instructions traditional mortgage loans from the secondary financial business from insured depository organizations and you may HUD-acknowledged mortgage lenders. They offers participation sales certificates secured from the pools out of old-fashioned mortgage fund, its dominating, and you will attention guaranteed by the national through the FHLMC. In addition, it carries Authorities National Home loan Organization (GNMA, otherwise “Ginnie Mae”) bonds to improve financing to invest in the purchase regarding mortgages. Popularly known as “Freddie Mac computer”.

Real estate loan Disclosure Operate (HMDA)Government legislation that requires certain types of loan providers to harvest and you will reveal data on the where also to exactly who the financial and house improve financing are increasingly being generated

Fannie mae- FNMA (Federal national mortgage association)Good taxpaying firm produced by Congress to support brand new second financial markets. They purchases and you will sells home-based mortgages insured by Government Construction Administration (FHA) or guaranteed because of the Veterans Administration (VA) also traditional home mortgages.

Payment SimpleThe top you are able to focus an individual may has from inside the genuine estate, like the right to discard the house or property or admission it on to a person’s heirs.

Earliest Adjusted PaymentThe estimated monthly payment due in the event that rate of interest towards an adjustable-rates mortgage is actually reset. Adopting the very first repaired-speed period, the rate increases otherwise fall off a year according to the business index. İncele

I am frightened that there surely is a beneficial disincentive in my situation to try and explore my PhD so you’re able to the fullest potential in order to make state $70,000 otherwise $80,000 annually due to the fact I do believe a great deal of who check out education loan payments, she said. Rather than, easily remain in the lower earnings group, I might have the ability to have the minimal amount of percentage. Then i you certainly will we hope get some of it forgiven for the an effective if you’re. That could be higher.

Including, an upswing off younger some body, most of them millennials, buying home prior to about pandemic whenever rates of interest have been reasonable and you can student financial obligation payments was indeed toward pause, was a sign of an altering economic wave. İncele

To the July step 3, 1973, so it Court registered your order to help you compel defendants to apply new Farmers House Administration’s focus borrowing from the bank loan system, pursuant so you can Section 521 off Label V of the Houses Work from 1949, 42 You.S.C. 1490a. With its accompanying Memorandum View, said within 361 F. Supp. 1320, it Legal held you to towards defendants to certify various qualified people in plaintiff group to be eligible to found head housing money under Areas 502 and you will 515 of your own Act, and to reject like individuals Area 521 interest borrowing finance because of the advantage off defendants’ unilateral suspension of one’s program, create perform in order to frustrate new intention regarding Congress into the enacting the new Area 502 and you may 515 direct financing applications. İncele

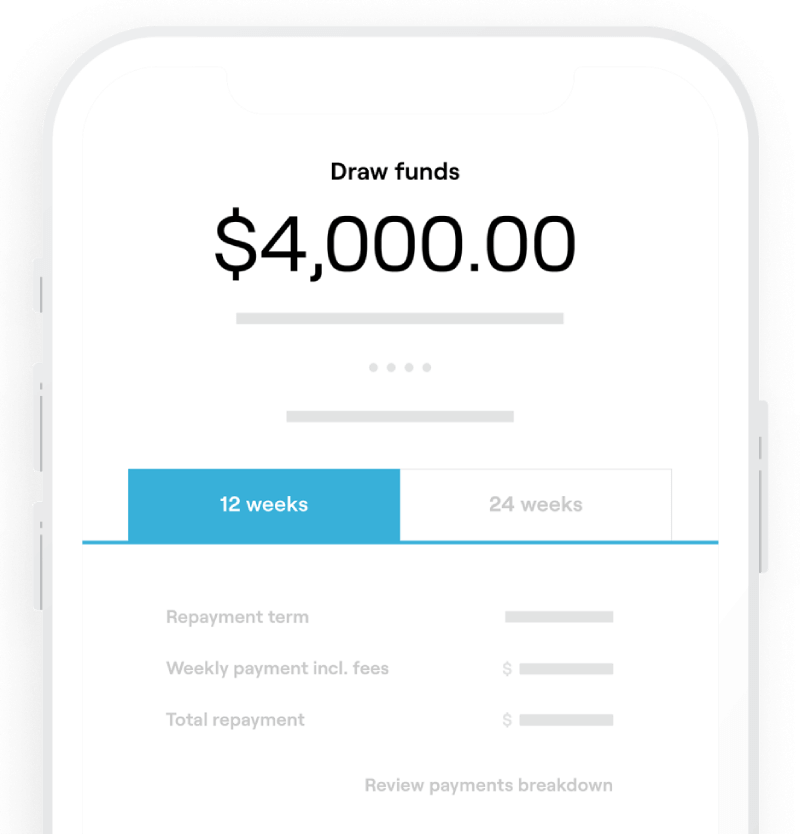

An armed forces Financial Household Security Credit line (HELOC) makes it possible for immediate access in order to funds from your house’s guarantee. Buying home improvements, financial obligation consolidations or studies costs is straightforward using this versatile line of borrowing. Obtain up to 85% of the house’s value, and you will spend lower interest levels than most credit cards. See more benefits particularly reduced to zero closing costs, and you may a great six-day introductory price.

Issues? For latest costs and you can terms and conditions or questions relating to using, call (844) 260-8587. Having latest mortgage clients with questions about the membership, log in in order to Digital Financial and send us a message. Otherwise, label or check out a part to have recommendations.

The new step one.99% Basic Annual percentage rate (APR) can be obtained towards House Equity Credit lines that have financing-to-value of 85% otherwise reduced in the event that auto-write money away from a bank checking account with this financial or representative try mainly based at that time the fresh new HELOC is actually opened. step 1.99% Basic Annual percentage rate (APR) is available for the Domestic Equity Lines of credit having a maximum LTV away from 85% with the loan number as much as $2 hundred,100 and you will 80% into mortgage numbers more than $200,one hundred thousand or more to $250,one hundred thousand. İncele

As much lenders reduce their attention cost, changing could save you cash and look out for bank card perks

There is particular much-needed great recently to have homeowners and the ones whose latest mortgage deal is about to run out. Home financing speed battle features intensified, having HSBC, Halifax and you may TSB among the loan providers cutting the price of their new repaired-rate sales in the last few days. İncele