Depending on your financial journey, there may be times when borrowing money makes sense. But what sort of borrowing from the bank choice you decide on hinges on your targets and you will what you need the money for. Uncertain precisely what the change try anywhere between that loan and you can a beneficial personal line of credit? That it breakdown is help.

What exactly is financing?

That loan is actually a certain number of currency provided to good borrower (you) by a https://paydayloanalabama.com/columbia lender. Finance are provided centered on a certain you prefer (envision home financing or car finance) and the borrower’s creditworthiness.

- Financial

- Pupil

- Providers

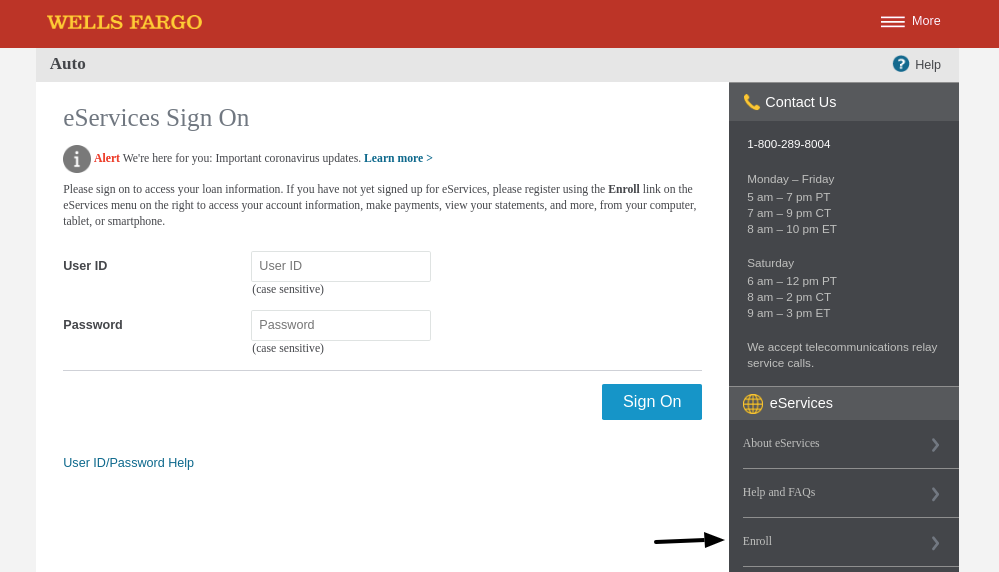

- Automobile

- Debt consolidation

- Do it yourself

Funds is swelling-share number delivered to one to-date play with. They are not revolving borrowing. The attention actually starts to gather into the total count immediately after the loan was state-of-the-art.

Payments on the loans are a percentage one would go to appeal and you may a member one happens towards paying down the main.

Benefits of funds

Straight down interest levels Finance routinely have straight down interest levels than just contours away from credit. Because they are a lot more of a predetermined equipment, money would be less risky in order to loan providers, impacting the speed he is ready to provide during the.

The pace you can access because a debtor often trust your credit rating; the higher the rating, the low the interest rate.

Why don’t we see credit money up against property as an example. That have home financing (loan), you can acquire up to 95% of your property’s really worth (with certain conditions). But with a property security credit line, you could always simply obtain doing 65% of your appraised value. There are criteria whenever that number tends to be because the high while the 80%, nonetheless it still drops in short supply of new 95% of your own worth the borrowed funds offers.

Like most financing equipment, the total amount there will be use of out-of a lender commonly depend on your credit rating.

Accessibility money all at once That loan improves each one of the income simultaneously. This will be a bonus if you want usage of all of your own currency immediately. When buying an auto or spending money on post-supplementary, access all the money at once is very important.

Less notice-punishment needed Whether or not financing may have changeable otherwise fixed cost, the payments are available based on a fixed fee plan.

Because the attract starts to accrue on whole amount borrowed instantaneously, there are no motion considering the means to access fund. You can’t availability any further money as compared to full amount, which means you don’t need the new worry about-abuse to pay otherwise utilize the lent fund.

A lot more activities readily available Because the listed above, there are numerous form of loans. Finance render a great deal more situations than just lines of credit. Like this, mortgage goods are a lot more flexible than credit lines.

Cons of funds

Often finance are not brand new superior tool when compared with traces out-of borrowing from the bank. Here you will find the disadvantages to take on before you sign up to own good mortgage.

Highest closing costs Only a few loans possess settlement costs, however if they actually do, he is usually more than expenses associated with establishing a column of borrowing from the bank.

Desire accrues instantly Which have financing, desire with the entire lent matter starts to accrue instantly. This is certainly distinct from a credit line or bank card and you will could end upwards costing you so much more focus fees in the title of the loan.

Less flexible Fund was shorter versatile than lines of credit. The cash state-of-the-art inside a loan pertains to a particular mission.

Lump-sum That loan increases the total lump sum payment of cash every immediately. It’s all otherwise nothing. It is a drawback otherwise require the currency the at once given that if or not you need it or perhaps not, attention is billed towards whole number instantly.