Whoever knows their full target can use on the internet lookup equipment, for the majority U.S. counties, to acquire public records about your financial. Regardless of if your bank account balance actually available due to the fact public records, the newest day you signed the borrowed funds in addition to label of your financing can be used to estimate their financial balance.

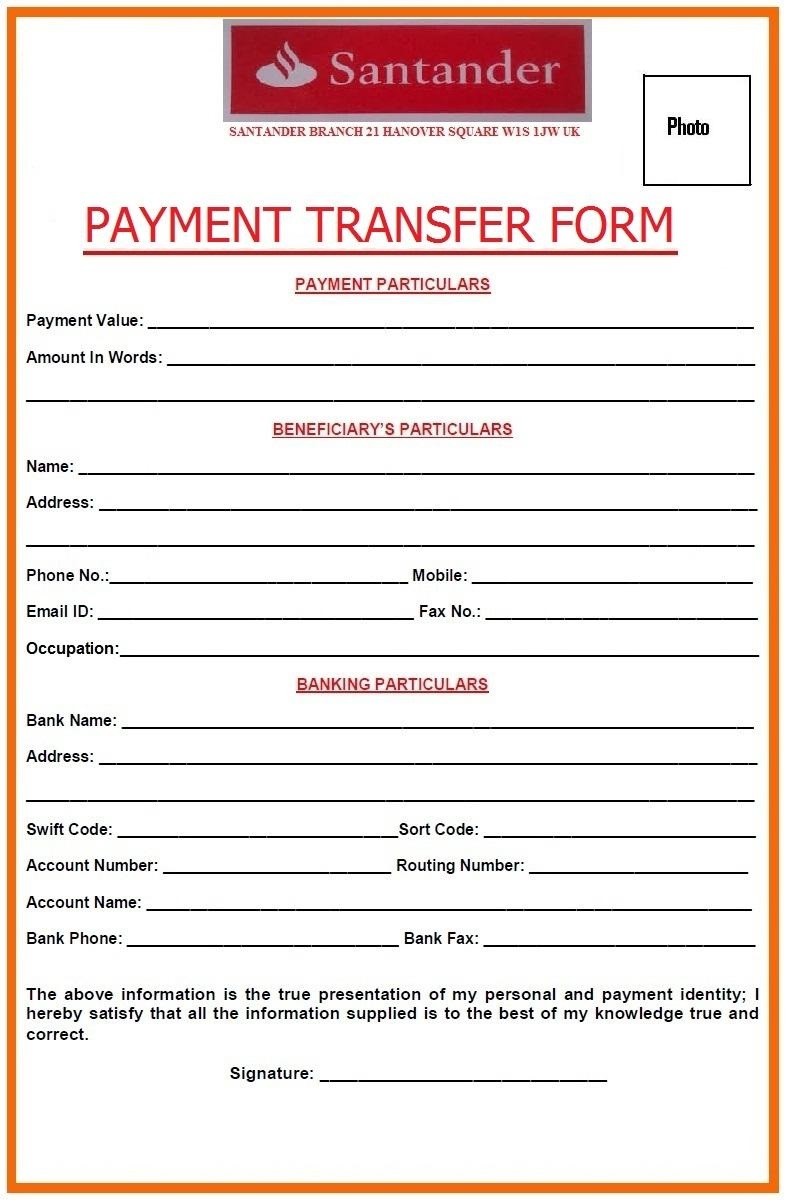

Whatever the a page generally seems to see, don’t provide addiitional information – such as your debit credit PINs, your ACH or routing wide variety, or your internet financial journal-from inside the credentials – in response to help you an unsolicited page.

If you’ve mutual this sort of username and passwords already, declaration so it for the lender immediately. You will likely need unlock the brand new levels immediately https://cashadvanceamerica.net/personal-loans-or/ and – continue a virtually vision on your online financial otherwise mobile app.

Once more, when you think scam, declaration it in the . You can also want to report this new page towards Best Business Bureau (BBB).

New available funds otherwise readily available funds number the truth is contained in this style of page try a quotation of your collateral gathered of your property. Commercially, so it equity is cashed-out by refinancing.

House equity is normally computed from the subtracting what you owe on the your home financing regarding the property’s fair market value. Although not, The new wide variety you notice on these characters are bogus or intro amounts supposed to give you the impact there clearly was a great huge container of cash available for individuals who respond, cards Ailion.

In fact, versus speaking straight to a loan provider, you simply can’t know exactly how much equity youre permitted cash-out, contributes Moonlight.

How much money you could potentially withdraw out of your home equity relies on the loan harmony, your credit rating, and you will what sort of mortgage you qualify for, certainly one of other factors. A lender can simply show exactly how much collateral you may be ready in order to cash out after you sign up while the lender requires a glance at your finances.

How-to tap your property security securely

If you’ve acquired an available loans page and you can you desire to find out more, you should contact a number of lenders of choosing.

You can now have household guarantee you have access to as a result of a beneficial cash-away re-finance or other kind of cash-straight back home mortgage. They’re:

- Household collateral money: Typically referred to as a great next financial, these types of financing spends your property to own security and you can generally speaking is sold with a predetermined interest rate which is reduced more four in order to fifteen years

- Family collateral personal lines of credit (HELOCs): In the place of a property equity loan, this really is a line of credit you could draw from when required. What’s more, it uses your residence given that collateral. You can withdraw as much as a great preapproved using restrict over a beneficial place draw months (often the first ten years). The speed is not fixed – it is a predetermined variable rate dependent on current perfect costs. You can only pay interest into cash you obtain, therefore start to build minimal monthly repayments once you’ve an equilibrium due

This type of loans render cash in the place of demanding you to re-finance all your valuable mortgage balance. They could be a better selection for a loved one towards stop of the home loan term, or an individual who currently enjoys a highly low interest rate.

Chat to a dependable financial who can provide the most readily useful home guarantee financing options for your situation, Moon suggests.

Almost every other refinance possibilities

Of a lot property owners refinance to lower their attention rates and you may month-to-month home loan costs, and that lowers the entire mortgage prices when you find yourself making your house collateral unaltered. This is an excellent option for one debtor who will down their attention rate, regardless of if they haven’t built up far equity in their home, cards Moon.