To be eligible for the fresh partial exception getting open-end lines of credit, a financial must have got its start, inside all the several before diary years, under five hundred unlock-stop personal lines of credit.

The limited exception isnt open to banking institutions that don’t satisfy certain Community Reinvestment Operate show analysis rating criteria.

To test monetary institutions’ conformity with HMDA criteria, OCC test employees commonly work on understood secret investigation sphere through the transaction evaluation pursuant to help you HMDA for data obtained on or just after ination team often focus on the 37 sphere given just below to own banking companies that will be at the mercy of event, recording, and you will revealing information for everybody HMDA data areas. Comparison having finance companies one to be eligible for a limited different out of HMDA analysis range, tape, and you may reporting conditions tend to work with 21 secret areas, because established below, and you can verify that financial suits the newest requirements to have a partial exception to this rule. In some points, but not, and you may consistent with the FFIEC direction, examination team will get dictate that it’s suitable to examine additional HMDA investigation industries.

Right revealing regarding HMDA info is essential in assessing the accuracy of your HMDA studies one to loan providers checklist and you will report. In which problems you to definitely meet or exceed based thresholds ten was known when you look at the an enthusiastic institution’s HMDA analysis, the latest OCC supervisory workplace keeps discretion for the demanding the school in order to proper specific problems, instead of requiring resubmission of research. The brand new supervisory workplace need resubmission off HMDA data if the inaccurate analysis is an indication from endemic internal handle weaknesses that label into the question the fresh ethics of one’s institution’s entire HMDA investigation statement.

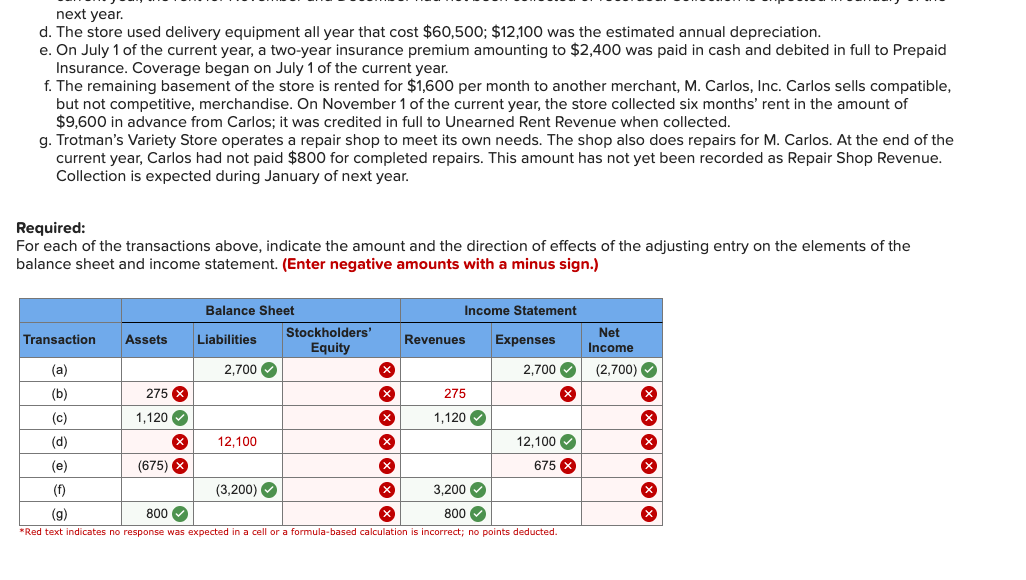

The next table lists the primary research industries one to examiners tend to used to ensure the precision of one’s HMDA Mortgage/Application Check in (LAR) having banking companies which can be full HMDA reporters and you may independently getting finance companies you to definitely be eligible for the limited exemption.

Compliance Report

Since revealed during the on a keen interagency foundation, the brand new OCC cannot want to wanted studies resubmission for HMDA analysis collected in 2018 and you will reported in 2019, except if study mistakes are point. Furthermore, the new OCC does not decide to assess penalties with respect to problems during the studies obtained inside 2018 and you may reported for the 2019. Collection and you may entry of your own 2018 HMDA study will offer financial institutions with a chance to pick people openings within implementation of brand new revised Control C and come up with improvements within HMDA conformity administration systems for the future. People examinations out of 2018 HMDA investigation could be diagnostic, to simply help banks pick compliance defects, together with OCC will borrowing from the bank a great-trust conformity operate.

More info

6 Starting with analysis built-up into or shortly after , loan providers susceptible to this new HMDA tend to collect and you can statement investigation to the secured financing specified in the Alaska installment loans 12 CFR 1003.4(a)(1)-(38) towards the a software sign in that features 110 analysis industries, just like the specified on FFIEC Submitting Advice Publication (FIG). Make reference to FFIEC Information having HMDA Filers for more information.

eight The fresh new FFIEC members are definitely the FRB, FDIC, new OCC, the fresh CFPB, the fresh new Federal Credit Connection Government, therefore the County Liaison Committee. The FFIEC participants render compliance that have government consumer shelter laws and you may statutes thanks to supervisory and outreach apps. The newest HMDA is one of this type of statutes.

8 OCC-controlled finance companies and their subsidiaries are required to declaration reasons for assertion into HMDA Loan/Application Sign in (LAR) despite partial exclusion condition. Make reference to twelve CFR 27 (federal finance companies) and you can a dozen CFR 128.6 (federal discounts contacts).

10 All the info offered within bulletin supplements suggestions awarded on -30, “FFIEC HMDA Examiner Deal Comparison Guidelines,” hence suggests examiners is always to head a bank to fix people investigation field within its full HMDA LAR for job where in fact the mistake price exceeds the fresh new mentioned resubmission threshold. OCC examiners often talk to the supervisory workplace and you may, since relevant, OCC’s Conformity Oversight Administration Section to choose if or not resubmission becomes necessary according to specific affairs and you will facts.

So you’re able to be eligible for the new partial difference to have signed-stop mortgage loans, a lender need started, for the each one of the a couple preceding schedule ages, less than five-hundred closed-prevent mortgage loans.