Within this book

Higher mortgage costs coupled with excessive home prices have really made it harder getting first-time buyers specifically discover a foot towards the the newest casing steps. Right here i display some pointers.

Mortgage cost try increasing in britain immediately following consecutive hikes to help you the bank from The united kingdomt lender rates, with finance companies a great deal more careful in order to provide within this ecosystem. But there are some things you could do to increase your own probability of bringing a home loan.

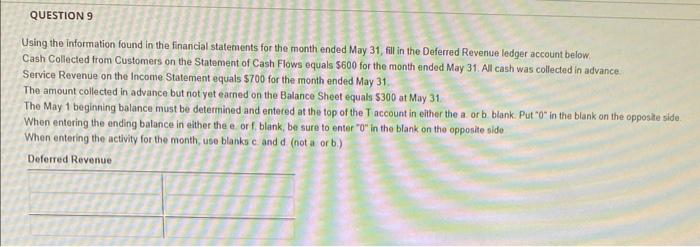

1. Build a more impressive deposit

You are able to get home financing with only an excellent quick put regarding simply 5%, however, which cuts back your chances of having the ability to pay for an effective financial.

For the reason that how big is the mortgage you might you want to obtain was a lot big, so your money might not continue far enough getting a lender to think you really can afford it.

- When you have a little ?ten,000 deposit into the good ?2 hundred,000 family, you’d you would like an effective ?190,000 financial

- But with good ?20,000 deposit on the same house, you might need an inferior home loan away from ?180,000

Whenever you can scrape together a much bigger put, the likelihood is you will find down interest levels and you can a wider solutions.

If you are weigh upwards whether or not to take out a little put mortgage, i outline advantages and you can disadvantages. I also make it easier to see the different types of mortgage loans.

dos. Replace your credit history

Your credit score suggests your percentage history over the past half dozen many years, plus credit cards, signature loans and financing agreements. Non-percentage off bills and you will smartphone contracts may also be entered.

Check your credit info which have all around three head borrowing reference enterprises really in advance of to make your own financial application.

- Test out your credit file free of charge thru ClearScore (having Equifax)

- MoneySavingExpert’s Borrowing from the bank Club (having Experian)

- Borrowing from the bank Karma*(to have TransUnion)

You have to know fixing one things just before they scupper the possibility of getting a decent interest rate away from a loan provider otherwise qualifying to own a home loan whatsoever.

You will find several small victories to own improving your credit history, such as for example registering in order to choose. I enter such in more detail within our guide toward fico scores.

step 3. Lower your outgoings

When trying to get a home loan, loan providers should check your income and you can outgoings and come up with sure you might comfortably afford the repayments.

Thus throughout the weeks prior to your own home loan app you should seek to maintain your outgoings as little as you can. You might want to prevent splashing the bucks for the anything beyond basic principles.

Lenders may also scrutinise the lender statements getting signs your you’ll have trouble with established debt. Don’t use overdrafts and you will pay down stability towards playing cards, store cards and unsecured loans.

However avoid trying to get people the brand new money or credit cards and therefore perform produce good hard check into your credit report. If you have got several current difficult inspections on the document, a home loan company could see it an indicator that you come in economic complications.

cuatro. Pin off papers

Find all documentation needed for a mortgage software now, which means you never miss out on that loan due to an excellent destroyed payslip.

- Proof label eg a creating permit and passport

- Lender comments for the past at least three months

- Evidence of earnings for example payslips for the past 3 months (otherwise extended if you find yourself mind-employed)

- Deals comments to prove your own deposit

- Present utility bills to demonstrate evidence of target

5. Use a mortgage broker

That have a lot fewer mortgages readily available and you may changing financing laws and regulations, a mortgage broker normally search the market industry to find the best price. A good mortgage agent will recommend and therefore loan providers be likely so you’re americash loans Allgood able to approve the application.