- Expert Articles

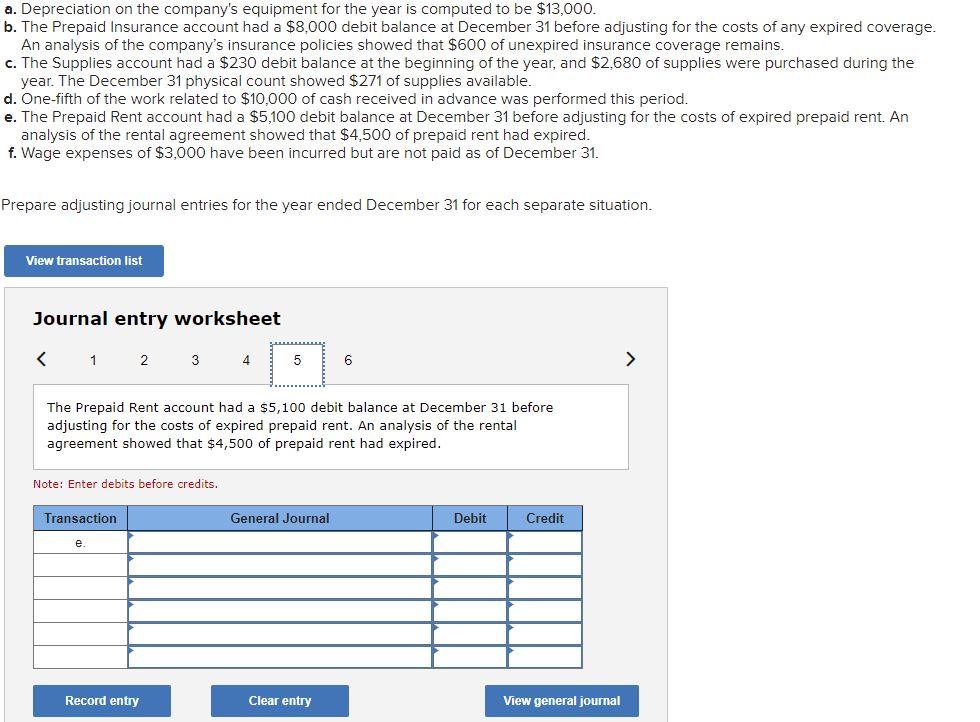

- Remortgaging

If you’re unsure about what probate are, the length of time it requires as well as how far a mortgage might cost having a house you’ve passed on, read on otherwise get in touch with a mortgage broker.

- I’ve advantages that define how to put an inherited house on your own name and exactly how probate mortgage loans work.

- They have usage of hundreds of lenders and certainly will look at the eligibility as opposed to damaging your credit score.

- Regardless of the your role, it works to get you a reasonable solution.

- Talk on the phone, through on the internet speak or in our very own organizations with a cup of teas.

While a benefactor and you are set to very own a home that has been leftover to you inside a might, you happen to be wondering what direction to go second. Exactly how much heredity taxation do you owe? Is there a fantastic home loan that really needs investing and can even you afford more substantial mortgage in the event that fixes toward home are needed?

You may possibly have passed on their parent’s family hence can bring up numerous emotions and you can questions about whether to keep it, rent it otherwise sell it completely.

This guide has been created so you’re able to sound right away from exactly what your options are and you can where you are able to pick obvious, simple and easy sincere advice about delivering a mortgage for a house that’s going through probate.

I have passed down property, just what must i manage?

In advance of one to even if, it should experience probate. And you may just before one? You will have to work out how far inheritance tax you borrowed.

What is actually probate?

Making an application for the right to deal with another person’s possessions, currency and you will possessions (the ‘estate’) installment loans in Massachusetts when they die is known as trying to get probate.

It’s the court means of certifying a might. If you’ve been named in the a might and also have inherited a home, it will need to go through the brand new probate process.

You simply will not manage to do just about anything to your home up until its undergone probate. If there is already a home loan connected to the property with an enthusiastic a great harmony, contact the lender and you will give an explanation for state.

Usually, they’re sympathetic and while they will certainly probably nonetheless costs appeal, they could bring a grace months which have suspended money up until the home is paid.

The brand new probate techniques informed me

In case your individual that died has remaining a might, it can most likely title an executor who’s responsible for performing the fresh new recommendations of your own tend to. This could be your, a unique cherished one, a reliable pal or a 3rd party representative such as for example a great solicitor. Anyone who is called the newest executor has a lot accomplish in advance of the probate procedure.

- They must collect financial and you will identity files.

- Find out if the home possess an excellent home loan.

- Verify that home loan repayments is protected by insurance coverage.

Due to the fact recipient, then you’re able to find out if you may be liable to shell out Heredity Income tax.If there isn’t a might therefore the person that passed away doesn’t enjoys a full time income companion, you’ll need to sign up for a good offer regarding representation’.

This might be also called probate so if you’re offered probate, you will have accessibility their savings account, allowing you to policy for the possessions to be sold or died so you can beneficiaries. Their money and cumulative home should be regularly accept any costs in order to pay one relevant taxation.

Inheritance taxation and you can probate

If you have to pay Inheritance Taxation, publish appropriate versions to HMRC and waiting 20 working days before applying having probate.